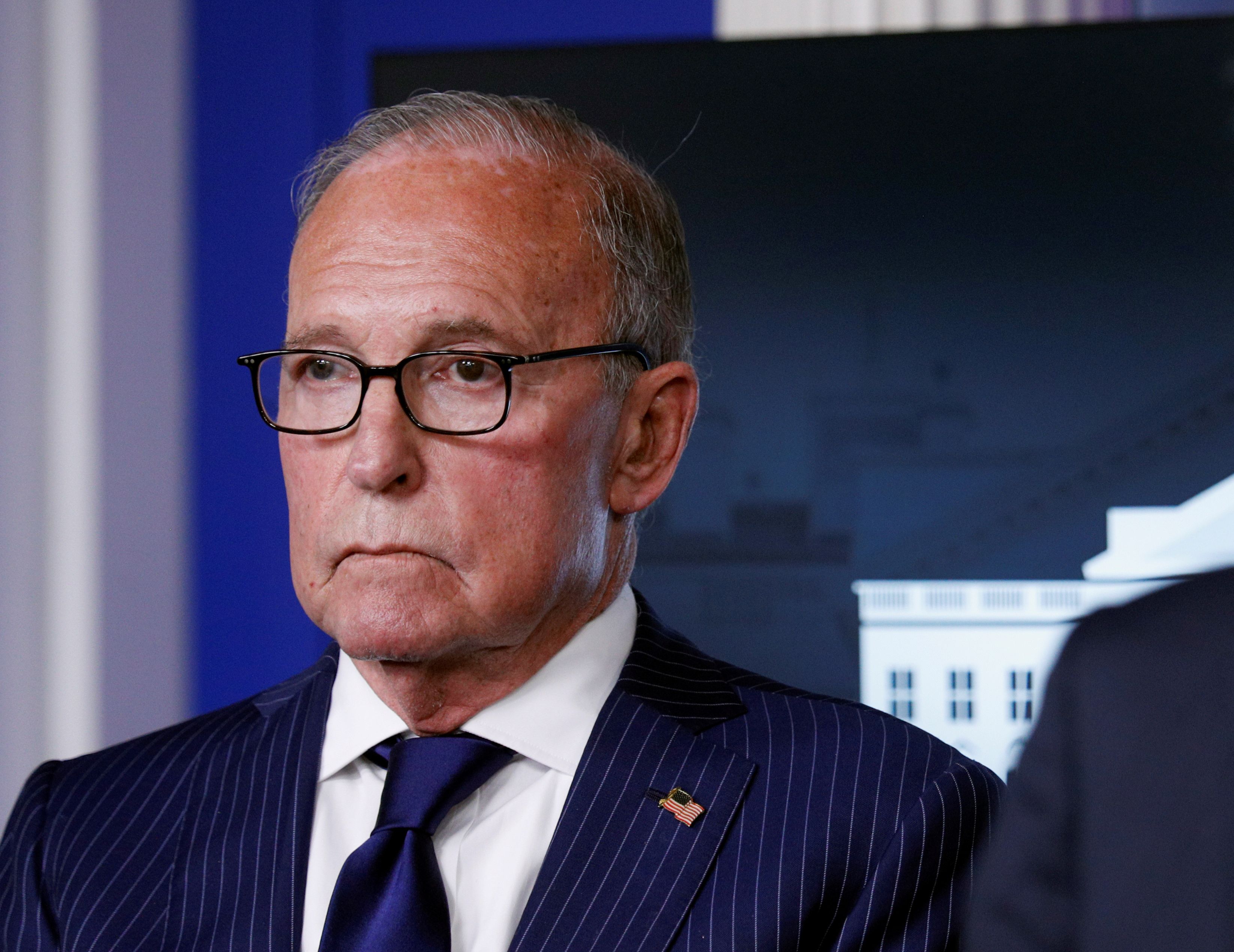

Larry Kudlow Calls for Transformational Fed Reform Amid FOMC Meeting

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on the Fox Business opinion piece [1] published on January 28, 2026, authored by Larry Kudlow, who serves as a Fox Business host and previously held the position of Director of the National Economic Council during the first Trump administration. The timing of this publication is particularly significant as it coincides with an ongoing Federal Open Market Committee meeting, suggesting an intentional effort to influence monetary policy decisions during a critical decision-making window.

Kudlow’s intervention represents more than typical media commentary; given his proximity to Trump administration figures and his former role as NEC director, this opinion piece functions as a strategic policy signal rather than isolated commentary. The piece directly addresses President Trump with the appeal “Mr. Trump, please give us a transformational Fed,” establishing clear political intent behind the message [1].

Kudlow’s central thesis directly confronts the foundational economic model that has guided Federal Reserve policy for decades—the Phillips curve, which posits an inverse relationship between unemployment and inflation, implying that economic growth (reduced unemployment) will eventually generate inflationary pressures. Kudlow argues this framework is fundamentally flawed, claiming that “growth does not cause inflation” [1].

This argument is not merely academic; it has profound implications for monetary policy settings. If true, the Fed’s cautious approach to rate cuts—predicated on fears of reigniting inflation—would be based on erroneous assumptions. The timing of this critique, arriving during an FOMC meeting where rate decisions are being deliberated, suggests tactical intent to shape immediate policy outcomes as well as longer-term structural reform [1].

