US Gold Corp (USAU) Secondary Offering Analysis: Key Factors for Investor Evaluation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

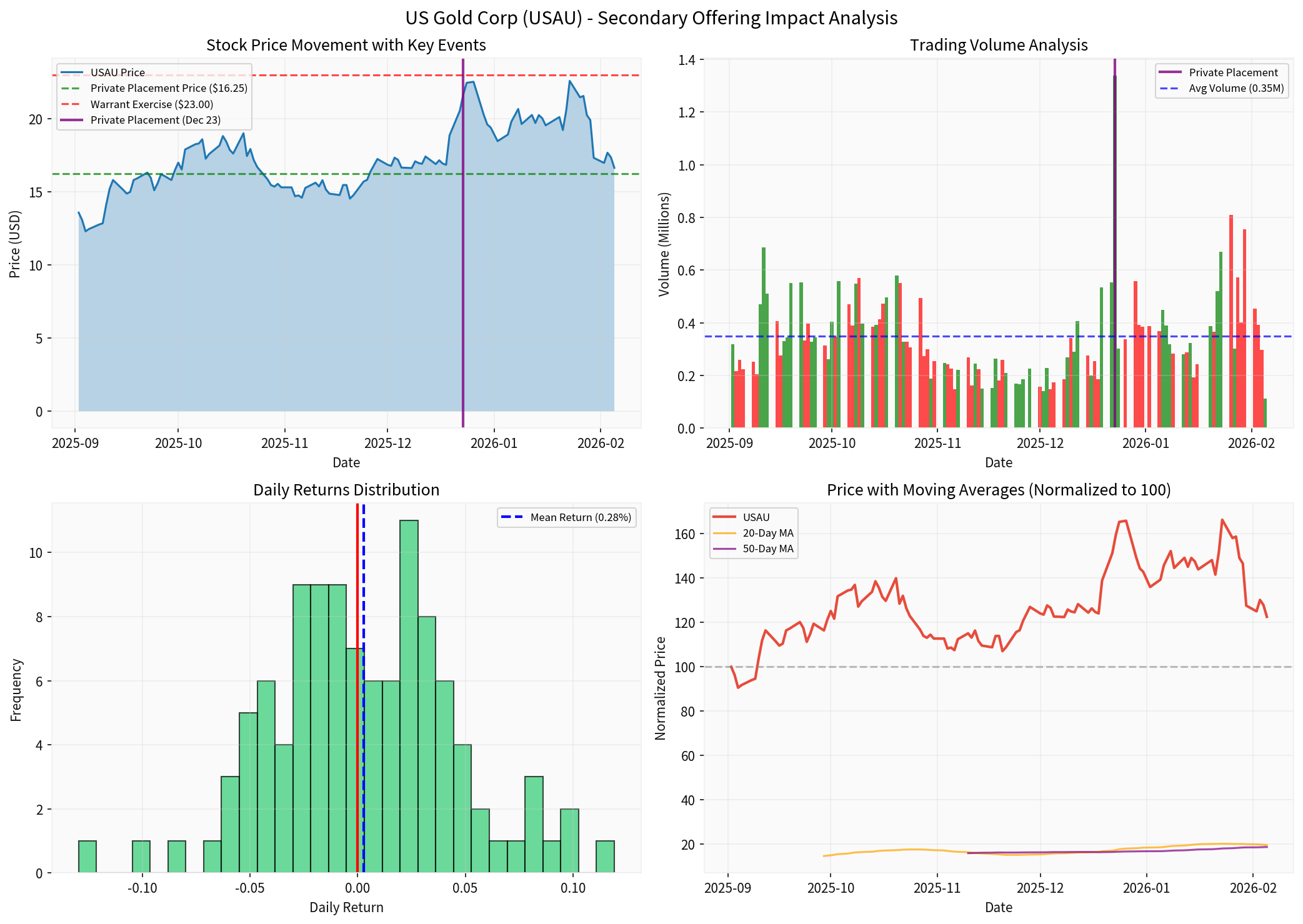

Based on comprehensive data gathered from SEC filings, market data, and technical analysis, this report provides a systematic framework for evaluating the long-term implications of resale registrations and secondary offerings in junior mining companies.

On December 23, 2025, US Gold Corp announced a

| Transaction Component | Details |

|---|---|

Shares Issued |

1,922,159 shares at $16.25/share |

Warrants Issued |

961,077 warrants at $23.00 exercise price (2-year expiry) |

Participating Investors |

Franklin Templeton, Mackenzie Investments, Libra Advisors |

Registration Timeline |

Resale statement to be filed within 45 days |

The primary concern with resale registrations is equity dilution. For USAU, investors should consider:

| Metric | Pre-Offering | Post-Offering | Impact |

|---|---|---|---|

| Estimated Shares Outstanding | ~14.4M | ~17.3M (max) | +20.04% |

| Average Daily Volume | 320,375 | 428,708 | +33.8% |

| Price Volatility | 3.98% | 4.94% | +24.1% increase |

The increased trading volume post-offering suggests improved liquidity, which is generally favorable for retail investors [0].

