Disney Q4 2025 Earnings: Mixed Results with Streaming Growth vs Linear TV Decline

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

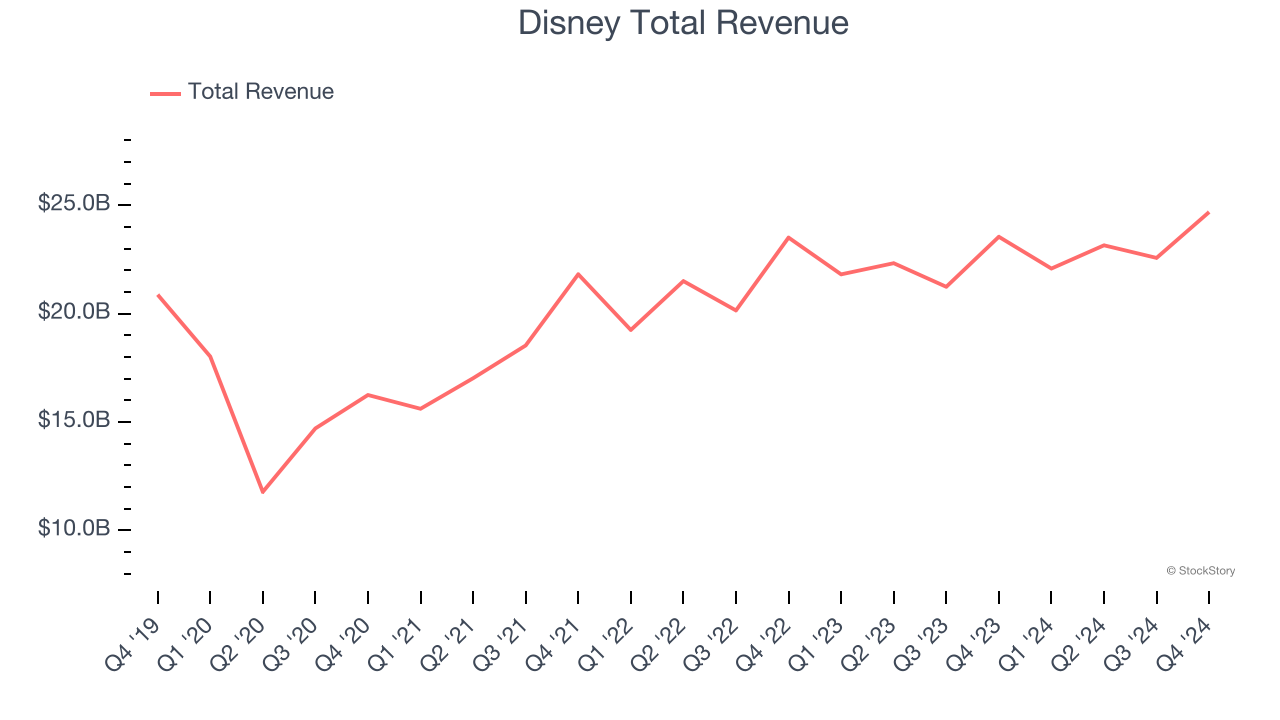

This analysis is based on Disney’s fiscal Q4 2025 earnings report released on November 13, 2025, at 8:48 AM EST [1][2]. The company delivered mixed financial results that triggered a significant stock decline, highlighting the ongoing transformation challenges in Disney’s business model from linear TV-dependent to streaming-first entertainment.

Disney beat earnings per share expectations but missed revenue estimates, creating a complex picture for investors. The company reported adjusted EPS of $1.11 versus $1.05 expected (5.7% beat), while revenue came in at $22.46 billion versus $22.75 billion expected (1.3% miss) [1][2]. Net income showed dramatic improvement at $1.44 billion, more than double the $564 million from the year-ago quarter [1].

The stock plunged 8.94% to $106.22 during regular trading hours, with trading volume surging to 24.53 million shares (3.1x average daily volume) [0]. This decline significantly underperformed broader market indices, with the S&P 500 down 0.88%, Nasdaq down 1.25%, and Dow down 0.75% on the same day [0]. The Communication Services sector declined only 0.72%, indicating company-specific factors rather than sector-wide pressures drove Disney’s stock decline [0].

