Integrated Analysis

Event Overview and Market Context

This analysis is based on the Seeking Alpha report “Country ETFs Crushing It” published on January 28, 2026 [1], which examines the year-to-date performance of over forty country-specific ETFs traded on US exchanges. The report reveals a striking performance divergence between emerging market and developed market ETFs during the early 2026 trading period, with emerging market instruments delivering substantially higher returns while US-focused ETFs lag significantly.

The timing of this report coincides with a period of elevated market volatility in US indices. The S&P 500 closed at 6,978.59 on January 27, 2026, representing a modest +0.18% daily gain, while the NASDAQ Composite rose +0.35% to 23,817.10 [0]. The Dow Jones Industrial Average slipped -0.20% to 49,003.42, and the Russell 2000 gained +0.25% to 2,666.70 [0]. This mixed performance in US markets contrasts sharply with the robust gains observed in emerging market country ETFs.

Performance Divergence: Emerging vs. Developed Markets

The Seeking Alpha analysis identifies a clear hierarchy of performance among country ETFs [1]:

Emerging Market Leaders:

- Peru’s EPU (Global X MSCI Peru): +25% to +30.68% YTD

- Colombia’s COLO: Strong double-digit returns

- South Korea’s EWY (iShares MSCI South Korea): +20% to +30.25% YTD

- Brazil’s EWZ (iShares MSCI Brazil): +12.23% YTD

Developed Market Laggards:

- Japan’s EWJ: +4.8% YTD (leading G7 nations)

- US SPY: +1.6% YTD (second-to-last among surveyed ETFs)

The magnitude of this divergence is remarkable. While emerging market ETFs have generated 20-30% returns in just weeks, the benchmark US equity ETF has barely surpassed a 1% gain, ranking near the bottom of the forty-plus country ETFs surveyed [1].

Quantitative Analysis of Top Performers

Detailed trading data reveals the extent of recent gains in emerging market ETFs [0]:

EPU (Global X MSCI Peru)

has delivered a +30.68% return over 29 trading days (December 15, 2025 – January 27, 2026), with prices surging from $70.10 to $91.61 [0]. The ETF traded within a range of $68.70 to $91.81, demonstrating significant volatility but consistently trending upward. Daily volatility measured 1.32%, with average daily volume of 138,604 shares indicating moderate liquidity [0].

EWY (iShares MSCI South Korea)

generated a +30.25% return over the same period, climbing from $94.20 to $122.70 [0]. This represents an even more impressive absolute price appreciation, with trading range spanning $88.40 to $122.82. Daily volatility of 1.92% exceeds EPU’s level, reflecting the higher risk profile of Korean equities. Average daily volume of 7.13 million shares indicates strong institutional interest and excellent liquidity [0].

EWZ (iShares MSCI Brazil)

produced a solid +12.23% YTD return, outperforming most developed market ETFs [0]. Prices moved from approximately $33-34 range to $37.97, with trading range of $30.72 to $37.97. Daily volatility of 1.87% is comparable to EWY. The ETF’s exceptional average daily volume of 31.67 million shares demonstrates very high liquidity and investor engagement [0].

Sector Rotation and Risk Sentiment

Current sector performance data reveals rotation patterns consistent with international risk-on sentiment [0]:

Outperforming Sectors:

- Utilities: +1.10%

- Consumer Cyclical: +0.74%

- Technology: +0.67%

Underperforming Sectors:

- Communication Services: -0.99%

- Financial Services: -0.68%

- Consumer Defensive: -0.52%

This sector rotation pattern suggests investors are shifting toward risk assets beyond US borders, particularly in emerging markets where growth differentials may be more pronounced. The rotation aligns with broader themes identified in recent market outlook analyses regarding AI-driven investment flows benefiting emerging markets [2].

Regional Performance Patterns

The Seeking Alpha survey reveals distinct regional performance themes [1]:

Latin America:

Peru leads global ETF performance, with Colombia also showing strong gains. This region benefits from commodity price dynamics and improving economic fundamentals in several major economies.

Asia-Pacific:

South Korea dramatically outperforms with +20%+ returns, driven significantly by technology sector momentum, particularly semiconductor-related companies. In contrast, Japan limited gains to +4.8% among G7 nations.

G7 Performance Hierarchy:

Japan (+4.8%) leads the G7, followed by other developed markets, while the US (SPY) ranks second-to-last with only +1.6% YTD [1].

Frontier Markets:

Vietnam (VNAM), Kuwait (KWT), and other frontier market ETFs were included in the broader survey, providing exposure to smaller but potentially high-growth economies.

Key Insights

AI Investment and Emerging Market Momentum

Recent analysis suggests emerging markets are benefiting disproportionately from AI-related capital spending and investment flows [2]. The technology sector’s strength in countries like South Korea, combined with AI adoption across emerging economies, is creating growth differentials that favor international equity exposure over relatively expensive US valuations.

Monetary Policy Divergence

Emerging market central banks have been implementing monetary easing measures amid subdued inflation, creating favorable financial conditions for domestic growth [3]. This contrasts with Federal Reserve policy uncertainty, which continues to affect capital flows between US and international markets. The combination of easier EM monetary policy and improving growth dynamics supports emerging market equity performance.

US Market Complacency Indicators

The modest US equity returns, despite overall market indices reaching new highs, suggest a period of consolidation and rotation. The S&P 500’s +1.6% YTD return ranking second-to-last among forty-plus country ETFs indicates significant relative underperformance [1]. This relative weakness may persist if AI investment benefits continue flowing to international markets with more attractive valuations.

