Geopolitical De-escalation Analysis: Impact on Gold and Oil Markets

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

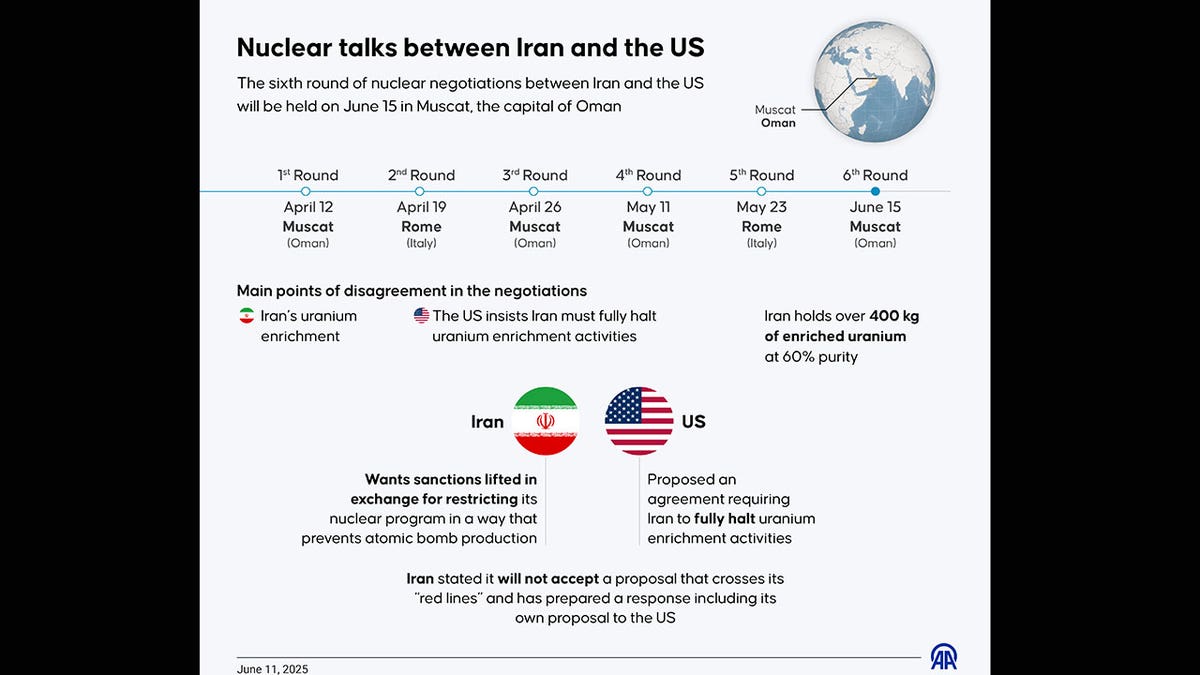

According to reports from The New York Times citing Iranian and American officials, Iran has signaled willingness to suspend or shut down its nuclear program as a major concession to the United States. This potential diplomatic breakthrough carries significant implications for global commodity markets, particularly safe-haven assets (gold) and energy markets (oil).

| Metric | Gold | Crude Oil |

|---|---|---|

| Current Price | $4,652.60/oz | $62.14/bbl |

| YTD Performance | +78.18% | -13.81% |

| Distance from 200-day MA | +19.42% | -0.13% |

| Implied Impact if Confirmed | -2% to -5% | -5% to -15% |

Gold prices are currently trading at extraordinary levels, having appreciated

- Geopolitical risk premium: Heightened tensions in the Middle East, including concerns about Iran’s nuclear program and regional proxy conflicts

- Central bank buying: Global central banks have acquired over 1,000 tonnes of gold annually since 2022, accelerating de-dollarization trends [1]

- Monetary policy expectations: Fed interest rate trajectory remains supportive for non-yielding assets

- Structural demand shift: Gold’s share of global foreign exchange reserves surpassed U.S. Treasuries for the first time in 29 years during 2025 [1]

Crude oil is trading essentially at fair value, sitting essentially

Gold’s remarkable rally toward record highs has been substantially driven by safe-haven demand triggered by geopolitical uncertainties [1][2]. A confirmed de-escalation in Iran tensions would likely trigger the following price movements:

| Scenario | Expected Impact | Price Target Range |

|---|---|---|

Immediate Full De-escalation |

-3% to -5% | $4,513 - $4,420/oz |

Progressive Diplomatic Movement |

-1% to -3% | $4,606 - $4,513/oz |

Uncertainty/Partial Agreement |

0% to -2% | $4,653 - $4,560/oz |

Deal Breakdown/Re-escalation |

+5% to +15% | $4,885 - $5,350/oz |

The most immediate and significant impact would be the

- Resistance: $4,827 (20-day MA), $5,000 (psychological), $5,627 (period high)

