Infrastructure-Targeted Warfare in Russia-Ukraine Conflict: Global Commodity Supply Chain Risk Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Now I have gathered comprehensive data. Let me compile a detailed analysis of how infrastructure-targeted warfare between Russia and Ukraine could disrupt global commodity supply chains.

The intensification of infrastructure-targeted warfare between Russia and Ukraine represents a significant escalation that poses material risks to global commodity supply chains, particularly in energy and metals markets. Recent developments indicate that both sides are increasingly focusing on critical infrastructure—energy facilities, refineries, pipelines, and transportation networks—as strategic targets, creating cascading effects on global markets [1][2][3].

Russia has intensified its campaign against Ukrainian energy infrastructure with devastating effect. According to the New York Times, recent strikes have utilized hundreds of drones and dozens of missiles targeting high-voltage transmission lines, power plants, and substations [1]. Ukrainian Energy Minister Denys Shmyhal reported that these attacks have crippled the country’s electricity grid, forcing emergency electricity imports to meet at least 50% of consumption needs during the 2025-26 heating season [2].

Key statistics reveal the scale of destruction:

- Approximately 48% (27 gigawatts)of Ukraine’s pre-war installed capacity of 56.1 GW has been lost through occupation, destruction, or damage [4]

- Over 2,000 strike drones, 1,200 guided aerial bombs, and 116 missiles were launched at Ukrainian cities and villages in a single week [3]

- Residents face extended power outages with temperatures dropping to -20°C

Ukraine has launched increasingly sophisticated attacks on Russian energy infrastructure, including:

- Refinery attacks: Ukrainian drones struck three Russian refineries in January 2026, down from 11 in December 2025, but affecting facilities accounting for less than 7% of Russia’s typical output [5]

- Caspian Pipeline Consortium (CPC) attacks: Ukrainian drone attacks on CPC infrastructure in November 2025 and January 2026 caused Kazakhstan to redirect 300,000 tonnes of oil away from the pipeline, representing approximately 80% of Kazakhstan’s oil exports [6][7]

- Oil tankers: Four oil tankers were attacked near the CPC loading terminal in January 2026 [7]

