US-Japan Treasury Communications: Policy Coordination Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on my comprehensive analysis of current macroeconomic developments, I will now provide a detailed assessment of US-Japan Treasury communications and their potential implications for currency and equity markets.

Japanese Finance Minister Satsuki Katayama has confirmed ongoing close communication with US Treasury Secretary Scott Bessent regarding yen-related concerns, signaling a notable shift in the bilateral economic relationship. The New York Federal Reserve’s recent “rate check” on the USD/JPY pair in late January 2026 represented the strongest signal to date that Japanese and US authorities are coordinating closely to address yen weakness [1]. This unusual market operation, typically conducted for internal purposes, was widely interpreted as preparatory groundwork for potential coordinated intervention.

The following mechanisms represent viable policy options under consideration:

- Unilateral Japanese Intervention: Japan retains significant foreign exchange reserves (approximately $1.2 trillion) and has demonstrated willingness to conduct yen-buying interventions, as seen in previous periods of excessive volatility.

- Coordinated US-Japan Selling of Dollars: While historically rare, the current environment presents unique conditions that may justify joint action. The threshold for intervention has been lowered following the Fed’s rate check, though analysts suggest coordinated selling of dollars remains “highly unlikely at this stage” [2].

- The Fed’s rate check itself constituted a form of verbal/symbolic intervention, temporarily spurring yen appreciation toward 154 per dollar—the strongest level in over two months [3].

- Continued Fed easing while the ECB maintains higher rates creates dollar softness, which indirectly supports yen stabilization.

- Japan would need to sell portions of its US Treasury holdings to conduct sustained yen-buying intervention, potentially pushing up US yields at a time when markets remain volatile.

- Washington faces a trade-off between supporting its ally and protecting Treasury market stability—a delicate balance that limits enthusiasm for aggressive coordinated intervention.

The central bank policy landscape for 2026 exhibits pronounced divergence that directly impacts currency valuations:

| Central Bank | Current Rate | 2026 Outlook | Inflation Context |

|---|---|---|---|

Federal Reserve (Fed) |

3.50% – 3.75% | One more cut projected (~3.25%–3.50% by year-end) | Policy flexibility remains |

European Central Bank (ECB) |

2.00% (held) | Pause expected; <10% probability of February 2026 cut | Inflation at 1.9% (2026 projection) |

Key observations from the policy divergence:

-

Directional Impact: Even though US rates remain higher than European rates, the narrowing differential (Fed cutting while ECB holds) has been supportive of the euro [4].

-

EUR/USD Implications: The euro has appreciated approximately 13% over the past year, trading within the 1.15–1.18 range. The 1.1800 level represents strong psychological resistance.

-

Market Pricing: Futures markets price roughly two additional Fed cuts in 2026, while the ECB is expected to maintain its pause throughout the year.

