Data Center Stock Analysis: Separating Sustainable AI Infrastructure from Speculative Plays

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Reddit investors are actively debating the merits of four key data center/AI infrastructure stocks, seeking to separate durable businesses from speculative AI plays:

- IRENemerges as a Reddit favorite, with users Extra_Indication7523 and catlovr1129 highlighting its secured cheap energy contracts and multi-year competitive lead in the transition from Bitcoin mining to AI cloud services [citation:1].

- NBISreceives strong support for its management team and GPU ownership model, positioning it as a pure AI cloud infrastructure play with major Microsoft partnership [citation:1].

- APLDgenerates mixed sentiment - while 15xorbust maintains a large position citing its hyperscaler pipeline, PrettyLittleRosey views it as riskier and less profitable than NBIS/IREN [citation:1].

- WULFis noted for potential upside from Fluidstack expansion and Google backing, with projected additional $190M revenue [citation:1].

- Redditors warn against CRWVdue to high debt and dilution risks, andBITFfor heavy Bitcoin correlation [citation:1].

- Alternative strategies suggested include broader exposure through hyperscale ETFs or direct Nvidia/AMD investments, while some dismiss ex-miners as “risky wrappers around Nvidia debt” [citation:1].

Fundamental analysis reveals distinct business models and risk profiles among the data center contenders:

- NBISoperates as a pure AI cloud infrastructure provider with massive growth trajectory and Microsoft partnership [citation:2]

- IRENleverages renewable energy infrastructure for Bitcoin-to-AI transition [citation:3]

- CIFRpivots from crypto mining to AI HPC workloads with Google partnership [citation:4]

- APLDspecializes in building/operating AI data centers with CoreWeave leasing agreements [citation:5]

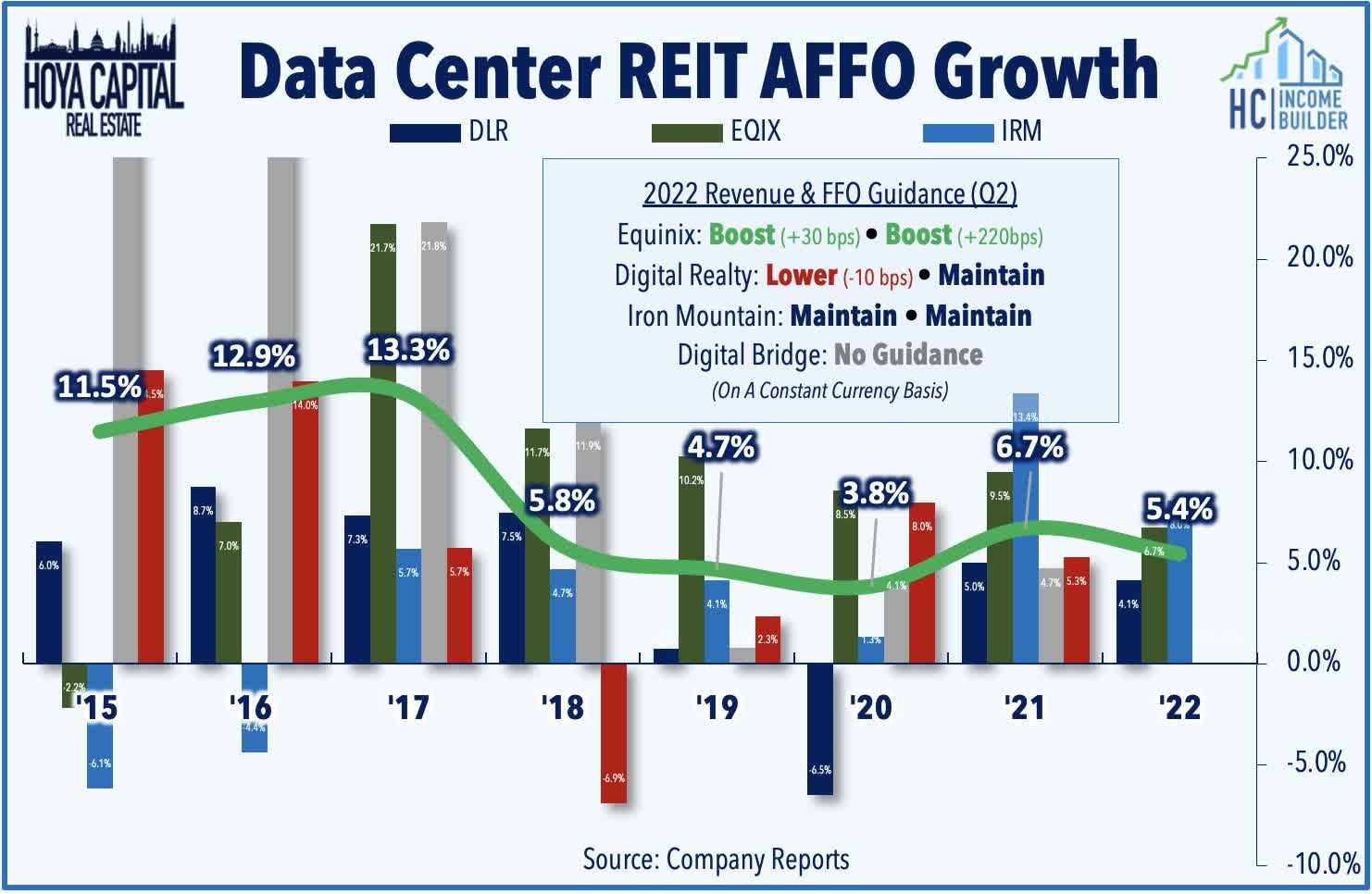

- REIT-specific metrics (FFO, AFFO, payout ratios) are essential for sustainable data center investments [citation:10]

- Long-term lease contracts with high renewal rates indicate durable revenue streams [citation:10]

- Customer concentration risk assessment is crucial - hyperscale dependency creates volatility [citation:10]

- Power availability constraints will become critical differentiators by 2027 [citation:10]

- Same-store growth and recurring revenue provide stability indicators [citation:10]

Both Reddit sentiment and research analysis converge on

Reddit shows more optimism about

- Power Infrastructure Advantage: Companies with secured cheap energy (IREN) or renewable capabilities will outperform as power constraints intensify

- Contract Quality Matters: Long-term leases with high renewal rates (CoreWeave agreements for APLD) provide revenue stability

- Balance Sheet Strength: Critical for weathering AI demand cycles and financing expansion

- Diversification Benefit: Companies avoiding single-customer dependency reduce volatility risk

- Power Availability Constraints: Grid limitations and energy costs could cap growth by 2027 [citation:10]

- AI Demand Volatility: Overexposure to AI hype cycles could create significant drawdowns

- Customer Concentration: Dependency on hyperscale clients creates revenue volatility

- Debt Burdens: High leverage from infrastructure investments could strain balance sheets

- First-Mover Advantage: Companies securing power contracts and locations early will benefit from scarcity

- AI Infrastructure Gap: Growing demand for specialized AI computing capacity creates sustained growth

- Renewable Energy Integration: Companies combining AI with clean energy positioning gain ESG and cost advantages

- Consolidation Potential: Weaker players may become acquisition targets for established data center operators

Based on the convergence of Reddit sentiment and fundamental analysis,

Investors should prioritize companies with:

- Secured power infrastructure and energy advantages

- Strong balance sheets and manageable debt levels

- Diversified customer bases with long-term contracts

- Proven operational execution in infrastructure management

Avoid companies with high customer concentration, excessive leverage, or those primarily serving as “Nvidia debt wrappers” without differentiated infrastructure advantages.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.