Kevin Gordon's "Tale of Two Markets": Mag 7 Weakness vs. S&P 493 Strength

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

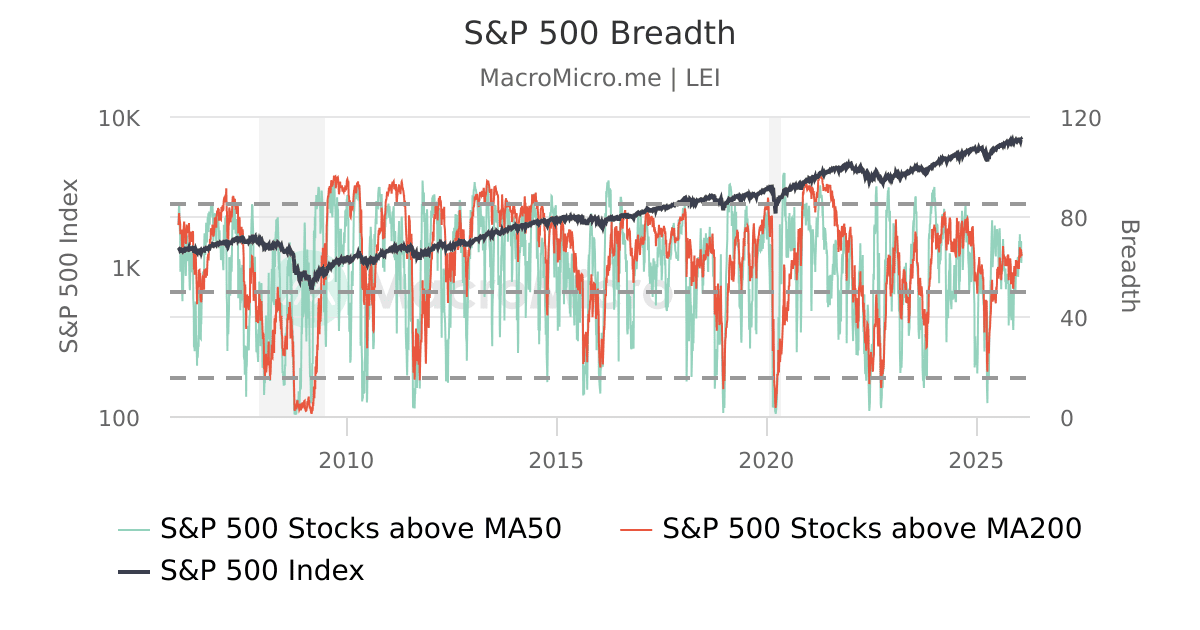

Kevin Gordon’s commentary on February 4, 2026, highlights a significant market phenomenon: the disconnect between headline index performance and underlying market breadth. While the NASDAQ Composite fell 1.45% and the S&P 500 declined 0.68% on that day, six of eleven S&P 500 sectors traded positive, with the Dow Jones Industrial Average rising 0.34% [0]. This divergence between indices and sector breadth is central to Gordon’s thesis that “red arrows in the indices” obscure underlying market strength.

The market data [0] reveals a clear rotation away from mega-cap technology toward other market segments. The Dow’s outperformance versus the NASDAQ (0.34% vs -1.45%) represents exactly the kind of breadth improvement Gordon describes—a shift from growth-heavy, technology-concentrated indexes toward value-oriented, diversified measures. This pattern suggests that non-Mag 7 segments of the market are capturing meaningful capital flows, even as the headline technology-weighted indices dominate market narrative.

Individual Mag 7 stock performance data substantiates Gordon’s observation that these mega-cap leaders are losing market influence [0][2]. NVIDIA Corporation (NVDA) fell 2.74% on February 4 alone, extending losses to approximately 15% from October 2025 highs around $212 to current levels near $175-180 [0][3]. Microsoft Corporation (MSFT) has shown multiple consecutive decline sessions, including -2.56% on February 3 and -2.02% on January 30, suggesting sustained selling pressure [0].

Historical data from Fortune’s January 2026 analysis [2] confirms this trend emerged earlier in the quarter, with Meta Platforms (META) down 4.39% and Apple Inc. (AAPL) down 3.98% during January. The Financial Content analysis [2] noted that “the S&P 493 Surges as the Magnificent Seven Grip Loosens,” with the earnings growth gap between Mag 7 and remaining S&P 500 companies narrowing to its tightest margin since the post-pandemic recovery began. This fundamental narrowing supports Gordon’s tactical observation about market breadth improvement.

