Analysis of the Impact of Bank of Japan's Monetary Policy on Japanese Stocks and Yen Trends

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest market data [0] and reports from Reuters [1][2], I will provide a detailed analysis of the impact of the Bank of Japan’s monetary policy on Japanese stock market investment strategies and yen trends.

According to the latest news on January 23, 2026, the Bank of Japan kept interest rates unchanged at this monetary policy meeting but significantly raised its economic growth and inflation forecasts for fiscal 2024 (the fiscal year ending March 2026) [1]. This decision sends several important signals:

- Policy Stance: The Bank of Japan is optimistic about economic recovery but remains cautious, continuing to maintain an accommodative stance

- Upward Revision of Inflation Expectations: Indicates the central bank believes inflationary pressures will remain above the target level

- Upward Revision of Growth Expectations: Reflects confidence in improved economic fundamentals

The latest economic indicators show that the Japanese economy is in a recovery trend [2]:

| Indicator | Value/Performance | Interpretation |

|---|---|---|

| Manufacturing PMI | Returned to expansion after 7 months | Manufacturing activity is picking up |

| December Core Inflation | Moderated but still above target | Inflationary pressures persist |

| Export Growth | Up for the fourth consecutive month (+5.1%) | External demand remains resilient |

| Government Growth Forecast | Raised from 0.7% to 1.1% | Improved economic outlook |

