Despite Powell's Stabilization Narrative, U.S. Labor Market Shows Persistent Weakness Ahead of January Payrolls Report

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

The Federal Reserve concluded its January 2026 FOMC meeting on January 28, maintaining the federal funds rate at its current level while revising its policy statement to note “some signs of stabilization” in the labor market [1]. This characterization from Chairman Powell contrasts with underlying economic data that reveals more persistent weakness in job creation dynamics. The Fed’s own Summary of Economic Projections (SEP) establishes 4.4% unemployment as the ceiling for 2026, making the current rate level a critical threshold rather than a comfortable baseline [1].

The January FOMC meeting produced notable dissent, with two Federal Reserve governors voting for an immediate rate cut [5]. This internal disagreement within the Federal Open Market Committee signals that concerns about labor market weakness are not limited to outside analysts but have penetrated the policy-making apparatus itself. The presence of dissenting votes suggests that the consensus view of “stabilization” may be contested among policymakers with direct access to comprehensive economic data.

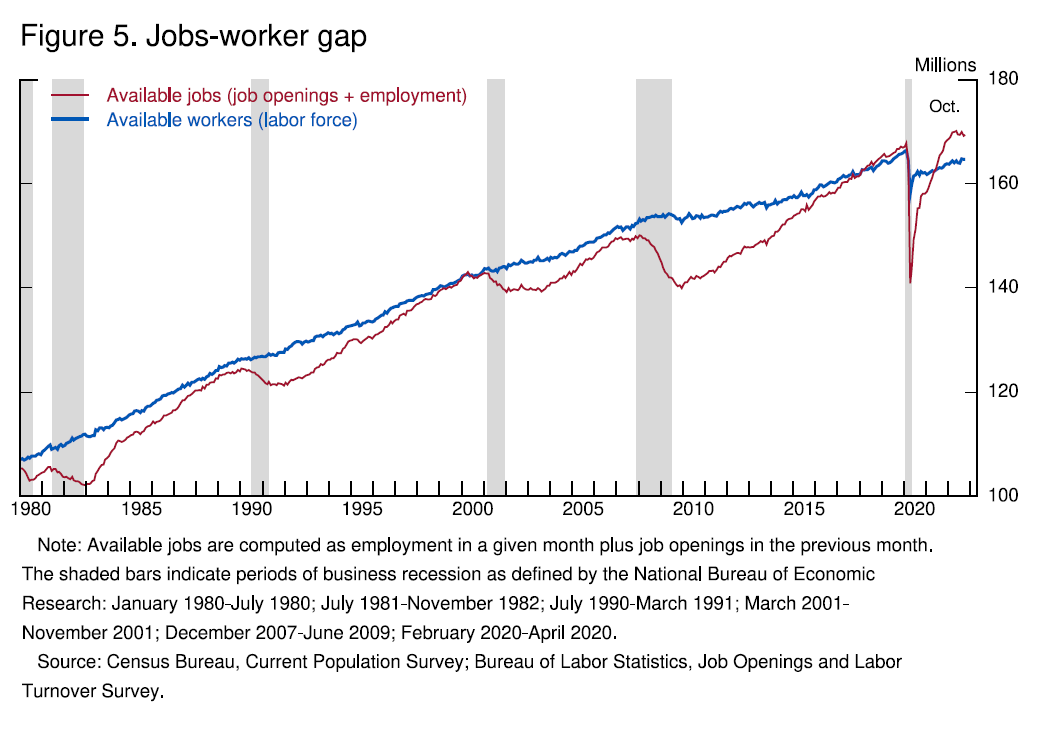

The labor market presents a complex picture with contradictory indicators that require careful interpretation. Jobless claims have fallen to 198,000, representing the second-lowest level in two years and suggesting continued tightness in the labor market [4]. However, this apparent strength in layoffs data contrasts sharply with weakness in job creation metrics.

The ADP weekly employment change data shows private sector hiring averaging 7,750 positions, down from 8,000 in prior periods [3]. This downward trend in hiring velocity indicates that employers are becoming more cautious about workforce expansion despite relatively low layoff rates. The combination of low layoffs but weak hiring creates a dynamic where the unemployment rate can remain stable while net job creation disappoints.