Kudlow supports his theoretical challenge with specific economic indicators that he interprets as disconfirming the Phillips curve narrative. The data points cited include core PCE running at 2.3% annualized over three months, core CPI at 1.6% over the same period, and top-line CPI at 2.1%. Perhaps most significantly, unit labor costs are reported at approximately 1% annually—a key measure suggesting limited wage pressure that might otherwise translate into inflationary outcomes [1].

This data presentation serves a dual purpose: it provides empirical support for the “growth does not cause inflation” thesis while simultaneously making the case for immediate monetary policy accommodation. Kudlow explicitly recommends a 0.25% rate cut, arguing that the Fed should recognize the U.S. economy as experiencing a “productivity-led, disinflationary boom” rather than an overheating system requiring continued restrictive policy [1].

Kudlow’s public appeal for a “transformational Fed” operating under direct presidential influence raises fundamental questions about central bank independence—a cornerstone of modern monetary policy credibility. While the Fed operates with statutory independence from political pressure, public campaigns by influential administration allies to reshape Fed policy frameworks represent a form of political leverage that could, if sustained, undermine market confidence in policy continuity [1].

The independence concern is heightened by the explicit framing of the Fed as needing transformation to align with the current administration’s economic vision. Historical precedents from other countries demonstrate that political pressure on central banks can lead to policy mistakes, capital flight, and currency instability—outcomes that would contradict the economic growth goals Kudlow ostensibly supports [1].

Beyond criticizing existing Fed models, Kudlow advocates for a paradigm shift toward productivity-focused monetary policy. This represents an alternative framework that would potentially prioritize economic output and efficiency gains over traditional inflation targeting. The argument holds appeal in principle, as productivity growth genuinely can generate higher living standards without inflation; however, implementing such a framework would require novel institutional arrangements and measurement systems that do not currently exist [1].

The practical challenges of transitioning to a productivity-focused Fed framework are substantial. Productivity measurement is complex, subject to significant revision, and influenced by factors largely outside monetary policy control. Critics would likely argue that abandoning inflation targeting without a clearly operational alternative could introduce uncertainty that ultimately harms economic performance [1].

The data cited by Kudlow reflects an inflation environment that has indeed moderated substantially from the peaks experienced in 2022. The core PCE figure of 2.3% and CPI at 2.1% represent readings near or below the Fed’s traditional 2% target, creating genuine policy space for consideration of accommodation. However, the interpretation of this data as definitively confirming the “growth does not cause inflation” thesis remains contested [1].

Alternative interpretations of the same data emphasize potential transitory factors, including the lag effects of prior rate hikes, favorable energy price developments, and ongoing economic adjustments following post-pandemic normalization. Additionally, regional and sectoral variations in inflation dynamics may not be captured in aggregate figures, suggesting that the “disinflationary boom” characterization may represent an optimistic interpretation rather than a universally applicable description [1].

The timing of Kudlow’s appeal during an active FOMC meeting introduces immediate market relevance. His mention of dissenters Miran and Waller suggests insider awareness of ongoing debate within the Fed regarding appropriate policy direction. Market participants should monitor the meeting outcome carefully for signals indicating how current Fed leadership is responding to both the data and the political pressure dynamics that Kudlow’s intervention represents [1].

The intersection of political advocacy, economic theory, and monetary policy timing in this event reveals several significant patterns. First, the Trump administration’s apparent intent to influence Fed policy direction extends beyond personnel considerations to fundamental model and framework challenges—a more ambitious agenda than typical post-election administration approaches to central banking. Second, the Phillips curve debate, which had largely faded from policy discussions following its apparent breakdown during the 2021-2022 inflation surge, has been revived in a new form that challenges the entire inflation-targeting paradigm [1].

Third, the economic data environment has genuinely shifted to one where inflation concerns have moderated, creating political opportunity for advocating accommodation. However, the question of whether this moderation represents a permanent structural change or a cyclical pause remains unresolved, making policy decisions particularly consequential [1].

Several risk dimensions emerge from this event that warrant monitoring.

Additionally,

The current low-inflation environment does create genuine opportunity for policy recalibration, should the Fed choose to respond to evolving economic conditions. The productivity-focused framework advocated by Kudlow, while operationally challenging, represents an innovative direction that could yield benefits if thoughtfully implemented. Market participants should remain attentive to genuine shifts in Fed communication and policy that may emerge from this policy debate [1].

This event represents a significant policy advocacy intervention by a Trump administration ally directly calling for fundamental reform of Federal Reserve monetary policy frameworks. Larry Kudlow’s core argument—that Fed models are wrong and growth does not cause inflation—is supported by cited economic data showing inflation indicators near or below the 2% target. The timing during an active FOMC meeting suggests both immediate policy influence intent and longer-term structural reform objectives. Market participants should monitor FOMC outcomes, Fed official responses to the critique, and any subsequent Trump administration announcements regarding Fed leadership or policy preferences. The broader debate on Fed framework reform may gain traction in policy circles, potentially altering long-term expectations for interest rate trajectories and inflation targeting approaches.

[1] Fox Business - “LARRY KUDLOW: Mr. Trump, please give us a transformational Fed”

URL: https://www.foxbusiness.com/politics/larry-kudlow-mr-trump-please-give-us-transformational-fed

Published: January 28, 2026

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.