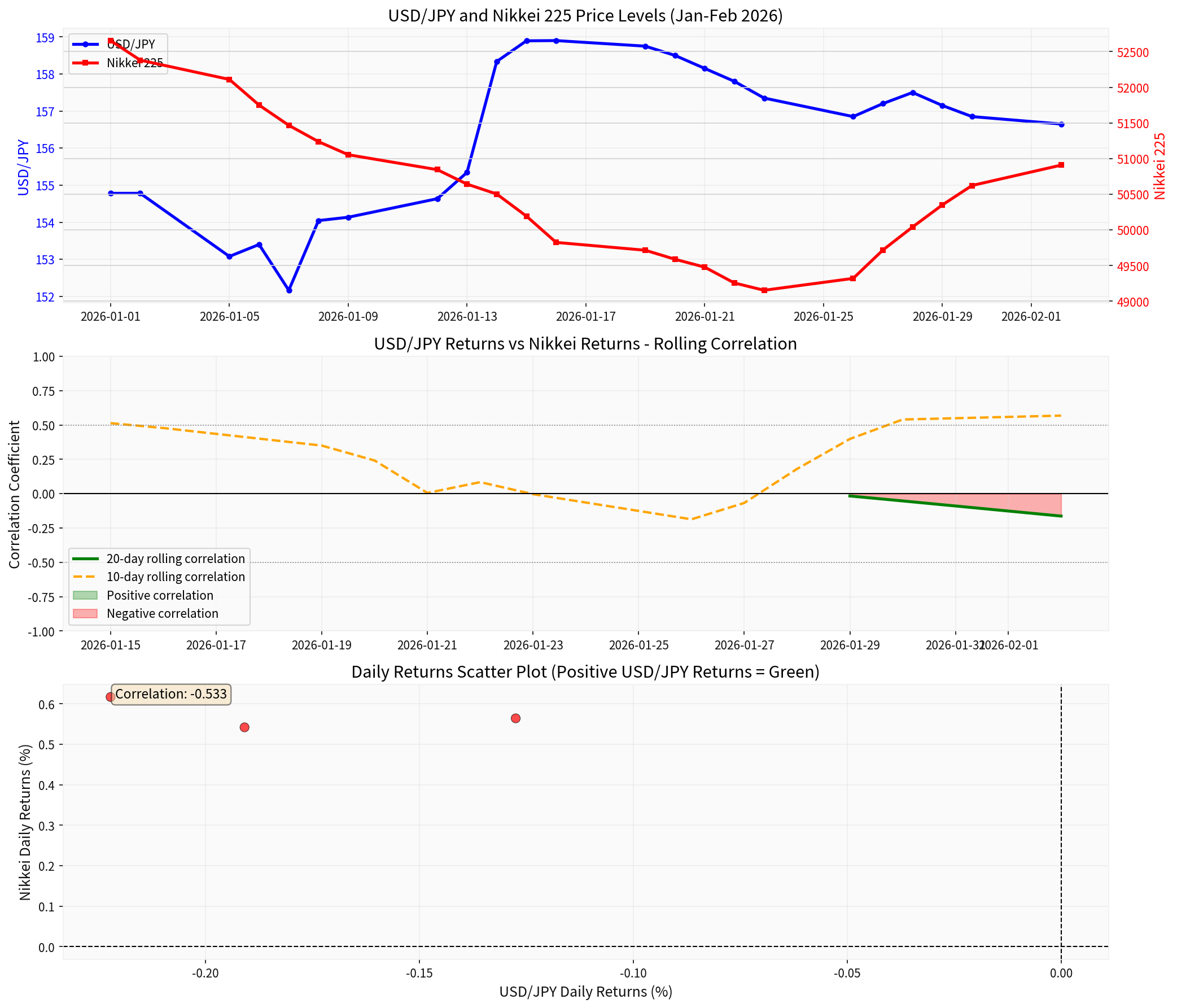

My analysis of recent market data reveals significant dynamics in the Nikkei-USD/JPY relationship:

- Overall level correlation: -0.7787 (strong negative relationship)

- 20-day rolling correlation: -0.1634 (approaching zero)

- 10-day rolling correlation: +0.5681 (positive, indicating regime shift)

-

Historical Relationship Breakdown: The traditional positive correlation between USD/JPY and the Nikkei (where a weaker yen supports Japanese export competitiveness) has been disrupted by policy coordination signals.

-

Recent Correlation Regime Shift: The 10-day rolling correlation has transitioned from negative (-0.19 on January 26) to positive (+0.57 on February 2), suggesting markets are repricing the intervention risk premium.

-

Market Data (Jan-Feb 2026):

- USD/JPY Range: 152.16 – 158.90

- Nikkei Range: 49,154 – 52,655

- The yen’s 3.8% gain in late January (from ~158 to ~154) coincided with Nikkei volatility

- Immediate Effect: USD/JPY decline of 2-4% in a sharp, short-lived move

- Nikkei Impact: Initial negative reaction as export competitiveness concerns resurface, followed by stabilization as intervention demonstrates commitment to currency stability

- Correlation: Likely returns to historical positive relationship (0.3–0.5)

- USD/JPY: Maintains range-bound trading (154–160) with heightened volatility around intervention thresholds

- Nikkei: Continues tracking domestic earnings and global risk sentiment, less sensitive to currency moves

- Correlation: Remains unstable, oscillating between positive and negative regimes

- USD/JPY: Dollar weakness pushes pair below 150, potentially triggering intervention

- Nikkei: Benefits from yen strength through improved purchasing power, though export margins face pressure

- Correlation: Complex dynamic—yen strength supports stocks but export concerns create headwinds

-

Hedging Strategies: The elevated intervention risk necessitates enhanced hedging of yen exposure for Japanese equity exposure.

-

Sector Implications: Based on current sector performance (February 2, 2026), Consumer Defensive (+2.56%), Technology (+1.12%), and Industrials (+0.86%) are outperforming [5], suggesting growth sectors remain resilient despite currency volatility.

-

Volatility Expectations: EUR/USD ATR has compressed from ~140 pips to ~50 pips, indicating a lower-volatility environment that may not persist during intervention events.

-

Key Monitoring Dates:

- ECB Meeting (tone check): January 30, 2026

- Fed Meeting (rate decision): January 28-29, 2026

- US December Jobs Report: January 10, 2026

- Eurozone Inflation Flash: January 7, 2026

US-Japan Treasury communications signal a new era of coordination that could fundamentally alter the USD/JPY-Nikkei correlation dynamics. The Fed-ECB policy divergence creates a dollar-soft environment that, combined with explicit US support for yen stability, may produce sustained yen appreciation. Markets should prepare for increased volatility around intervention thresholds (158-160 zone) while recognizing that the historical positive Nikkei-USD/JPY correlation may resurface as the primary driver once intervention concerns subside.

The critical question remains whether coordinated intervention will move beyond signaling to actual execution—a decision that balances Japan’s desire for currency stability against concerns about Treasury portfolio impacts and potential retaliation dynamics.

[1] Reuters/Yahoo Finance - “US rate check masks stiff hurdle to coordinated Japan-US intervention” (https://finance.yahoo.com/news/analysis-us-rate-check-masks-082539508.html)

[2] Mainichi Shimbun - “Japan’s Katayama says concern over weak yen shared with US Treasury Secretary Bessent” (https://mainichi.jp/english/articles/20260113/p2g/00m/0bu/020000c)

[3] Trading Economics - “Japanese Yen Exchange Rate” (https://tradingeconomics.com/japan/currency)

[4] BabyPips - “ECB Hits Pause While The Fed Keeps Cutting” (https://www.babypips.com/trading/explainer-ecb-vs-fomc-interest-rate-outlook-2026)

[5] Ginlix API - Sector Performance Data (February 2, 2026) [0]

[6] Ginlix API - Nikkei 225 and USD/JPY Price Data (December 2025 – February 2026) [0]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.