Portfolio Strategy Transition: From All-Weather to Barbell Allocation Amid Structural Macro Shifts

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

The transition from Ray Dalio’s All-Weather Portfolio to a Barbell Allocation strategy represents a fundamental reconsideration of portfolio construction assumptions that have guided institutional investment for over three decades. This analysis synthesizes macroeconomic, market structure, and competitive landscape factors to provide a comprehensive understanding of the drivers, implications, and stakeholder considerations surrounding this strategic shift [1].

The All-Weather Portfolio was constructed on the premise that U.S. Treasury bonds would serve as reliable risk-free assets that appreciate during economic stress, providing portfolio balance through negative correlations with equities and other risk assets [2]. This core assumption is increasingly challenged by three converging structural trends that have accelerated in recent years.

First, the de-dollarization trend represents a structural shift in global monetary architecture. Data indicates the U.S. dollar’s share of global foreign exchange reserves has declined from approximately 71% in 2000 to 58.4% in Q1 2025 [3]. This decline reflects growing multilateral efforts to diversify reserve holdings away from single-currency dependence, with central banks consistently adding gold to balance sheets as part of this reallocation. The fiat currency confidence erosion that Ray Dalio himself identified as the “biggest story” of 2025 directly challenges the AWP’s assumption that currency-denominated assets will maintain their store-of-value function [4].

Second, U.S. debt sustainability concerns have intensified, with the fiscal trajectory raising questions about Treasury securities’ risk-free status. Dalio has publicly warned that structural fiscal challenges could undermine confidence in government bonds as the foundation of portfolio construction [4]. The intersection of rising debt-to-GDP ratios with increased Treasury issuance creates potential supply-demand imbalances that may affect yield dynamics and price stability.

Third, persistently low Treasury yields create a challenging environment for duration-focused strategies. Current market conditions show the 10-year Treasury yield hovering around 4.21-4.22% while the 30-year yield sits near 4.81% [5]. More critically, the constrained yield environment limits price appreciation potential that has historically benefited bond-heavy portfolios. Schwab’s 2026 fixed-income outlook suggests limited room for yields to fall further, fundamentally altering the risk-reward calculus for long-duration allocations [6].

Beyond macroeconomic headwinds, the AWP’s Treasury allocation faces structural market issues that complicate its traditional hedging function. Bloomberg reported that 10-year Treasury delivery fails surged to the highest level in eight years in December 2025, reflecting liquidity stress in the repo market [7]. This dysfunction stems from multiple sources: the Federal Reserve’s balance sheet contraction since 2022 has reduced the availability of Fed-owned paper for lending, while the fourth quarter of 2025 saw the Fed quietly inject liquidity through what analysts characterize as “shadow quantitative easing” via bills purchases, regulatory relief, and expanded Standing Repo Facility usage [8]. These interventions, while stabilizing in the short term, highlight underlying market fragility that challenges the AWP’s reliance on Treasury securities as reliable portfolio ballast.

