Disney Q4 2025 Earnings: Streaming Profitability Milestone Amid Linear TV Decline

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on Disney’s fiscal Q4 2025 earnings report published on November 13, 2025 [1][2], which revealed a complex picture of transformation and strategic progress across the company’s diverse business segments.

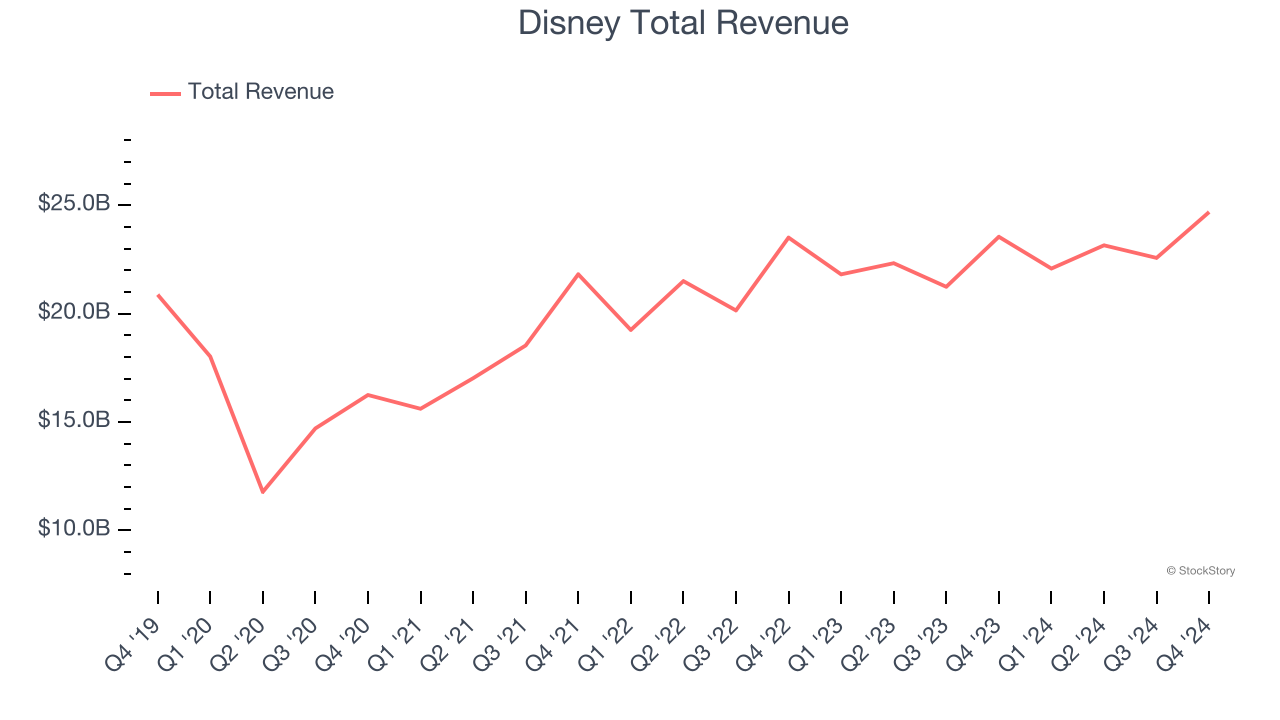

Disney delivered mixed financial results that initially disappointed markets but ultimately demonstrated underlying strategic strength. The company beat adjusted earnings expectations by 6 cents ($1.11 actual vs $1.05 expected) while falling short on revenue by $290 million ($22.46 billion actual vs $22.75 billion expected) [1]. Net income showed remarkable improvement, more than doubling to $1.44 billion from $564 million in the same quarter last year [1]. The stock’s trajectory—from a 5% pre-market decline to a 1.57% gain at $116.65 close—reflects investors’ nuanced assessment of these results [0].

The standout achievement was Disney’s streaming segment, which reached a critical profitability milestone. Streaming operating income jumped 39% to $352 million [1], marking a significant turning point in the company’s direct-to-consumer strategy. Subscriber growth remained robust across platforms:

- Disney+ added 3.8 million subscribers, reaching 131.6 million total [1]

- Hulu maintained strong presence with 64.1 million customers [1]

- Total streaming subscribers reached 196 million across all platforms [2]

This growth was driven by successful bundling strategies (80% of new ESPN retail subscribers chose bundles), international expansion (half of growth came from overseas markets), and strategic partnerships like the Charter Communications carriage deal [1].

The revenue miss was primarily attributable to continued deterioration in traditional television operations. Linear networks operating income declined 21% to $391 million, impacted by lower political advertising (approximately $40 million impact) and accelerating cord-cutting trends [1]. Additionally, an ongoing carriage dispute with YouTube TV since October 31, 2025, has created distribution uncertainty [1].

Disney’s parks and experiences business demonstrated continued strength, serving as a reliable growth driver. The segment posted 6% revenue growth to $8.77 billion and 13% operating income growth to $1.88 billion [1]. Cruise operations showed strong momentum despite fleet expansion costs, while bookings increased 3% with per-person spending up 5% in fiscal Q1 [1].

- Distribution Disputes: The ongoing YouTube TV carriage dispute could impact revenue and subscriber growth if not resolved promptly [1]

- Linear TV Acceleration: The 21% decline in linear networks operating income could accelerate as cord-cutting trends intensify [1]

- Content Investment Pressure: Higher programming costs, particularly for ESPN’s direct-to-consumer launch, may pressure margins in upcoming quarters [1]

- International Expansion: With half of streaming growth coming from international markets, significant global expansion opportunities remain [1]

- ESPN DTC Potential: The August ESPN direct-to-consumer app launch represents a new revenue stream, though initial costs have impacted domestic ESPN operating income [1]

- Shareholder Returns Enhancement: The 50% dividend increase to $1.50 and doubled share buyback program to $7 billion demonstrate management confidence in future cash generation [2]

Disney’s Q4 2025 results reveal a company in successful transition, with streaming profitability marking a watershed moment in its strategic evolution. The 39% increase in streaming operating income to $352 million [1] demonstrates the effectiveness of Disney’s direct-to-consumer strategy, while total streaming subscribers reaching 196 million [2] shows sustained platform growth.

The experiences segment continues to provide stable growth with 6% revenue increase and 13% operating income growth [1], serving as a reliable foundation during the streaming transformation. Management’s commitment to shareholder returns—evidenced by the dividend increase to $1.50 and $7 billion buyback program [2]—reflects confidence in sustained double-digit EPS growth expected for fiscal 2026-2027 [2].

The primary challenges remain in legacy media operations, with linear networks declining 21% in operating income [1], and ongoing distribution disputes that require resolution. However, the strong streaming performance and robust parks business position Disney well for continued strategic execution through its upcoming leadership transition.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.