The January nonfarm payrolls report, scheduled for release on Friday, is expected to show approximately 70,000 net new jobs [2]. This figure falls well below the monthly averages needed to accommodate population growth and absorb new labor market entrants, indicating that the economy is not generating sufficient employment opportunities to maintain healthy labor market conditions. The December payroll figure of only 50,000 net new jobs provides concerning precedent for this trend [1].

Beyond cyclical indicators, the analysis identifies three structural pressures that threaten to perpetuate labor market weakness:

Market performance this week has reflected growing concerns about labor market trajectory, with major indices showing modest declines. The S&P 500 declined 0.17% over the five sessions ending January 30, while the NASDAQ fell 0.59% over the same period [0]. More significantly, the Russell 2000 index of small-capitalization stocks dropped 1.02% on January 28 alone and has shown particular weakness throughout the week, declining 0.76% on January 30 [0].

Small-cap stock performance is often considered a barometer for labor-sensitive sectors, as smaller companies tend to have greater exposure to domestic economic conditions and labor costs. The Russell 2000’s relative weakness may reflect investor concerns about small business hiring prospects given the challenging labor market environment. Retail, hospitality, and construction sectors—particularly dependent on small business employment—may face continued pressure if labor market weakness persists.

The current unemployment rate of 4.4% carries particular significance because it represents the Federal Reserve’s own projected ceiling for 2026 [1]. This creates a situation where what might ordinarily appear as acceptable labor market conditions is instead characterized by policymakers as a boundary condition requiring attention. The distinction matters because it frames policy decisions: the Fed may perceive itself as operating closer to its comfort zone’s limits rather than comfortably within it.

This threshold interpretation has implications for Fed communications and market expectations. If unemployment holds steady at 4.4% or rises above it, the Fed may face pressure to respond with accommodative policy regardless of inflation developments. The dual mandate’s employment component could increasingly dominate policy considerations as the labor market approaches or exceeds projected limits.

The contemporary labor market presents interpretation challenges through divergent data signals. Jobless claims at near-two-year lows suggest employer reluctance to lay off workers despite economic uncertainty [4]. Simultaneously, weak payroll gains indicate limited enthusiasm for hiring expansion. This combination creates a “limping” labor market where neither layoffs nor hiring accelerate, resulting in stable unemployment rates that mask underlying weakness in job creation.

This divergence complicates policy responses and market positioning. Traditional recession indicators relying on rising unemployment may fail to signal distress until the dynamic shifts. The current equilibrium—where employers retain workers without expanding headcount—can persist for extended periods before manifesting in traditional unemployment metrics. Market participants and policymakers should monitor payroll gains rather than unemployment rates for early signals of labor market deterioration.

The two dissenting votes at the January FOMC meeting represent an important signal that the Federal Reserve’s consensus view on labor market conditions is not universal [5]. Dissents in FOMC meetings, while not uncommon, often foreshadow future policy shifts. The governors who voted for rate cuts presumably possessed concerns about economic conditions that justified immediate accommodation rather than continued patience.

The presence of dissenting votes may also reflect differing interpretations of incoming data among Fed officials. If two governors perceived sufficient labor market weakness to warrant immediate action, the underlying data may support more concern than the consensus characterization of “stabilization” suggests. Future meeting minutes and speeches may provide additional context for the dissents’ reasoning.

The analysis identifies several risk factors warranting attention from market participants and economic observers:

The January 2026 employment report, due for release on Friday, represents a critical test of the labor market thesis presented in the Seeking Alpha analysis. Current indicators suggest the following key data points warrant monitoring:

- Nonfarm Payrolls: Expected gain of approximately 70,000 positions, well below the 100,000-150,000 monthly average typically needed for sustainable labor market health [2]

- Unemployment Rate: Expected to remain at 4.4%, representing the Fed’s projected 2026 ceiling [1]

- ADP Weekly Hiring: Averaging 7,750 positions, down from 8,000 in prior periods [3]

- Jobless Claims: At 198,000, near two-year lows [4]

The divergence between low layoff rates (jobless claims) and weak hiring (ADP and expected payrolls) creates a complex interpretive environment. Market participants should recognize that stable unemployment rates can coexist with meaningfully weak labor market conditions, as currently appears to be the case.

The upcoming employment report should be evaluated not merely for its headline numbers but for underlying details including labor force participation changes, wage growth trends, and sector-specific hiring patterns. These nuances will inform assessments of whether the “stabilization” characterization accurately reflects labor market conditions or represents an overly optimistic interpretation of mixed data.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.