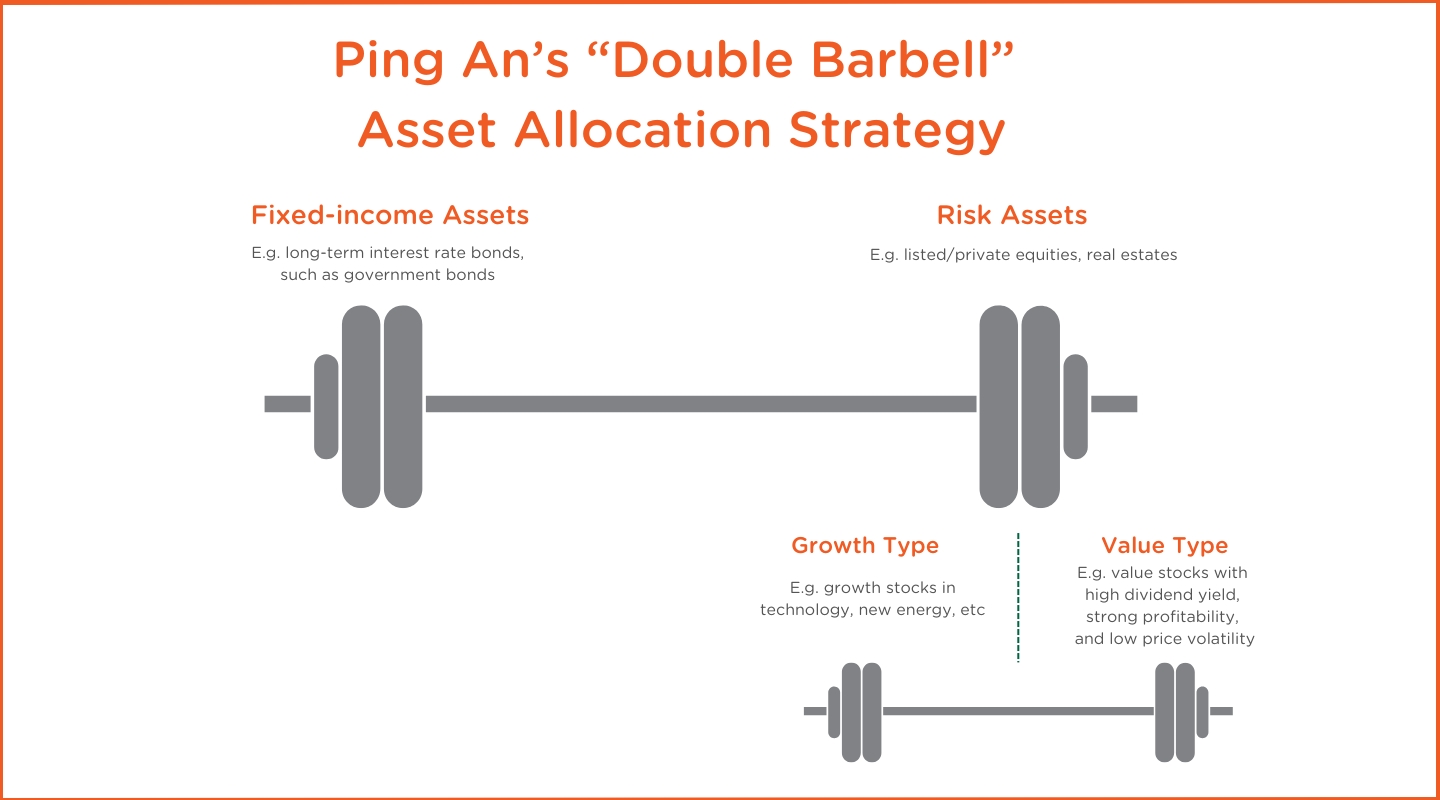

The proposed Barbell Allocation strategy draws on principles articulated by Nassim Nicholas Taleb while aligning with Dalio’s own more recent public commentary. The strategy represents a fundamental departure from the AWP’s balanced risk-parity approach by embracing asymmetry—being “extremely conservative with most capital and aggressively opportunistic” with the remainder [9]. Under this framework, the traditional 40% long-term Treasury allocation is significantly reduced, while gold allocation increases to 5-15% from the traditional 7.5%, and short-term cash positions receive higher allocation. Equities are concentrated in growth positions rather than diversified across market caps and sectors.

This approach accepts that economic environment prediction is inherently uncertain and chooses not to attempt balance across all scenarios but rather to construct portfolios resilient to worst-case outcomes while participating in upside scenarios. The barbell structure acknowledges that traditional diversification may provide false comfort when the correlations that underpin it become unreliable under stress.

The most significant insight from this strategic transition involves gold’s evolving role from peripheral diversifier to potential portfolio cornerstone. Gold has surged past $2,680 per ounce in January 2026, with some forecasts targeting $5,000-$6,000 per ounce [10]. More importantly than price appreciation, gold’s structural role is transforming as central bank buying driven by de-dollarization provides fundamental demand support independent of investor sentiment. As eToro analyst Lale Akoner observed, “gold is increasingly being used by investors as a hedge against equity risk, and in many portfolios, it is starting to replace long-duration government bonds as the preferred defensive asset” [11]. This represents a generational shift in how portfolios approach defensive allocation, with significant implications for traditional fixed-income products and the risk-parity industry broadly.

The irony of investors transitioning away from the All-Weather Portfolio is heightened by Ray Dalio’s own shifting public positions. His 2025 reflections highlighted fiat money depreciation as the defining market narrative, and his 2026 outlook includes warnings about AI bubble risks, weak monetary conditions, and political instability [4]. Dalio has maintained a positive view on gold as a reserve asset while expressing concern about Treasury market dynamics—positions that implicitly support the barbell rationale even as Bridgewater Associates continues managing All Weather strategies. Bridgewater’s All Weather Fund returned +20.4% in 2025 according to Fonte Capital analysis [12], but near-term performance obscures the structural concerns about Treasury allocation that the Seeking Alpha author and others have identified.

