AI Benefits Beyond Tech Giants: Market Concentration at Historic Peaks and Signs of Broadening

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Seeking Alpha article [1] published on February 4, 2026, poses a fundamental question about the future trajectory of artificial intelligence benefits distribution across the broader economy. The analysis highlights two critical market conditions: unprecedented market concentration with the S&P 500’s market capitalization approaching 200% of GDP—a historic peak—and the uncertain impact of Federal Reserve rate cuts on market support. GuruFocus data confirms the “Buffett Indicator” stands at approximately 219.1%, signaling significant overvaluation with projected average annual returns of -0.4% from these historical levels [4]. The Russell 1000 Growth Index shows even greater concentration, with its top 10 holdings representing over 60% of the index’s total weight [5].

The “Magnificent 7” (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla) have driven substantial S&P 500 gains in recent years, but Q4 2025 earnings reports reveal a notable shift: the Mag 7’s share of earnings growth decreased to 31% in Q3 2025, down from previous quarters [5]. Projections indicate Mag 7 profits will climb approximately 18% in 2026—the slowest pace since 2022—while other S&P 500 companies are expected to see 13% earnings growth [6]. This earnings convergence represents a potential inflection point in market structure.

Federal Reserve maintained its benchmark interest rate at 3.50%–3.75% following its January 2026 FOMC meeting [2], with expectations of limited additional cuts in 2026. J.P. Morgan research indicates the Fed is expected to remain on hold through 2026, with only one projected 0.25% cut [7][8]. The critical distinction for market trajectory lies in the motivation behind potential rate cuts: “cutting because they can” (inflation moderation and labor market stabilization without economic weakness) suggests positive market conditions, while “cutting because they should” (distressed labor markets) would likely produce poor equity performance [9].

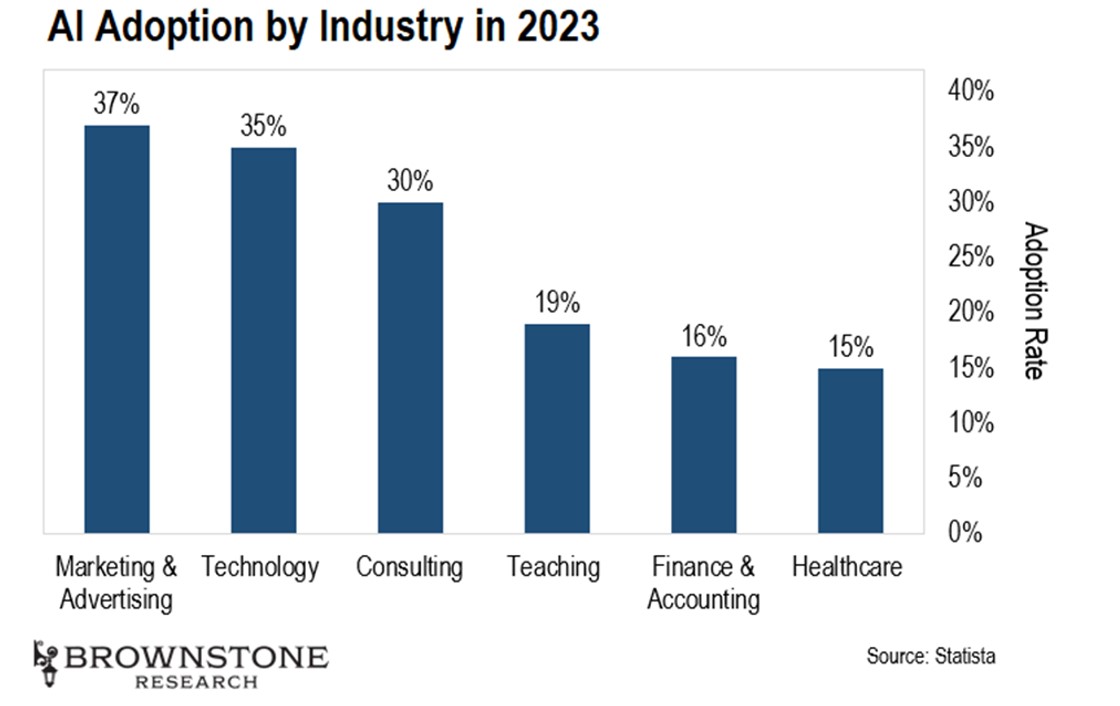

Evidence suggests AI benefits are beginning to penetrate non-technology sectors, though adoption remains uneven. Global investment in generative AI solutions more than tripled from 2024 to 2025, reaching approximately $37 billion in 2025 [10]. Industries including SaaS, financial services, healthcare, logistics, and manufacturing are actively implementing AI solutions [10]. However, deployment statistics reveal significant variation: only 8.6% of companies report having AI agents deployed in production, while 14% are developing agents in pilot form and 63.7% report no formalized AI initiative at all [10]. McKinsey data indicates 72% of organizations are using Gen AI in one or more business functions in 2024, compared to 56% in 2021 [11].

