AI Adoption Defines the Next Leg of the Bull Market: Industry Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

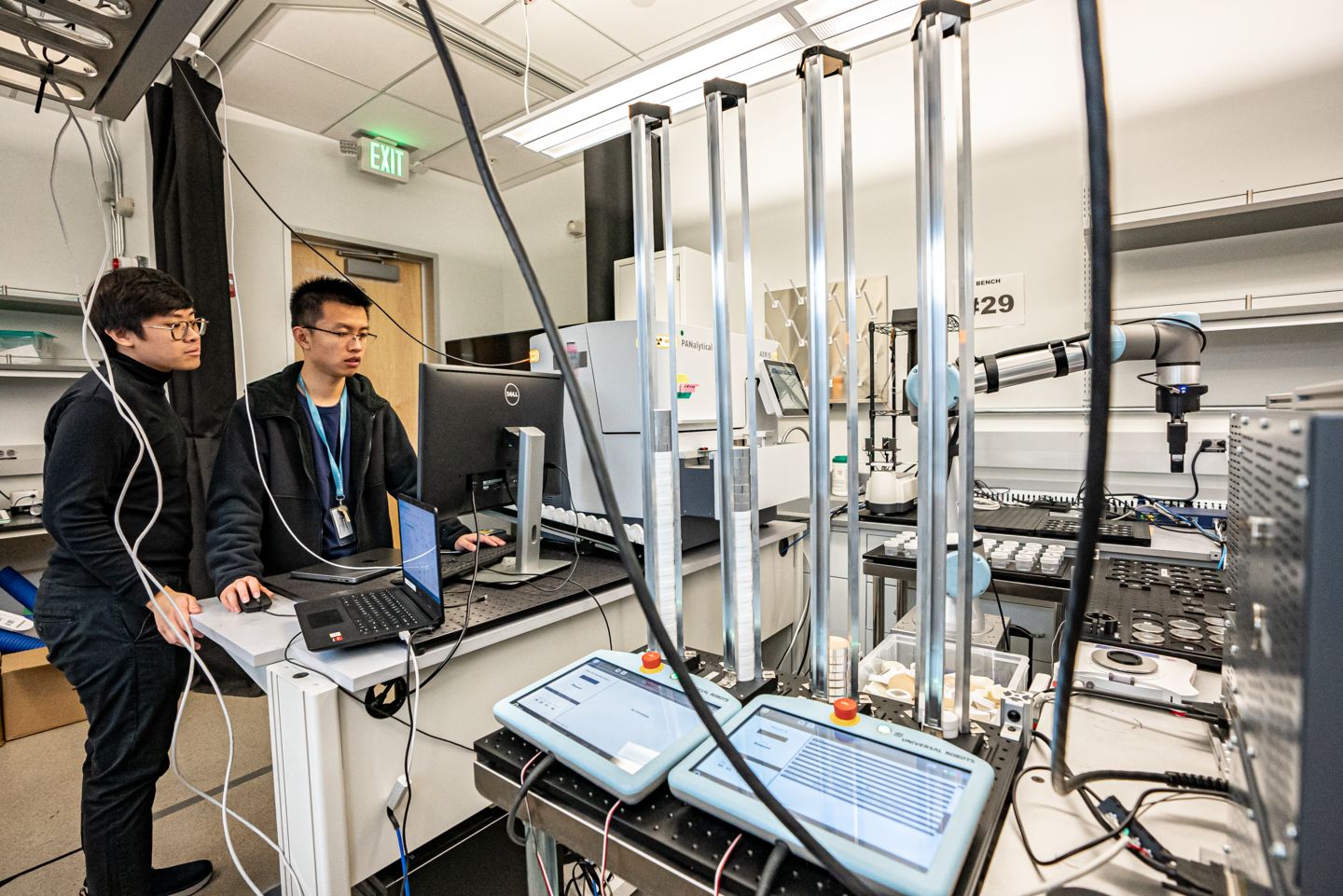

The Seeking Alpha article published on February 3, 2026, presents a thesis positioning artificial intelligence adoption as the defining catalyst for the next phase of the current equity bull market [1]. This analysis emerges at a critical juncture where multiple economic and market indicators converge to either validate or challenge the AI-driven growth narrative. The article’s central proposition rests on three interconnected pillars: operational efficiency gains from AI integration, manufacturing optimization through AI-powered systems, and sustained corporate profit margin expansion driven by artificial intelligence deployment [1].

The macroeconomic backdrop provides essential context for evaluating this thesis. The S&P 500 trades near all-time highs, reflecting investor confidence in continued economic expansion. More significantly, the ISM New Orders index has surged to 57.1, firmly in expansion territory and signaling renewed momentum in the manufacturing sector [1]. This economic acceleration occurs alongside a 17.6% AI adoption rate among companies, suggesting the market remains in the early majority phase of the technology adoption lifecycle with substantial runway for continued penetration [1].

