Taiwan Export Growth & Semiconductor Industry Valuation Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now let me compile a comprehensive analysis based on all the gathered data.

Taiwan’s semiconductor industry stands at the center of the global AI revolution, with January 2026 export data revealing an extraordinary

Taiwan’s Ministry of Finance reported explosive export growth in January 2026, driven predominantly by artificial intelligence and cloud computing demand:

| Metric | Value | Context |

|---|---|---|

Total Export Growth |

+69.9% YoY |

vs. +51.9% analyst forecast; fastest in 16 years |

Exports to United States |

+151.8% YoY ($21.28B) |

Primary growth engine |

Exports to China |

+49.6% YoY |

Secondary contributor |

Electronic Components |

+59.8% YoY ($22.36B) |

Record high; AI chips lead |

Import Growth |

+63.6% YoY ($46.87B) |

Indicates robust domestic demand |

The January surge significantly outperformed December’s +43.4% growth, indicating

-

Supply Chain Centrality Reinforced: Taiwan’s position as the world’s leading contract chip manufacturer has been further cemented, with TSMC commanding approximately90% market share in advanced logic semiconductorsused in AI accelerators.

-

US-Taiwan Trade Pact Dynamics: The upcoming US-Taiwan trade agreement, potentially incorporating tariff reductions, has prompted Taiwanese firms to pledge$250 billion in US investment, with TSMC alone committing $52-56 billion in 2026 capital expenditures [2].

-

Export Visibility: The Finance Ministry projects February exports to grow+20% to +27% YoY, suggesting sustained momentum [1].