Current market sector dynamics provide empirical support for the barbell rationale. Recent performance data shows Technology (+1.26%) and Healthcare (+1.20%) leading gains while Consumer Defensive (-0.67%) lags [13]. This divergence between growth and traditional defensive sectors supports the barbell approach of pairing ultra-safe assets with aggressive growth positions rather than seeking balanced exposure across risk profiles. The traditional defensive sector logic—which informed the AWP’s balanced construction—is being challenged by an environment where growth assets appreciate during both risk-on and risk-off scenarios under certain conditions.

The broader risk-parity industry faces questions about strategy effectiveness that extend beyond individual portfolio decisions. Traditional 60/40 portfolios face similar headwinds, with bond yields offering limited upside potential and equity valuations stretched with the S&P 500 trading at approximately 23.5x forward earnings [14]. Asset managers offering barbell or tail-risk strategies may see increased demand as investors reconsider traditional diversification approaches. The structural shifts are also intensifying debates about passive allocation, with simple three-ETF portfolios gaining popularity among retail investors while sophisticated investors explore return-stacking approaches seeking higher Sharpe ratios through leverage and derivatives [15].

The analysis reveals several risk factors warranting attention from market participants considering portfolio strategy transitions. Traditional portfolio construction frameworks face structural headwinds that may require significant adaptation to maintain relevance. Risk-parity products that rely on negative correlations between stocks and bonds could experience correlation breakdown during stress events, potentially amplifying rather than dampening portfolio volatility. Investors transitioning to barbell strategies face concentration risk in growth equity allocations, which have experienced significant appreciation and may be vulnerable to multiple compression. Additionally, gold allocation increases introduce commodity-specific risks including potential price volatility, storage costs, and liquidity considerations during stressed market conditions.

The Treasury market dysfunction identified in the analysis—including elevated delivery fails and liquidity stress—suggests potential volatility in government bond markets that could affect even reduced-duration allocations. Market participants should be aware that the interventions characterizing Q4 2025 as “shadow quantitative easing” may create dependencies that complicate the path toward normalized market functioning.

The structural shifts creating challenges for traditional approaches also create opportunities for adaptive strategies. The barbell framework offers potential for improved risk-adjusted returns by eliminating middle-ground allocations that may offer unfavorable risk-reward profiles in the current environment. Increased gold allocation provides portfolio protection against currency depreciation and de-dollarization trends that appear structurally supportable rather than temporary. Reducing long-duration Treasury exposure may improve portfolio resilience given yield constraints that limit price appreciation potential.

For asset managers, the environment creates opportunities to develop products offering gold exposure, alternative assets, and flexible duration management that address evolving investor needs. Products communicating clearly about structural macro shifts and their portfolio implications may capture demand from investors seeking guidance through the transition. Financial advisors who proactively address portfolio construction challenges may strengthen client relationships through periods of market uncertainty.

Near-term catalysts that will influence the trajectory of this strategic debate include the January 29, 2026 FOMC decision and subsequent rate expectations, Q1 2026 Treasury auction demand, and gold price sustainability at current levels [1]. Medium-term developments in fiscal trajectory, central bank policy paths, and currency dynamics will further shape the competitive landscape between traditional and barbell approaches. Long-term trends in de-dollarization pace, gold’s portfolio role evolution, and risk-parity strategy adaptation will determine which approaches prove most durable.

The Seeking Alpha analysis presenting a transition from Ray Dalio’s All-Weather Portfolio to Barbell Allocation reflects convergent structural concerns about the macroeconomic assumptions underlying traditional diversified portfolio construction [1]. The traditional AWP framework of balancing risk across economic environments through diversified allocation faces challenges from de-dollarization trends, U.S. debt sustainability concerns, persistently low Treasury yields, and Treasury market structural dysfunction.

The proposed barbell approach—emphasizing gold and short-term cash on the “safe” side while maintaining aggressive equity exposure—represents an adaptation to an environment where traditional diversification assumptions may be unreliable. Industry participants including individual investors, asset managers, and financial advisors must grapple with these structural shifts and consider portfolio construction approaches that address changed market foundations.

The transition does not suggest the AWP is fundamentally broken but rather that its implementation may require adaptation for current macroeconomic conditions. The traditional framework remains a viable baseline for diversification, but the structural environment has shifted in ways that warrant reconsideration of specific allocation weights and the role of individual asset classes. Gold’s emerging role as a portfolio hedge replacing long-duration government bonds represents perhaps the most significant allocation consideration, with implications extending across the investment landscape.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.