The technology sector demonstrated notable relative strength on February 3, 2026, registering a gain of +1.13% and ranking among the top-performing sectors alongside Consumer Defensive (+2.56%) and Consumer Cyclical (+1.23%) [0]. This sector performance pattern reveals a nuanced market environment where both growth-oriented and economically sensitive segments participate in the advance. The simultaneous strength in Technology and Industrials (+0.85%) aligns with the Seeking Alpha thesis of a broadening market rally supported by both AI-driven productivity gains and broader economic recovery momentum [0][1].

The sector rotation dynamics observed in recent trading sessions merit careful attention. Consumer Defensive’s outperformance (+2.56%) typically signals risk-off positioning, yet this occurred alongside Technology’s strength, suggesting a more complex market environment [0]. Communication Services experienced modest pressure (-0.43%), while Utilities declined sharply (-2.14%), indicating sector rotation away from traditional defensive positioning [0]. This mixed sector performance pattern suggests market participants are actively reassessing leadership positions in anticipation of the next major catalyst, with AI adoption serving as a potential selection criterion.

Technical analysis of the Invesco QQQ Trust, which tracks the NASDAQ-100 and serves as a proxy for technology sector performance, reveals a consolidation phase with defined boundaries [0]. As of February 2, 2026, QQQ trades within a narrow range bounded by support at $621.85 and resistance at $630.43, with the current price at $626.14 [0]. The beta coefficient of 1.15 relative to SPY indicates elevated sensitivity to market movements, suggesting QQQ will likely respond decisively when a clear directional catalyst emerges [0].

The momentum indicators present a neutral-to-slightly bearish picture. The MACD shows no cross, indicating absent momentum shifts, while the KDJ指标 reveals K at 66.9 and D at 68.8, suggesting a slight bearish bias in the near term [0]. The overall trend assessment describes sideways movement with no clear trend, characteristic of a market in consolidation awaiting clearer catalysts [0]. This technical backdrop aligns with the thesis that AI adoption acceleration could serve as the catalyst triggering the next directional move, potentially to the upside if adoption data confirms the thesis.

The central thesis connecting AI adoption to sustained bull market performance rests on the premise that artificial intelligence will deliver measurable productivity gains sufficient to justify and sustain elevated market valuations. The 17.6% adoption rate among companies indicates the market is transitioning from early adopter experimentation toward early majority deployment [1]. This maturation phase typically accelerates as proof-of-concept projects transition to production deployments, generating measurable return on investment that justifies expanded adoption.

AI integration contributes to corporate profitability through multiple channels. Back-office automation reduces labor costs associated with repetitive tasks while improving process efficiency and accuracy [1]. Manufacturing optimization through predictive maintenance, quality control, and supply-chain AI applications delivers productivity gains that directly improve margins [1]. The convergence of AI-driven margin expansion with broader economic recovery creates a compound effect on corporate profitability, potentially sustaining market valuations even as interest rate considerations limit multiple expansion [1].

The AI-driven market performance has exhibited significant concentration, with gains disproportionately benefiting the “Magnificent Seven” technology giants and a narrow group of core infrastructure beneficiaries [4]. This concentration presents both opportunities and risks for market participants evaluating the AI adoption thesis. The opportunities lie in early movers gaining competitive advantages, enterprise software companies monetizing AI capabilities, and semiconductor companies benefiting from infrastructure build-out [4]. However, the risks include potential valuation compression if AI-driven earnings growth disappoints, sector rotation away from concentration risk, and increasing regulatory scrutiny on AI market leaders [4].

The transition from capital expenditure to operational deployment represents a maturation phase in the AI investment cycle. The AI trade in 2026 is increasingly defined by a deceleration in investment spending growth coupled with rising AI adoption and consequent rotations into more adoption-focused beneficiaries [5]. This shift suggests market leadership may broaden beyond the current concentration in infrastructure providers toward companies successfully monetizing AI applications and delivering measurable productivity improvements.

The analysis reveals several cross-domain correlations that strengthen the AI adoption thesis. The ISM New Orders expansion (57.1) combined with record S&P 500 profit margins suggests an economy-wide productivity improvement cycle potentially amplified by AI adoption [1]. The sector performance data showing simultaneous strength in Technology and economically sensitive sectors like Industrials indicates investor expectations for AI-driven productivity gains across the broader economy [0][1].

The technical consolidation in QQQ, combined with the AI adoption acceleration thesis, suggests a potential catalyst-response relationship where AI adoption data could trigger the next market advance [0]. The current sideways pattern with defined support and resistance levels creates a technical setup where positive AI adoption catalysts could generate meaningful upside momentum.