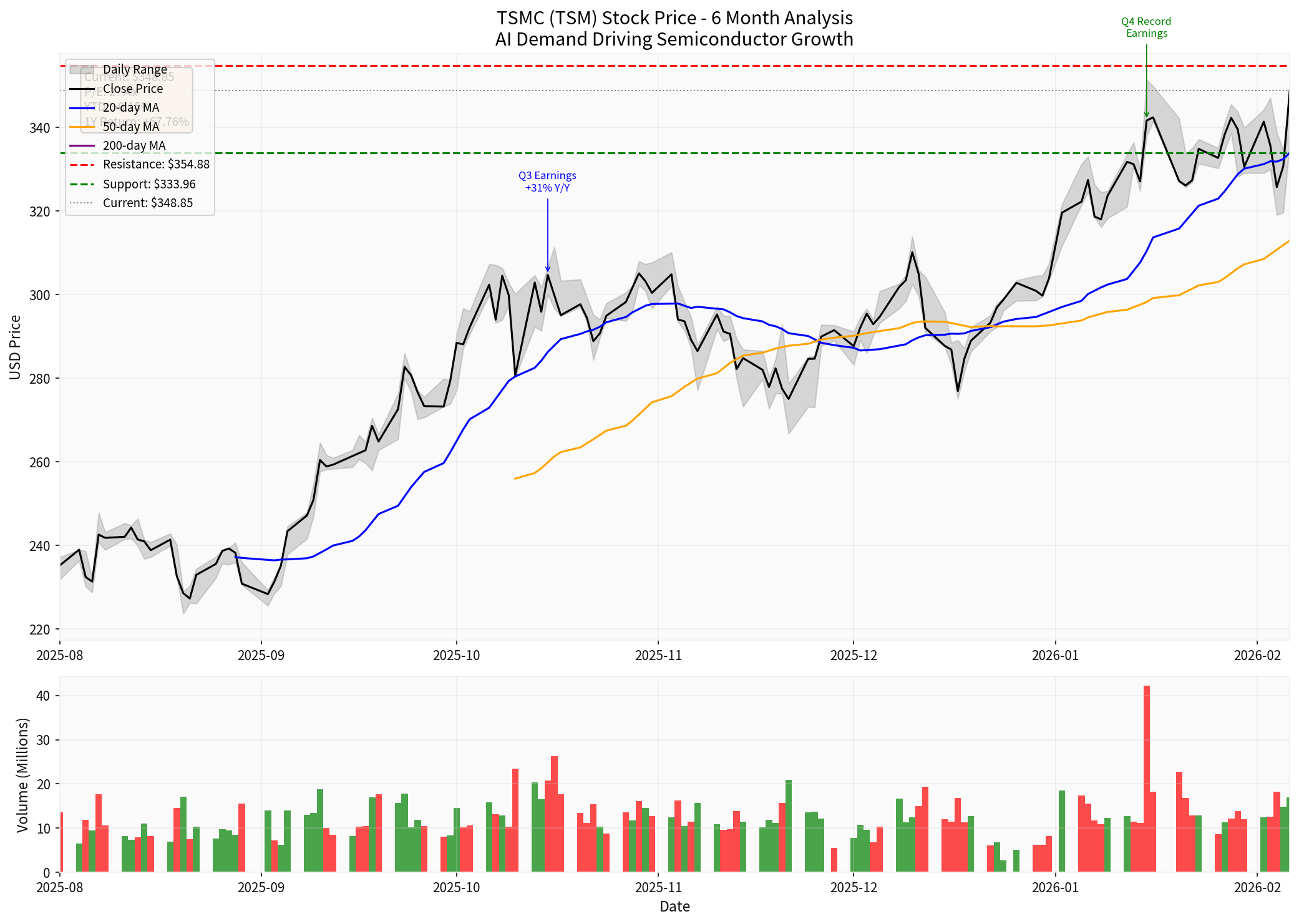

TSMC (NYSE: TSM) has delivered exceptional shareholder returns across all timeframes:

| Period | Return |

|---|---|

YTD |

+9.15% |

1 Month |

+7.79% |

3 Months |

+21.76% |

6 Months |

+44.25% |

1 Year |

+67.76% |

3 Years |

+260.79% |

5 Years |

+162.93% |

| Metric | Actual | Consensus | Surprise |

|---|---|---|---|

EPS |

$3.09 | $2.90 | +6.55% |

Revenue |

$33.14B | $33.01B | +0.39% |

Profit Growth |

+35% YoY | — | Record |

TSMC posted

| Metric | Value | Industry Context |

|---|---|---|

Net Profit Margin |

45.10% |

Exceptional; among highest in semiconductor industry |

Operating Margin |

50.83% |

Reflects pricing power in advanced nodes |

ROE |

35.12% |

Superior capital efficiency |

Current Ratio |

2.62 |

Strong liquidity position |

P/E Ratio |

27.40x |

Premium to broader market, reasonable for growth |

Our three-scenario DCF model projects significant upside:

| Scenario | Fair Value | Upside vs. Current | Key Assumptions |

|---|---|---|---|

Conservative |

$490.78 | +40.7% | 0% revenue growth; 66.4% EBITDA margin |

Base Case |

$545.13 | +56.3% |

24.8% revenue growth; 69.9% EBITDA margin |

Optimistic |

$730.53 | +109.4% | 27.8% revenue growth; 73.4% EBITDA margin |

Probability-Weighted |

$588.81 |

+68.8% |

Balanced scenario approach |

| Component | Value |

|---|---|

Beta |

1.27 |

Risk-Free Rate |

4.5% |

Market Risk Premium |

7.0% |

Cost of Equity (CAPM) |

13.4% |

Cost of Debt |

4.0% |

WACC |

9.8% |

The relatively elevated WACC reflects TSMC’s higher systematic risk, though the company’s strong moat and cash generation characteristics provide substantial risk mitigation [4].

| Metric | Target |

|---|---|

Consensus Target |

$405.00 (+16.1% upside) |

Target Range |

$330.00 - $450.00 |

Buy Rating |

69.6% (16 analysts) |

Hold Rating |

30.4% (7 analysts) |

TSMC has announced a

- Advanced node development (2nm, 1.6nm processes)

- US expansion (Arizona fabs)

- Japan expansion (Kumamoto)

- Germany expansion (Dresden)

-

Nvidia: Goldman Sachs projects Nvidia will deliver$2 billion revenue beatin Q4 FY2026, with hyperscaler spending climbing to$527 billion for 2026(up from $394 billion) [6].

-

Hyperscale Cloud Providers: Amazon announced$200 billioncapex; Alphabet disclosed$185 billion— both predominantly AI-focused infrastructure investments.

