U.S. Dollar Falls to Four-Year Low as Trump Claims Currency is "Doing Great"

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

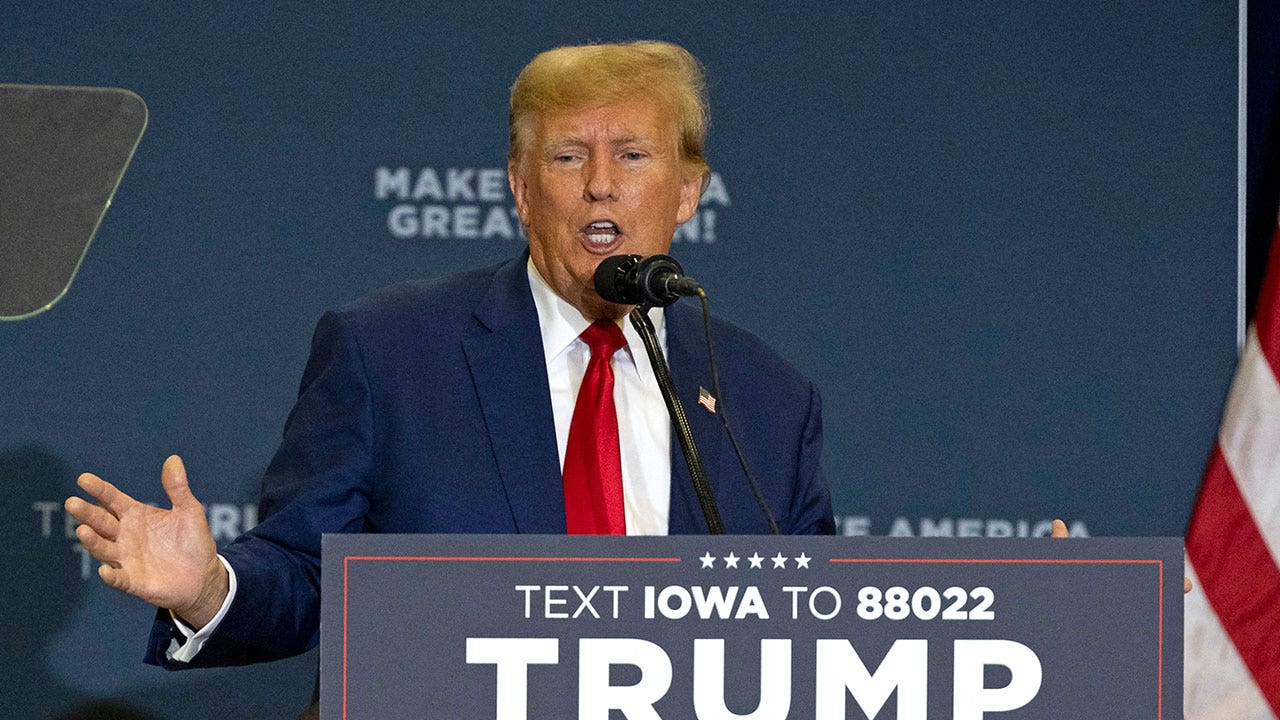

The U.S. dollar’s decline to a four-year low represents a significant market event with far-reaching implications for global financial markets, U.S. monetary policy, and international trade dynamics. On January 27, 2026, the Dollar Index (DXY) touched 95.566 during trading sessions, marking the weakest position for the U.S. currency since February 2022 [1][2]. This decline occurred in a context where President Trump, speaking in Iowa, explicitly stated that the dollar’s value was “great” when asked whether it had declined too much [1][2]. The apparent disconnect between the President’s characterization and market reality highlights the complex and sometimes conflicting signals emanating from the current administration regarding currency policy.

The timing of Trump’s comments proved particularly significant, as they appeared to validate market expectations that the administration may be comfortable with or even encouraging of dollar weakness. Market analysts noted that selling pressure on the dollar accelerated immediately following the President’s remarks, suggesting that traders interpreted the comments as tacit endorsement of further currency depreciation [1][3]. This dynamic raises important questions about whether the administration has a coherent dollar policy or whether its stance is emergent and reactive.

The current dollar weakness is not an isolated event but rather the continuation of a broader trend that has been developing since late 2026. According to Reuters reporting, investors have been systematically reassessing Trump administration policies and weighing associated geopolitical risks, which has created persistent downward pressure on the currency [3]. This reassessment process reflects growing uncertainty about the consistency and direction of U.S. economic policy under the new administration.

The dollar’s decline to 95.566 represents a critical technical milestone that could set the stage for further weakness. Historical analysis of the Dollar Index shows that this four-year low establishes new support and resistance levels that market participants will closely monitor in coming sessions. Technical traders are likely to treat 95.566 as a significant reference point, with the next support levels becoming important indicators of the currency’s trajectory [2].

