ORB Strategy Performance Analysis: Asia vs. London/NY Sessions for Gold Trading

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

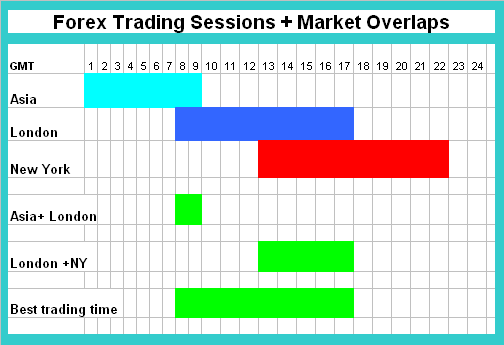

The trader documented their 81st day of applying a 5-minute Opening Range Breakout (ORB) strategy to gold futures during the Asia session, resulting in a small loss due to weak follow-through and fakeouts [source: Reddit]. Key Reddit insights include:

- Session Timing Issues: The trader acknowledged timezone confusion, initially trading 2 hours early for the Asia open, later clarifying they trade futures open rather than Tokyo exchange open [source: Reddit]

- Strategy Transparency: Questions arose about manual PnL entry, which the OP confirmed, and requests for comprehensive strategy sharing, with the OP indicating incremental release pending optimization [source: Reddit]

- Contradictory Experience: Another user (tehfadez1) reported success using ORB during Asia open to accommodate their schedule, directly contradicting the OP’s conclusion about session superiority [source: Reddit]

The ORB strategy establishes an opening range using the first 5-15 minutes of trading, entering positions on confirmed breakouts [citation:1][citation:2]. For gold trading, the standard approach uses a 15-minute range (9:30-9:45 AM EST) with 5-minute chart entries [citation:1].

The Reddit trader’s conclusion that ORB performs better in London/NY sessions aligns with theoretical market structure advantages but lacks empirical validation. The contradictory experience from another Reddit user suggests individual execution, risk management, and session-specific adaptations may be more critical than session selection alone.

- Limited empirical data may lead to flawed session selection

- Timezone confusion can result in trading outside optimal liquidity windows

- Strategy sharing without comprehensive backtesting may propagate suboptimal approaches

- Gap exists for session-specific ORB optimization research

- Asia session ORB could offer advantages for traders in different time zones with proper adaptation

- Incremental strategy sharing approach allows for real-time optimization based on community feedback

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.