Cuba's Fuel Allocation Strategy for Rice Production and Global Sugar Trade

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on my research, I can now provide a comprehensive analysis of Cuba’s fuel allocation strategy for rice production and its potential implications for global sugar trade dynamics.

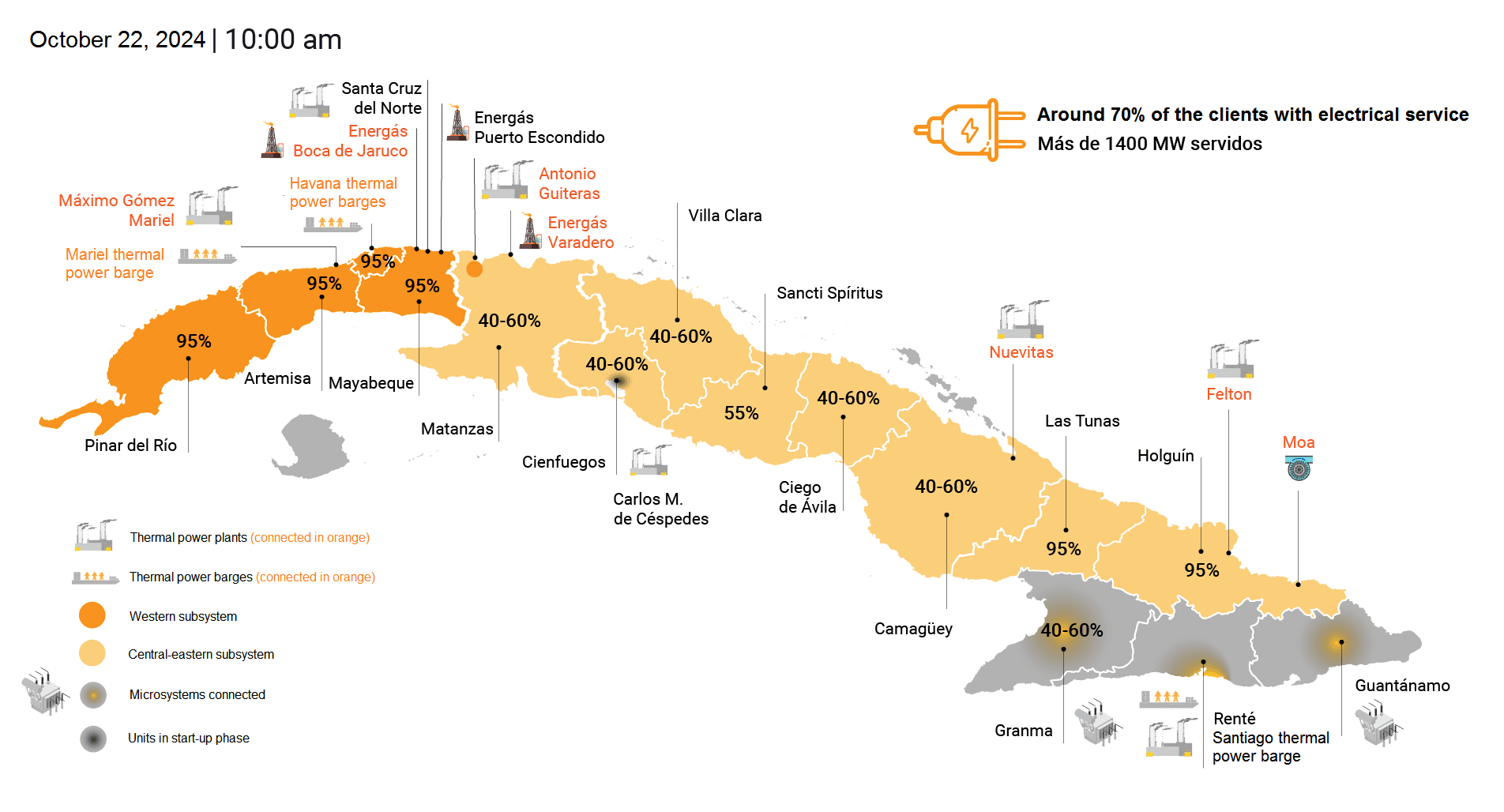

Cuba is facing an acute fuel shortage due to intensified U.S. blockade measures that threaten to cut off oil supplies from Venezuela, historically Cuba’s largest supplier [1]. President Miguel Díaz-Canel announced a multi-sector contingency plan to ration fuel across transportation, healthcare, education, tourism, and the broader economy [2]. Despite generating approximately 1,000 megawatts (38% of daytime capacity) from solar panels, Cuba must still import fuel to maintain essential services [1].

