Disney Q4 2025 Earnings: Mixed Results with Streaming Growth Amid Linear TV Decline

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Yahoo Finance report [1] published on November 13, 2025, which detailed Disney’s mixed Q4 2025 earnings results and subsequent market reaction.

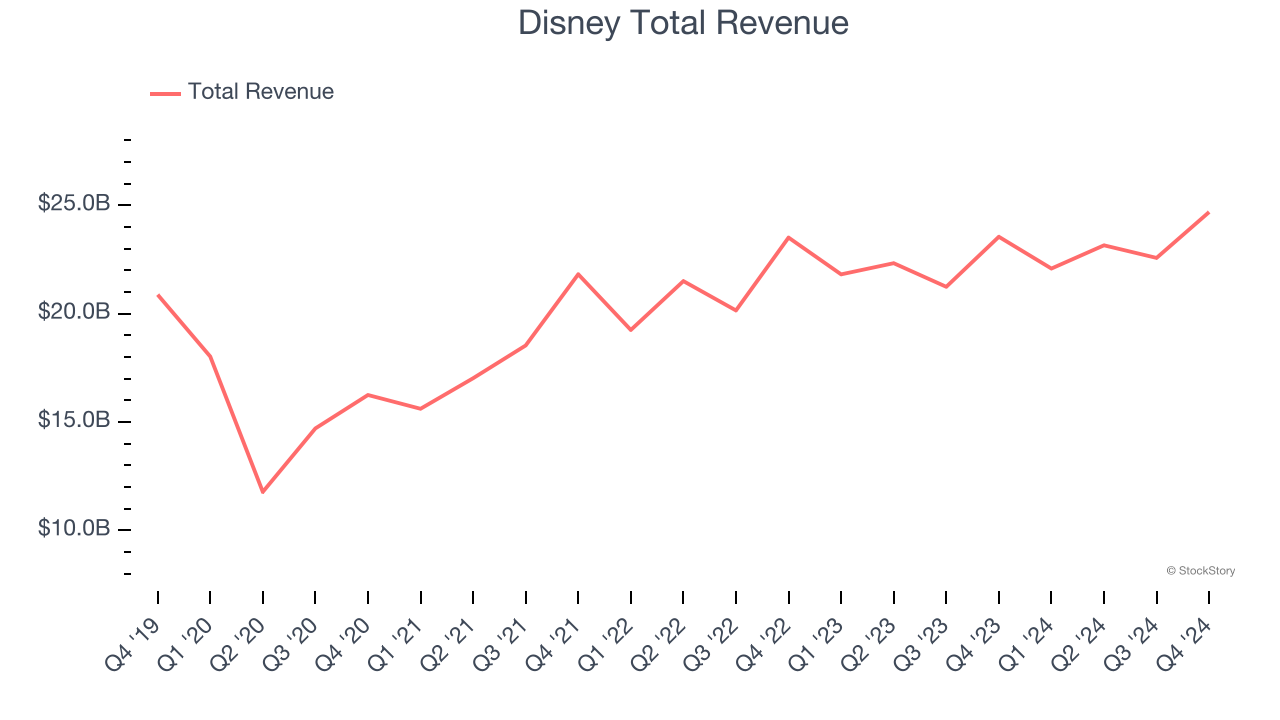

Disney’s fourth quarter fiscal 2025 results reveal a company in transition, with traditional media challenges offset by strong streaming profitability and robust parks performance. The revenue miss of $22.46 billion versus $22.83 billion consensus [1] was primarily driven by accelerating declines in linear networks, which fell 16% year-over-year in revenue and 21% in operating income [1]. This structural decline in traditional television represents the most significant concern for investors, contributing to the stock’s 5% pre-market decline and eventual 7.72% drop to $107.65 at market close [0].

However, the streaming business demonstrated remarkable progress, achieving $352 million in operating income (+39% YoY) [1] and reaching the full-year target of $1.33 billion streaming operating income [1]. Disney+ added 3.8 million subscribers, exceeding expectations of 2.4 million [1], while the new ESPN Unlimited service showed strong adoption with 80% of new sign-ups opting for the bundle [1]. These results validate Disney’s streaming strategy and provide confidence in the company’s ability to monetize its content directly to consumers.

The Experiences division continued its strong performance with 6% revenue growth to $8.77 billion [1] and 13% operating income growth for the full year [1]. This segment’s resilience demonstrates the value of Disney’s integrated entertainment ecosystem and provides a stable foundation during the media transition.

-

Linear TV Business Decline:The accelerating 16% year-over-year revenue decline and 21% operating income drop in linear networks [1] represents a structural challenge that could continue to pressure results if the cord-cutting trend accelerates further.

-

YouTube TV Carriage Dispute:The ongoing two-week carriage dispute with YouTube TV could result in approximately $60 million in quarterly revenue losses [1] and may affect subscriber relationships and brand perception.

-

Content Cost Inflation:Disney projects $1 billion in additional content spending for fiscal 2026 [1], primarily driven by sports rights costs. This could pressure margins if not offset by subscriber growth and pricing power.

-

Streaming Margin Expansion:With streaming profitability established, Disney has significant opportunity to expand margins through international expansion and price optimization, particularly for ESPN content.

-

Parks Growth Potential:The Experiences division continues to show strong growth potential, with new attractions and international expansion opportunities that could drive sustained double-digit growth.

-

Sports Content Monetization:The ESPN Unlimited platform provides a direct-to-consumer opportunity for sports content monetization that could become increasingly valuable as traditional sports broadcasting models evolve.

Disney’s Q4 2025 results reflect a company successfully navigating the media transition, with streaming operating income reaching $352 million (+39% YoY) [1] and full-year streaming profitability of $1.33 billion achieved [1]. While linear network revenue declined 16% [1], the Experiences division grew 6% to $8.77 billion [1] with 13% operating income growth for the full year [1]. Management issued confident guidance for fiscal 2026, expecting double-digit adjusted EPS growth [1] supported by the dividend increase to $1.50 and expanded $7 billion share repurchase program [1]. The current valuation appears attractive at a P/E ratio of 16.87x [0] with analyst consensus maintaining BUY ratings and $140 target price [0], though investors should monitor the linear TV decline trajectory and execution of strategic initiatives closely.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.