Gordon’s characterization of the software sector as experiencing a “DeepSeek moment” refers to a repricing dynamic similar to what occurred when DeepSeek disrupted the AI cost narrative in early 2026 [1][2]. The DeepSeek-V4 model, released in January 2026, reportedly outperforms GPT-4.5 Turbo on coding and logic tasks at approximately 40% of the inference cost [2], forcing market participants to reassess software sector valuations and growth expectations.

The Technology sector was the worst performer on February 4, declining 1.97% [0]. Technical indicators confirm oversold conditions, with XLK (Technology Select Sector SPDR ETF) 14-day RSI readings ranging from 38.84 on Investing.com (indicating a sell signal) to 45.91 on GuruFocus [3]. These readings suggest the software sector has experienced capitulation or exhaustion among sellers, potentially setting up for technical rebounds consistent with Gordon’s characterization of “short-term pullback but longer-term upside” [1].

The February 4, 2026 sector performance data [0] provides strong confirmation of Gordon’s breadth improvement thesis:

| Sector | Performance | Breadth Implication |

|---|---|---|

| Basic Materials | +1.77% | Strongest sector; AI infrastructure beneficiary |

| Real Estate | +0.89% | Recovery underway; data center demand |

| Consumer Defensive | +0.71% | Defensive leadership stability |

| Financial Services | +0.55% | Regional bank resilience |

| Communication Services | -0.24% | Mixed; Meta/Google drag |

| Energy | -0.30% | Commodity strength support |

| Industrials | -0.65% | Infrastructure plays |

| Consumer Cyclical | -1.42% | Retail pressure |

| Technology | -1.97% | DeepSeek repricing |

| Utilities | -3.73% | Defensive overbought correction |

The leadership from Basic Materials (+1.77%) is particularly significant, as copper and industrial metals are increasingly characterized as “strategic tech metals” [2] essential for AI infrastructure buildout. This sector rotation suggests institutional capital reallocation away from mega-cap tech toward industrial and materials beneficiaries of AI deployment.

The convergence of Gordon’s commentary with independent market data reveals several structural market insights. First, the Mag 7 concentration risk that has dominated S&P 500 performance since 2023 appears to be easing, with market returns broadening across sectors. The European market strength (MSCI EAFE outperforming S&P 500 by approximately 4%) [2] indicates this rotation extends beyond domestic markets.

Second, the software sector’s “DeepSeek moment” represents a broader reassessment of AI-related valuations. The approximately $1 trillion market value wipeout attributed to DeepSeek disruption [2] reflects the market’s sensitivity to efficiency narratives in artificial intelligence. Gordon’s observation that software-focused ETFs hit near-record low RSI levels [1] suggests this repricing has created value opportunities for contrarian investors willing to accept near-term volatility.

Third, the technical pattern formation in key Mag 7 stocks warrants attention. NVIDIA’s potential head-and-shoulders pattern [3] and double-top formation around $193 [3] suggest some technical analysts perceive topping patterns in previously dominant semiconductor names. While technical analysis should be considered alongside fundamental factors, these patterns correlate with Gordon’s thesis about Mag 7 weakness.

The market dynamics Gordon describes have systemic implications for portfolio construction and risk management. If market breadth continues improving, strategies focused on equal-weighted S&P 500 exposure or sector diversification beyond technology may benefit relative to concentrated mega-cap positions. The narrowing earnings growth differential between Mag 7 and S&P 493 companies [2] suggests the growth premium on mega-cap stocks may compress further.

The basic materials sector strength (+1.77%) tied to AI infrastructure buildout represents a structural shift in how markets price commodity demand. Rather than viewing copper and industrial metals through a traditional industrial demand lens, investors increasingly price “strategic tech metal” premiums [2] that reflect AI data center and semiconductor manufacturing requirements.

This analysis integrates Kevin Gordon’s February 4, 2026 commentary [1] with market data [0] and supporting research [2][3] to evaluate market breadth dynamics and sector rotation patterns.

- Technology sector declined 1.97% on February 4, 2026 [0]

- Basic Materials (+1.77%) led sector performance [0]

- Dow Jones (+0.34%) outperformed NASDAQ (-1.45%) significantly [0]

- XLK 14-day RSI ranged from 38.84 to 45.91 across sources, indicating oversold conditions [3]

- NVIDIA fell approximately 15% from October 2025 highs [0][3]

- Fortune reported Mag 7 weakness dating to January 2026 [2]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.