Labor Market Weakness and Gen Z Savings Trends: Market Analysis for January 23, 2026

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The January 23, 2026 trading session revealed notable divergence across major equity indices, reflecting investor uncertainty about the economic trajectory and potential Federal Reserve policy responses. The S&P 500 closed marginally higher at 6,915.62, representing a 0.11% gain, while the NASDAQ demonstrated more pronounced strength at 23,501.24 with a 0.26% advance [0]. The Dow Jones Industrial Average recorded a decline of 0.34% to finish at 49,098.72, highlighting the mixed sentiment pervading the market. Most significantly, the Russell 2000—often viewed as a barometer of smaller-cap company health and domestic economic vitality—declined by 1.61% to close at 2,669.16, suggesting heightened concern about the implications of labor market weakness for businesses that depend heavily on U.S. consumer spending [0].

The sector rotation pattern observed during this session provides important context for understanding market positioning around labor market dynamics. Financial Services emerged as the worst-performing sector, declining 1.65% in apparent correlation with rate expectation dynamics [0]. Basic Materials led advancers with a 1.73% gain, followed by Communication Services at 1.07%, Consumer Defensive at 0.82%, and Technology at 0.78%. The lagging sectors—Healthcare, Energy, and Industrials—each declined between 0.34% and 0.52%, collectively suggesting a market environment where cyclical concerns are beginning to influence asset allocation decisions [0].

The central thesis presented in the CNBC discussion centers on the paradoxical relationship between labor market deterioration and equity market performance. Talley Léger’s analysis suggests that weakening employment conditions may ultimately prove beneficial for stocks by creating conditions that prompt the Federal Reserve to implement interest rate cuts [1]. This perspective aligns with a broader market view that lower borrowing costs would provide a tailwind for corporate profitability and equity valuations.

The expert projections for Federal Reserve rate cuts in 2026 reveal significant divergence that reflects ongoing economic uncertainty. Mark Zandi of Moody’s Analytics has forecasted three rate cuts, anticipating early 2026 action before mid-year based on the reasoning that insufficient job growth will continue pushing unemployment higher, and as long as unemployment trends upward, the Fed will respond with accommodative policy [3]. The CME FedWatch tool projects two cuts, with the first expected post-April and the second around September [3]. The Federal Reserve’s own Dot-Plot from December 2025 presents a more conservative projection of just one cut for the full year [3]. This disparity between Zandi’s aggressive three-cut forecast and the Fed’s conservative single-cut projection underscores the fundamental uncertainty surrounding the economic trajectory.

The January 27-28 FOMC meeting represents an immediate focal point, with CME FedWatch indicating only a 13.8% probability of a rate cut at that gathering, suggesting market expectations of a holding pattern in the near term [3]. However, the trajectory of incoming labor market data—particularly monthly payroll reports and unemployment figures—will likely prove decisive in shaping the policy path forward.