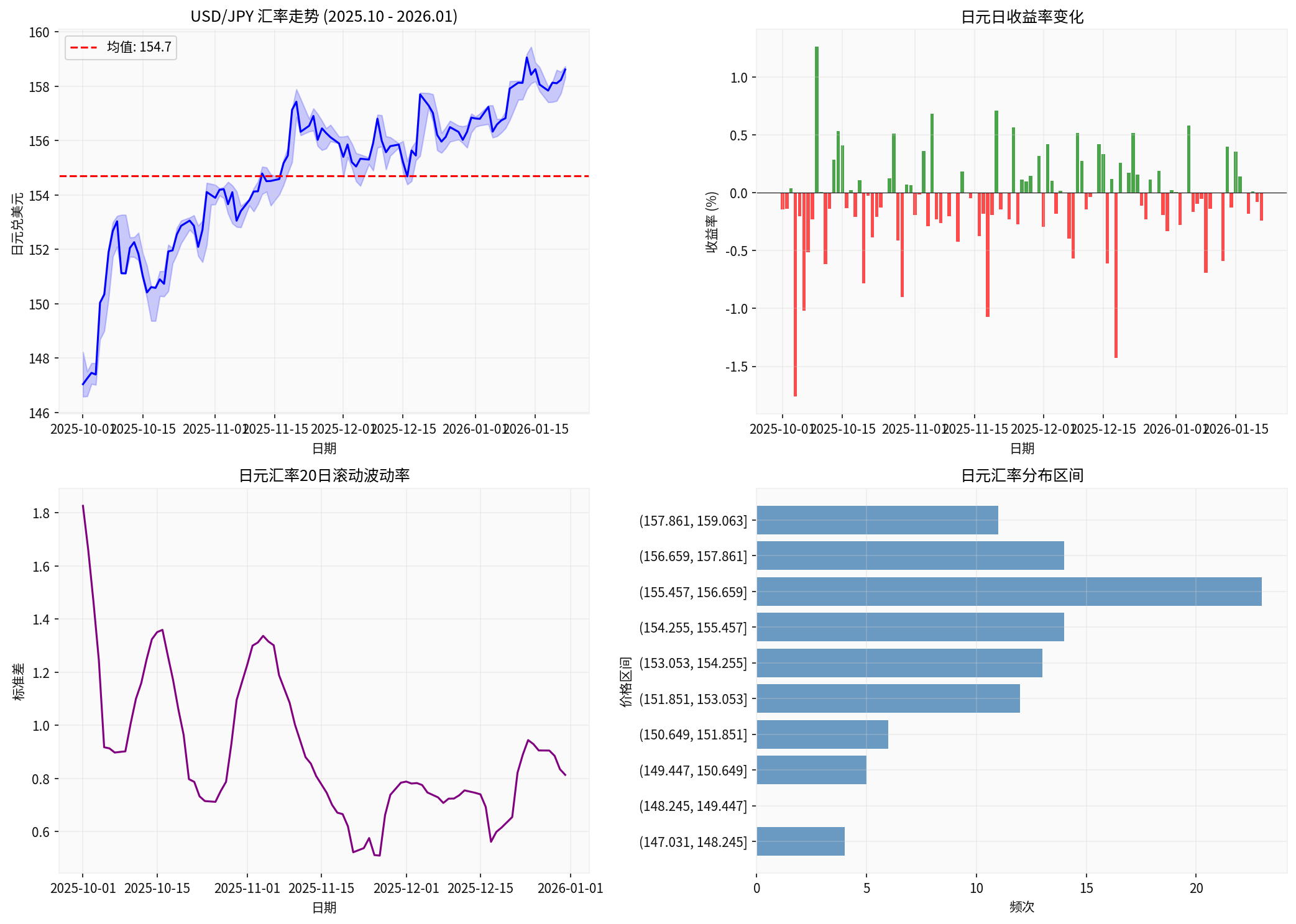

Based on market data analysis [0], the yen exchange rate has shown the following characteristics recently:

- Latest Exchange Rate: 147.04 yen per US dollar

- Period Change: Appreciated by about 7.3% from around 159 yen in early October 2025 to 147 yen

- Fluctuation Range: 146.59-159.45 yen

- Average Level: Approximately 154.70 yen

| Factor | Direction | Impact Analysis |

|---|---|---|

Monetary Policy Divergence |

Supports the yen | The Bank of Japan has continued to raise interest rates (already increased to 0.75% in December 2025 [2]), while the Federal Reserve may slow its rate hike pace |

Trade Data |

Supports the yen | The trade surplus has narrowed but remains in surplus, providing fundamental support for the yen |

Safe-Haven Demand |

Supports the yen | Increased global economic uncertainty has boosted demand for the yen as a safe-haven currency |

Carry Trade Unwinding |

Supports the yen | The normalization of the Bank of Japan’s policy has reversed carry trades, accelerating the yen’s appreciation |

- The yen is expected to fluctuate within the 145-155 range

- If the Bank of Japan sends a clearer signal of interest rate hikes, it may test the 140 level

- It is necessary to pay attention to the impact of the new US administration’s trade policy on the yen

- The Bank of Japan is expected to continue the process of monetary policy normalization

- The yen may gradually move towards the 140-145 range

- However, it is necessary to warn that the impact of US tariff policies on Japanese exports may delay the pace of interest rate hikes

