TSLA Bearish Strategy Analysis: Comparing Short Stock, Options, and Inverse ETFs

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Reddit community on r/StockMarket and r/investing shows strong consensus against using inverse ETFs for bearish TSLA exposure. Multiple users shared negative experiences:

- KkatT1o1 reported losing 85% on TSLQand strongly advised against leveraged inverse ETFs[5]

- Alkthree warned against shorting TSLA in an uptrendwith Fed liquidity supporting markets[5]

- skate1243 suggested selling call spreadsto control maximum risk while expressing bearish sentiment[5]

- duqduqgo recommended a synthetic shortvia ATM put/call at same strike to avoid borrow fees[5]

- stocker0504 proposed a zero-cost ratio put spread(buy ATM put, sell 2 OTM puts) for moderate bearish views[5]

- RipWhenDamageTaken advised shorting TSLA directlyand holding proceeds in SPY/GOOG for 5+ years, warning against leveraged ETFs and options due to decay and time[5]

Market data validates Reddit concerns about inverse ETF performance and costs:

- TSLQ (2x inverse):Declined 86-87% with 1.17% expense ratio[1][2]

- TSLS (1x inverse):Declined 58-60% with lower costs[1]

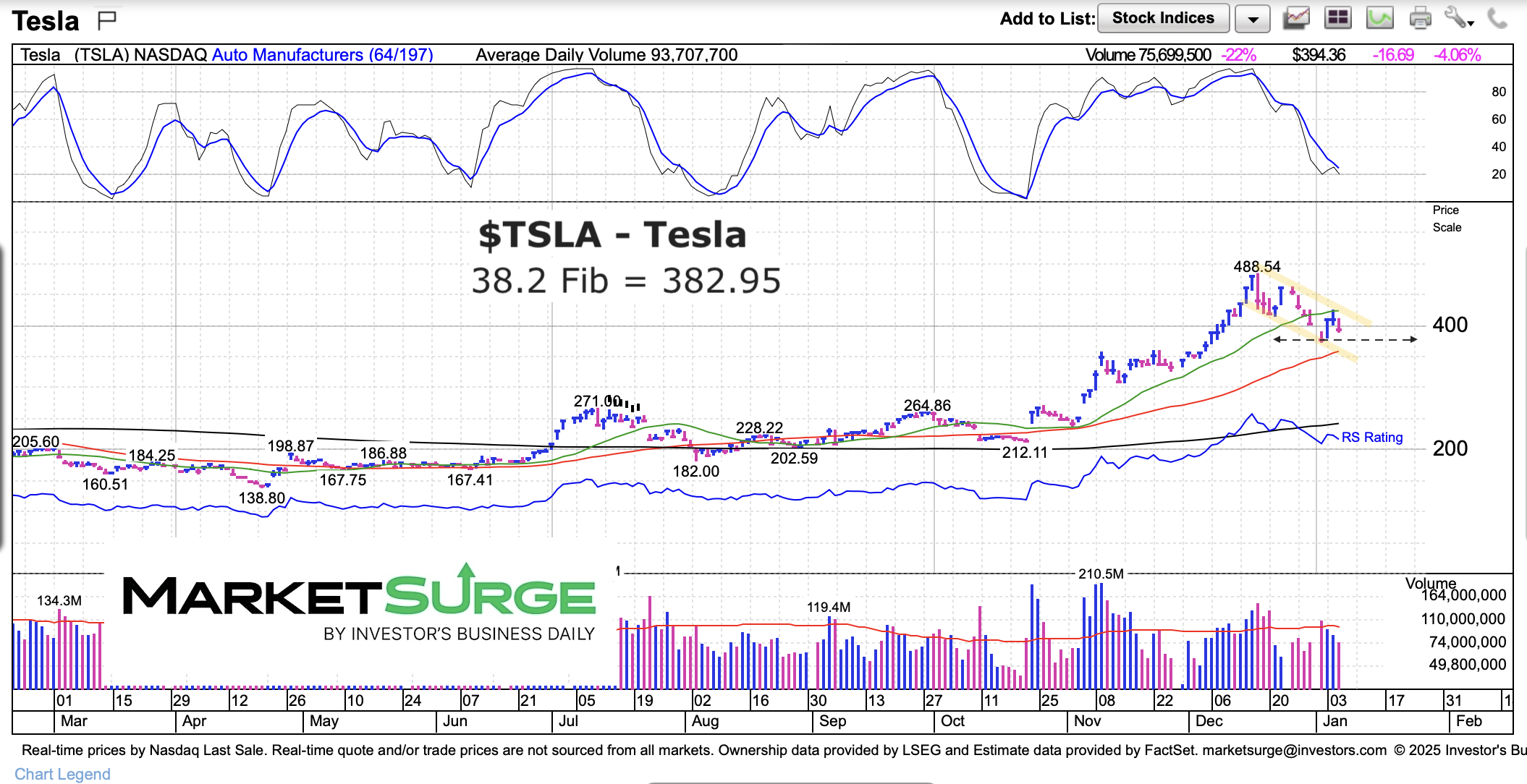

- TSLA stock:Gained approximately 50% in 2024, driving inverse ETF losses[1]

- Borrow fees:Extremely volatile, ranging from 0.25% to over 445% depending on broker and timing[4]

- Options volatility:60-day implied volatility at 60.35% as of November 2024[7][8]

- Short interest:72.69M shares shorted, representing 2.75% of float[4]

Reddit warnings about inverse ETFs are strongly supported by 2024 performance data. The

The

Community recommendations align with quantitative analysis:

- Inverse ETFs:Poor choice due to volatility drag and high costs

- Direct shorting:Cost uncertainty due to fee volatility

- Options strategies:High IV makes simple puts expensive, supporting spread recommendations

- Synthetic positions:Viable alternative to avoid borrow fees

- Volatility dragseverely impacts inverse ETFs, especially leveraged products

- Borrow fee uncertaintymakes short selling cost unpredictable

- High options IVincreases cost of bearish options strategies

- Market timing risk- TSLA’s strong 2024 performance shows difficulty of bearish positioning

- Defined-risk spreadscan limit exposure while expressing bearish views

- Synthetic shortsavoid borrow fee volatility

- Strategic timing- current high IV may present opportunities for volatility-selling strategies

- Long-term short positioningwith proceeds deployed to quality stocks (as suggested by Reddit users)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.