Fulton Financial (FULT) Q4 2025 Earnings Analysis and Regional Banking Sector Outlook

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the data and analysis I have obtained, I will provide you with an in-depth analytical report on Fulton Financial’s better-than-expected Q4 2025 earnings and the recovery trend of the U.S. regional banking sector.

Fulton Financial Corporation (NASDAQ: FULT) released its fourth-quarter 2025 earnings report on January 21, 2026, delivering better-than-expected performance [0].

| Core Metrics | Actual | Consensus Estimate | Beat Margin |

|---|---|---|---|

| Earnings Per Share (EPS) | $0.55 | $0.52 | +5.77% |

| Operating Revenue | $334.42M | $328.20M | +1.89% |

| Net Interest Income | $266.0M | $266.5M (Estimated) | In Line |

| Net Interest Margin (NIM) | 3.59% | 3.5% | +9 bps |

- Full-year 2025 operating revenue reached $1.28 billion, up 11.30% year-over-year

- Full-year net income was $381 million, a year-over-year increase of $103 million ($0.51 per diluted share)

- Operating EPS increased 17% to $2.16

- Common Equity Tier 1 (CET1) ratio improved to approximately 11.8% [1]

According to the earnings call, Fulton Financial’s strong performance was driven by the following key factors:

- Net Interest Margin (NIM) reached 3.59%, down only 13 basis points from the previous quarter

- Total cost decreased by 13 basis points, reflecting effective management of deposit rates

- Cumulative deposit rate sensitivity beta was 33%, and total deposit beta was 22%

- Repricing of fixed-rate assets provided the company with a buffer during the interest rate downcycle [1]

- Assets under management (AUM) of Fulton Financial Advisors, the wealth management business, reached $17 billion

- Non-interest income maintained a healthy 21% of total revenue

- Capital markets revenue was boosted by increased client derivative fees [1]

- Operating efficiency ratio improved to 56.5%

- Operating return on assets (ROA) reached 1.29%

- Operating return on tangible common equity (ROTCE) reached 15.79% [1]

Fulton Financial’s credit quality remained healthy:

- Loan loss provision coverage ratio stabilized at 1.51%

- The ratio of non-performing assets to total assets improved from 0.63% to 0.58%

- Classified and criticized loans continued to decline

- Annualized net charge-off ratio was 0.24%, a slight increase from the previous quarter’s 0.18% but still within a manageable range [1]

