In-Depth Research Report on Anker Innovations' 'Hit Product Dilemma' and AI Hardware Strategy

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now I will present the full in-depth analysis report:

As a representative enterprise of China’s cross-border consumer electronics brands, Anker Innovations (300866.SZ) is facing a fundamental strategic dilemma:

From the perspective of business structure evolution, Anker Innovations exhibits typical ‘fast-moving consumer electronics’ characteristics:

| Business Category | 2020 Proportion | 2024 Proportion | Trend |

|---|---|---|---|

| Charging Category | 44.2% | 32.1% | ↓ Decreased by 12.1 percentage points |

| Audio Category | 28.5% | 34.5% | ↑ Increased by 6.0 percentage points |

| Smart Home | 15.3% | 12.8% | ↓ Decreased by 2.5 percentage points |

Innovative Categories |

12.0% |

20.6% |

↑ Increased by 8.6 percentage points |

The continuous increase in the proportion of innovative categories reflects the company’s urgent demand for a ‘second growth curve’, but it also amplifies the risks of the ‘hit product dilemma’.

By sorting out the lifecycles of Anker’s main products, a worrying pattern can be clearly observed:

| Product Line | Hit Product Peak | Maturity Period | Current Status | Duration |

|---|---|---|---|---|

| Anker Power Bank | 2018 | 2018-2021 | Stable Period | Approximately 4 years |

| Soundcore Speakers | 2020 | 2019-2022 | Stable Period | Approximately 3 years |

| Eufy Smart Doorbell | 2022 | 2021-2024 | Maturity Period | Approximately 3 years |

| Nebula Projector | 2021 | 2020-2023 | Maturity Period | Approximately 3 years |

3D Printer M5 |

2023 |

2023-2024 |

Decline Period |

Approximately 1 year |

UV Printer E1 |

2024 |

2024-2025 |

Maturity Period |

Approximately 1 year |

According to the latest data [0], Anker Innovations is currently facing significant financial pressure:

| Indicator | Value | Industry Positioning |

|---|---|---|

| Market Capitalization | USD 56.8 Billion | Consumer Electronics Leader |

| Price-to-Earnings Ratio (PE) | 21.96x | Medium Valuation |

| Price-to-Book Ratio (PB) | 5.72x | Relatively High |

| ROE | 27.58% | Excellent |

| Net Profit Margin | 8.80% | Medium in the Industry |

| Gross Profit Margin | 38.8% | Under Pressure |

Analyzed from a five-year perspective, Anker’s financial indicators show a trend of ‘increasing revenue but not profit’ and even ‘simultaneous decline in volume and price’:

- Gross Profit Margin: Dropped from 44.2% in 2020 to 38.8% in 2024, a cumulative decrease of 5.4 percentage points

- Net Profit Margin: Dropped from 10.5% to 8.5%, a cumulative decrease of 2.0 percentage points

- R&D Expense Ratio: Increased from 5.2% to 8.1%, reflecting the company’s increasing investment in technology

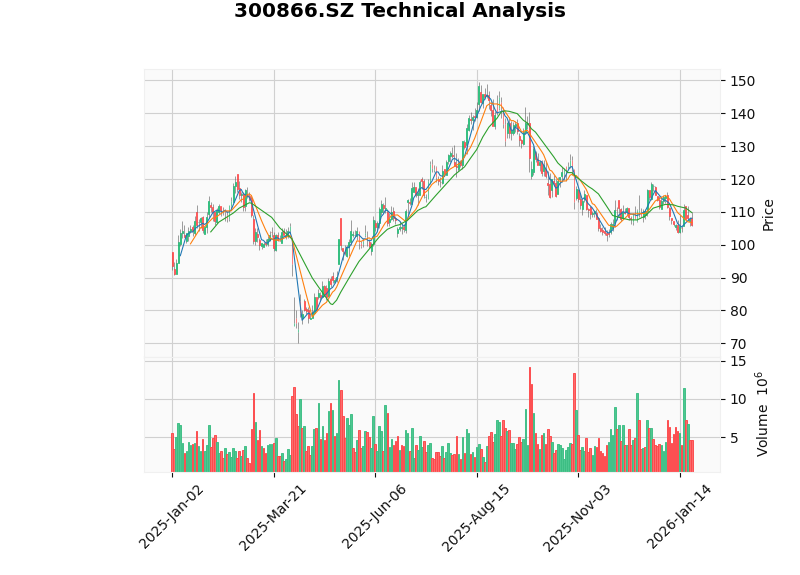

Anker Innovations’ stock price has performed weakly in the past year [0]:

| Period | Price Change | Evaluation |

|---|---|---|

| 1 Month | -7.60% | Significant Pullback |

| 3 Months | -13.26% | Deep Correction |

| 6 Months | -10.97% | Continued Downturn |

| 1 Year | -2.01% | Basically Flat |

The stock price trend reflects the market’s concerns about the sustainability of the company’s ‘hit product model’.