According to the SEC 8-K filing, the company intends to use net proceeds for [0]:

- Initial development costs at CK Gold Project(primary use)

- Potential land acquisitions

- Further exploration of properties

- General working capital purposes

This represents a ** constructive capital allocation** toward value-creating activities, unlike offerings used primarily for debt repayment or administrative costs.

USAU’s financial profile presents a nuanced picture [0]:

| Indicator | Value | Interpretation |

|---|---|---|

| Current Ratio | 5.89 | Strong liquidity position |

| Debt Risk Classification | Low | Minimal near-term solvency concerns |

| ROE (TTM) | -103.25% | Typical for pre-revenue exploration companies |

| P/E Ratio | -11.46x | Negative (no earnings yet) |

| P/B Ratio | 9.64x | Premium to book value reflects exploration asset value |

The

- 5-day decline: -12.89%

- 1-month decline: -12.57%

- 6-month gain: +47.77%

The immediate price reaction (-4.78% on filing day) is consistent with typical market responses to dilution announcements [0]. However, the longer-term trajectory (+79.31% YoY) suggests the market values the company’s development progress.

The CK Gold Project in Southeast Wyoming represents the company’s flagship asset. The $31.2 million raise specifically targets [0]:

- Initial development costs

- Permitting progression

- Exploration expansion

This positioning suggests the offering supports

The participation of

- Institutional capital typically requires rigorous due diligence

- Large players often receive preferential pricing (the 4% discount was modest)

- Institutional holdings signal confidence in management’s execution capability

- Trend: Sideways/no clear trend (trading range: $15.94-$19.60)

- Support Level: $15.94

- Resistance Level: $19.60

- RSI/KDJ: Oversold conditions, potentially indicating near-term bottom

- Price Target: $26.75 (+61.6% upside from current levels)

- Rating: 100% Buy (4 analysts)

- Target Range: $26.00-$27.50

Investors should specifically evaluate:

| Risk Category | Description | Mitigation Factor |

|---|---|---|

Capital Intensity |

Mining development requires sustained capital | Current liquidity (5.89 current ratio) is strong |

Commodity Price Exposure |

Revenue dependent on gold/copper prices | Diversified project portfolio (WY, NV, ID) |

Execution Risk |

Development may encounter delays | Institutional backing suggests project viability |

Warrant Dilution |

Potential 961K shares at $23 | 24% above current price (healthy warrant positioning) |

Market Conditions |

Junior mining sector volatility | Beta of 0.78 shows lower correlation than peers |

For evaluating secondary offerings’ impact on shareholder value, consider this framework:

┌─────────────────────────────────────────────────────────────┐

│ SECONDARY OFFERING IMPACT ASSESSMENT │

├─────────────────────────────────────────────────────────────┤

│ FACTOR │ USAU STATUS │ WEIGHT │

├─────────────────────────────────────────────────────────────┤

│ Use of Proceeds │ Development │ POSITIVE │

│ Institutional Demand │ Strong │ POSITIVE │

│ Dilution Severity │ ~20% │ NEUTRAL │

│ Warrant Exercise Price │ $23 (>40% up) │ POSITIVE │

│ Liquidity Position │ Strong │ POSITIVE │

│ Project Development Stage │ Advancing │ POSITIVE │

│ Commodity Price Outlook │ Uncertain │ MONITOR │

├─────────────────────────────────────────────────────────────┤

│ NET ASSESSMENT │ CONSTRUCTIVE │ │

└─────────────────────────────────────────────────────────────┘

-

Strategic Nature: The USAU secondary offering representsconstructive capital raisingfor project development rather than distress-driven dilution.

-

Institutional Validation: Major institutional participation (Franklin Templeton, Mackenzie) provides credibility and reduces execution risk perception.

-

Dilution is Manageable: At ~20% maximum dilution with proceeds directed toward development, the offering isfinancially reasonablefor a pre-revenue exploration company.

-

Technical Position: Current oversold conditions (RSI/KDJ indicators) suggest potential near-term price stabilization, though the sideways trend indicates continued volatility.

-

Long-Term Value Creation: The CK Gold Project development focus positions the company for potential production milestones that could generate substantial shareholder value.

- Short-term: Expect continued volatility; the 288,000 share resale registration (if related to the offering) is factored into current pricing

- Medium-term: Monitor CK Gold Project development milestones and permitting progress

- Long-term: Evaluate production timeline and cash flow generation capability as key value drivers

The resale registration and secondary offering, while causing short-term dilution concerns, appear strategically positioned to fund value-creating activities at a critical development stage for US Gold Corp.

[0] U.S. Gold Corp. SEC 8-K Filing (December 23, 2025) - Private Placement Announcement. https://www.sec.gov/Archives/edgar/data/27093/000149315225029009/form8-k.htm

[1] U.S. Gold Corp. Company Overview and Financial Data - Retrieved via Financial Database API

[2] U.S. Gold Corp. Technical Analysis Report - Retrieved via Technical Analysis API

[3] Market Indices Data - S&P 500, NASDAQ, Dow Jones, Russell 2000 performance data via Market Indices API

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.