Napco Security Technologies (NSSC): Investment Implications of CEO Insider Sale

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now I have comprehensive data. Let me provide a thorough analysis of the investment implications.

On

| Parameter | Details |

|---|---|

Insider |

Richard Soloway (CEO, Chairman of the Board, Secretary) |

Transaction Date |

February 5, 2026 |

Shares Sold |

150,000 |

Average Price |

$42.74 per share |

Total Value |

$6,411,000 |

Filing Type |

Form 4 (SEC) |

Post-Sale Holdings |

1,256,010 shares retained |

This sale represents approximately

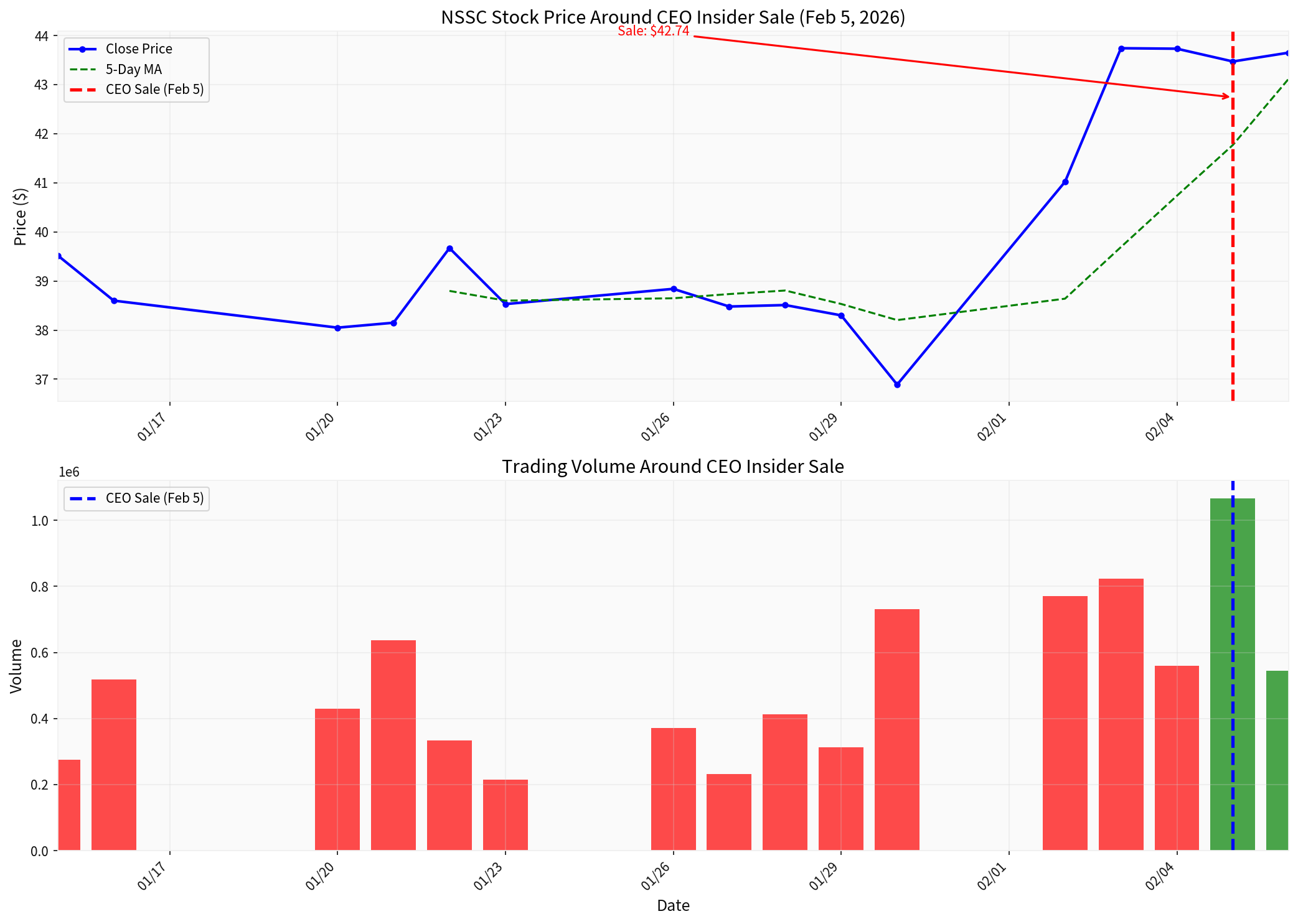

The trading data reveals an interesting price trajectory around the insider sale:

- Average Price: $39.43

- Price Range: $36.89 - $43.74

- The stock experienced significant volatility, including a sharp drop to $36.89 on January 30

