飞沃科技(301232)强势表现分析:概念驱动与业绩拐点的博弈

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

飞沃科技进入强势股池的主要驱动因素呈现"双轮驱动"特征,但实质支撑力度存在显著差异。

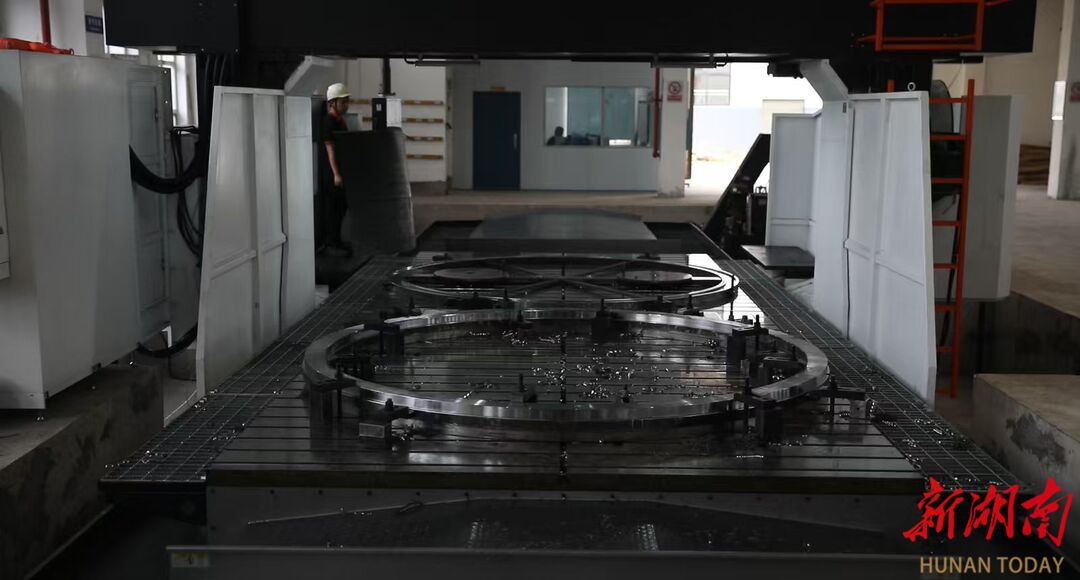

从历史财务数据看,公司业绩波动较大:2022年归母净利润8986万元,2023年降至5625万元,2024年大幅亏损1.57亿元,2025年预计扭亏至3200-4500万元 [4][5]。即便按照最优预期计算,2025年净利润率也仅1.3-1.8%,盈利能力恢复力度有限。公司核心业务为高强度紧固件,风电叶片预埋螺套占全球细分市场70%以上份额 [1],这一市场地位相对稳固,但风电行业整体增速放缓是长期挑战。

飞沃科技的强势表现是业绩扭亏预期与商业航天概念热炒共同作用的结果。业绩改善是相对扎实的基本面支撑,但商业航天业务占比极低,当前股价主要由概念驱动。主力资金持续净流入和融资余额处于高位显示资金关注度高,但高换手率也意味着筹码快速换手。技术面已突破关键压力位,但估值风险和概念炒作风险需要高度警惕。投资者应理性看待市场情绪波动,避免将概念热度等同于投资价值。

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.