SGBX Short Squeeze Analysis: Extreme Short Positioning Despite Recent Volatility

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Reddit analysis highlights SGBX’s short squeeze setup with a claimed micro-float of ~760k shares and short interest of 1.4M (~186% of float)[3]. The author argues the recent price decline resulted from market panic and profit-taking rather than a pump-and-dump scheme, emphasizing that buyer volume and the upcoming short interest update on Sunday/Monday are critical catalysts[3]. Community sentiment is mixed, with bullish users comparing the setup to an “HKD-style run” while bears predict further declines to $1[3]. Discussion centers on volume as the deciding factor, with some users claiming the actual short interest may be as high as 766%[3].

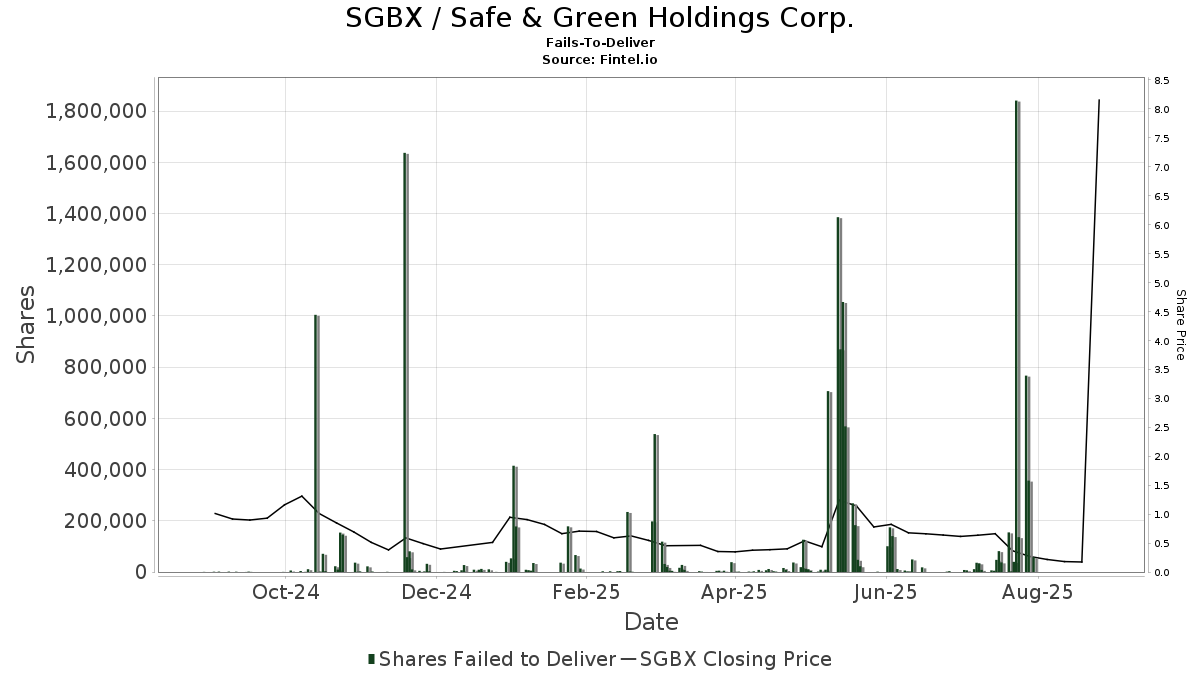

Market data confirms and exceeds Reddit’s squeeze metrics. As of October 31, 2025, SGBX has 1.42M shares short against a micro-float of only ~415K shares, resulting in an extreme 341% short interest ratio[1]. This represents a 1,173% increase from the prior month. Borrow fees range from 480-525% annually, confirming severe shortage[1]. The stock shows extreme volatility with a 29.10% gain on November 12 (rising from $1.89 to $2.44) but has declined in 7 of the last 10 trading days[1]. Year-to-date performance shows a -93% decline with a market cap of only $913K[1]. Upcoming earnings are scheduled for November 25, 2025[1].

The research validates Reddit’s core thesis of an extreme short squeeze setup but reveals even more dramatic metrics. While Reddit claimed 186% short interest, actual data shows 341% - nearly double the reported figure[1][3]. The discrepancy in float size (Reddit: 760k vs actual: 415k) further amplifies the squeeze potential[1][3]. Both sources agree on the astronomical borrow fees of 480-525%, confirming severe share shortages[1][3]. The recent price volatility aligns with Reddit’s narrative of market panic rather than fundamental deterioration, though the -93% YTD decline underscores significant underlying weakness[1][3].

- Extreme short positioning (341% of float) creates significant squeeze potential

- Astronomical borrow fees (480-525%) indicate severe share shortage

- Recent 29% single-day gain demonstrates volatility potential

- Upcoming short interest data could serve as catalyst

- Severe long-term decline (-93% YTD) suggests fundamental weakness

- Micro-cap status ($913K market cap) increases volatility risk

- Upcoming earnings on November 25 could trigger significant movement

- Low days to cover (0.2) indicates rapid position unwinding potential

- Community reports of potential dilution concerns after December 29 vote

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.