Margin Call Risk Analysis: Record Leverage Signals Market Volatility Ahead

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

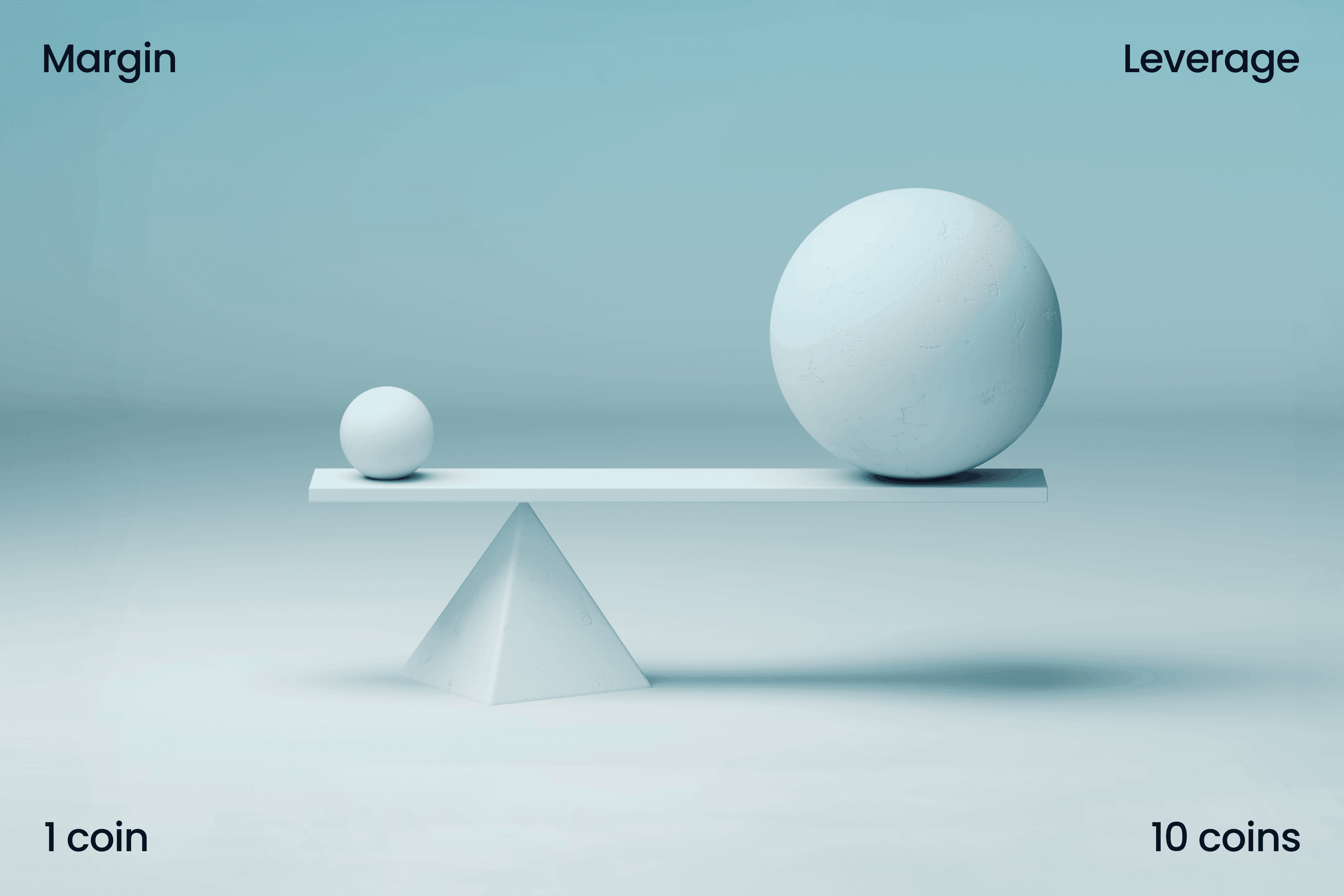

Reddit users in r/StockMarket and related investing communities are sounding alarms about margin call risks based on FINRA statistics showing a debit-to-total-free-credit ratio of 3, meaning investors have borrowed three times the cash available in margin accounts[1]. Key discussions include:

- OP presented nearly 30 years of FINRA monthly margin statistics comparing debit balances to free credit balances[1]

- Community members clarified the metric is debit-to-credit ratio, not credit-to-debit as initially stated[1]

- Users explained that high ratios mean investors lack cash to cover losses, potentially triggering rapid broker selling that amplifies declines[1]

- Personal anecdotes shared margin trading lessons, including one user’s experience turning $10k into $40k in 1998, then losing almost everything in the subsequent pullback[1]

- Estimates suggest total U.S. margin debt around $1 trillion, though some questioned whether FINRA data captures all leverage sources[1]

- Historical parallels drawn to 1929 and 2008, with discussions of forced-selling cascades when debt ratios are elevated[1]

Current market data validates Reddit’s concerns with even more extreme leverage levels:

- Record Margin Debt: FINRA margin debt reached $1.13 trillion in September 2025, a new all-time high representing 6.3% increase from August and the fifth consecutive monthly increase[2]

- Historical Pattern Recognition: Margin debt peaks in 2000 (dot-com bubble), 2007 (financial crisis), and 2021 all preceded major market crashes[2]

- Expert Warnings: Major banks including Deutsche Bank warn current margin debt levels resemble those seen during the dot-com bubble[3]

- Correction Forecasts: Market analysts predict potential market corrections of 10-20% in equities over the next 6 months[4]

- Retail Vulnerability: 2.20% of CFD accounts experienced margin calls over the past 12 months, indicating elevated retail investor risk[4]

- Sector Concentration: Tech stocks and precious metals face particular vulnerability to forced liquidations due to high leverage concentrations[5,6]

The Reddit community’s margin call concerns are strongly supported by current market data and expert analysis. While Reddit users identified the debit-to-credit ratio of 3 as a warning sign, actual FINRA data shows even more extreme leverage with margin debt at record highs. Both sources agree on the mechanism: high leverage creates vulnerability to forced selling cascades that can amplify market declines.

The historical patterns identified by both Reddit users and institutional research are particularly concerning - every major margin debt peak in recent decades has preceded a significant market downturn. Current leverage levels exceed those prior to previous crashes, suggesting potentially more severe consequences.

- Margin Call Cascades: High leverage could trigger widespread forced selling, accelerating market declines

- Tech Sector Vulnerability: Highly leveraged technology stocks face disproportionate risk

- Retail Investor Losses: Margin-trading retail investors face potential catastrophic losses

- Market Volatility: Next 6 months could see increased volatility and rapid price movements

- Defensive Positioning: Investors can reduce leverage and increase cash positions

- Short Opportunities: Highly leveraged sectors may present short-selling opportunities

- Bargain Hunting: Potential for significant buying opportunities after corrections

- Risk Management: Current environment emphasizes importance of proper position sizing and stop-losses

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.