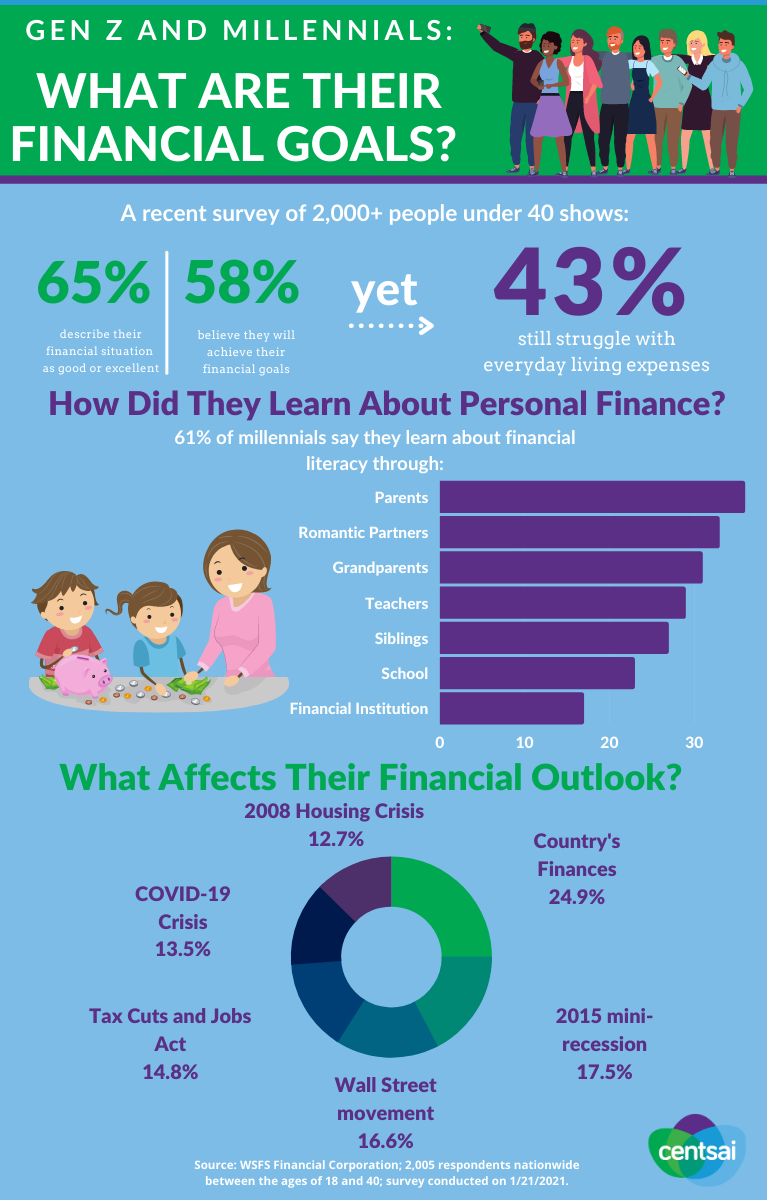

A parallel trend of considerable long-term significance involves the retirement savings behavior of Generation Z, defined as individuals aged 18-29. According to Allianz Life research cited by Yahoo Finance, more than 60% of Gen Z workers have either stopped or reduced their retirement savings contributions over the past six months [2]. This figure substantially exceeds comparable metrics for older generations, with Gen X showing 46% and Baby Boomers at 36% [2]. The magnitude of this behavioral shift raises important questions about long-term wealth accumulation patterns and potential implications for future consumption capacity.

Multiple contributing factors appear to be driving this trend. The average Gen Z credit card debt level of $3,493 represents a meaningful financial burden that competes with long-term savings priorities [2]. Entry-level salary pressures, inflation-adjusted cost-of-living increases, persistent student loan obligations, and elevated housing and healthcare costs collectively create a challenging financial environment for younger workers. Kelly LaVigne of Allianz Life observed that Gen Z may perceive an ability to defer retirement savings based on their long investment horizon, noting that these individuals “have decades until they will likely stop working” [2].

Financial planning experts emphasize the potential long-term consequences of this deferred savings behavior. Tricia Rosen of Access Financial Planning highlighted the “time value of money” principle, explaining that those who delay contributions will need to save substantially more later to achieve comparable retirement outcomes [2]. This dynamic represents a classic intertemporal choice problem where short-term financial pressures conflict with long-term wealth accumulation objectives.

The interconnection between labor market conditions, Fed policy expectations, and Gen Z savings behavior creates a complex feedback loop with implications for multiple market dimensions. Labor market weakness directly affects Gen Z employment security and wage growth potential, contributing to the financial pressures that drive reduced savings behavior. Simultaneously, labor market deterioration increases the probability of Fed rate cuts, which—according to the analysis presented on CNBC—could provide equity market support [1].

The Russell 2000’s pronounced weakness on January 23 may reflect market sensitivity to these dynamics, as smaller-cap companies often demonstrate greater correlation with domestic economic conditions and labor market health. The Financial Services sector’s underperformance suggests the market is already incorporating expectations of lower rates into asset valuations [0]. These sector rotation patterns warrant continued monitoring as indicators of evolving market positioning.

