ASEAN Macro to Equity Markets: 5 Key Questions Shaping 2025 and Beyond

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The ASEAN macroeconomic and equity market landscape in 2025 presents a complex confluence of global trade tensions, shifting monetary policies, and structural economic transformations. This analysis synthesizes multiple perspectives on the five key questions that will determine the trajectory of ASEAN equity markets in the coming years.

The introduction of US tariffs on ASEAN countries through executive order in July 2025 has fundamentally altered the trade landscape for the region [1]. The differentiated tariff structure reflects the United States’ strategic assessment of bilateral trade relations: Singapore faces a minimal 10 percent tariff due to its diversified economy, while Thailand, Malaysia, and Indonesia operate under a 19 percent rate following negotiated reductions. Smaller economies including Laos and Myanmar confront significantly higher 40 percent rates, creating substantial export pressure [4]. The electronics sector faces particularly severe tariff exposure, with certain products facing duties up to 49 percent, disproportionately impacting Malaysia and Vietnam [2]. However, the “Sell America” trend triggered by moderating US job growth and trade tensions is redirecting global investor flows toward ASEAN assets, creating counterbalancing opportunities [3].

Central bank policies across ASEAN and major economies are creating a complex but increasingly favorable environment for equity valuations. Bank Indonesia delivered a surprise rate cut to stimulate growth, with potential additional cuts expected to boost equity markets particularly in banks and real estate developers [3]. Singapore’s Monetary Authority has implemented an Equity Market Development Programme aimed at enhancing market depth and supporting valuation re-rating [5]. The expected trajectory of US Federal Reserve rate cuts over the next 12 months is improving investor sentiment and creating favorable conditions for Asia-Pacific equities through currency stabilization and improved capital flows [5]. This multi-layered interaction between regional monetary policies and US Federal Reserve decisions creates differentiated impacts on currency valuations, capital flows, and equity market performance across ASEAN nations.

China’s economic deceleration presents both structural challenges and opportunities for ASEAN markets. Recent economic data reveals a marked slowdown trend in China-ASEAN trade in 2025, with growth rates declining sharply compared to previous years [6]. China’s economy expanded at one of the slowest rates in decades last year as authorities struggle to overcome structural challenges including a persistent property slump and slowing fixed-asset investment [8]. However, multinational corporations are actively diversifying supply chains away from China, creating substantial opportunities for ASEAN manufacturing hubs. Vietnam, Thailand, and Malaysia are benefiting from these supply chain shifts, particularly in electronics and manufacturing sectors, though Vietnam’s Q2 and Q3 2025 growth slowed to the slowest in three quarters as electronics exports faltered [2][7].