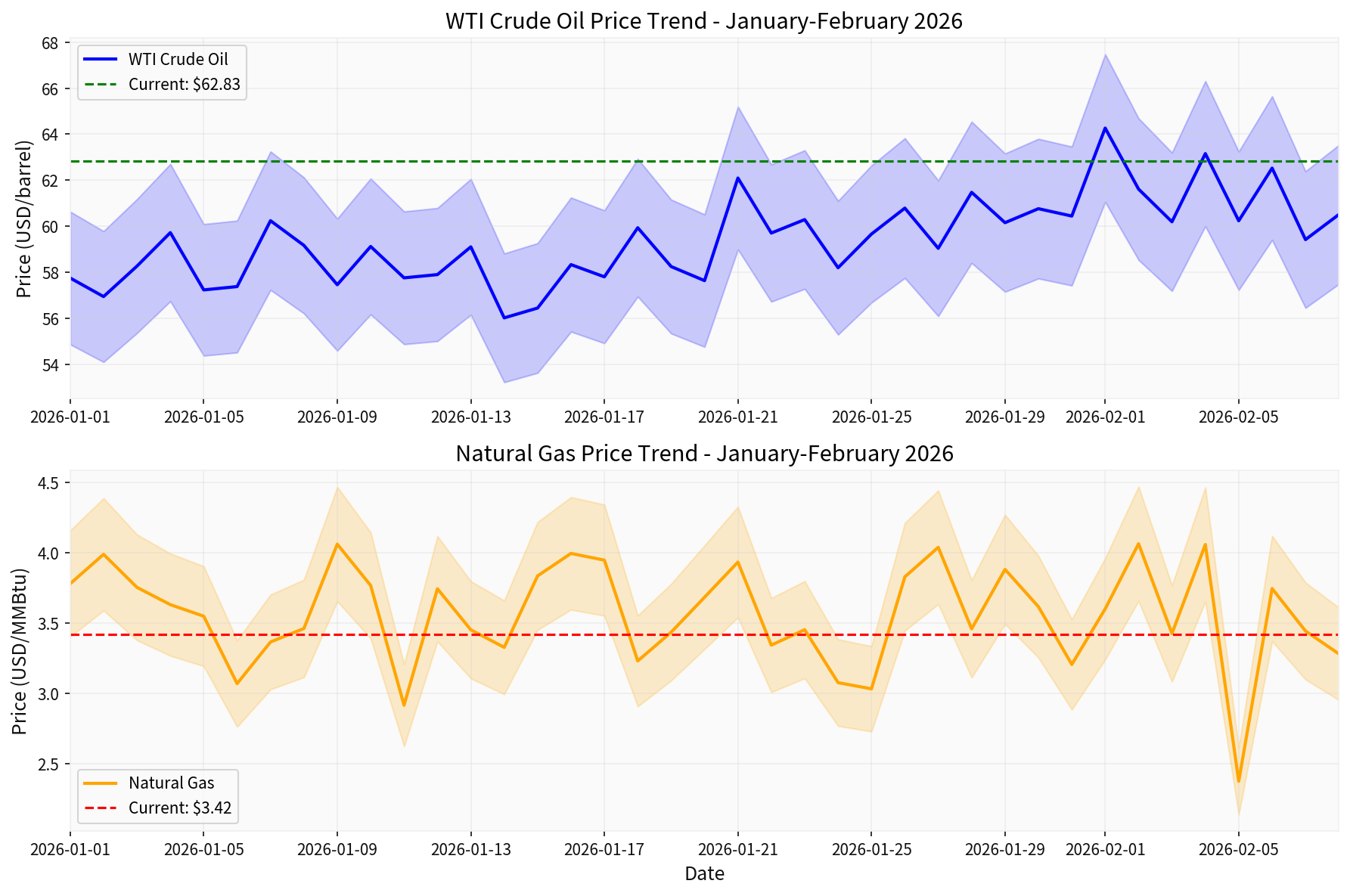

The energy sector is experiencing measurable disruption from the conflict escalation. Current market data indicates:

| Indicator | Value | Change |

|---|---|---|

| WTI Crude Oil | $62.83/barrel | +9.44% year-to-date |

| Brent Crude | ~$66/barrel | +8-10% range |

| 20-Day Moving Average | $62.01 | Above trend |

The oil market faces two countervailing forces:

- Upside risks: Potential disruptions to Russian exports, Middle East tensions (Iran), and CPC pipeline vulnerabilities

- Downside pressures: Structural oversupply from non-OPEC producers, potential Russia-India deal reducing Russian oil purchases [8]

European natural gas futures have shown significant volatility:

- Current price: €36/MWh(rebounding from three-week low of €32.86)

- Volatility: 12.83% annualized

- Storage levels: Germany 73.12 TWh, France 35.83 TWh [9]

