Tech & Telecom Stock Analysis: Oversold Communication Services Opportunities Carry Significant Risk

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

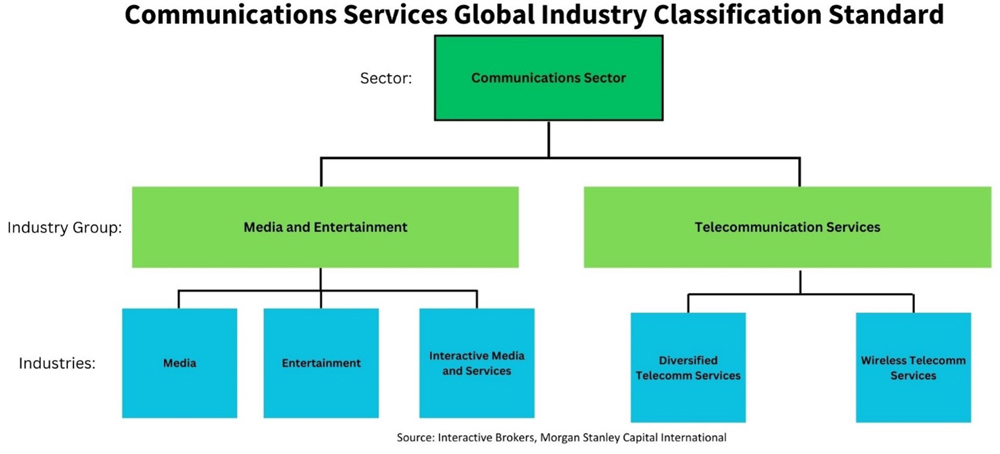

The Benzinga article by Avi Kapoor was published on January 28, 2026, during a period of notable sector rotation away from communication services. While major indices showed strong weekly gains—the NASDAQ advancing 3.76% and the S&P 500 rising 1.67%—the communication services sector declined 0.99%, making it the worst-performing sector on the publication day [0][1]. This divergence between sector and broad market performance provides essential context for evaluating the oversold thesis presented.

The three stocks highlighted—IHRT, RDDT, and CHTR—all traded near their 52-week lows with RSI readings in deeply oversold territory (27-30), traditionally considered potential buy signals by technical analysts. However, the convergence of sector weakness, bearish analyst revisions, and company-specific fundamental challenges complicates the investment thesis significantly.

The communication services sector’s underperformance on January 27, 2026, occurred while other sectors demonstrated strength: utilities gained 1.10% and technology rose 0.67% [0]. This relative weakness suggests institutional investors may be systematically reducing exposure to communication services stocks, potentially reflecting concerns about advertising market health, competitive pressures, or regulatory risks that extend beyond temporary oversold conditions.

The contrast between the NASDAQ’s strong weekly performance (+3.76%) and the communication services sector’s decline creates a scenario where breadth momentum is concentrated in technology subsectors other than communication services. This sector rotation pattern may persist if advertising-dependent business models face structural headwinds from changing consumer behavior and competitive digital platforms.

The most significant insight from this analysis is the potential contradiction between technical oversold conditions and fundamental weakness driving institutional selling. All three stocks have received bearish analyst actions coinciding with their RSI readings dropping below 30, suggesting that professional analysts and institutional investors may be responding to underlying business challenges rather than temporary market dislocations. This convergence of technical and fundamental negative signals raises the possibility that the oversold conditions represent rational market pricing rather than mispricing.

The RSI-based contrarian thesis assumes that oversold conditions create buying opportunities when price declines exceed fundamentals. However, when fundamental deterioration accompanies technical weakness—as appears to be the case with all three stocks—the probability of value trap scenarios increases substantially. Investors considering these recommendations should evaluate whether the selling pressure reflects temporary sentiment shifts or fundamental business model challenges.

The three stocks exhibit sufficiently different risk characteristics that blanket application of the oversold thesis may be inappropriate. IHRT faces financial sustainability concerns requiring assessment of debt refinancing risk and advertising revenue trends. CHTR’s balance sheet risk demands analysis of debt covenant compliance and capital expenditure requirements for network upgrades. RDDT’s valuation risk requires evaluation of user growth trajectories and advertising revenue sustainability.

These differentiated risk profiles suggest that any investment approach based on the Benzinga article should involve company-specific due diligence rather than sector-wide allocation. The technical oversold signal provides only one input dimension for investment decisions, and its signal quality varies based on the underlying fundamental conditions affecting each company.

The communication services sector’s relative underperformance during a period of broad market strength suggests sector rotation dynamics that may persist. If institutional investors are systematically reducing communication services exposure, oversold conditions in individual stocks may not generate the anticipated bounces even if company-specific fundamentals stabilize. The sector’s advertising-dependent revenue models face structural pressures from digital transformation and changing media consumption patterns that may not be fully reflected in current stock prices.

The analysis reveals several risk factors that warrant serious consideration by decision-makers:

Despite the significant risk factors, several opportunity windows merit consideration:

The opportunity windows identified carry significant time sensitivity. The RSI oversold signal may dissipate quickly if broader market conditions change or if company-specific developments alter the fundamental outlook. Upcoming earnings reports for all three companies represent potential catalysts that could either validate or contradict current concerns. The Federal Reserve’s communications regarding interest rate policy may affect debt-sensitive stocks like CHTR more immediately than other investment considerations.

The Benzinga article presents a technical analysis framework for identifying oversold communication services stocks, but the simultaneous bearish analyst actions and sector weakness introduce substantial complexity. The three highlighted stocks—IHRT, RDDT, and CHTR—exhibit fundamentally different risk profiles requiring tailored evaluation approaches rather than uniform investment application.

Financial data indicates that IHRT faces profitability and cash flow challenges despite manageable debt levels, RDDT carries aggressive valuation multiples reflecting growth expectations now being questioned by the market, and CHTR presents an attractive valuation paradox combining low P/E multiples with high balance sheet risk. The worst-performing sector designation on the publication day suggests institutional skepticism about the sector’s near-term outlook that may persist beyond technical oversold conditions.

Decision-makers should weigh the technical bounce potential against fundamental concerns driving institutional selling. The combination of downgrades from Goldman Sachs and Wells Fargo with sector weakness may indicate a “flight to quality” pattern rather than indiscriminate selling of attractively priced opportunities. Additional fundamental due diligence focusing on company-specific catalysts, debt maturity schedules, advertising market conditions, and subscriber trends is strongly recommended before acting on these recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.