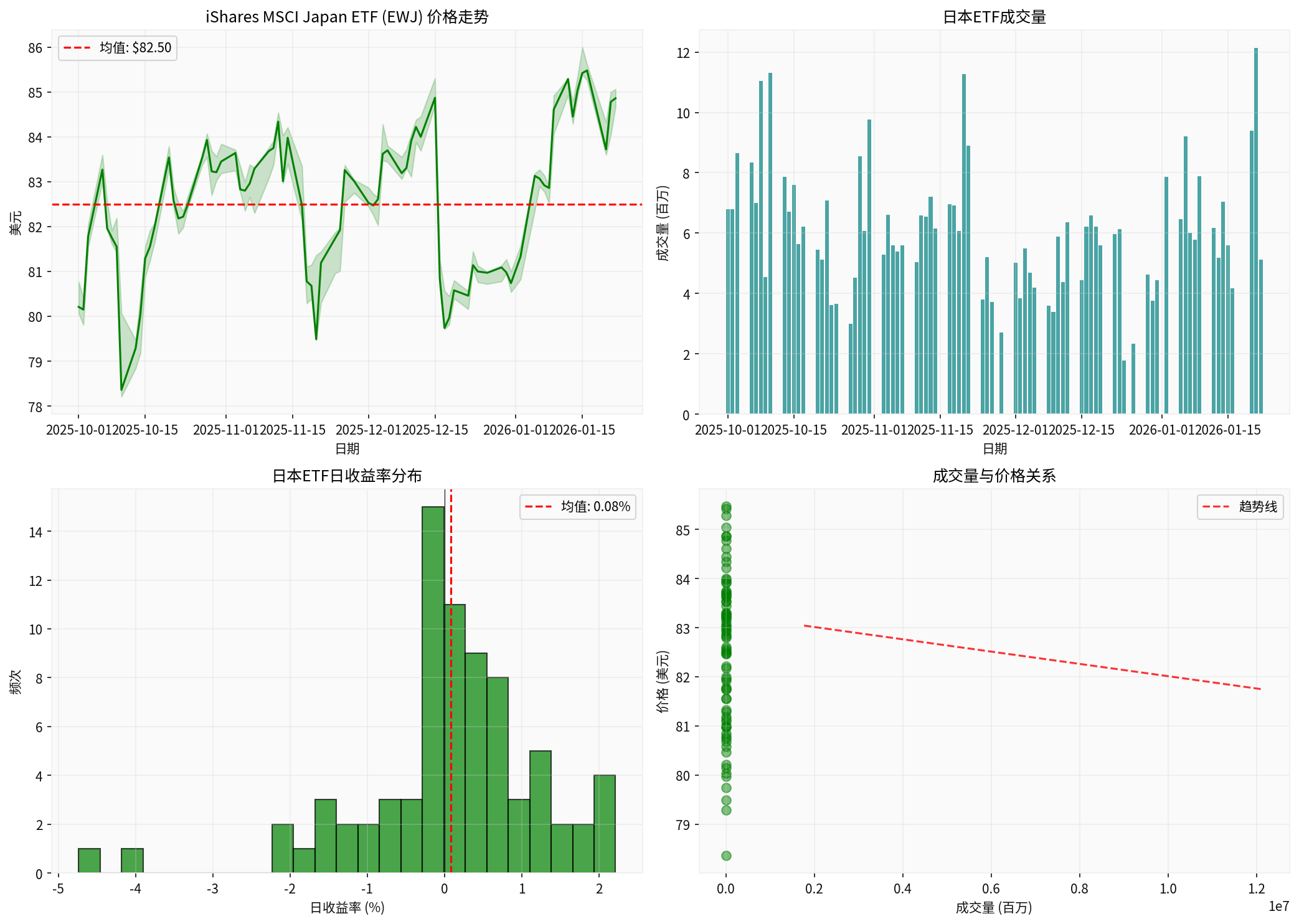

Based on analysis of the iShares MSCI Japan ETF (EWJ) [0]:

- Initial Price: US$80.21 (October 2025)

- Ending Price: US$84.86 (January 2026)

- Period Gain: +5.80%

- Price Range: US$78.21-86.00

- Average Trading Volume: 6.076 million shares

The Japanese stock market shows obvious structural differentiation [2]:

| Industry | Performance | Driving Factors |

|---|---|---|

Technology/Semiconductors |

Strong | AI boom drives demand for data center chips, Asian exports up 10.2% |

Export Manufacturing |

Neutral to Weak | Exports to the US fell 11.1% due to tariff impacts |

Domestic Demand Sectors |

To Be Observed | Whether wage growth can translate into consumption remains to be verified |

| Strategy | Recommendation | Rationale |

|---|---|---|

Overweight Technology/High-end Manufacturing |

★★★★★ | Strong demand for AI chips, Asian supply chains benefit |

Benchmark Weight Export-Oriented |

★★★☆☆ | Yen appreciation compresses profit margins, but Asian demand offsets the impact |

Underweight Companies with High US Exposure |

★★☆☆☆ | High tariff uncertainty |

Focus on Domestic Demand Recovery Sectors |

★★★★☆ | Wage growth + policy stimulus may drive consumption |

- Manufacturing PMI returned to expansionary territory, confirming economic recovery

- Corporate profit expectations raised, valuations have support

- Japanese corporate governance reforms continue to advance, enhancing shareholder returns

