AAII Sentiment Survey Shows Extreme Pessimism as Bearish Sentiment Surges to 49.1%

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Seeking Alpha report [1] published on November 13, 2025, which revealed a significant shift in individual investor sentiment toward extreme pessimism.

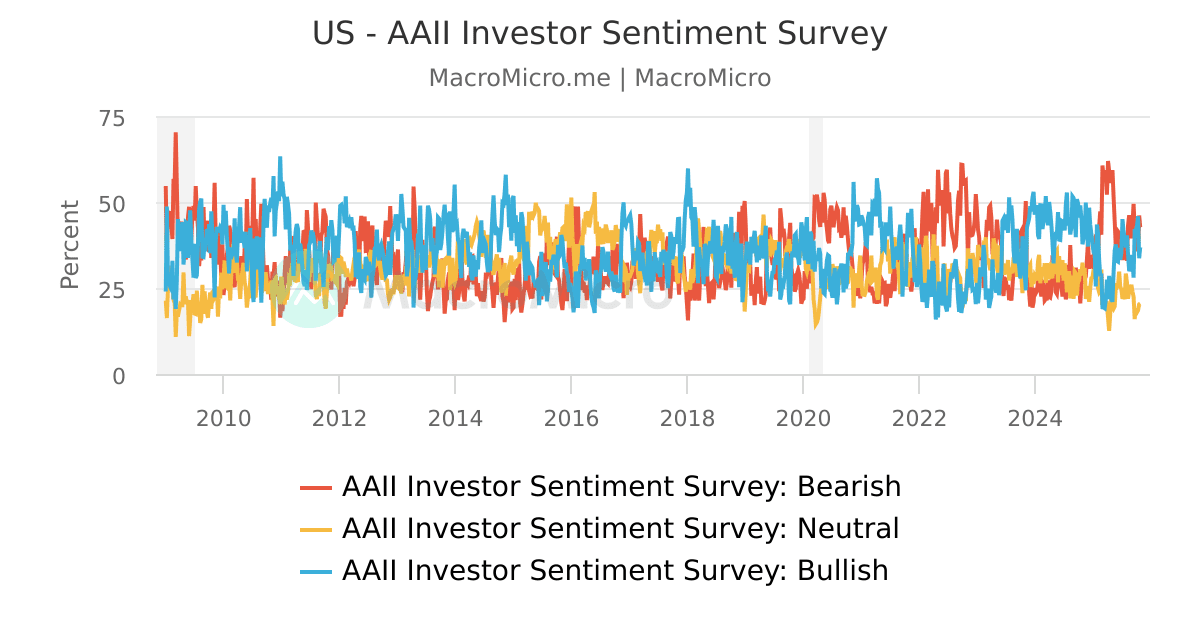

The American Association of Individual Investors (AAII) weekly sentiment survey showed dramatic changes in investor psychology. Bullish sentiment decreased 6.4 percentage points to 31.6%, while neutral sentiment dropped 6.5 percentage points to 19.2% [1]. Consequently, bearish sentiment surged 12.9 percentage points to 49.1% - the highest level since April 2025 when it reached 61.9% [3].

This sentiment shift coincided with significant market weakness on November 13, 2025:

- S&P 500 (^GSPC): Closed down 1.3% at 6,737.49 [0]

- NASDAQ Composite (^IXIC): Declined 1.69% to 22,870.36 [0]

- Dow Jones (^DJI): Fell 1.49% to 47,457.22 [0]

- Russell 2000 (^RUT): Suffered the steepest decline at -2.4% [0]

The market downturn was broad-based, with defensive sectors showing relative strength. Only Consumer Defensive (+0.87%) and Basic Materials (+0.08%) managed gains, while Utilities (-3.07%), Consumer Cyclical (-2.87%), and Real Estate (-2.35%) led the declines [0]. This pattern suggests a genuine flight to safety rather than sector-specific concerns.

The current sentiment represents a complete reversal from the previous week (November 7, 2025) when bullish sentiment stood at 38.0%, neutral at 25.8%, and bearish at 36.3% [2]. The current bearish reading of 49.1% is 18.1 percentage points above the historical average of 31.0%, indicating extreme pessimism [3].

The AAII sentiment survey is traditionally viewed as a contrarian indicator. The current bearish reading of 49.1% approaches levels that have historically marked market bottoms, though it has not yet reached the extreme levels (60%+) that typically signal strong contrarian buying opportunities. The 1-year high of 61.9% was recorded in April 2025 [3].

The broad-based nature of the decline across all major indices and most sectors suggests this is more than a sector-specific rotation. The Russell 2000’s steeper decline (-2.4%) indicates particular weakness in small-cap stocks, often a sign of increased risk aversion [0].

The dramatic sentiment shift aligns with several market stress factors including increased volatility (S&P 500 intraday range from 6,724.72 to 6,828.05) and defensive sector outperformance [0]. This correlation suggests the sentiment survey is accurately reflecting current market conditions rather than being an outlier.

- Sentiment Extremes: While elevated at 49.1%, bearish sentiment has not reached the extreme levels that typically signal strong contrarian opportunities

- Momentum Confirmation: The broad market decline suggests genuine risk aversion rather than temporary volatility

- Defensive Flight: The outperformance of defensive sectors indicates sustained investor concern

- Sentiment Sustainability: The key question is whether bearish sentiment continues to rise above 50% or begins to stabilize

- Contrarian Potential: If bearish sentiment reaches extreme levels (60%+), it could signal a market bottom

- Economic Data Impact: Upcoming economic releases could validate or contradict current pessimistic sentiment

Sustained bearish sentiment above 50% has historically preceded both extended market downturns (when confirmed by fundamental deterioration) and market bottoms (when representing capitulation levels). The current 49.1% reading places investors in a cautionary zone requiring careful monitoring.

The AAII sentiment survey reveals extreme pessimism with bearish sentiment at 49.1%, coinciding with broad market declines across all major indices. The shift represents a complete reversal from the previous week and places bearish sentiment significantly above historical averages. While the survey serves as a contrarian indicator, current levels suggest caution rather than immediate opportunity. The defensive sector rotation and broad-based market weakness indicate genuine risk aversion that warrants continued monitoring of sentiment trends, economic data, and institutional positioning for confirmation of whether this represents a buying opportunity or the beginning of a more prolonged decline.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.