- Support: $4,568 (50-day MA), $4,400 (strong support), $3,896 (200-day MA)

Iran’s oil infrastructure represents a significant supply variable in global markets. According to industry analysis, Iran’s potential contribution includes:

- Pre-sanctions production capacity: ~3.8-4.0 million barrels/day (mbd)

- Current production: ~3.0-3.2 mbd under sanctions

- Export capacity if sanctions relieved: +1.0-1.5 mbd to global markets [0]

Key infrastructure includes the Kharg Island export terminal and the Abadan Refinery with over 400,000 bpd capacity [0]. Iran’s potential addition would represent

| Scenario | Expected Impact | Price Target Range |

|---|---|---|

Iran Exports Resume (1.0-1.5 mbd) |

-10% to -15% | $55.93 - $52.82/bbl |

Regional De-escalation Premium |

-5% to -10% | $59.03 - $55.93/bbl |

Nuclear Agreement Only |

-2% to -5% | $60.90 - $59.03/bbl |

No Deal/Escalation Risk |

+10% to +20% | $68.35 - $74.57/bbl |

The most bearish scenario assumes not only a nuclear agreement but also the rapid resumption of Iranian oil exports to global markets. Given current oil prices trading near long-term averages, such a supply shock could have significant price implications.

Historically, gold and oil exhibit weak correlation, but this relationship strengthens during geopolitical crises. Currently, an unusual configuration exists where

Safe-haven flows out of gold during de-escalation would typically correlate with

The S&P 500 typically benefits from de-escalation with short-term gains of

- Implementation Risk: Even with an agreement, IAEA verification takes significant time

- Israel Opposition: Israeli authorities have expressed concerns that negotiations may not address missile limitations or proxy support [0]

- Regional Proxy Conflicts: May continue despite nuclear de-escalation

- Domestic Political Risk: Iranian hardliner opposition could undermine implementation

- Premium Extent: Much of the geopolitical risk premium may already be priced into current prices

- Structural Support: Central bank buying provides a floor for gold prices regardless of geopolitics

- Fed Policy: Monetary policy trajectory remains a dominant driver for precious metals

- Global Growth: Economic slowdown concerns could offset de-escalation benefits

- Position Sizing: De-escalation creates meaningful downside risk; adjust exposure accordingly

- Hedging Strategies: Consider protective puts on long gold positions

- Sector Allocation: Reduce exposure to gold miners (leveraged to metal prices)

- Short-term Posture: Clearly bearish; potential for shorts or put options

- OPEC+ Response: Critical determinant of long-term price trajectory

- Sector Rotation: Underweight energy; consider consumer discretionary exposure

- Risk-on Positioning: De-escalation favors risk assets over defensive positioning

- Sector Allocation: Shift from defensive sectors (utilities down -2.14% on Feb 2) to cyclical exposure [0]

- Currency Positioning: Potential USD strength from reduced safe-haven demand

If Iran’s reported willingness to curb its nuclear program is confirmed, the market impact would likely manifest as follows:

-

GOLD: Expected2-5% declinein the immediate term as the geopolitical risk premium is reduced. However, structural support from central bank buying and Fed policy expectations should limit downside. Key support levels around $4,400-4,500 represent significant buying interest.

-

OIL: Expected5-15% declinedepending on the pace of sanctions relief and Iran’s ability to restore exports. The OPEC+ response will be critical in determining the ultimate trajectory. Prices could test $55-60 range in a full de-escalation scenario.

-

TIMING: Market reaction may be rapid and potentially exaggerated. Investors should distinguish between immediate trading opportunities and fundamental shifts in the geopolitical landscape.

-

CONTINGENCIES: The degree of actual de-escalation matters significantly. A comprehensive, verified agreement has different market implications than preliminary diplomatic overtures. The market will closely watch IAEA verification reports and statements from regional actors.

-

MONITORING: Key indicators to watch include IAEA verification reports, Iranian oil tanker activity, statements from Israel and Saudi Arabia, and the trajectory of U.S.-Iran diplomatic engagement.

[0] Ginlix API Data (Market Prices and Technical Indicators)

[1] Ainvest News - “U.S. Tariff Policy Shifts and the Golden Surge: Geopolitical Risk and Gold’s Safe-Haven Role” (https://www.ainvest.com/news/tariff-policy-shifts-golden-surge-geopolitical-risk-gold-safe-haven-role-2509/)

[2] Moneta Markets - “Geopolitical Tensions Drive Safe-Haven Rally; Gold & Silver Surge Amid Venezuela Crisis” (https://www.monetamarkets.com/markets/geopolitical-tensions-drive-safe-haven-rally-gold-silver-surge-amid-venezuela-crisis-6th-january-2026/)

[3] Ynetnews - “Iranian officials say Tehran may suspend or shut down nuclear program to ease tensions with US” (https://www.ynetnews.com/article/b1ado5ru11g)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.