Several indicators suggest the market is diversifying beyond mega-cap tech leaders. On February 4, 2026, the S&P 500 equal-weighted index added 0.9% while the market-capitalization weighted index showed more modest gains [14], reinforcing the breadth improvement narrative. Small caps are leading large caps, and value sectors are outperforming growth, indicating risk appetite broadening [13]. The technology sector declined 2.00% on February 4, 2026—the worst performer among major sectors—while basic materials gained 1.35%, financial services rose 0.93%, and energy advanced 0.89% [15]. This rotation suggests investors are reallocating from high-valuation tech leaders to economically sensitive sectors.

A significant structural shift is occurring in AI investment patterns: capital is transitioning from software-as-a-service margins toward hardware and industrial infrastructure. U.S. AI data center power demand is projected to increase from 4 GW in 2024 to 123 GW by 2035—a 30-fold increase over 11 years [16]. This “Physical Upgrade” creates what analysts describe as a “massive arbitrage opportunity” as markets remain unprepared for the capital-intensive industrial re-platforming required [12]. Grid connection queues averaging five years and transformer supply constraints represent critical bottlenecks affecting deployment timelines [12].

Enterprise AI is evolving toward agentic AI systems capable of autonomous decision-making, with 33% of enterprise software applications projected to include agentic AI by 2028, up from less than 1% in 2024 [11]. Software development represents the biggest use case, with 75% of business leaders identifying this area for agentic AI deployment [11]. Organizations that successfully implemented AI have largely redesigned jobs around the technology, with 84% undertaking such restructuring [18], and 92.1% of businesses have seen measurable results from AI adoption [11].

The healthcare sector is experiencing an AI-driven transformation, with consumer health showing particular momentum. Growth has been driven by frustration with traditional healthcare complexity, increased interest in preventative health, and AI adoption in daily life [17]. Companies like Hims & Hers and Function Health demonstrate the potential for AI-enabled consumer health solutions, suggesting AI benefits can extend beyond traditional technology boundaries into direct consumer applications [17].

The elevated market concentration presents substantial risks to portfolio performance if AI benefits fail to broaden beyond current beneficiaries. The 219%+ market cap to GDP ratio historically correlates with negative forward returns [4]. Technology sector pressure—evidenced by the 2.00% decline on February 4, 2026 [15]—could accelerate if earnings growth deceleration continues. Infrastructure bottlenecks including permitting delays, grid connection queues, and transformer shortages may constrain AI deployment and associated capital investment [12]. Federal Reserve policy uncertainty adds another layer of complexity, with the distinction between “cutting because they can” versus “cutting because they should” carrying significantly different market implications [9].

The narrowing earnings growth gap between Mag 7 and other S&P 500 companies creates opportunity for diversification beyond mega-cap technology leaders. Improving market breadth—evidenced by equal-weight outperformance and small-cap leadership [13]—suggests broader participation in equity gains. The “Physical Upgrade” thesis identifies capital allocation opportunities in industrial and infrastructure sectors positioned to benefit from AI hardware deployment [12]. Healthcare AI adoption represents an emerging frontier with demonstrated consumer demand [17]. Goldman Sachs projects the S&P 500 to produce a 12% total return in 2026 [19], suggesting markets anticipate continued earnings growth beyond mega-cap leaders.

Near-term factors (3-6 months) including Q4 2025 earnings confirmation, Fed FOMC communications, and Mag 7 stock performance will significantly influence market trajectory. The medium-term trend (1-2 years) toward earnings convergence between technology leaders and the broader market suggests structural rather than temporary broadening. Long-term positioning should account for the transition from software-centric investment to industrial and infrastructure capital deployment, with the degree of AI integration across all sectors representing a key variable.

The February 4, 2026 Seeking Alpha analysis highlights a critical inflection point in the AI-driven market cycle. Three convergent trends shape the outlook: structural market concentration at unprecedented levels (S&P 500 market cap near 200% of GDP), early signs of market broadening (equal-weight outperformance, small-cap leadership, narrowing earnings growth between Mag 7 and other companies), and Fed policy uncertainty with rate cut impact dependent on economic context.

The AI benefit diffusion question—whether gains can spread from tech giants to the broader economy—remains unresolved but increasingly relevant. Enterprise AI adoption is accelerating beyond technology companies into healthcare, financial services, and industrial sectors, though implementation remains uneven with 63.7% of companies reporting no formalized AI initiative [10]. The transition toward “Physical World Upgrade” infrastructure requirements creates both capital deployment challenges and investment opportunities in industrial and energy sectors.

For industry participants, understanding AI’s transition from a technology-sector phenomenon to an economy-wide transformation will be essential for strategic positioning. Market structure evolution, AI integration depth across sectors, and capital reallocation patterns from software to industrial infrastructure represent key considerations for stakeholders navigating this transition period.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.