Ukraine Energy Facility Attacks Impact on Global Commodity Markets

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on my comprehensive analysis of current news, market data, and geopolitical developments, here is a systematic assessment of how prolonged attacks on Ukraine’s energy facilities could disrupt global commodity markets:

Recent large-scale Russian attacks on Ukraine’s energy infrastructure represent a significant escalation with far-reaching implications for global commodity markets. As of February 2026, Ukraine has lost approximately

The energy attacks have fundamentally altered Europe’s gas supply architecture. Key developments include:

- Complete cessation of gas transit via Ukrainesince early 2025, leaving TurkStream as the sole remaining pipeline transporting Russian gas to the European Union [3]

- EU Russian gas ban finalized: European Union member states approved a phase-out plan to eliminate all imports of Russian pipeline gas and LNG by 2027, with pipeline gas sanctions commencing September 2026 [4]

- Continued EU exposure: Despite reduction efforts, the EU still imported13% of its gas from Russia in 2025, leaving significant vulnerability to supply disruptions [4]

Natural gas markets reflect heightened uncertainty. The United States Natural Gas Fund (UNG) ETF has exhibited significant volatility:

| Metric | Value |

|---|---|

| Current Price | $13.27 |

| 52-Week Range | $9.95 - $24.33 |

| 50-Day Moving Average | $13.16 |

| 200-Day Moving Average | $14.14 |

| Daily Volatility | 4.18% |

The natural gas ETF has declined

The attacks on Ukrainian infrastructure have accelerated Europe’s transition away from Russian energy:

- Domestic production halt: Ukraine’s natural gas production capacity has been decimated, eliminating a regional supply source

- Import surge: Ukraine’s natural gas imports reached6.47 billion cubic meters in 2025, nine times more than 2024’s 724 million cubic meters [5]

- Strategic repositioning: Ukraine has repurposed portions of Russian pipeline infrastructure for reverse flows to Europe

Ukraine remains a

- Egypt (largest buyer)

- Indonesia

- Turkey

- Pakistan

- Bangladesh

- North Africa and Middle East (86% of exports as of December 2025) [7]

The attacks on energy facilities create compounding risks for wheat exports:

-

Processing disruption: Power outages are disproportionately affecting smaller processing plants, constraining Ukraine’s agricultural processing capacity [8]

-

Port logistics: With over90% of Ukraine’s agricultural exports traditionally transported by sea, any disruption to port operations or energy-dependent logistics systems directly impairs export capabilities [9]

-

Production inputs: Fertilizer production and distribution—energy-intensive processes—face operational constraints

-

Storage infrastructure: Grain elevators and cold storage facilities require reliable electricity, which emergency power cuts cannot adequately sustain

