AI Investment Risk Analysis: Depreciation Accounting vs. Growth Capex Returns

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on a Reddit discussion published on November 14, 2025, examining investment risks in AI infrastructure companies and challenging Michael Burry’s recent critique of depreciation practices [Event Content].

Michael Burry, renowned for predicting the 2008 housing crisis, has accused major tech hyperscalers (Meta, Oracle, Microsoft, Amazon, Alphabet) of artificially boosting earnings by extending AI hardware depreciation schedules from 2-3 years to 5-6 years [1][2]. Burry estimates this accounting maneuver could understate depreciation by $176 billion between 2026-2028, with Oracle potentially overstating earnings by 27% and Meta by 21% by 2028 [1][3].

The Reddit author counters that depreciation is merely an “accounting timing device, not a cash flow issue” [Event Content]. From a technical accounting perspective, this characterization has merit. Under US GAAP ASC 360-10-35-4, companies have discretion in estimating useful lives based on their experience and industry practice [5]. The extensions made by tech companies are technically permissible as changes in accounting estimates per ASC 250-10-45-17 [5].

However, the LinkedIn analysis by Michael M. Landman-Karny reveals a striking disconnect between accounting treatment and technological reality [5]. When companies depreciate AI-specific servers over six years while the underlying technology becomes competitively obsolete in two to three years, they’re effectively capitalizing losses that should flow through current period earnings [5].

The quantified impact is substantial: if AI-focused infrastructure actually depreciates over three years rather than stated assumptions, the pre-tax profit impact would be approximately $26 billion annually across the five companies—an 8% reduction from current levels [5]. Under more aggressive assumptions matching Nvidia’s annual release cycle, the impact could reach $130 billion annually [5].

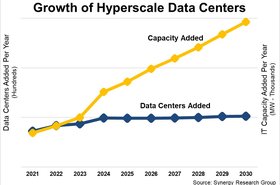

The Reddit author’s focus on return on growth capex addresses a more fundamental issue. The hyperscalers are collectively deploying over $1 trillion in capex between 2024-2026 [5]. The critical question becomes whether these investments will generate adequate returns.

Several factors complicate this analysis:

-

Technological Obsolescence Risk: Nvidia’s accelerated product cycle means today’s cutting-edge AI infrastructure may become competitively disadvantaged within 24 months [5]

-

Monetization Uncertainty: Unlike traditional infrastructure investments with predictable returns, AI monetization pathways remain evolving and uncertain

-

Component Analysis Complexity: Not all data center equipment faces identical obsolescence curves. While AI-specific GPUs may become quickly outdated, supporting infrastructure maintains longer useful lives [5]

-

Utilization Variability: AI workloads are still maturing, making it difficult to predict long-term utilization rates and ROI

The analysis reveals that both depreciation timing and growth capex return uncertainty are material to valuations, but they represent different types of risk:

- Depreciation timingrepresents an accounting transparency risk that can be quantified and potentially corrected through enhanced disclosure

- Growth capex returnsrepresent a fundamental business model risk that is harder to quantify and may not be fully appreciated by market participants

At current valuation multiples, the depreciation adjustments translate to market capitalization impacts ranging from $780 billion to $4 trillion [5]. This suggests that both issues are highly material to current valuations.

The Reddit author’s assertion that uncertainty is “already priced into lofty AI valuations” may be optimistic [Event Content]. Market participants may not fully appreciate the magnitude of either the accounting timing differences or the fundamental ROI challenges. The scale of investment—over $1 trillion by major hyperscalers through 2026—creates significant exposure if returns fall short of expectations [5].

Amazon’s decision to return to five-year depreciation, reducing 2025 operating profit by $700 million, demonstrates the material impact of these accounting choices and may signal regulatory pressure [5]. This controversy could drive broader reforms in how technology companies account for rapidly evolving assets.

-

Technological Obsolescence Risk: The accelerated product cycle in AI hardware means investments may become competitively obsolete faster than depreciation schedules assume [5]

-

Monetization Timeline Risk: AI investments may take longer than expected to generate positive cash flows, creating funding gaps

-

Accounting Scrutiny Risk: Burry’s accusations, regardless of merit, will likely trigger enhanced SEC scrutiny of tech companies’ depreciation assumptions [5]

-

Market Valuation Risk: At current multiples, accounting adjustments could impact market capitalizations by $780 billion to $4 trillion [5]

-

Return on Investment Risk: The fundamental question of whether massive AI capex will generate adequate returns remains unanswered

-

Enhanced Disclosure Requirements: Companies that provide transparent, component-level depreciation analysis may gain investor confidence

-

Sophisticated Analysis Tools: Development of better frameworks for evaluating AI infrastructure ROI could create competitive advantages for investors

-

Capital Allocation Discipline: Companies demonstrating clear ROI paths for AI investments may outperform peers

-

Regulatory Clarity: Potential FASB guidance could reduce accounting uncertainty and improve comparability

The analysis reveals that while Michael Burry’s depreciation critique highlights legitimate accounting concerns, the Reddit author’s focus on growth capex returns addresses a more fundamental investment risk. Both issues are material given the scale of investment—over $1 trillion by major hyperscalers through 2026 [5].

Key information points include:

- All major hyperscalers have extended depreciation schedules: Microsoft (4 to 6 years in 2022), Alphabet (3 to 6 years in 2023), Amazon and Oracle (to 6 years in 2024), Meta (to 5.5 years in January 2025) [5]

- Amazon subsequently reversed to 5-year depreciation, reducing 2025 operating profit by $700 million [5]

- The accounting treatment faces a fundamental challenge with Nvidia’s accelerated product cycle, with new AI chip generations launching annually rather than biennially [5]

- Current US GAAP provides substantial management discretion in estimating useful lives, requiring only that estimates be “reasonable” based on facts and circumstances [5]

The uncertainty surrounding AI infrastructure returns represents a significant investment consideration that may not be fully reflected in current market valuations, particularly given the rapid technological evolution in AI hardware and the evolving nature of AI monetization strategies.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.