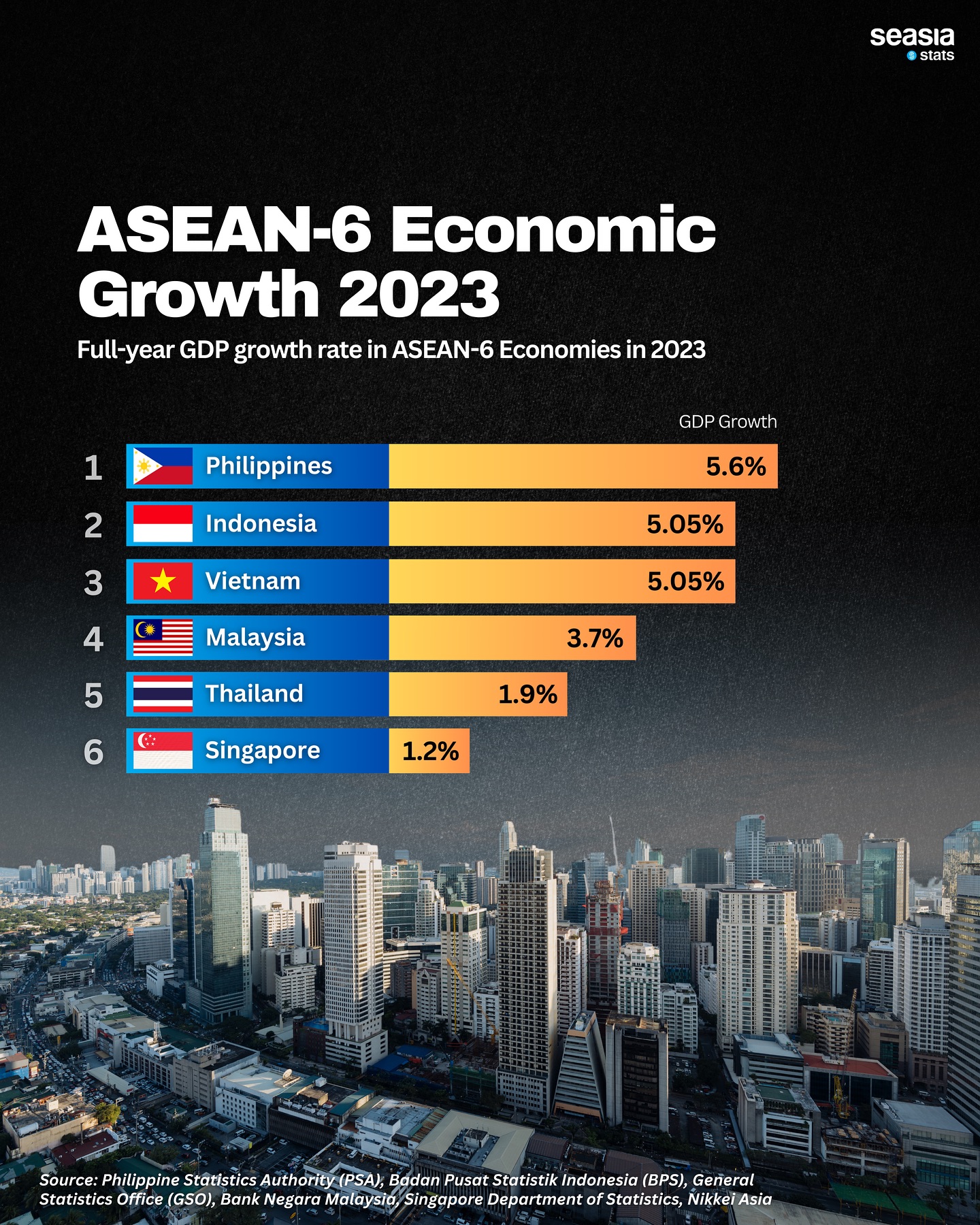

The ASEAN+3 Macroeconomic Research Office projects the region will maintain robust growth above 4 percent in both 2025 and 2026, with domestic demand serving as a key pillar of growth supported by improving investment activity [2]. This resilience varies significantly across countries: Singapore stands out for its domestic resilience, safe haven appeal, capital returns, and AI adoption across key sectors [3]. The Philippines is projected to be the East Asia and Pacific region’s third fastest-growing economy until 2027, while Thailand faces mixed dynamics with strong baht creating export and tourism headwinds but EV battery materials and automotive components offering supply chain opportunities [9]. Indonesia maintains healthy fundamentals with anticipated earnings recovery in H2 2025, supported by its sovereign wealth fund’s focus on data centres and healthcare [9].

The electronics sector, critical to ASEAN export economies, faces significant structural changes requiring adaptive strategies. Oil & gas has been downgraded to NEUTRAL due to reduced offshore activity and lower Brent crude assumptions of USD67 per barrel for 2025 [3]. Conversely, Singapore REITs remain POSITIVE, supported by falling rates and resilient economic growth [3]. Long-term secular trends identified by PineBridge Investments include continued capital expenditure into AI infrastructure, a surge in global demand for energy storage systems and EV adoption, and drug licensing and biotech development [5]. The Johor-Singapore Special Economic Zone is generating growing interest as companies restructure supply chains to mitigate tariff impacts [4].