The implications of dollar weakness extend across multiple economic dimensions in ways that create both winners and losers. U.S. multinational corporations with significant foreign revenue streams stand to benefit from enhanced competitiveness when their foreign earnings are converted back to dollars, potentially improving reported earnings and expanding profit margins. Similarly, U.S. exporters gain competitive advantage in global markets as their products become relatively cheaper for foreign purchasers [2][3]. However, these benefits are counterbalanced by costs to domestic consumers and importers, who face higher prices for imported goods and potentially renewed inflationary pressures.

The Federal Reserve faces a potentially complicated policy environment as dollar weakness interacts with its dual mandate of price stability and maximum employment. If sustained currency depreciation contributes to imported inflation, the Fed may find itself in a position where it needs to consider monetary policy responses to prevent inflationary pressures from rekindling [2]. This creates a dynamic where the Treasury’s apparent tolerance for dollar weakness could constrain Fed policy flexibility, potentially leading to tension between monetary and fiscal policy objectives.

Commodity markets present another dimension of impact from dollar weakness. Gold and silver, denominated in dollars, tend to rise in value as the dollar declines, making precious metals increasingly attractive to both institutional and retail investors [2]. The carry trade dynamics associated with dollar weakness may accelerate unwinds of existing positions, creating additional volatility in commodity and emerging market currency markets. Foreign holders of U.S. assets, including Treasury securities and equities, face eroded asset values when measured in their home currencies, potentially triggering portfolio rebalancing flows that could amplify market movements.

The currency decline presents several risk factors that warrant careful monitoring by market participants and policymakers alike. First, the potential for imported inflation represents a meaningful concern, as a weaker dollar diminishes purchasing power and makes foreign-sourced goods and materials more expensive for U.S. consumers and businesses [3]. If this inflationary pressure proves persistent, it could complicate the Federal Reserve’s ongoing efforts to maintain price stability and could force reconsideration of the current interest rate trajectory.

Second, the relationship between dollar decline and Fed policy creates potential tension that markets must navigate. Analysts have noted that sustained currency weakness could force the Federal Reserve to consider rate responses if inflation concerns resurface, potentially creating volatility in bond markets and affecting the broader interest rate environment [2]. This dynamic underscores the interconnected nature of currency markets and monetary policy, where movements in one dimension can cascade into others.

Third, foreign investors’ continued holding of U.S. assets, combined with increasing hedging of dollar exposure, creates potential volatility in bond and equity markets [2]. As foreign holders reassess the dollar’s trajectory, they may adjust their U.S. asset allocations, potentially creating selling pressure in Treasury markets and affecting U.S. government financing costs.

Opportunity windows exist for market participants who can navigate the currency dynamics effectively. U.S. exporters and multinational corporations with significant international operations may experience improved competitive positioning and enhanced earnings translation, creating potential value opportunities in these segments. Commodity investors may benefit from dollar-denominated asset appreciation, particularly in precious metals. However, opportunities must be weighed against the risks of potential policy inconsistency or sudden reversals in dollar trends.

The time sensitivity of these considerations is elevated given the rapid pace of dollar decline and the potential for ongoing acceleration in either direction. Market participants should prioritize monitoring Federal Reserve communications, official Treasury statements, and reactions from major trading partners—particularly Japan and China—for signals about the sustainability and intentionality of current dollar trends.

The U.S. dollar’s decline to a four-year low of 95.566 on January 27, 2026, following President Trump’s characterization of the currency as “doing great,” represents a significant market event with complex implications. The Dollar Index reached its lowest level since February 2022, with selling pressure accelerating after the President’s comments [1][2]. This decline is part of a broader trend of dollar weakness driven by investor reassessment of Trump administration policies and geopolitical risks [3].

The currency depreciation creates asymmetric impacts across the U.S. economy: benefiting exporters and multinational corporations through improved foreign revenue conversion and competitive positioning, while potentially increasing costs for domestic consumers through more expensive imports and renewed inflationary pressures. The Federal Reserve may face policy complications if dollar weakness contributes to imported inflation, potentially forcing consideration of monetary policy responses [2].

Key monitoring priorities include official Treasury responses, Federal Reserve communications regarding currency trends and inflation implications, and reactions from major trading partners. The technical level of 95.566 represents a significant support marker, with next support areas warranting close attention. The consistency and intentionality of any administration dollar policy remains an open question that markets are actively evaluating.

For market participants, the event underscores the importance of currency exposure management for multinational corporations, assessment of imported goods pricing dynamics, and monitoring of carry-trade unwind impacts on related asset classes including precious metals and emerging market currencies.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.