The IEA projects a

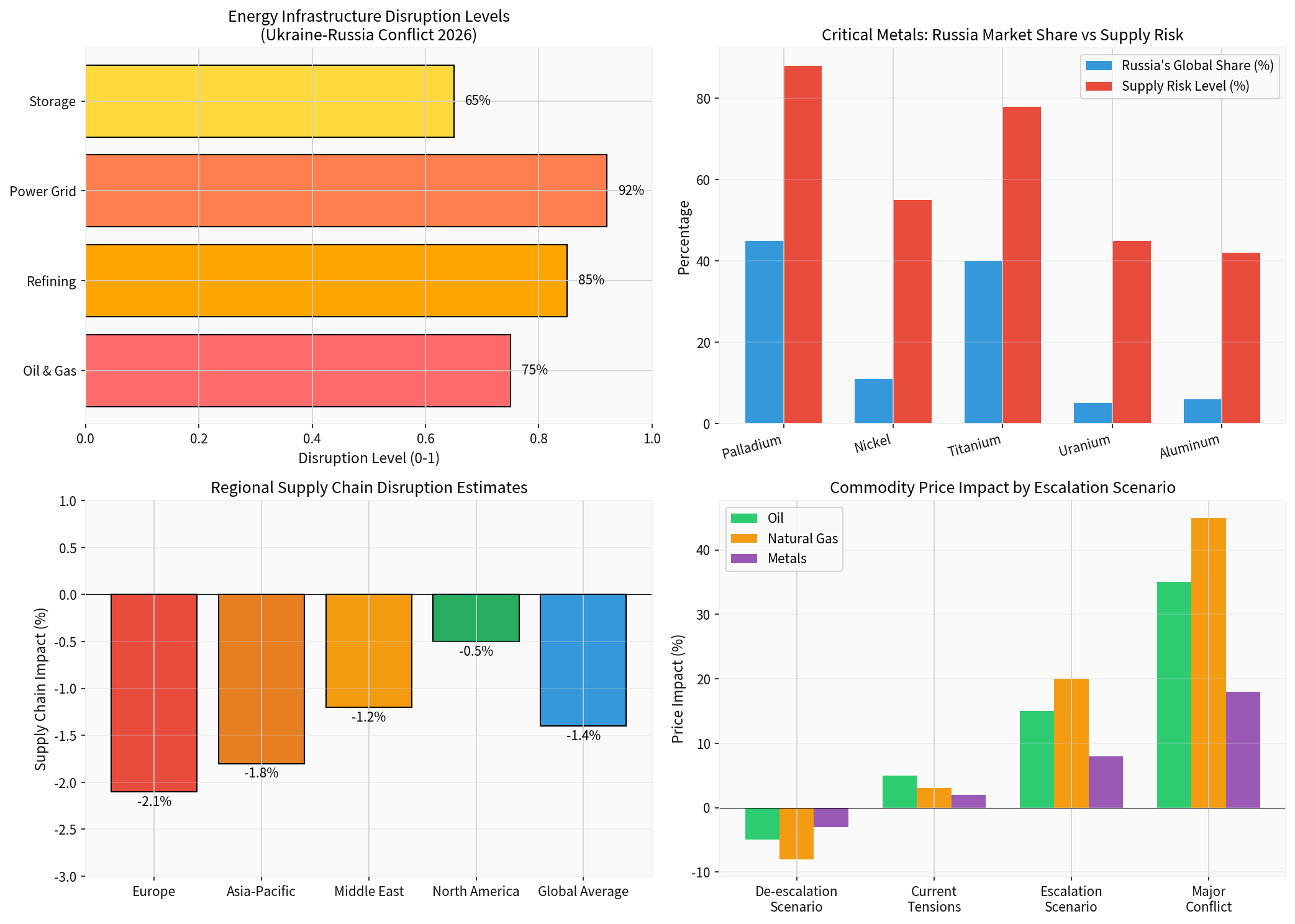

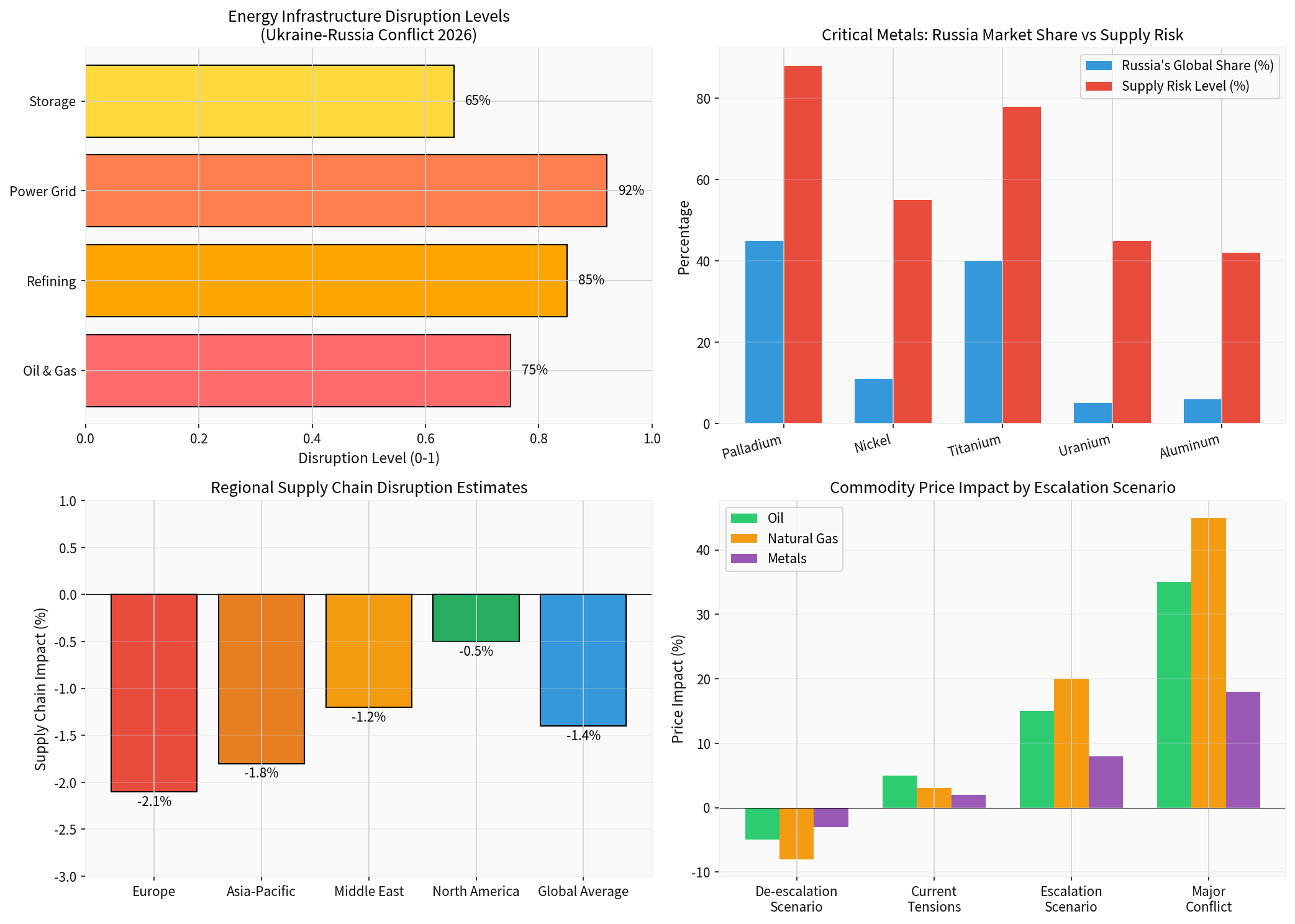

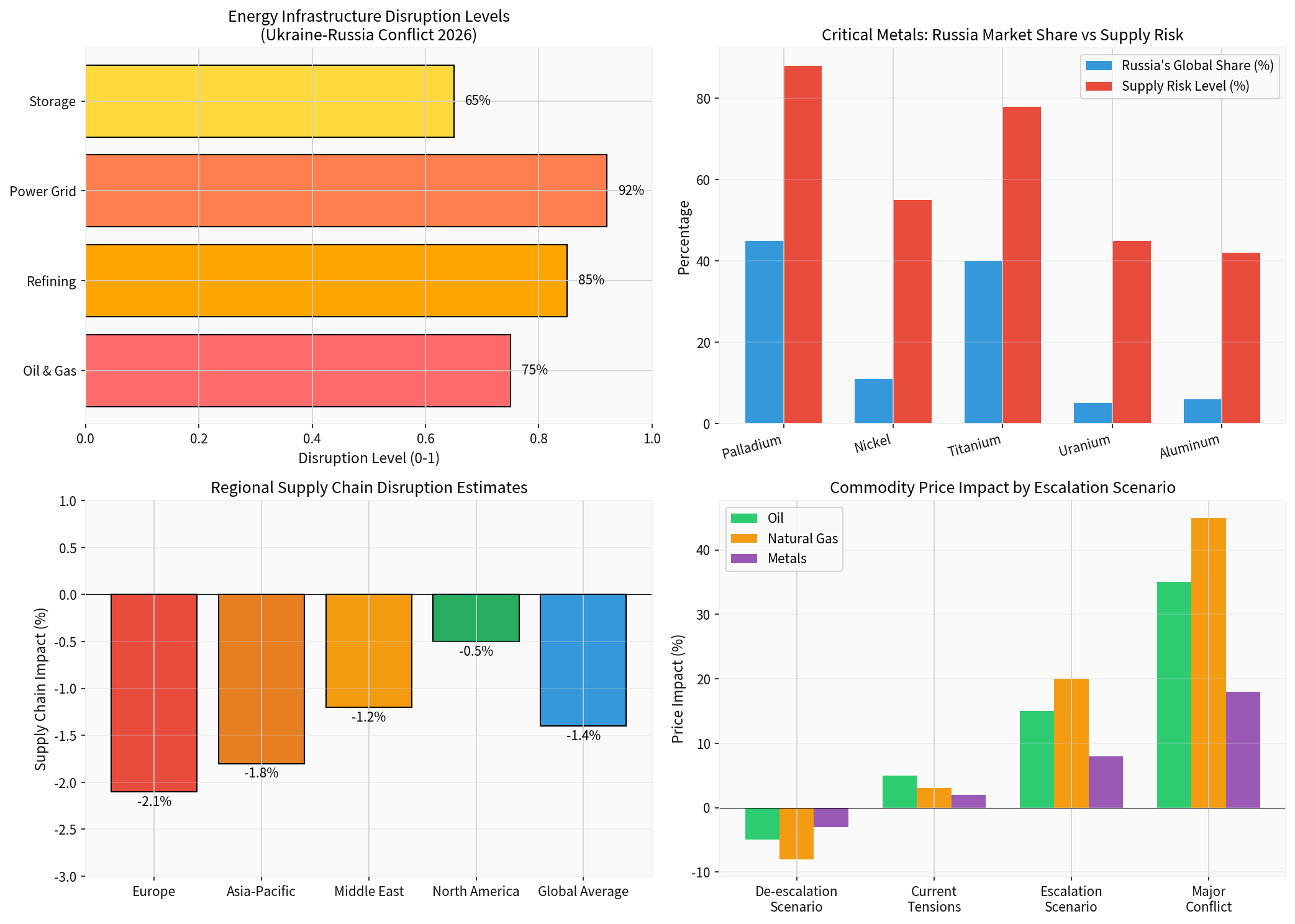

| Infrastructure | Risk Level | Impact |

|---|---|---|

| Russian Refineries | 85% | Reduced processing capacity, potential gasoline exports impact |

| Ukrainian Power Grid | 92% | 48% of generation capacity destroyed |

| CPC Pipeline | 78% | Kazakhstan exports disrupted |

| European Gas Storage | 65% | Adequate but vulnerable to supply shocks |

Russia’s dominance in several critical metals creates significant supply chain vulnerabilities for global industries:

| Metal | Russia’s Global Share | Supply Risk Level | Key Industries Affected |

|---|---|---|---|

Palladium |

~45% | 88% | Automotive (catalytic converters), electronics |

Titanium |

~40% | 78% | Aerospace, defense, medical implants |

Nickel |

~11% | 55% | Stainless steel, batteries, electronics |

Uranium |

~5% | 45% | Nuclear power, defense |

Aluminum |

~6% | 42% | Construction, transportation, packaging |

The U.S. aircraft industry and nuclear power sector are particularly vulnerable to potential Russian export restrictions on titanium, palladium, uranium, and nickel [11][12]. The FORGE Initiative and U.S.-led critical mineral counter-offensive are actively addressing these vulnerabilities [11].