The analysis reveals several important insights that extend beyond the immediate market headlines. First, the relationship between labor market weakness and equity performance is contingent on the Fed’s response and the ultimate economic trajectory. A scenario where modest labor weakness triggers rate cuts without precipitating a broader recession would represent a favorable “Goldilocks” outcome for markets. However, if labor deterioration accelerates and signals fundamental economic weakness, the same dynamics could presage more concerning outcomes.

Second, the Gen Z savings behavior trend may have structural implications that extend well beyond the immediate financial concerns of younger investors. Deferred retirement savings represent deferred demand that could constrain future consumption patterns during the decades when this cohort represents an increasingly large share of economic activity. The interaction between reduced savings behavior and potential labor market weakness creates compounding risks for long-term wealth accumulation.

Third, the divergence between Fed projections and market expectations—as reflected in the Zandi forecast versus the Dot-Plot—highlights ongoing uncertainty that creates both opportunity and risk for market participants. The 13.8% probability of a January rate cut reflects near-term caution, but the potential for more aggressive easing later in the year suggests the market may be underpricing accommodation [3].

Fourth, the sector rotation patterns observed—with Financial Services declining 1.65% while Basic Materials advanced 1.73%—reveal how rate expectations are already influencing capital allocation decisions [0]. Continued monitoring of these rotation patterns may provide early signals of evolving market consensus.

The analysis identifies several risk factors warranting attention. Labor market deterioration represents the primary catalyst that could trigger both Fed response and potential economic concern. The Gen Z savings reduction pattern suggests long-term wealth accumulation challenges that may have generational implications. Fed independence remains a consideration given potential political pressure on monetary policy, particularly in the context of Trump administration Fed appointments [3]. Inflation persistence continues to present a complicating factor, with PCE at 2.8% as of November 2025 remaining above the 2% target [3].

The potential for labor market weakness to signal broader economic slowdown represents a material concern. Rising recession probability if labor deterioration accelerates would fundamentally alter the risk-reward calculus for equity exposure. Additionally, the Gen Z savings behavior trend may represent deferred demand that constrains future consumption capacity, with implications for corporate earnings growth across multiple sectors.

The potential for Fed rate cuts in 2026—regardless of whether the ultimate number proves to be one, two, or three—suggests an environment of gradually declining borrowing costs that could extend the equity bull market. Lower rates would reduce corporate financing costs, potentially supporting capital investment and shareholder returns. The current mixed market conditions may present tactical opportunities for investors with longer time horizons and tolerance for volatility.

A “Goldilocks” scenario wherein modest labor weakness prompts Fed cuts without causing recession would represent the most favorable configuration for risk assets. Consumer spending resilience despite savings pullback among Gen Z suggests underlying economic strength that could prove more durable than current concerns imply.

Market participants should track several indicators going forward. The January 27-28 FOMC meeting outcomes and forward guidance will provide important policy signals. Upcoming jobs reports—including monthly payroll data and unemployment figures—will prove critical for assessing labor market trajectory. Gen Z employment trends merit monitoring for any deterioration in younger worker job security. Sector rotation patterns, particularly continued Financial Services weakness, could signal evolving rate cut expectations. The Russell 2000’s performance serves as a potential leading indicator of smaller-cap sensitivity to domestic economic conditions.

The market analysis for January 23, 2026 reflects an environment characterized by competing forces and evolving expectations. Labor market weakness, while concerning from an employment perspective, has created conditions that may prompt Federal Reserve accommodation through interest rate cuts—a dynamic that, according to expert analysis, could prove supportive for equity valuations [1]. The diverging Fed policy projections—ranging from one to three projected cuts—underscore fundamental uncertainty about the economic path forward [3].

The Gen Z retirement savings trend represents a concerning development with long-term implications, as over 60% of younger workers have reduced or eliminated contributions amid mounting financial pressures including average credit card debt of $3,493 [2]. While the immediate market focus remains on Fed policy and labor data, the structural implications of deferred savings for future consumption and wealth accumulation warrant continued attention.

Market performance on January 23 reflected these crosscurrents, with the Russell 2000 declining 1.61% while the NASDAQ gained 0.26%, and the Financial Services sector underperforming by 1.65% [0]. These patterns suggest that rate expectations are already influencing asset allocation decisions, a dynamic that is likely to persist as labor market conditions continue to evolve.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.