The AI adoption thesis has significant implications for market structure and investment strategy. If AI adoption accelerates from current 17% levels toward 40-50% penetration, market leadership would likely broaden beyond the current concentration in mega-cap technology companies [4]. This broadening would represent a structural shift from narrow AI beneficiary selection toward broad-based AI integration across industries, potentially lifting market averages more inclusively.

The transition from investment spending growth to adoption-focused beneficiary selection suggests an evolution in how investors should approach the AI theme. Capital expenditure leaders (semiconductors, infrastructure) may face relative pressure as adoption-focused beneficiaries (enterprise software, AI-integrated industrials) attract capital flows [5]. This rotation dynamic has implications for sector allocation and security selection within technology and related sectors.

The current AI-driven market cycle differentiates from historical technology cycles through the emphasis on actual earnings growth rather than speculative multiple expansion. Bloomberg analysis notes that AI stocks have outperformed the broader market for three consecutive years, with gains driven by actual earnings growth rather than speculation [5]. This distinction is critical for evaluating sustainability—previous technology cycles often collapsed when speculation exceeded underlying fundamentals, whereas the current cycle benefits from demonstrable earnings contributions from AI integration.

The Seeking Alpha thesis specifically emphasizes margin expansion through AI-driven productivity rather than multiple expansion, providing a more defensible foundation for continued market optimism [1]. This emphasis aligns with historical bull market patterns where earnings growth sustains advances more reliably than multiple expansion alone.

The current market environment presents several opportunity windows aligned with the AI adoption thesis. The 17.6% AI adoption rate suggests substantial runway for continued penetration as early majority deployment accelerates through 2026 and beyond [1]. Companies successfully demonstrating AI-driven productivity improvements may experience multiple expansion as the market revalues adoption beneficiaries.

The technical consolidation in QQQ creates an entry point for investors believing the AI adoption thesis, with defined support at $621.85 providing a technical stop-loss level [0]. The narrow trading range suggests limited downside risk if the thesis fails to materialize while preserving upside participation if adoption acceleration confirms the thesis.

The potential broadening of market leadership beyond “Magnificent Seven” concentration creates opportunities in secondary and tertiary AI beneficiaries [4]. Enterprise software companies successfully monetizing AI capabilities, industrial companies integrating AI for manufacturing optimization, and sector-specific AI application providers may attract capital flows as adoption accelerates.

Several risk factors warrant attention when evaluating the AI adoption thesis. Capital Economics has articulated a bubble thesis predicting an AI-fueled stock market crash in 2026, citing higher interest rates and elevated inflation as headwinds for AI-dependent valuations [7]. This counterpoint represents a significant risk to the bullish thesis and merits serious consideration.

The sector concentration risk remains substantial, with AI-led performance concentrated in a narrow group of beneficiaries [4]. This concentration implies that broader market performance depends disproportionately on a limited number of mega-cap technology companies. Any disappointment in AI adoption trajectories or earnings from these concentration leaders could trigger broader market weakness.

Execution risk represents a significant variable in the AI adoption thesis. Realizing AI’s productivity potential requires successful enterprise integration, which involves substantial implementation challenges including data quality issues, integration complexity, change management requirements, and vendor selection considerations [4]. The 17.6% adoption rate may not linearly extrapolate to higher penetration levels if early majority adopters encounter significant implementation obstacles.

The analysis reveals elevated but manageable risk levels requiring attention rather than alarm. The Seeking Alpha thesis presents a constructive case supported by economic indicators (ISM expansion), adoption data (17.6% penetration), and market dynamics (margin expansion) [1]. However, the counterpoint thesis from Capital Economics and the concentration risk inherent in AI-led performance warrant monitoring [4][7]. Investors should maintain awareness of these risk factors while recognizing the substantive supporting evidence for the AI adoption thesis.

This analysis synthesizes the Seeking Alpha thesis that AI adoption will define the next leg of the bull market with supporting market data and external research. The S&P 500 trades near all-time highs alongside ISM New Orders at 57.1, indicating economic expansion [1]. AI adoption at 17.6% of companies suggests substantial runway for continued penetration [1]. The technology sector demonstrated relative strength (+1.13%) on February 3, 2026, with QQQ consolidating within a $621.85–$630.43 range [0].

The convergence of economic recovery indicators, technology sector strength, and the AI adoption thesis provides a foundation for continued market optimism, though execution risk, concentration risk, and counterpoint bubble theses represent significant variables requiring ongoing monitoring [4][7]. The key determinant for market direction will be whether AI adoption accelerates beyond current levels to deliver measurable productivity gains and margin expansion sufficient to sustain elevated valuations.

The information presented supports informed decision-making by contextualizing the AI adoption thesis within current market conditions, technical indicators, and external research perspectives. Investors should evaluate this information alongside their individual risk tolerance and investment objectives.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.