Anker’s launch of AI Recording Beans in partnership with Feishu marks the company’s official entry into the AI hardware track. The essence of this cooperation is a

| Partner | Contribution Field | Core Advantages |

|---|---|---|

| Anker Innovations | Hardware Design, Manufacturing, Channels | Supply Chain Integration, Brand Marketing |

| Feishu | AI Algorithms, Software Ecosystem | Speech Recognition, Large Model Capabilities, Enterprise Customer Resources |

- Rapid Market Entry: With Feishu’s AI capabilities, Anker can skip the long period of technology accumulation

- Reduced R&D Risk: Avoid the risk of huge investment in AI algorithms

- Channel Synergy: Feishu’s enterprise customer resources open up the B-end market for Anker

- Brand Endorsement: Cooperation with a leading technology enterprise enhances product credibility

- Limited Product Differentiation: Under the model of separating hardware design and AI algorithms, Anker struggles to form a unique technological barrier

- Profit Distribution Pressure: Under the cooperation model, the core profits of the AI value chain may be captured by Feishu

- Giant Competition: Players such as iFLYTEK and Huawei have deepened their presence in the AI recording field for many years, and Anker, as a new entrant, faces fierce competition

- Dependency Risk: Over-reliance on a single partner may lead to backlash if ‘Feishu launches its own brand’

Anker needs to face a key issue:

To break the curse, Anker must achieve the following transformation:

| Dimension | Current Status | Target Status | Transformation Path |

|---|---|---|---|

| Technological Capability | Rely on External Cooperation | Establish In-House AI Capabilities | Acquire/Build AI Teams |

| Product Logic | Marketing-Driven | Technology-Driven | Increase R&D Expense Ratio to 15%+ |

| Organizational Culture | Rapid Response | Long-Termism | Adjust Assessment Mechanisms |

| Business Model | Hardware Sales | Hardware + Services | Explore Subscription Models |

- Deepen strategic cooperation with leading AI enterprises such as Feishu

- Focus on hardware design aesthetics and user experience, and establish the ‘Anker Aesthetics’ brand label

- Rapidly learn and understand the boundaries of AI technical capabilities

- Key Indicator: AI product revenue accounts for 10%

- Acquire or invest in AI technology teams to make up for algorithm shortcomings

- Establish in-house AI laboratories and cultivate core technology teams

- Transform from a pure hardware company to a ‘smart hardware + services’ company

- Key Indicators: R&D expense ratio reaches 12%, gross profit margin recovers to 42%

- Achieve the transition from ‘fast-moving consumer electronics’ to ‘smart terminals’

- Establish differentiated technological barriers and form a closed-loop ecosystem of ‘hardware + software + services’

- Become a leader in the AI hardware niche

- Key Indicator: Innovative category revenue accounts for more than 35%

- Improved R&D Investment Efficiency: The current R&D expense ratio is 8.1%, but the success rate of new products continues to decline, requiring optimization of R&D resource allocation

- Product Lifecycle Management: Establish a ‘hit product maintenance’ mechanism to extend the product maturity period

- Differentiated Positioning: Avoid direct competition with technology giants and focus on the niche high-end market

- Organizational Capability Upgrade: Introduce AI talents and adjust the organizational structure to adapt to agile development

Anker Innovations’ current price-to-earnings ratio is 21.96x, which is at a historical medium level. Taking into account:

- Downside Risk: If the ‘hit product dilemma’ persists, performance growth may stall

- Upside Potential: If the AI hardware strategy is successfully implemented, there may be opportunities for valuation reconstruction

| Evaluation Dimension | Score | Explanation |

|---|---|---|

| Business Quality | 7/10 | Significant brand power and channel advantages |

| Growth Potential | 6/10 | Traditional businesses are under pressure, new businesses to be verified |

| Profitability | 7/10 | Excellent ROE, net profit margin under pressure |

| Valuation Rationality | 8/10 | Has reflected pessimistic expectations |

Comprehensive Rating |

7/10 |

Need to monitor the implementation effect of the AI strategy |

- Risk of Hit Product Model Failure: If new products continue to ‘decline after the second generation’, performance growth may stall

- Risk of Gross Profit Margin Decline: Intensified industry competition may lead to continued pressure on profitability

- AI Strategy Underperforming Expectations: The effect of cooperation with Feishu is uncertain

- Exchange Rate Risk: High proportion of overseas revenue, significant impact from exchange rate fluctuations

Anker Innovations is standing at a crossroads of strategic transformation. The company’s ‘hit product dilemma’ is essentially a mismatch between its business model and capability boundaries:

Launching AI Recording Beans in partnership with Feishu is a pragmatic choice for Anker to ‘leverage others’ strength’, but

From a long-term perspective, Anker needs to complete a genetic recombination from a ‘fast-moving consumer electronics company’ to a ‘smart hardware company’. This transformation will not happen overnight, and requires 3-5 years of continuous investment and organizational change.

Above: Technical Analysis K-line Chart of Anker Innovations (300866.SZ), showing it is currently in a sideways consolidation phase [0]

[0] Jinling AI Financial Database - Real-Time Market, Financial Data and Technical Analysis of Anker Innovations (300866.SZ) (January 22, 2026)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.