-

AI Foundry Demand: TSMC’s C. Wei acknowledged concerns about AI demand durability but emphasized that committing $50B+ annual capex locks in advanced node leadership for the multi-year AI infrastructure buildout [2].

| Risk Category | Assessment |

|---|---|

Debt Risk |

Low — Strong balance sheet, low leverage |

Liquidity |

High — Current ratio 2.62, robust cash generation |

Accounting |

Conservative — High depreciation/capex ratios suggest earnings quality |

FCF Generation |

Strong — Latest FCF: $1.1 trillion TWD |

| Risk | Impact | Mitigation |

|---|---|---|

AI Demand Moderation |

Medium-High | Diversified customer base; recurring revenue from chip designs |

Geopolitical Risk |

High | US investment pledges; geographic diversification |

Competition |

Medium | Technological leadership in advanced nodes; R&D intensity |

Valuation |

Medium | Premium multiples justified by growth; DCF supports upside |

| Sector | Daily Change | Status |

|---|---|---|

Technology |

+1.31% | 📈 Outperforming |

Communication Services |

-0.23% | 📉 Underperforming |

Real Estate |

+3.07% | 📈 Best performer |

The Technology sector’s outperformance reflects positive sentiment around AI infrastructure spending, with semiconductor stocks serving as primary beneficiaries.

| Company | Role | Relevance to TSMC |

|---|---|---|

Nvidia |

AI GPU leader | Primary TSMC customer for H100, Blackwell chips |

AMD |

AI accelerator challenger | TSMC customer for MI300 series |

Intel |

Foundry expansion | TSMC customer for select advanced designs |

Samsung |

Memory/HBM competitor | TSMC maintains logic leadership |

- Revenue Growth: Consensus expects$35.41Bin Q1 FY2026 revenue (+7% QoQ)

- EPS Estimate:$3.26(+5.5% YoY)

- AI Demand: Robust visibility through at least H1 2026

- Capex Execution: Arizona and Japan fabs ramping production

- Advanced Node Adoption: 2nm process volume production

- US Manufacturing: Arizona fabs entering production

- AI Infrastructure: Continued hyperscaler capex supporting foundry demand

- Generative AI Proliferation: Jensen Huang (Nvidia CEO) projects “$10 trillion of computing being modernized” to AI infrastructure [6]

- Edge AI: Smartphone and PC AI chip integration

- Automotive AI: Autonomous driving and EV electronics

- Geographic Diversification: Reduced concentration risk through global fab network

| Factor | Assessment | Implication |

|---|---|---|

Growth |

Exceptional (+30% 2026 revenue guidance) | Strong upside |

Valuation |

DCF supports +40-109% upside | Attractive |

Momentum |

Technical: Sideways; Fundamental: Positive | Neutral |

Risk/Reward |

Favorable | BUY |

-

Taiwan’s AI-driven export surge(+69.9% YoY in January 2026) confirms sustained demand for semiconductors, with TSMC as the primary beneficiary.

-

TSMC valuationremains compelling, with DCF analysis indicating40-109% upside potentialfrom current levels, supported by record earnings, expanding margins, and robust capital investment programs.

-

Capital expenditure of $52-56 billionin 2026 positions TSMC to capture multi-year AI infrastructure demand, with management emphasizing long-term competitive positioning over short-term demand concerns.

-

Risk factorsare primarily geopolitical and demand-cyclical, though TSMC’s technological leadership, diversified customer base, and conservative financial management provide substantial risk mitigation.

-

Analyst consensusremains constructive with a$405 target price(+16% upside), though our DCF analysis suggests more aggressive valuation scenarios are warranted given the structural AI growth opportunity.

[1] Reuters - “Taiwan January exports surge at fastest pace in 16 years on AI demand” (https://www.reuters.com/world/asia-pacific/taiwan-january-exports-surge-fastest-pace-16-years-ai-demand-2026-02-09/)

[2] Yahoo Finance - “TSMC Lifts 2026 Capex Outlook as AI Demand Stays Strong” (https://finance.yahoo.com/news/tsmc-lifts-2026-capex-outlook-154053660.html)

[3] LinkedIn/Ainvest - “TSMC’s 2026 Growth Engine: Scaling AI Demand into Market Dominance” (https://www.ainvest.com/news/tsmc-2026-growth-engine-scaling-ai-demand-market-dominance-2602/)

[4] 金灵API - DCF Valuation Analysis for TSM

[5] 金灵API - Company Overview for TSM

[6] Watcher.Guru/Motley Fool - “Nvidia Stock Forecast Reset by Goldman Sachs Ahead of Earnings” (https://watcher.guru/news/nvidia-stock-forecast-reset-by-goldman-sachs-ahead-of-earnings)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.