Disney’s direct-to-consumer streaming segment demonstrated remarkable improvement, representing a significant strategic victory:

- Operating income reached $352 million, up 39% year-over-year[1][2]

- Full-year streaming operating income hit $1.33 billion, exceeding the $1.3 billion target[2]

- Disney+ subscribers increased by 3.8 million to 131.6 million total, exceeding the 2.4 million expected [1][2]

- Q1 2026 guidance projects approximately $375 million in streaming profits[2]

This performance represents a dramatic $5.3 billion turnaround from three years ago when the streaming business was running a $4 billion operating loss [1]. The achievement validates Disney’s streaming strategy and provides confidence in the company’s transition to a digital-first model.

The entertainment division’s 6% revenue decline was primarily driven by accelerating linear network challenges:

- Linear network revenue dropped 16% year-over-year[2]

- Linear network operating income declined 21% to $391 million[1]

- Contributing factors include cord-cutting acceleration, $40 million decline in political advertising versus prior year, and ongoing YouTube TV carriage dispute[1][2]

The 16% linear revenue decline represents an accelerating trend that creates significant near-term headwinds until streaming profitability can fully compensate for the traditional TV business erosion.

The experiences segment continued its strong performance trajectory:

- Revenue reached $8.77 billion, up 6% year-over-year[1][3]

- Operating income increased 13% to $1.88 billion[1]

- Domestic parks revenue grew 6% to $5.86 billion[1]

- International parks revenue surged 10% to $1.74 billion[1]

- Cruise business highlighted as key growth driver with new ships coming online[1][2]

The parks segment’s consistent growth demonstrates Disney’s pricing power and brand strength in physical experiences, providing a stable foundation amid media business transformation.

-

Linear TV Acceleration Risk:The 16% revenue decline in linear networks [2] represents an accelerating trend that could continue to pressure results until streaming fully compensates. This creates uncertainty about near-term revenue stability.

-

Carriage Dispute Volatility:The ongoing YouTube TV conflict [1] costs approximately $60 million in quarterly revenue [2] and potential future disputes with other distributors could create revenue volatility and customer access issues.

-

Competitive Pressure:Universal’s Epic Universe opening in Florida [2] could impact parks attendance, though Disney reports performance “in line with expectations” so far. The competitive landscape in both streaming and theme parks continues intensifying.

-

Execution Risk:The integration of Hulu, ESPN Unlimited rollout, and Asian expansion all require significant execution in competitive markets. Disney’s decision to stop reporting subscriber numbers following Netflix’s model [1] reduces transparency for investors.

-

Capital Return Enhancement:Disney announced significant shareholder-friendly actions including a 50% dividend increase to $1.50 per share and doubled share repurchases to $7 billion for fiscal 2026 [2]. The company also projected double-digit adjusted EPS growth for fiscal 2026 [2].

-

Cruise Expansion:New ships including Disney Adventure (March 2026) should drive high-margin growth [2]. The cruise business represents one of Disney’s highest-margin segments with significant expansion potential.

-

AI Integration Opportunities:CEO Bob Iger’s comments about AI enhancing Disney+ user experience [4][5] could create new engagement and revenue streams. AI technology could improve content recommendations, personalization, and potentially reduce content production costs.

-

International Growth:Asian market expansion and international parks growth [1] provide diversification opportunities beyond the mature U.S. market, particularly as streaming penetration continues globally.

Disney’s Q4 2025 results reflect a company in successful but painful transition. The streaming profitability achievement represents a major strategic milestone, with the business generating $1.33 billion in annual operating income versus a $4 billion loss three years ago [1]. However, the accelerating decline in linear TV revenues creates near-term uncertainty.

The company’s strong balance sheet supports continued investment in growth initiatives while returning capital to shareholders through increased dividends and expanded share buybacks [2]. Management’s confidence is reflected in the double-digit EPS growth guidance for fiscal 2026 [2].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.