Defensive Sectors Analysis: Historical Outperformance and Current Opportunity Assessment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

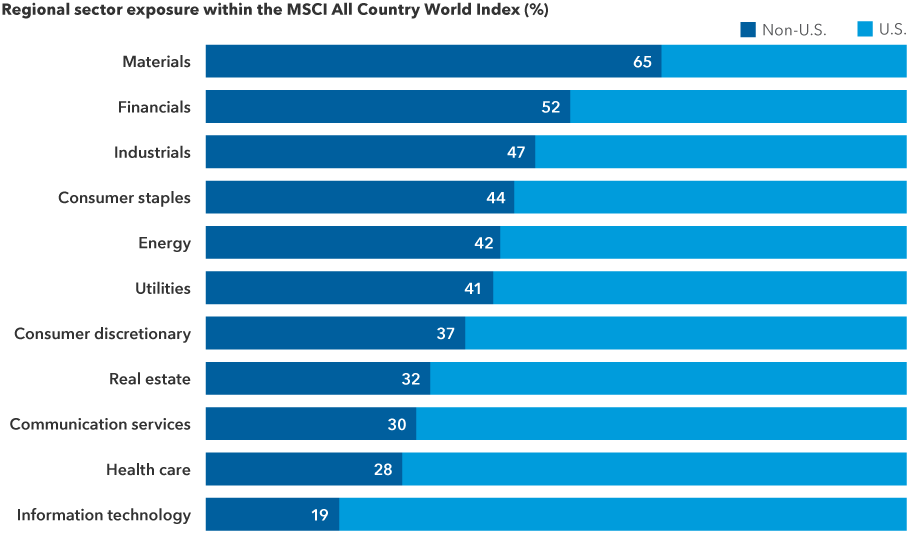

This analysis examines a Reddit post published on November 13, 2025, at 13:47:05 EST, which argued that defensive sectors historically outperformed during market crashes and currently present undervalued opportunities [Reddit post source]. The post specifically highlighted Energy, Consumer Staples, Utilities, and Materials sectors as attractive alternatives to technology holdings or cash positions.

- Sector-Specific Challenges:Energy faces commodity price volatility and ESG transition risks; Materials remain cyclical and tied to industrial activity; Utilities are sensitive to interest rate changes and regulatory shifts [0]

- Valuation Risk:Some defensive sectors may be overvalued relative to historical norms, particularly those skewed by large constituents [3]

- Concentration Risk:Overweighting defensive sectors could lead to underperformance if growth sectors resume leadership

- Economic Sensitivity:While traditionally defensive, these sectors still face pressure from prolonged economic downturns affecting consumer spending and industrial demand

- Attractive Valuations:Energy and Consumer Staples currently offer reasonable valuations with strong balance sheets and profitability metrics [0]

- Historical Resilience:Defensive sectors have demonstrated consistent outperformance during market stress periods [1, 2]

- Income Generation:Many defensive stocks offer attractive dividend yields, providing income during volatile periods

- Analyst Support:Consumer Staples and Utilities receive BUY consensus from analysts with meaningful upside potential [0]

The Reddit post’s thesis about defensive sector opportunities has substantial historical merit and current relevance. Energy and Consumer Staples appear most compelling based on current valuations, financial health, and analyst consensus. Exxon Mobil offers attractive 17.26x P/E with strong profitability, while Procter & Gamble demonstrates excellent fundamentals with 19.74% net margin and 32.13% ROE [0]. However, the Materials sector faces challenges, as evidenced by Dow’s negative earnings and poor recent performance [0].

Current market data shows mixed defensive sector performance, suggesting that defensive characteristics are not uniform across all sectors in the present environment [0]. While historical analysis consistently shows defensive sectors outperforming during market crashes [1, 2], investors should be aware that not all defensive sectors are equally attractive, and individual stock selection within sectors remains crucial.

The analysis supports a balanced approach rather than wholesale sector rotation, as timing defensive positioning correctly remains challenging. A hybrid strategy, as suggested in the original post, may provide balanced exposure while managing risk during continued market volatility.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.