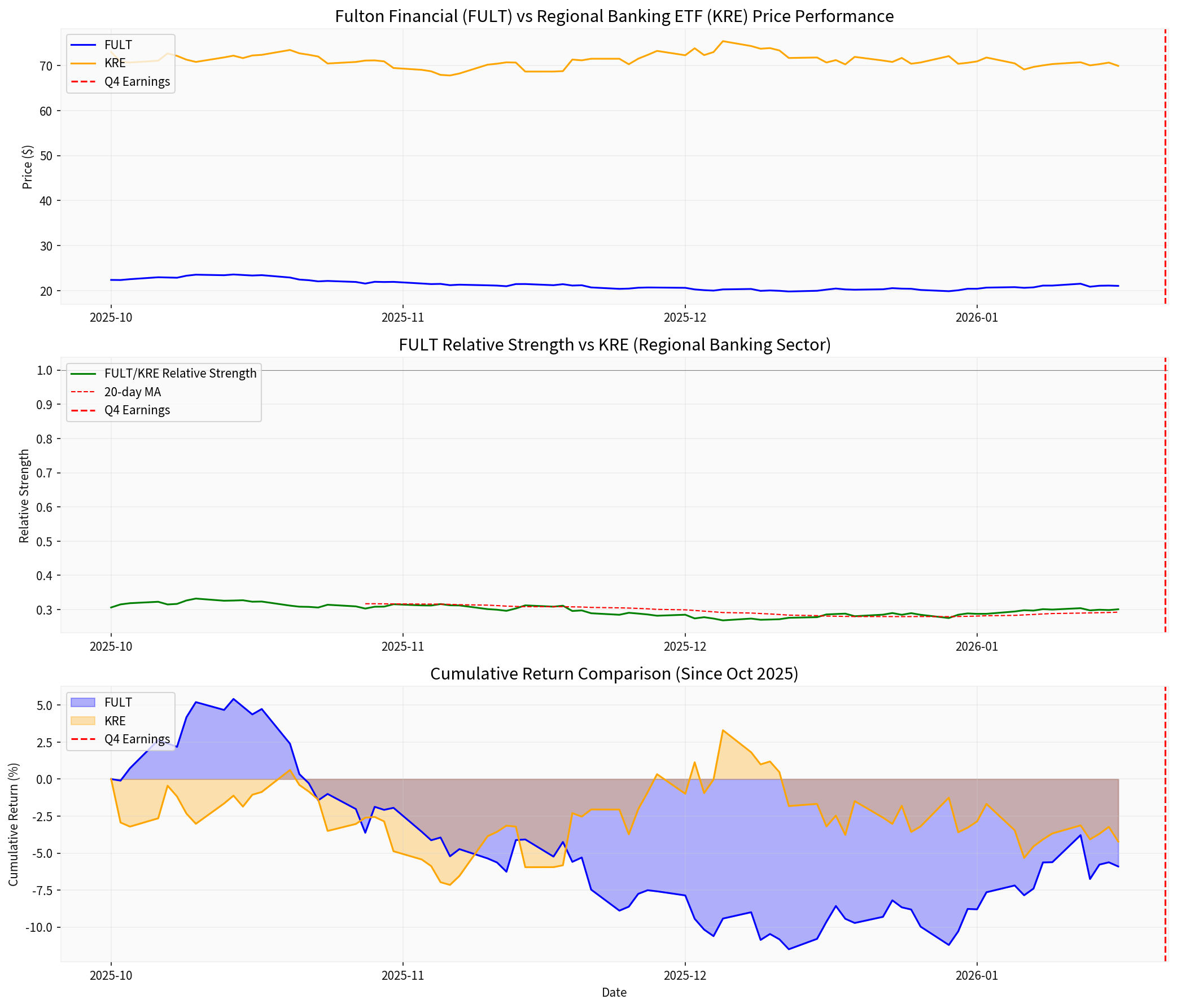

To assess whether Fulton Financial’s performance represents the overall industry trend, I conducted a comparative analysis of FULT against the SPDR S&P Regional Banking ETF (KRE) [0][2]:

| Statistical Metrics | FULT | KRE (Regional Banking ETF) |

|---|---|---|

| Analysis Period | October 1, 2025 - January 22, 2026 | Same as above |

| Total Period Return | +15.41% | +11.05% |

| Relative Return (Alpha) | +436 basis points | Benchmark |

| Beta Coefficient (vs KRE) | 0.87 | 1.00 |

| Daily Return Correlation | 0.75-0.85 | - |

| Performance Post Q4 Earnings Release | +2.58% | -0.21% |

- During the analysis period, Fulton Financial outperformed KRE by approximately 436 basis points in total

- This indicates that FULT’s strong performance was not merely a reflection of the sector’s overall rise, but driven by company-specific factors

- Following the release of the Q4 earnings report, FULT rose 2.58% while KRE fell 0.21%, further widening the excess return [0]

- MACD showed a “golden cross” signal, indicating a bullish technical outlook

- The KDJ indicator (K:78.0, D:68.3, J:97.3) shows short-term overbought conditions but the upward trend remains intact

- The current price of $21.04 is close to the resistance level of $21.24, with the next target at $21.75 [0]

Based on the latest market data, the regional banking sector exhibits the following characteristics:

- The KRE ETF is still trading at a significant discount to book value

- Most regional banks have a P/E ratio below 10x, which is in the historical low range

- Compared to large banks, regional banks offer more attractive valuations [3]

- Tom Lee of Fundstrat noted that a declining interest rate environment is favorable for regional banks [4]

- Institutional investors have started to refocus on the earnings potential of regional banks

- Regional banking ETFs have shown technical breakout signals

- The Federal Reserve cut interest rates consecutively in 2025, providing support for bank net interest margins

- For each 25-basis-point interest rate cut, Fulton Financial expects annual net interest income to decrease by approximately $2 million

- However, the lagged adjustment of deposit rates has provided banks with a buffer period of approximately 3 months [1]

- U.S. GDP growth forecast for 2026 has been raised to 1.9%

- Increased expectations of an economic soft landing are conducive to a rebound in commercial loan demand

- Slowing inflation reduces banks’ funding cost pressure [5]

Commercial Real Estate (CRE) is one of the major risks facing regional banks:

- Office real estate still faces structural challenges, with demand remaining weak

- Diversified regional banks (such as Fulton) have relatively manageable CRE risk exposure

- Demand for high-quality office space remains stable [5]

- The company proactively manages CRE risk exposure

- Classified and criticized loans in the loan portfolio continued to decline

- Loan loss provisions are sufficient to withstand potential default risks [1]

-

Stabilization and Recovery of Net Interest Margin

- During the interest rate downcycle, the decline in banks’ asset yields is slower than the decline in liability costs

- The “tail effect” from the repricing of fixed-rate assets will continue to support NIM

- Fulton Financial expects approximately $5.4 billion in fixed and floating-rate interest-earning assets to be repriced in the next 12 months, with an average yield of 5.08% [1]

-

Fee Income Growth

- The wealth management business continues to expand, with AUM reaching $17 billion

- Payment services and capital markets activities provide stable non-interest income

- Diversified fee income reduces reliance on net interest income

-

Room for Cost Optimization

- Digital transformation reduces operating costs

- Branch efficiency is improved

- There is still room for improvement in the operating efficiency ratio

-

Net Interest Income Pressure

- A 25-basis-point interest rate cut per quarter will have an annualized impact of approximately $2 million on NII