Cuba’s Ministry of Commerce has committed to ensuring fuel supplies to support a

- 200,000 hectaresof new rice cultivation across 14 provinces and 133 municipalities

- Targeting approximately 23,000 producers

- Goal of achieving food sovereignty and halting the decline in rice production, which reached only 30% of 2018 levels by 2024[3]

The plan requires significant fuel allocation for:

- Agricultural machinery (tractors, combines)

- Irrigation systems

- Harvesting equipment

- Transportation of rice to markets

Cuba’s sugar industry is in unprecedented decline:

| Year | Production (metric tons) |

|---|---|

| 2019 | 1.3 million |

| 2023 | 350,000 |

| 2025 | ~165,000 (actual vs. 265,000 target) |

2025 marks the first year since the 19th century that production will fall below

Cuba’s collapsing sugar production means the country will transition from a

- Domestic supply shortfall: Cuba may need to import sugar to meet even minimum domestic consumption needs

- Rum industry disruption: Major rum producers face authenticity concerns and production constraints due to alcohol shortages [4]

- Foreign exchange loss: Reduced export earnings compound Cuba’s economic crisis

The rice expansion program creates

| Resource | Rice Program Demands | Potential Impact on Sugar |

|---|---|---|

Arable land |

200,000 hectares | Land previously used for sugar cane may be converted to rice |

Water |

Intensive irrigation needed | Sugar cane fields may face water shortages |

Fuel |

Priority allocation | Sugar milling operations receive reduced fuel allocations |

Labor |

23,000 producers mobilized | Agricultural workforce diverted from sugar harvest |

Capital |

Machinery, seeds, inputs | Credit and subsidies shifted toward food crops |

Despite Cuba’s historical significance as a sugar exporter, its current production levels have

- Global sugar production (2025/26): 189.3 million metric tons [5]

- Cuba’s share: <0.1% of global production

- Major producers: Brazil (44.4 million tons), India (major rebound expected), China (11.5 million tons) [5]

The void left by Cuban sugar exports is insignificant compared to production increases from Brazil and India.

While global impact is minimal,

- Cuba’s sugar imports will increasingly come from friendly nations (Vietnam, China, Venezuela)

- Rum producers may seek alternative alcohol sources, potentially affecting regional rum trade

- Cuba’s focus on food security (rice) represents a strategic shift from its traditional export-oriented agricultural model

The rice program signals a fundamental

- From cash crop export model(sugar, nickel) tofood self-sufficiency priority

- From single-commodity dependenceto diversified production

- From fossil fuel intensiveagriculture to potentially more sustainable approaches

| Factor | Assessment |

|---|---|

Cuba’s sugar export role |

Effectively ended; production below 200,000 tons annually |

Global market impact |

Negligible; Cuba’s share <0.1% of 189 million ton market |

Rice vs. sugar trade-off |

Explicit resource reallocation toward food security |

Fuel allocation priority |

Rice production receives fuel priority over sugar milling |

Trade pattern shift |

Cuba becomes sugar importer; maintains focus on domestic consumption |

Cuba’s fuel allocation strategy for rice production represents a pragmatic response to the converging pressures of

The more significant story is Cuba’s

[1] Al Jazeera - “Cuba to introduce plan to address fuel shortage amid US blockade” (https://www.aljazeera.com/economy/2026/2/5/cuba-to-introduce-plan-to-address-fuel-shortage-amid-us-blockade)

[2] GV Wire - “Cuba to Roll out Rationing Plan as US Moves to Block Fuel Supply” (https://gvwire.com/2026/02/05/cuba-to-roll-out-rationing-plan-as-us-moves-to-block-fuel-supply/)

[3] Rice News Today - “Cuba Increases Rice Cultivation by 200,000 Hectares” (https://ricenewstoday.com/cuba-increases-rice-cultivation-by-200000-hectares/)

[4] Reuters - “Cuban sugar production falls further, rattling rum makers” (https://www.reuters.com/markets/commodities/cuban-sugar-production-falls-further-rattling-rum-makers-2025-05-14/)

[5] USDA Foreign Agricultural Service - “Sugar: World Markets and Trade December 2025” (https://apps.fsa.usda.gov/psdonline/circulars/sugar.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.