$10K Investment Strategy: Reddit vs. Professional Analysis for November 2025

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Reddit community demonstrates diverse but concentrated investment preferences for $10,000 deployment:

- Broad Market ETFs: VOO and VTI receive strong support from multiple users (zehboost, Yaruo0310) as foundational holdings

- Megacap Technology: GOOGL, MSFT, NVDA, and META are favored by growth-oriented investors (Sempai6969, Average_TechSpec)

- Sector-Specific Bets:

- Cybersecurity as a cross-sector play (rokman)

- Space stocks including RKLB, ASTS, LUNR, BKSY (Ulrich_Von_Urikon, Icy_Dirt_1609)

- AI & defense (BBAI, CTM), EV (RIVN), data centers (TSSI)

- Dividend Income: SCHD ETF and high-yield AIPI for monthly income (Subieast, Effective_Promise581)

- Risk Management: SGOV for cash safety (BaconJacobs, FistEnergy)

Current market conditions favor technology-driven growth with emerging market strength:

- NASDAQ: +23.5% YTD, technology sector +6% in October 2025

- Emerging Markets: +33.6% YTD with ten consecutive monthly gains

- Fixed Income: U.S. Aggregate Bond Index +6.8% YTD providing stability

- 50% Equities: Overweight technology and emerging markets

- 30% Bonds: For stability and income generation

- 20% Alternatives: Including commodities and digital assets (up to 4% allocation per Morgan Stanley)

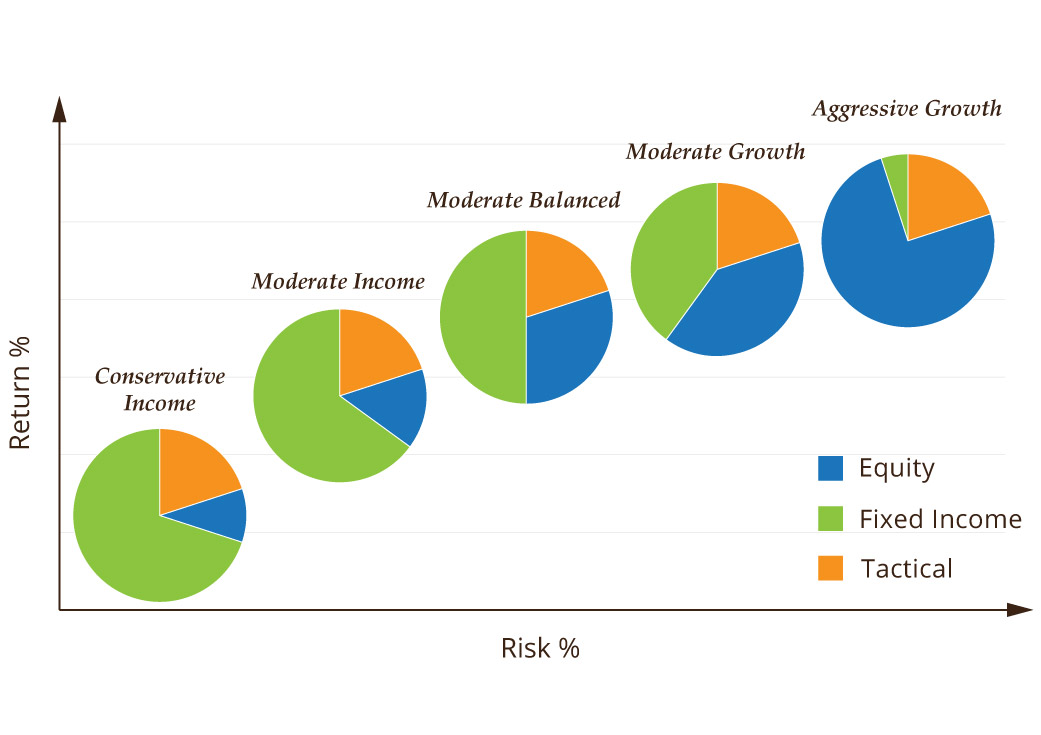

- Conservative: 80% fixed income/20% equity

- Balanced: Mixed allocation

- Aggressive Growth: 30% fixed income/70% equity

- Warren Buffett’s 90/10 strategy (90% stocks, 10% short-term government bonds) remains popular

- Both communities recognize technology’s dominance, particularly AI-related investments

- ETF preference is common - Reddit for specific exposure, professionals for diversification

- Growth orientation dominates sentiment

- Concentration Risk: Reddit favors concentrated bets in individual stocks, while professionals recommend broad diversification

- Fixed Income: Professional analysis emphasizes 30% bond allocation, largely absent from Reddit discussions

- Risk Management: Reddit shows higher risk tolerance with speculative plays, while experts emphasize capital preservation strategies

For a $10,000 investment in November 2025:

- Core Holdings (60%): VTI/VOO for broad market exposure

- Growth Satellite (20%): Select megacap tech (NVDA, MSFT) or sector ETFs (cybersecurity, AI)

- Income/Stability (15%): SCHD or short-term Treasury ETFs

- Speculative (5%): High-conviction ideas from Reddit community (space, emerging tech)

- AI infrastructure facing electrical grid constraints

- Technology sector valuation concerns despite strong fundamentals

- Emerging market sustainability after extended rally

- AI bottleneck solvers (chips to power generation)

- Undervalued dividend growth stocks

- Emerging market continued momentum

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.