Foreign investors are demonstrating renewed confidence in ASEAN markets, with Malaysia seeing net buying on Bursa Malaysia indicating returning confidence [9]. Indonesia’s attractive valuations and earnings rebound expectations are driving inflows, while Singapore benefits from wealth management inflows supporting market resilience [3]. The competitive landscape shows Maybank Research maintaining overweight recommendations for Singapore, Malaysia, and Indonesia, reflecting confidence in domestic resilience and regional integration initiatives [3]. Singapore banks, while rated NEUTRAL due to tariff-related macro uncertainty, demonstrate low single-digit loan growth of 3.4 percent year-over-year as of April 2025, indicating stable but cautious expansion [3].

The external risk environment presents several concerns requiring careful monitoring. Escalating or de-escalating US-China trade tensions will significantly impact export-dependent ASEAN economies and supply chain investment decisions. Global economic slowdown affecting export demand remains a persistent concern, particularly for the electronics sector facing tariff headwinds. Geopolitical tensions, particularly in the South China Sea, introduce uncertainty for shipping routes and regional trade flows. The Philippines’ growth trajectory and Vietnam’s manufacturing expansion depend heavily on stable global trade conditions and continued supply chain diversification from China.

Internal risks vary across ASEAN member states and require differentiated responses. Political instability in some member states can disrupt economic policy continuity and foreign investment confidence. Regulatory fragmentation across ASEAN creates compliance costs and operational complexity for multinational corporations. Infrastructure gaps in smaller economies limit competitiveness and ability to attract foreign direct investment. Malaysia’s 2025 ASEAN chairmanship presents an opportunity to strengthen regional integration, promote sustainable growth, and enhance cooperation through initiatives like the ASEAN-EU Business Summit and FTA negotiations [4].

The current environment creates several compelling opportunity windows. The tariff environment encourages stronger intra-ASEAN partnerships and new market development beyond traditional Western markets. Digital transformation through AI adoption represents structural growth opportunity, with Singapore’s “Singapore 4.0” initiative and Microsoft’s partnerships supporting technology adoption across key sectors [9]. Energy transition investment in solar, wind, and battery storage infrastructure, exemplified by Keppel’s partnership with Dell to develop green data centres and AI platforms in Asia, represents emerging opportunity [9]. Vietnam’s innovation ranking of 44th in the 2025 Global Innovation Index demonstrates growing technological capabilities that can support advanced manufacturing and services development [9].

The ASEAN region faces 2025 with a complex but navigable macroeconomic environment. Regional growth projections above 4 percent demonstrate fundamental resilience, though sectoral and country-specific variations require nuanced positioning. US tariffs have created differentiated impacts across ASEAN nations, with Singapore demonstrating the greatest resilience while smaller economies face greater challenges. The electronics sector faces particular pressure from tariff exposure, while rate-sensitive sectors and domestic consumption-driven industries show relative strength.

Monetary policy convergence, with regional rate cuts aligning with US Federal Reserve easing expectations, creates favorable conditions for equity valuations particularly in Indonesia, Singapore, and Malaysia. China’s economic slowdown, while challenging for trade-dependent ASEAN economies, is simultaneously driving beneficial supply chain diversification that supports Vietnam, Thailand, and Malaysia’s manufacturing sectors.

For stakeholders navigating this environment, strategic positioning should emphasize Singapore as the most resilient market, followed by Malaysia and Indonesia. Sector allocation should favor digital transformation, fintech, and high-growth consumer services in Singapore; EV components and automotive supply chains in Thailand; and manufacturing and logistics capabilities in Vietnam. Risk management requires maintaining flexibility to adjust allocations based on tariff developments and policy changes while capitalizing on long-term structural trends in AI infrastructure, energy transition, and healthcare innovation.

Malaysia’s 2025 ASEAN chairmanship provides a platform to strengthen regional integration and present coordinated responses to trade challenges. The fundamental drivers of ASEAN growth remain intact despite external pressures, and the region’s positioning as a beneficiary of global supply chain diversification provides constructive backdrop for equity market performance through the forecast period.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.