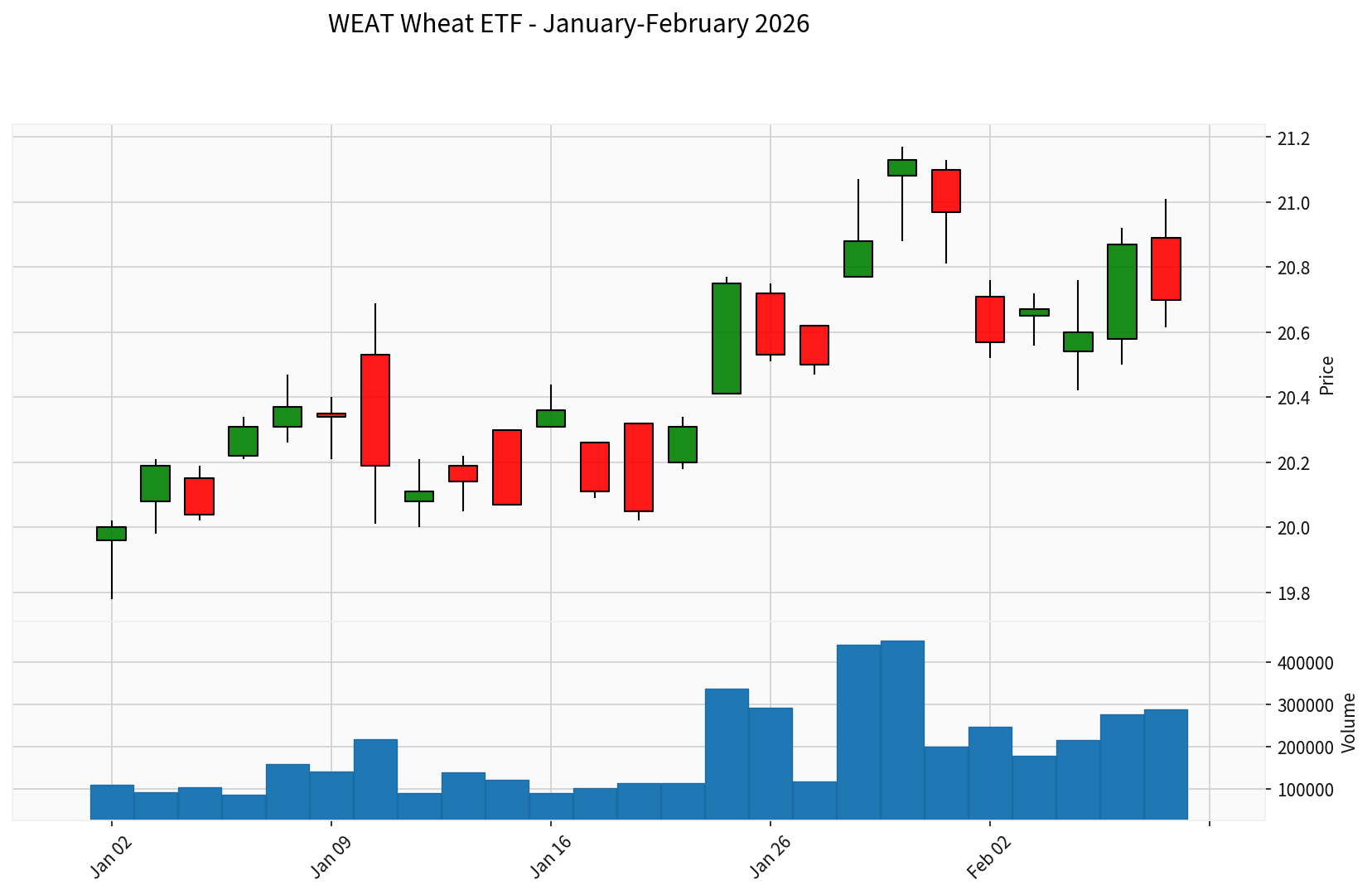

The Teucrium Wheat Fund (WEAT) reflects challenging market fundamentals:

| Metric | Value |

|---|---|

| Current Price | $20.70 |

| 52-Week Range | $19.78 - $27.60 |

| 20-Day Moving Average | $20.49 |

| 50-Day Moving Average | $20.44 |

| 200-Day Moving Average | $21.44 |

The wheat ETF has declined

- Strong global production from competing exporters (particularly Russia, projected to be the top exporter in 2025/2026) [10]

- High delivered costs due to freight and insurance premiums

- Bearish market sentiment despite supply risks

| Channel | Energy → Natural Gas | Energy → Wheat |

|---|---|---|

Production |

Destroyed extraction infrastructure | Disrupted planting/harvesting (fuel shortages) |

Processing |

Gas processing plant destruction | Milling capacity reduced (electricity dependency) |

Storage |

Underground storage vulnerability | Grain elevator operations impaired |

Transportation |

Pipeline damage | Rail/truck fuel constraints, port equipment failures |

Export |

Transit route elimination | Black Sea corridor security concerns |

-

Fertilizer markets: Natural gas is the primary feedstock for nitrogen fertilizer. Ukrainian production cuts contribute to global fertilizer price volatility, indirectly affecting wheat production costs worldwide

-

Insurance premiums: Increased geopolitical risk elevates freight and trade insurance costs, raising the “delivered cost” of grain to importing nations despite stable commodity prices

-

Currency correlations: The Ukrainian hryvnia’s depreciation affects export pricing competitiveness, creating market distortions

-

Alternative supply routing: Increased reliance on longer shipping routes (via Danube ports or overland through EU) raises costs and introduces additional friction points

- Countries including Egypt, Algeria, Morocco, and Saudi Arabia rely heavily on Ukrainian wheat

- Food price inflation in these regions has historically triggered social instability

