Tech Earnings Analysis: Magnificent Seven Market Concentration at Record 38% of S&P 500

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

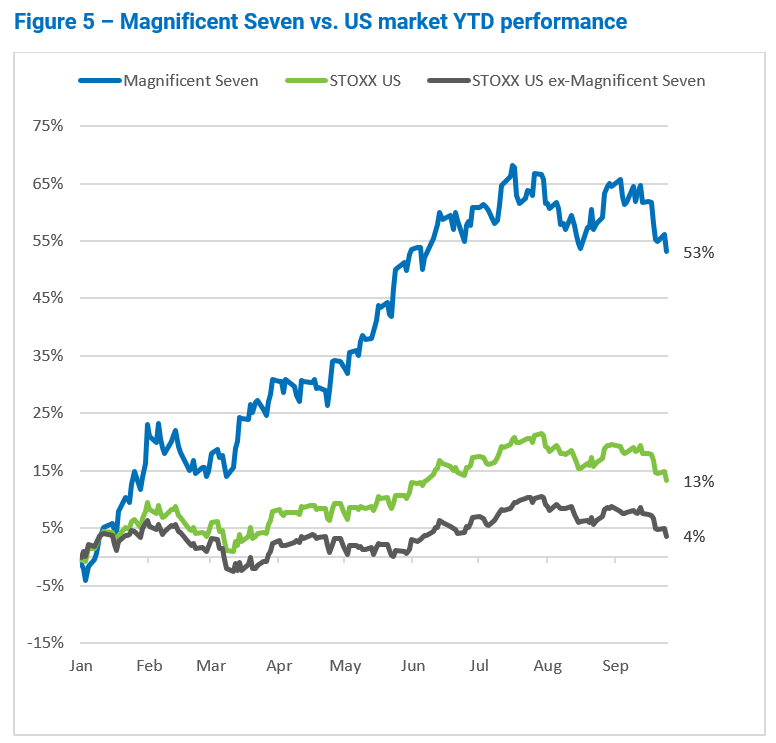

This analysis is based on the Wall Street Journal report [1] published on November 1, 2025, which revealed that the “Magnificent Seven” technology companies have achieved unprecedented market dominance, constituting a record 38% of the S&P 500’s total market capitalization. This represents a dramatic threefold increase from their 12% market share in 2015 [1].

The Magnificent Seven (Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta Platforms, and Tesla) have demonstrated extraordinary market power:

- Market Share: 37-38% of S&P 500 market capitalization as of October 2025 [1]

- Combined Market Cap: Approximately $20.9 trillion as of October 9, 2025 [2]

- Historical Performance: 697.6% return from 2015-2024 vs. S&P 500’s 178.3% [1]

Recent market data shows mixed performance across indices over the past 30 days [0], with the NASDAQ Composite leading at +4.95%, while technology sector performance on November 1 showed underperformance at -1.74%, contrasting with energy (+2.81%) and financial services (+1.38%) gains [0].

The most significant development is the narrowing earnings growth advantage. Recent earnings data reveals a concerning trend [3]:

- Q2 2025: Magnificent Seven delivered 27% earnings growth vs. 14% forecast for broader market

- Q3 2025: Growth at 24% vs. 7% for other companies

- Q4 2025 Forecast: Gap narrowing to 18% vs. 9% for the remaining 493 S&P companies

This compression suggests that the premium valuations commanded by these tech giants may face pressure as their growth differential with the broader market diminishes.

Key Magnificent Seven stocks showed varied performance on November 1 [0]:

Year-to-date market cap gains have been highly concentrated, with NVIDIA (+40%, +$1.31T), Microsoft (+25%, +$0.77T), Alphabet (+27%, +$0.63T), and Meta (+22%, +$0.32T) driving 82% of the group’s total $3.3 trillion gains in 2025 [2].

The extreme concentration creates several systemic considerations:

- Index Fund Vulnerability: Passive investors now have extremely high exposure to just seven stocks, creating potential correlation risks

- Market Breadth Concerns: The performance divergence between the Magnificent Seven and the “S&P 493” indicates unhealthy market dynamics

- Liquidity and Price Discovery: Large-cap dominance may affect market depth and efficient price discovery mechanisms

The Magnificent Seven’s historical outperformance has created high expectations that may be difficult to maintain. Historical data shows the S&P 500 tends to be more resilient than the Magnificent Seven during bear markets [1], suggesting that diversification benefits may emerge during market stress periods.

Much of the recent growth has been driven by massive AI infrastructure investments. The key question remains whether these investments will generate sustainable returns, particularly as the earnings growth differential narrows and regulatory scrutiny increases.

-

Valuation Compression Risk: The narrowing earnings growth advantage (from 13 percentage points in Q2 to 9 points projected in Q4) suggests premium valuations may not be sustainable [3]

-

Regulatory Scrutiny: The unprecedented 38% market concentration will likely attract increased antitrust attention and potential regulatory action

-

Interest Rate Sensitivity: Higher interest rates could disproportionately impact high-growth technology valuations

-

AI Investment ROI: The massive capital expenditures on AI infrastructure require demonstration of sustainable returns

- Earnings Quality: Revenue growth sustainability and margin maintenance across AI investments

- Regulatory Developments: Any antitrust actions or increased scrutiny of market dominance

- Market Breadth: Relative performance of the “S&P 493” versus Magnificent Seven

- Interest Rate Environment: Federal Reserve policy impacts on growth stock valuations

The Magnificent Seven’s record 38% concentration of the S&P 500 represents both an achievement of technological dominance and a potential market vulnerability. The narrowing earnings growth differential from Q2 2025 (27% vs 14%) to projected Q4 2025 (18% vs 9%) suggests that the premium valuations may face pressure [3]. Year-to-date performance shows the group outperforming the broader market (19% vs 15%), but recent daily performance indicates technology underperformance relative to other sectors [0].

The market structure implications are significant, with passive investors facing concentrated exposure and potential systemic risks if any of these seven companies experience significant declines. Historical resilience of the broader S&P 500 during bear markets compared to the Magnificent Seven [1] suggests that diversification remains important despite the tech giants’ impressive performance track record.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.