Housing Market Distress: Foreclosures Jump 20% in October 2025

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the CNBC report [1] published on November 13, 2025, which revealed significant increases in foreclosure activity across the United States.

New foreclosure filings jumped 20% in October 2025 compared to the previous year, with 36,766 U.S. properties receiving foreclosure filings, representing a 3% increase from September and a 19% jump from October 2024 [1]. This marks the eighth consecutive month of annual increases, indicating sustained housing market distress. The increases span all phases of the foreclosure process, with foreclosure starts up 6% month-over-month and 20% year-over-year, while completed foreclosures rose 32% year-over-year [1].

The housing sector underperformed significantly, declining 1.26% on the day of the report [0]. Major homebuilders showed mixed performance, with D.R. Horton (DHI) falling 0.43% to $145.40 and Lennar (LEN) declining 0.70% to $123.26, while NVR Inc. outperformed peers with a 0.36% gain to $7,313.57 [0]. This divergence suggests market differentiation based on business models and target markets.

Despite the alarming 20% increase, current foreclosure activity remains well below historical norms [1]. The current foreclosure rate is less than 0.5% of mortgages, compared to historical averages of 1-1.5% and the Great Recession peak of over 4% of mortgages. Current delinquency rates stand at 4% of mortgages versus 12% during the financial crisis peak [1].

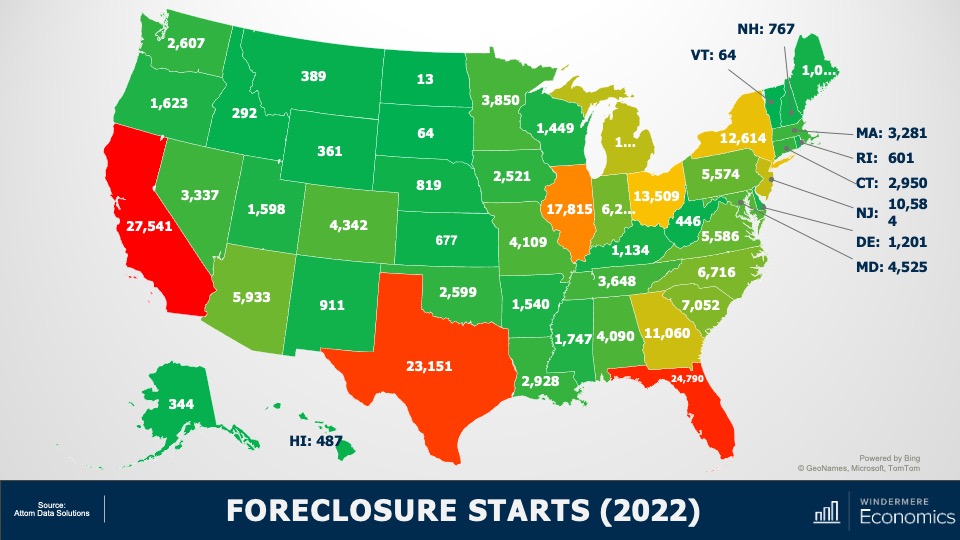

Florida, South Carolina, and Illinois led in foreclosure filings, with Tampa, Jacksonville, and Orlando (Florida) having the most filings, followed by Riverside, CA and Cleveland, OH [1]. States like Florida and Texas face particular pressure from falling home prices combined with soaring insurance premiums, creating a negative feedback loop for homeowners [1].

A critical insight is the concentration of risk in FHA loans, with delinquencies exceeding 11% and accounting for 52% of all seriously delinquent loans [1]. This suggests potential for substantial FHA foreclosures in 2026, representing a significant systemic risk factor in the housing market.

Several economic factors are contributing to housing market stress, including mortgage rates remaining within one percentage point of recent highs despite Fed rate cuts, consumer debt at all-time highs with rising delinquencies across credit types, a weakening job market, and home prices that remain stubbornly high nationally despite easing [1].

The analysis reveals several risk factors that warrant attention. The FHA loan concentration risk is particularly concerning, with delinquencies over 11% representing 52% of seriously delinquent loans, which could trigger substantial foreclosure increases in 2026 [1]. Regional insurance premium inflation in states like Florida and Texas creates compounding pressure from falling home values alongside rising insurance costs [1]. Record-high consumer debt levels combined with rising delinquencies across credit categories suggest broader financial strain that could spill into mortgage markets [1].

Decision-makers should track monthly foreclosure trends for acceleration beyond the current 20% YoY increase, mortgage rate movements that could trigger additional borrower stress, regional employment data particularly in construction and real estate-dependent markets, housing inventory levels as increasing foreclosure inventory could pressure prices further, and FHA loan performance including monthly delinquency and foreclosure rates for government-backed mortgages [1].

The market faces several potential trajectories: a moderate case of gradual normalization toward historical averages (1-1.5%), a risk case of accelerating defaults in high-cost insurance states combined with economic weakness, or a severe case of systemic stress if consumer debt problems cascade into mortgage markets [1].

Current foreclosure activity shows significant increases but remains below historical crisis levels, with regional concentrations creating localized risk. The FHA loan segment represents a particular vulnerability with high delinquency rates. Macroeconomic pressures including high consumer debt, elevated mortgage rates, and employment weakness suggest continued housing market stress. While the overall market indices have shown resilience (S&P 500 +0.67%, Dow Jones +2.56% over 30 days) [0], the housing sector’s underperformance (-1.26% on report day) [0] reflects growing concerns about market stability. The technical indicators [0] show warning signals that historically correlate with increased market volatility in distressed housing markets.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.