- Limited domestic agricultural capacity creates substitution challenges

- Despite reduced direct Ukrainian energy dependence, EU remains linked through:

- Processing re-exports of Ukrainian grain

- Supporting Ukrainian transit infrastructure

- Managing refugee-related demand increases

- Bangladesh, Indonesia, and Pakistan face import cost increases

- Foreign exchange reserves strains in vulnerable economies

- Probability: High for continued infrastructure attacks

- Market effect: Moderate price volatility (10-20% swings)

- Primary channels: Supply chain friction, insurance cost increases

- Probability: High for sustained disruption

- Market effect: Structural market repositioning

- Primary channels: Permanent route diversification, storage capacity constraints

- Probability: Medium for fundamental market restructuring

- Market effect: Potential secular shift in trade flows

- Primary channels: New production capacity in alternative regions, permanent Black Sea corridor reconfiguration

-

Natural Gas: Consider hedged positions in US LNG exporters (Cheniere Energy) as European demand shifts toward American supplies

-

Wheat: Supportive of prices long-term due to structural supply risks, though current oversupply from Russia tempers appreciation

-

Fertilizers: Nutrien and other fertilizer producers may benefit from production constraints and demand recalibration

Markets have historically underpriced Black Sea region risks. Current conditions suggest:

- Permanent risk premium in freight markets

- Insurance cost structural increase

- Just-in-time supply chain models under review

Prolonged attacks on Ukraine’s energy infrastructure represent a

While current market prices (Chicago wheat futures at approximately $5.22/bu) [11] have not fully incorporated these risks due to competing supplies from Russia, the

The fundamental shift in European energy sourcing, combined with the erosion of Ukraine’s role as a breadbasket, suggests

[1] Russia-Ukraine War Report Card, Feb. 4, 2026 - Russia Matters, Harvard (https://www.russiamatters.org/news/russia-ukraine-war-report-card/russia-ukraine-war-report-card-feb-4-2026)

[2] Euromaidan Press - Russia destroyed 60% of Ukraine’s gas production (https://www.facebook.com/euromaidanpress.en/posts/russia-destroyed-60-of-ukraines-gas-production-with-24-strikes-on-naftogaz-facil/1366178942191459/)

[3] Energy and Clean Air - December 2025 Monthly Analysis (https://energyandcleanair.org/december-2025-monthly-analysis-of-russian-fossil-fuel-exports-and-sanctions/)

[4] The Moscow Times - EU Gives Final Approval to Russian Gas Ban (https://www.themoscowtimes.com/2026/01/26/eu-gives-final-approval-to-russian-gas-ban-a91781)

[5] Ukraine Future - Developments in Ukraine’s Energy Sector (https://uifuture.org/en/digests/developments-in-ukraines-energy-sector-3/)

[6] Euromaidan Press - Ukraine exported $22.6 billion in agricultural products (https://www.facebook.com/euromaidanpress.en/posts/ukraine-exported-226-billion-in-agricultural-products-in-2025-nearly-half107-bil/1367204948755525/)

[7] Gwangju News GIC - The Price of Bread: Attack on Ukraine’s Fields (https://gwangjunewsgic.com/features/global-focus/the-price-of-bread-attack-on-ukraines-fields-impact-the-world/)

[8] Mundus Agri - Market News on Oilseeds (https://www.mundus-agri.eu/latest/oilseeds1/oilseeds/)

[9] Daily Mare - Ukraine maintains a safe maritime corridor (https://dailymare.com/news/ukraine-maintains-a-safe-maritime-corridor-amid-ongoing-war,2210)

[10] LinkedIn/Prospex Agro - Ukraine Grain Exports Reach 16.38M Tons in 2025/26 (https://www.linkedin-com/posts/prospex-agro_ukraine-grainexports-wheat-activity-7416501776494886912-VRIw)

[11] Business Times Online - Fragile Stability: Navigating the 2026 Black Sea Grain Outlook (http://business.times-online.com/times-online/article/marketminute-2026-1-28-fragile-stability-navigating-the-2026-black-sea-grain-outlook-amidst-shifting-geopolitics)

[12] Ukrinform - Ukrenergo implements emergency power cuts (https://www.ukrinform.net/rubric-economy/4088684-ukrenergo-implements-emergency-power-cuts-in-most-regions-due-to-massive-enemy-attack.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.