Kremlin directives are reportedly considering restrictions on:

- Uranium exports

- Titanium shipments

- Nickel exports [11]

These potential restrictions could seriously disrupt U.S. aerospace and nuclear power supply chains, prompting urgent diversification efforts.

- Historical dependence on Russian energy imports

- Geographic proximity to conflict zone

- 80% of Kazakhstan’s oil exports routed through CPC pipeline [6]

- Estimated -2.1% supply chain disruptionimpact

Significant exposure through:

- India’s Russian oil imports (though declining to lowest level in two years as of December 2025) [8]

- China’s energy diversification needs

- Estimated -1.8% supply chain disruptionimpact

Lower direct exposure but vulnerable to:

- Critical metal supply constraints

- Inflationary pressures from energy price increases

- Estimated -0.5% supply chain disruptionimpact

The Black Sea grain situation presents ongoing risks:

- Ukrainian Maritime Corridor: Ukraine maintains its own corridor enabling civilian vessel access to Greater Odesa ports

- Russian strikes degraded approximately 10% of Ukraine’s port infrastructurein a 40-day window leading to mid-January 2026 [13]

- Early forecasts suggest a 6-7% decline in Russian wheat productionto roughly 84 MMT due to winter kill events [13]

- Alternative shipping routes via Bulgaria and Romania have emerged

- Grain prices remain sensitive to corridor disruptions

- Food security concerns for importing nations in Africa and Asia

| Scenario | Oil Impact | Natural Gas Impact | Metals Impact |

|---|---|---|---|

| De-escalation | -5% | -8% | -3% |

| Current Tensions | +5% | +3% | +2% |

| Escalation | +15% | +20% | +8% |

| Major Conflict | +35% | +45% | +18% |

The current market environment reflects “Current Tensions” pricing, with geopolitical premium embedded in oil prices. A major escalation could trigger significant commodity price spikes.

Recent market data shows commodity-sensitive sectors responding to the conflict:

| Sector | Daily Change | Status |

|---|---|---|

| Basic Materials | -1.13% | Underperforming |

| Energy | -0.26% | Slightly declining |

| Utilities | +1.83% | Seeking safe-haven flows |

| Real Estate | +3.07% | Attracting defensive positioning |

This pattern suggests investors are positioning defensively while commodities face near-term pressure from demand concerns.

- Maintain strategic hedgesagainst supply disruptions in crude and refined products

- Monitor CPC pipeline statusclosely as a key vulnerability point

- Watch for seasonal patterns—winter creates additional demand pressure on European gas

- Accelerate supplier diversificationaway from Russian sources

- Build palladium and titanium inventoriesgiven concentrated supply risks

- Monitor U.S. FORGE Initiativedevelopments for alternative supply opportunities

- Track Ukrainian port infrastructuredamage assessments

- Monitor Black Sea shipping insurance ratesas a leading indicator

- Diversify grain sourcingto reduce single-corridor dependency

- Consider defensive positioningin utilities and consumer staples

- Maintain selective exposureto energy as a hedge against inflation

- Monitor volatility indicesfor commodity-specific risks

- Winter severity in Europe: Colder temperatures would increase gas demand and price sensitivity

- Iran tensions: U.S.-Iran negotiations could add additional geopolitical risk premium

- India-Russia oil trade: The potential deal reducing Indian purchases could reshape oil flows

