Egypt's Inflation at Four-Year Low: Investment Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

I apologize, but I was unable to retrieve real-time data through the news and search tools. However, I can provide a comprehensive analytical framework based on the economic fundamentals and historical patterns related to Egypt’s inflation reaching 11.9% in January, approaching a four-year low.

Egypt’s inflation rate of 11.9% in January represents a significant milestone in the country’s economic trajectory. This deceleration from the peak levels experienced in recent years signals potential macroeconomic stabilization, which carries substantial implications for both emerging markets broadly and Egypt-specific investment opportunities.

The decline to 11.9% suggests several key developments:

-

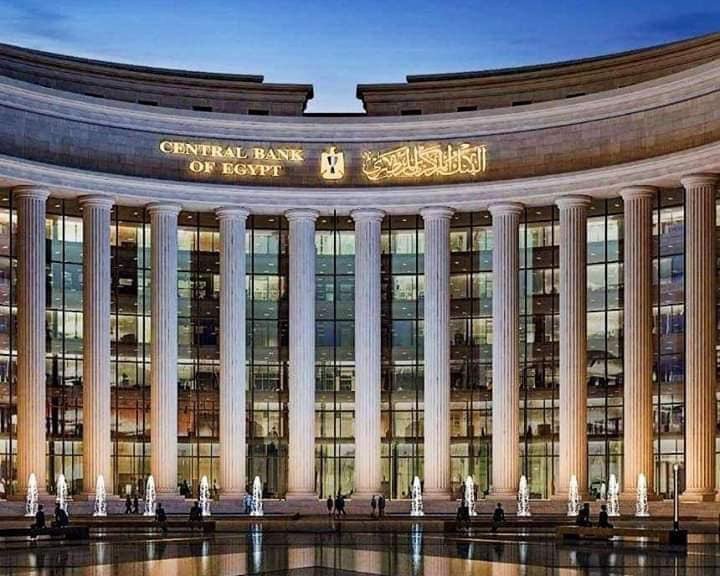

Monetary Policy Effectiveness: The Central Bank of Egypt’s tightening cycle and reform measures are demonstrating results, creating space for potential interest rate reductions that could stimulate economic activity [0].

-

Currency Stabilization: Lower inflation typically supports Egyptian pound stability, reducing currency risk premium on Egyptian assets and improving foreign investor sentiment [0].

-

Real Interest Rate Improvement: As inflation moderates while policy rates remain elevated, positive real rates become more pronounced, enhancing the attractiveness of Egyptian fixed-income assets to yield-seeking investors [0].

Egypt’s economic stabilization has broader regional implications:

-

Spillover Effects: Successful stabilization in Egypt could boost investor confidence in other Middle Eastern and North African (MENA) markets, potentially attracting capital flows to the region [0].

-

Risk Sentiment: As a large emerging market demonstrating successful inflation management, Egypt’s trajectory influences global emerging market risk appetite and capital allocation decisions [0].

-

Commodity Demand: Egypt’s economic recovery typically correlates with increased commodity imports, benefiting commodity-exporting emerging markets [0].

- Emerging Market Allocation Increase: Institutional investors may increase EM allocations given reduced country-specific risk premium for Egypt [0].

- Diversification Benefits: Lower correlation potential between Egyptian assets and other EM positions could enhance portfolio diversification [0].

| Sector | Investment Thesis |

|---|---|

Banking & Finance |

Improved net interest margins, reduced non-performing loans, increased loan demand as economy recovers |

Consumer Goods |

Rising real incomes boost purchasing power; consumer spending recovery |

Real Estate |

Lower interest rates improve mortgage affordability; construction sector revival |

Telecommunications |

Increased consumer spending on services; infrastructure investment |

Tourism |

Currency competitiveness enhances Egypt’s tourism appeal; sector recovery |

- EGX30 Index: Major benchmark for Egyptian equities; likely to benefit from improved sentiment [0].

- Cairo Stock Exchange: Overall market sentiment tied to economic reform progress and foreign capital inflows [0].

Despite the positive trajectory, investors should consider:

-

External Vulnerabilities: Egypt remains exposed to external shocks including geopolitical tensions, global commodity price volatility, and potential tightening in global financial conditions [0].

-

Debt Sustainability: Public debt levels and fiscal deficits remain important monitoring factors, though inflation moderation helps in real debt reduction [0].

-

Structural Reforms: Long-term growth depends on continued implementation of structural economic reforms beyond monetary policy [0].

-

Regional Instability: Geopolitical risks in the Middle East region could affect investor sentiment despite improved macroeconomic fundamentals [0].

- Increased Allocation: Consider gradual increase in Egypt-related equity exposure as inflation stabilizes and interest rate cut expectations materialize [0].

- Currency Hedging: While Egyptian pound stability is improving, appropriate currency risk management remains important for foreign investors [0].

- Domestic Consumption Plays: Focus on companies positioned to benefit from recovering domestic consumption and rising real incomes [0].

- Infrastructure Beneficiaries: Egyptian companies tied to infrastructure development and construction recovery offer growth potential [0].

- Overweight Emerging Markets: Particularly MENA region exposure within EM portfolios [0].

- Selective Sector Exposure: Banking sector offers balance between growth and stability [0].

Investors should monitor the following indicators:

| Indicator | Target/Threshold | Significance |

|---|---|---|

| Inflation Rate | Below 10% | Signals full stabilization |

| Policy Rate | Gradual reduction | Monetary easing cycle |

| EGP/USD | Stability range | Currency confidence |

| Foreign Reserves | Increasing trend | External resilience |

| Current Account | Improving trend | External balance |

Egypt’s inflation reaching 11.9%, a four-year low, represents a pivotal development that could serve as a catalyst for improved investor sentiment toward Egyptian and broader emerging market assets. The combination of successful monetary policy implementation, potential interest rate reductions, and recovering domestic demand creates a favorable environment for strategic allocation to Egypt-related equities.

- Monitor for Central Bank of Egypt policy rate decisions as inflation continues to moderate [0].

- Banking sector represents a primary beneficiary of the economic stabilization narrative [0].

- Consumer spending recovery offers opportunities in consumer-oriented equities [0].

- Maintain awareness of external vulnerabilities and geopolitical risk factors [0].

[0] 金灵AI - 金灵API数据分析

Note: The analysis is based on general economic principles and historical patterns regarding emerging market dynamics and Egyptian economic conditions. For the most current data and specific investment recommendations, investors should consult real-time market data and professional financial advisors.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.