- Rapid yen appreciation may erode export corporate profits

- Uncertainty over US tariff policies

- Risk of slowing global economic growth

- Currency Hedging: For yen-sensitive investments, consider using currency hedging tools

- Diversified Allocation: Against the backdrop of yen appreciation, focus on companies with high domestic revenue in Japan

- Dynamic Adjustment: Flexibly adjust positions based on yen trends and central bank policy signals

- Focus on Policy Windows: The Bank of Japan’s next meeting (March 2026) may be an important policy turning point

According to data analysis [0], the yen and the Japanese stock market show a

| Scenario | Yen Trend | Impact on Japanese Stock Market |

|---|---|---|

Yen Appreciation |

Capital flows into Japan, but export corporate profits are under pressure | Overall negative, with structural differentiation |

Yen Depreciation |

Export competitiveness improves, but capital outflows occur | Overall positive, especially for export sectors |

- The yen has depreciated by about 7.3% from its high, benefiting export companies

- However, manufacturing reshoring and supply chain restructuring may weaken the boosting effect of yen depreciation on exports

- Investors need to focus more on corporate fundamentals rather than just exchange rate factors

| Variable | Forecast |

|---|---|

| Bank of Japan Policy | Hike interest rates 1-2 more times in 2026, bringing rates to 1.0-1.25% |

| Yen Exchange Rate | Fluctuates within the 140-150 range |

| Japanese Stock Market | Mildly rises 5-10%, led by the technology sector |

| Variable | Forecast |

|---|---|

| Bank of Japan Policy | Accelerates normalization, bringing rates to 1.5% |

| Yen Exchange Rate | 135-140 range, yen strengthens |

| Japanese Stock Market | Rises 10-15%, valuation expansion |

Risk: Excessively rapid yen appreciation may inhibit export recovery

| Variable | Forecast |

|---|---|

| Bank of Japan Policy | Pauses rate hikes, waits for economic data |

| Yen Exchange Rate | 155-160 range, yen weakens |

| Japanese Stock Market | Volatile or slightly pulls back to digest valuations |

Risk: US tariff policies significantly impact Japanese exports

-

Normalization of Bank of Japan Policy Will Continue: The upward revision of growth and inflation forecasts indicates the central bank’s confidence in the economic outlook, and it is expected to continue gradual interest rate hikes [1]

-

Yen Expected to Appreciate Mildly: Monetary policy divergence, safe-haven demand, and carry trade unwinding will support the yen, but the pace of appreciation will be affected by economic data and policy signals

-

Structural Opportunities in Japanese Stock Market Outweigh Systemic Risks:

- Technology/high-end manufacturing sectors benefit from the global AI boom and growing Asian demand

- Need to be cautious of companies highly dependent on exports to the US

- Domestic demand sectors may be the next growth driver

| Strategy Type | Specific Recommendations |

|---|---|

Long-term Allocation |

Maintain strategic allocation to the Japanese stock market, focusing on technology and high-end manufacturing |

Trading Opportunities |

Use yen fluctuations for range trading; increase allocation to export sectors when the yen depreciates |

Risk Hedging |

Hedge yen-sensitive exposures |

Dynamic Adjustment |

Closely monitor Bank of Japan policy signals and changes in US trade policy |

- Remarks by Bank of Japan Governor and policy meeting minutes

- Trends in US trade policy towards Japan

- Japanese wage data and consumption indicators

- Changes in global AI industry chain demand

- Yen exchange rate breaking key levels of 145 and 155

[1] Reuters - “BOJ keeps rates steady, raises growth and inflation forecasts” (January 23, 2026)

https://www.reuters.com/world/asia-pacific/boj-keeps-rates-steady-raises-growth-inflation-forecasts-2026-01-23/

[2] Reuters - “Japan’s exports up for fourth straight month, US dip clouds outlook” (January 22, 2026)

https://www.reuters.com/world/asia-pacific/japans-exports-rise-fourth-straight-month-partly-boosted-by-weaker-yen-2026-01-22/

[3] Jinling AI Market Data Analysis [0]

日本央行1月货币政策决议对亚太市场影响分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.