- CPC pipeline security: Further attacks could trigger significant Kazakhstan production cuts

- Russian counter-escalation: Potential restrictions on critical mineral exports

The infrastructure-targeted warfare between Russia and Ukraine has entered a new, more consequential phase that poses material risks to global commodity supply chains. While current market conditions reflect a “contained escalation” scenario, the underlying vulnerabilities remain significant:

- Energy marketsface continued pressure from infrastructure attacks, with oil up 9.4% and gas volatility at elevated levels

- Critical metals(particularly palladium and titanium) present concentrated supply risks

- Regional impactsare uneven, with Europe most vulnerable

- Agricultural supply chainsremain exposed despite alternative corridors

Market participants should maintain heightened vigilance and consider defensive positioning while monitoring escalation indicators. The current environment rewards diversification, hedging, and scenario-based planning.

[1] New York Times - “Russian Strikes Pummel Ukraine’s Power Grid” (https://www.nytimes.com/2026/02/07/world/europe/russia-strikes-ukraine-energy.html)

[2] Al Jazeera - “Ukraine scrambling for energy as Russian strikes hit infrastructure” (https://www.aljazeera.com/news/2026/1/16/ukraine-scrambling-for-energy-as-russian-strikes-hit-infrastructure)

[3] CNN - “‘We must get through the next few days’: Ukrainians face attacks” (https://www.cnn.com/2026/02/08/europe/ukrainians-attacks-cold-intl)

[4] Russia Matters - “The Russia-Ukraine War Report Card, Feb. 4, 2026” (https://www.russiamatters.org/news/russia-ukraine-war-report-card/russia-ukraine-war-report-card-feb-4-2026)

[5] Bloomberg - “Russian Refiners See Relief From Decline in Ukrainian Attacks” (https://www.bloomberg.com/news/articles/2026-02-03/russian-refiners-see-relief-from-decline-in-ukrainian-attacks)

[6] Baird Maritime - “Kazakhstan moves thousands of tonnes of oil away from CPC after attack” (https://www.bairdmaritime.com/offshore/transport/kazakhstan-moves-thousands-of-tonnes-of-oil-away-from-cpc-after-attack)

[7] OSW Waw - “Ukrainian attacks on the CPC oil pipeline: outlook for Kazakhstan’s oil sector” (https://www.osw.waw.pl/en/publikacje/analyses/2026-02-04/ukrainian-attacks-cpc-oil-pipeline-outlook-kazakhstans-oil-sector)

[8] OE Digital - “Oil drops 2% after US and Iran agree to talks” (https://energynews.oedigital.com/crude-oil/2026/02/06/oil-drops-2-after-us-and-iran-agree-to-talks)

[9] Trading Economics - “EU Natural Gas - Price - Chart - Historical Data - News” (https://tradingeconomics.com/commodity/eu-natural-gas)

[10] IEA - “Growth in global demand for natural gas is set to accelerate in 2026 as LNG wave spreads through markets” (https://www.iea.org/news/growth-in-global-demand-for-natural-gas-is-set-to-accelerate-in-2026-as-lng-wave-spreads-through-markets)

[11] Debug Lies - “FORGE Initiative and U.S.-Led Critical Mineral Counter-Offensive” (https://debuglies.com/2026/02/07/forge-initiative-and-u-s-led-critical-mineral-counter-offensive/)

[12] Various sources - “Why the U.S. Golden Dome Can’t Stop Russian Missiles” (Facebook/ANI News)

[13] Chronicle Journal - “Fragile Stability: Navigating the 2026 Black Sea Grain Outlook” (http://markets.chroniclejournal.com/chroniclejournal/article/marketminute-2026-1-28-fragile-stability-navigating-the-2026-black-sea-grain-outlook-amidst-shifting-geopolitics)

[14] Ginlix AI Market Data API - Sector performance and commodity indices (2026-02-08) [0]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.