Market Rotation Reality Check: Should Investors Stay Risk-On or Fold?

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Reddit post “Do not fold now” argues against capitulating during the recent risk-off selloff, claiming improving macro conditions support leaning risk-on, particularly in beaten mid-cap growth stocks. The post suggests that while AI, crypto, and high-growth names have been hit hard, underlying fundamentals remain solid with falling rates and easing US-China tensions.

Community discussion reveals significant divergence:

- Bullish case: Some users note the market is only 2.5% below all-time highs with 15% YTD gains, calling the VIX at 20 and recent panic “ridiculous” overreaction

- Bearish warnings: Others point to concerning signals including insider selling, prominent investors like Burry and Buffett moving to cash, and recommendations for 20% gold allocation

- Active positioning: Several investors report buying beaten-down names including NVTS, NBIS, CRWV, IREN, RDDT, and SOFI, while noting mid-cap ETFs trading 20-50% below highs on fundamentally sound companies

The macro environment shows mixed signals that partially support the Reddit thesis but with important caveats:

- Federal Reserve implemented two consecutive 0.25% rate cuts in October and November 2025, bringing rates to 3.75-4.0% range

- US-China trade relations improved significantly with preliminary agreement reached October 30, 2025, halting tariff escalations

- Fed announced conclusion of quantitative tightening in December 2025

- Market expectations for December rate cut plummeted to 47-49% probability from 95% a month ago

- Inflation remains sticky with core PCE at 2.7% and core CPI at 3.0%

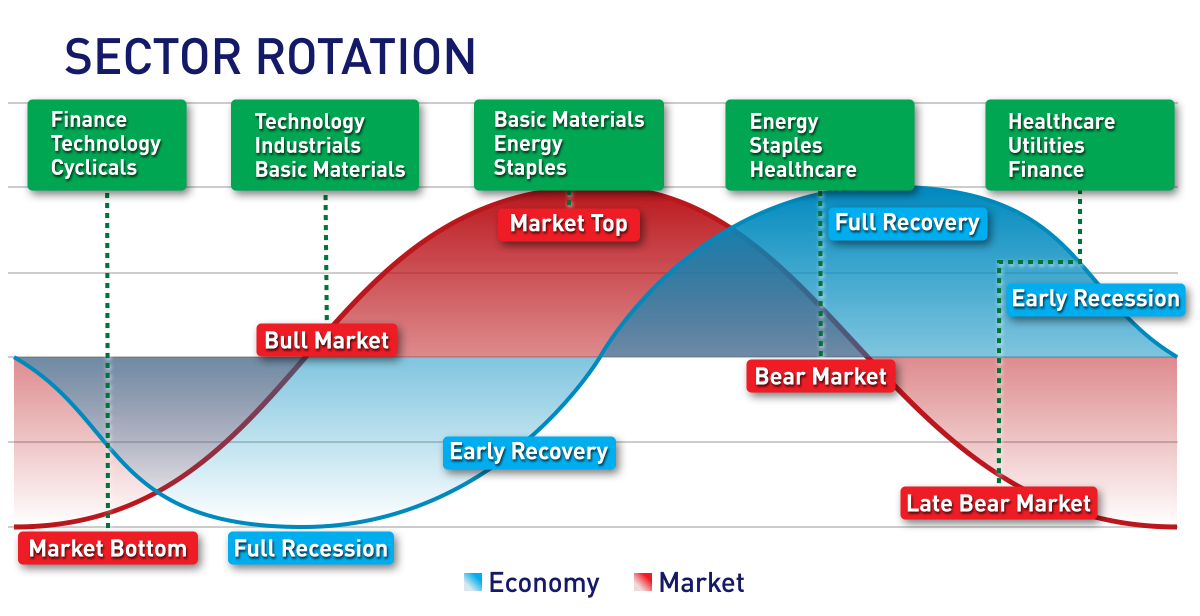

- Major sector rotation confirmed with AI stocks suffering severe declines (Nvidia down 16% in four days, losing ~$800B in market value)

- Cryptocurrency volatility intensified with Bitcoin falling 4% from recent highs and public companies reducing BTC purchases by 42%

- Value stocks significantly outperformed growth in Russell Midcap indices

The Reddit community’s optimism about staying risk-on faces substantial challenges from market realities. While the post correctly identifies some macro improvements (rate cuts, US-China progress), it underestimates the fundamental nature of the current sector rotation.

- The selloff appears fundamental rather than purely sentiment-driven, evidenced by sustained capital flows from growth to value

- Sticky inflation and uncertain Fed policy create headwinds that contradict the “clear skies” narrative

- The scale of AI sector declines suggests deeper valuation concerns beyond temporary panic

- Mid-cap growth opportunities may exist but require selective stock-picking rather than broad exposure

- The “hyperscalers holding up indices” observation has merit - quality large-cap tech may provide better risk-adjusted returns

- Dollar-cost averaging into beaten-down quality names could be prudent, but timing remains critical

- Further Fed policy tightening if inflation remains elevated

- Continued sector rotation away from high-growth names

- Geopolitical tensions despite recent US-China progress

- Valuation compression in AI/crypto sectors

- Select mid-cap growth stocks trading 20-50% below highs with solid fundamentals

- Quality large-cap technology companies with reasonable valuations

- Dollar-cost averaging strategies for long-term investors

- Value sectors benefiting from the rotation trend

The evidence suggests a more nuanced approach than the Reddit post’s binary “don’t fold” advice - selective opportunities exist within a broader risk-off environment.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.