- Average Price: $43.56

- Price Range: $43.47 - $43.65

- Notably stable trading range with volume of 1.067 million shares on sale day

The CEO sold at

| Metric | Value | Assessment |

|---|---|---|

Market Cap |

$1.56 billion | Mid-cap growth |

P/E Ratio |

32.83x | Above average for sector |

P/B Ratio |

8.42x | Premium valuation |

Net Profit Margin |

24.70% | Excellent profitability |

ROE |

27.45% | Superior returns |

Current Ratio |

7.99 | Exceptional liquidity |

Free Cash Flow Margin |

30.1% | Strong cash generation |

The company reported

| Metric | Q2 FY2026 | YoY Change |

|---|---|---|

Net Revenue |

$48.17 million | +12.2% |

Diluted EPS |

$0.38 | +35.7% |

Adjusted EBITDA |

$15.35 million | +26.0% |

Gross Margin |

58.6% | +160 bps |

Key highlights:

- Recurring Service Revenue (RSR): $23.85 million (+12.5% YoY) with 90.2% gross margin

- Annual RSR Run Rate: ~$99 million based on January 2026 data

- Dividend Increase: 7% quarterly dividend hike announced

Insider selling can stem from various motivations, and investors should consider the full context:

- Diversification: Executives often diversify personal portfolios, especially after significant stock appreciation

- Pre-Planned Sales (Rule 10b5-1): Many executives operate under pre-established trading plans

- Tax Planning: Sales may be timed for tax efficiency

- Personal Liquidity Needs: Unrelated to company outlook

- Selling at All-Time Highs: If selling at peak valuations

- No Purchases: Lack of corresponding insider buying

- Accelerated Selling: Increased frequency or volume of sales

- Selling Before Negative News: Timing concerns

| Factor | Observation | Implication |

|---|---|---|

Timing relative to earnings |

Sale 3 days AFTER strong Q2 results | Neutral to slightly positive |

Stock performance |

Up 69.65% over 1 year | Taking profits is rational |

Sale size |

10.7% of holdings | Significant but not dominant |

Retained ownership |

Still holds 1.26M shares | Maintains alignment |

Previous insider activity |

Mixed sell/buy history | No clear pattern |

| Rating | Count | Percentage |

|---|---|---|

Buy |

8 | 72.7% |

Hold |

3 | 27.3% |

Sell |

0 | 0% |

| Metric | Value |

|---|---|

Consensus Target |

$49.00 |

Current Price |

$43.65 |

Upside Potential |

+12.3% |

Target Range |

$40.00 - $50.00 |

Analysts have largely maintained

-

Fundamental Strength: The company’s 24.7% profit margins, 27.5% ROE, and record Q2 results demonstrate exceptional operational performance[2]

-

Growth Trajectory: 12.2% YoY revenue growth, 35.7% EPS growth, and expanding service revenue (50% of revenue) suggest sustained momentum

-

Insider Sale Context: The CEO’s sale appears opportunistic rather than predictive of trouble, occurring after strong earnings and near the upper end of the trading range

-

Valuation Considerations: At 32.8x P/E, the stock commands a premium reflecting growth expectations

- Execution Risk: Converting equipment customers to recurring service model

- Competition: Electronic security market has established players

- Economic Sensitivity: Commercial/industrial security spending can slow in downturns

- Valuation Risk: Premium multiples leave little room for disappointment

| Scenario | Insider Behavior | Investment Implication |

|---|---|---|

| Sale at low valuations | Negative | May signal lack of confidence |

| Sale after strong results | Neutral | Likely profit-taking |

| Sale before negative news | Very Negative | Potential information advantage |

| Sale with retained large stake | Neutral | Still aligned with shareholders |

| No corresponding purchases | Slightly Negative | Could indicate lack of conviction |

The CEO’s

- Record quarterly earningsreported just days earlier

- 69.65% stock appreciationover the past year

- Significant retained ownership(1.26 million shares)

- Strong analyst support(73% Buy ratings)

- Robust company fundamentals

While any insider sale deserves scrutiny, this transaction appears consistent with rational portfolio management by an executive who continues to hold substantial equity in the company. The sale timing—after strong earnings rather than before negative news—is more indicative of profit-taking than loss avoidance.

[0] Market data and company overview from financial API (2026-02-07)

[1] TradingView - “NAPCO Security Technologies CEO Sells 150,000 Shares” (https://www.tradingview.com/news/tradingview:ece68ef317bfb:0-napco-security-technologies-ceo-sells-150-000-shares/)

[2] SEC Form 8-K Filing - NAPCO Security Technologies Q2 FY2026 Results (https://www.sec.gov/Archives/edgar/data/69633/000110465926009129/nssc-20260129x8k.htm)

[3] Finviz - NSSC Stock Quote and Insider Trading Data (https://finviz.com/quote.ashx?t=NSSC)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.