Liquidity and Accessibility Trends

The high average daily volumes for major emerging market ETFs (EWZ: 31.67M shares, EWY: 7.13M shares) demonstrate that international equity exposure is highly accessible to US investors [0]. This liquidity reduces transaction costs and enables efficient portfolio adjustments, making country ETFs viable diversification tools.

Risks and Opportunities

Risk Factors

Overbought Conditions:

The exceptional YTD gains in EPU (+30.68%) and EWY (+30.25%) suggest potential overbought technical conditions [0]. Historical patterns indicate that rapid appreciation of 25-30% in compressed timeframes often precedes mean-reversion, particularly in inherently volatile emerging market instruments.

Elevated Volatility:

EWY’s 1.92% daily standard deviation and EWZ’s 1.87% daily volatility significantly exceed typical developed market ETF volatility [0]. These elevated volatility levels require appropriate position sizing and risk management.

Currency Exposure Risk:

International ETFs carry implicit currency risk that can amplify or diminish returns depending on dollar strength. The Seeking Alpha article does not specify whether highlighted returns are currency-hedged, and investors should verify hedged versus unhedged exposure before positioning.

Liquidity Disparities:

While major ETFs like EWZ and EWY exhibit strong liquidity, EPU’s 138,604 average daily volume is substantially lower [0]. Investors in less-liquid instruments may face wider bid-ask spreads and potential market impact when entering or exiting positions.

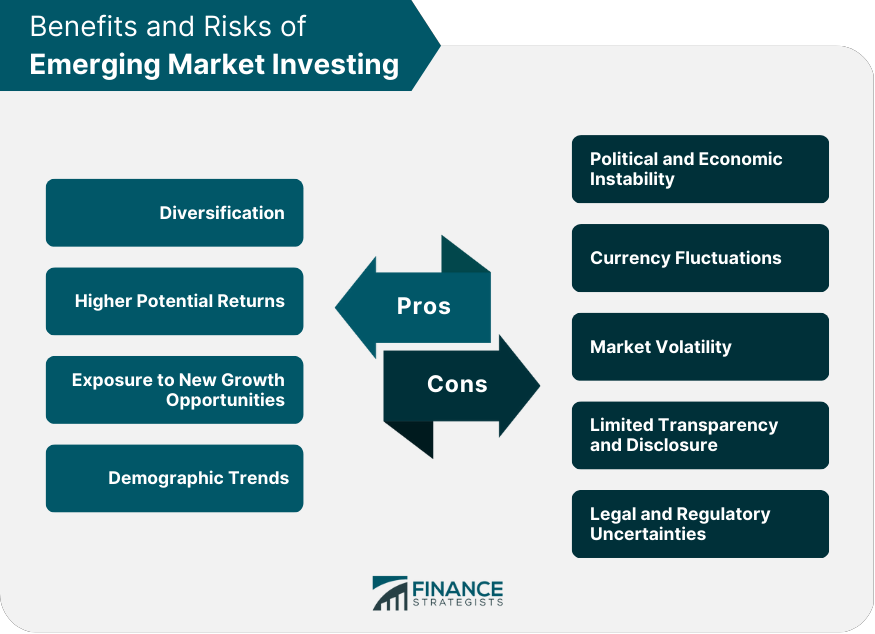

Political and Economic Risks:

Emerging markets face inherent political instability risks, fiscal challenges, and economic policy uncertainty that can affect market performance [3]. Investors should maintain awareness of country-specific developments when holding concentrated positions.

Opportunity Windows

Portfolio Diversification:

The clear outperformance of country ETFs relative to US markets provides meaningful diversification benefits for investors with US-heavy portfolios. The correlation structure between emerging market and US equities may offer risk reduction during periods of US market weakness.

AI and Technology Exposure:

South Korea’s strong performance provides indirect exposure to global technology and semiconductor demand without concentration in individual US mega-cap tech names. This geographic diversification reduces single-company and single-country risk.

Commodity-Linked Growth:

Peru’s performance correlates with commodity price dynamics, providing inflation hedging characteristics and exposure to global resource demand trends.

Continued Momentum Potential:

If AI investment flows and EM monetary easing continue supporting growth differentials, emerging market momentum may persist [2][3]. Dollar-cost averaging strategies can capture potential continued appreciation while managing timing risk.

Time Sensitivity Considerations

The compressed timeframe of 25-30% YTD gains (achieved in approximately one month) suggests urgency in evaluation for investors considering positions. Entry timing significantly affects risk-reward profiles given current elevated price levels relative to recent ranges.

Key Information Summary

Performance Leadership:

Peru’s EPU (+30.68%) and South Korea’s EWY (+30.25%) lead global country ETF performance in early 2026, followed by Brazil’s EWZ (+12.23%) [0]. These emerging market ETFs substantially outperform developed market counterparts including US-focused SPY (+1.6%) [1].

Volatility Profiles:

Emerging market ETFs exhibit elevated volatility (1.32-1.92% daily standard deviation) requiring appropriate risk management and position sizing [0].

Liquidity Assessment:

Major emerging market ETFs offer strong liquidity (EWZ: 31.67M avg daily volume; EWY: 7.13M avg daily volume), enabling efficient portfolio construction [0].

Supporting Trends:

AI-driven investment flows, EM central bank monetary easing, and improved growth differentials support continued emerging market momentum [2][3].

Risk Indicators:

Rapid price appreciation suggests potential overbought conditions, and investors should consider dollar-cost averaging rather than lump-sum positioning at current elevated levels [0].

Regional Diversification Value:

The performance divergence highlights meaningful portfolio diversification opportunities through international country ETF exposure, particularly for US-heavy portfolios [1].