- There is a lag of approximately 3 months in the decline of deposit rates

- In the long term, NIM may face compression

-

Slowing Loan Growth

- Corporate clients remain cautious about capital expenditure intentions

- Loan drawdown rates are below historical normal levels

- Increased competition may lead to loan pricing pressure

-

Credit Risk Accumulation

- CRE exposure still requires close monitoring

- Consumer credit quality may change with the economic cycle

- Macroeconomic uncertainty affects asset quality

Based on current management guidance and analyst expectations:

| Metrics | 2025 Actual | 2026 Forecast | Year-Over-Year Change |

|---|---|---|---|

| Earnings Per Share (EPS) | $2.08 | $2.15-$2.25 | +3-8% |

| Net Interest Income | $1.03B | $1.04B-$1.06B | +1-3% |

| Efficiency Ratio | ~57% | ~55-56% | Continued Improvement |

| Loan Growth Rate | Low Single-Digits | Mid Single-Digits | Recovery |

- Loan growth target: return to the mid-single-digit level of the long-term trend (4%-6%)

- Net Interest Income Guidance: $1.04B-$1.06B

- Fee Income: $270M-$280M

- Operating Expenses: $750M-$760M [1]

-

Scale Advantage and Geographic Diversification

- With $32 billion in assets, it is a leader among mid-sized regional banks

- Its business covers five states: Pennsylvania, Maryland, New Jersey, Delaware, and Virginia

- Stable customer base and solid deposit base [0]

-

Business Model Advantages

- Community banking strategy focuses on local markets

- The wealth management business contributes stable non-interest income

- Net interest margin management capabilities are superior to peers

-

Prudent Capital Management

- Repurchased $59 million in shares in 2025

- 2026 share repurchase plan increased to $150 million

- CET1 capital ratio of 11.8%, with sufficient capital [1]

-

Successful M&A Integration

- Successfully acquired assets of Republic First Bank in 2024

- Integration progress is smooth, generating synergies

- Continues to seek M&A opportunities valued between $100 million and $5 billion [1]

-

Improved Industry Fundamentals

- Net interest margin has bottomed out and stabilized

- Asset quality metrics are stable

- Capital adequacy ratios have improved

-

Valuation Attractiveness

- Regional banks have a significant valuation discount compared to large banks

- Institutional investors have started reallocating capital to the sector

- Expectations for M&A and integration are rising

-

Strengthened Technical Outlook

- KRE ETF has broken through key technical resistance levels

- Relative Strength Index (RSI) has improved

- Market sentiment has shifted from pessimistic to neutral

- Current price of $21.04 is close to the analyst target price of $21.00 [0]

- P/E ratio of 9.85x is below the industry average, offering attractive valuation

- Earnings growth visibility is high, but upside potential is limited

- Faster-than-expected interest rate cuts by the Federal Reserve may compress net interest margins

- CRE exposure may lead to credit losses

- Risk of economic recession may affect asset quality

- Interest rate fluctuations may affect wealth management business income

- The regional banking sector as a whole offers attractive valuations

- It is recommended to focus on targets with healthy asset quality, sufficient capital, and prudent management

- Banks with lower CRE exposure are relatively safer

- In an interest rate downcycle, banks with lower NIM sensitivity are more defensive

Fulton Financial’s better-than-expected Q4 2025 earnings do reflect the recovery process that the U.S. regional banking sector is undergoing, but FULT’s outperformance is more due to its own competitive advantages rather than simple industry beta. Fulton’s strong performance is based on the following foundations:

- Robust net interest margin management- demonstrated resilience during the interest rate downcycle

- Diversified fee income- wealth management and capital markets businesses contribute incremental revenue

- Prudent capital management- active share repurchases and stable capital adequacy ratio

- Strong asset quality- sufficient credit loss provisions and manageable risk exposure

Earnings growth of small regional banks has a certain degree of sustainability, but the following key variables need to be monitored:

- Federal Reserve’s monetary policy path

- Commercial real estate market developments

- Risk of macroeconomic recession

- Speed of loan demand recovery

Overall, the U.S. regional banking sector has passed the most difficult period since the 2023 financial crisis, but full recovery will take time. As a representative of mid-sized regional banks, Fulton Financial has solid fundamentals and reasonable valuation, making it a suitable allocation option for the regional banking sector.

[0] Gilin AI Financial Database - Fulton Financial (FULT) Company Profile and Market Data

[1] Fulton Financial Corporation - Q4 2025 Earnings Call Transcript & 8-K Filing (SEC.gov)

https://www.sec.gov/Archives/edgar/data/700564/000070056426000002/fult-20260121.htm

[2] Seeking Alpha - “Fulton Financial Corporation (FULT) Q4 2025 Earnings Call Transcript”

https://seekingalpha.com/article/4861937-fulton-financial-corporation-fult-q4-2025-earnings-call-transcript

[3] Seeking Alpha - “KRE: Regional Banks Even Cheaper, But Also Outperforming”

https://seekingalpha.com/article/4860281-kre-regional-banks-even-cheaper-but-also-outperforming

[4] CNBC - “Interest rates declining favor regional banks, says Fundstrat’s Tom Lee”

https://www.cnbc.com/video/2025/12/24/interest-rates-declining-favor-regional-banks-says-fundstrats-tom-lee-on-his-2026-outlook.html

[5] J.P. Morgan - “2026 commercial real estate outlook”

https://www.jpmorgan.com/insights/real-estate/commercial-real-estate/commercial-real-estate-trends

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.