Global Markets Analysis: Tech Rally Pause and Asian Market Dynamics on February 9-10, 2026

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Wall Street Journal report [1] published on February 10, 2026, which documented a period of market calm following significant tech sector momentum. The article highlighted that major U.S. indexes were steady in premarket trading after a notable surge in technology stocks during the previous session, while a Japan-led rally in Asian equity markets had stalled during European trading hours. This pause represents a consolidation phase in what has been an eventful period for global markets, characterized by strong technology sector performance and consequential political developments in Japan [0].

The timing of this market pause is particularly significant given the preceding volatility. The most recent trading session on February 9, 2026, demonstrated robust recovery in U.S. equity markets, with the NASDAQ Composite advancing +1.25% to close at 23,238.67, building on an even stronger +1.79% gain recorded on February 6 [0]. This recovery pattern indicates that the market has successfully absorbed earlier weekly losses, suggesting underlying bullish momentum despite the current period of consolidation.

The February 9 trading session revealed a broadly constructive market environment across multiple indices. The S&P 500 closed at 6,964.81 with a gain of +0.69%, maintaining its position within recent trading ranges [0]. The Dow Jones Industrial Average advanced +0.29% to finish at 50,135.88, remaining near record territory, while the Russell 2000 small-cap index showed strength with a +0.81% gain to 2,689.05, indicating participation beyond large-cap technology names [0].

Sector rotation patterns during this session revealed an interesting dynamic. Utilities emerged as the top performer with a +2.09% advance, followed by Basic Materials at +1.81% and Technology at +1.60% [0]. Meanwhile, defensive consumer sectors lagged, with Consumer Defensive declining -0.76%, Consumer Cyclical falling -0.27%, and Healthcare slightly down at -0.14% [0]. This sector performance pattern suggests that investors are adopting a balanced approach following the tech rally, maintaining technology exposure while selectively rotating into defensive names. The mixed sector performance may indicate uncertainty about the sustainability of the tech-led rally or simply a healthy diversification of positions.

Individual technology stocks showed varied performance within the broader sector move. NVIDIA (NVDA) closed at $190.04, representing a +2.50% gain that reinforced its position as a market leader in the AI semiconductor space [0]. The stock remains near the upper end of its 52-week trading range of $86.62 to $212.19, with a substantial market capitalization of $4.63 trillion and a price-to-earnings ratio of 47.04 [0]. In contrast, Apple (AAPL) closed at $274.62, reflecting a -1.26% decline that indicates some weakness despite the broader tech rally [0]. Apple’s 52-week range spans $169.21 to $288.62, suggesting the stock remains within a reasonably defined trading corridor [0].

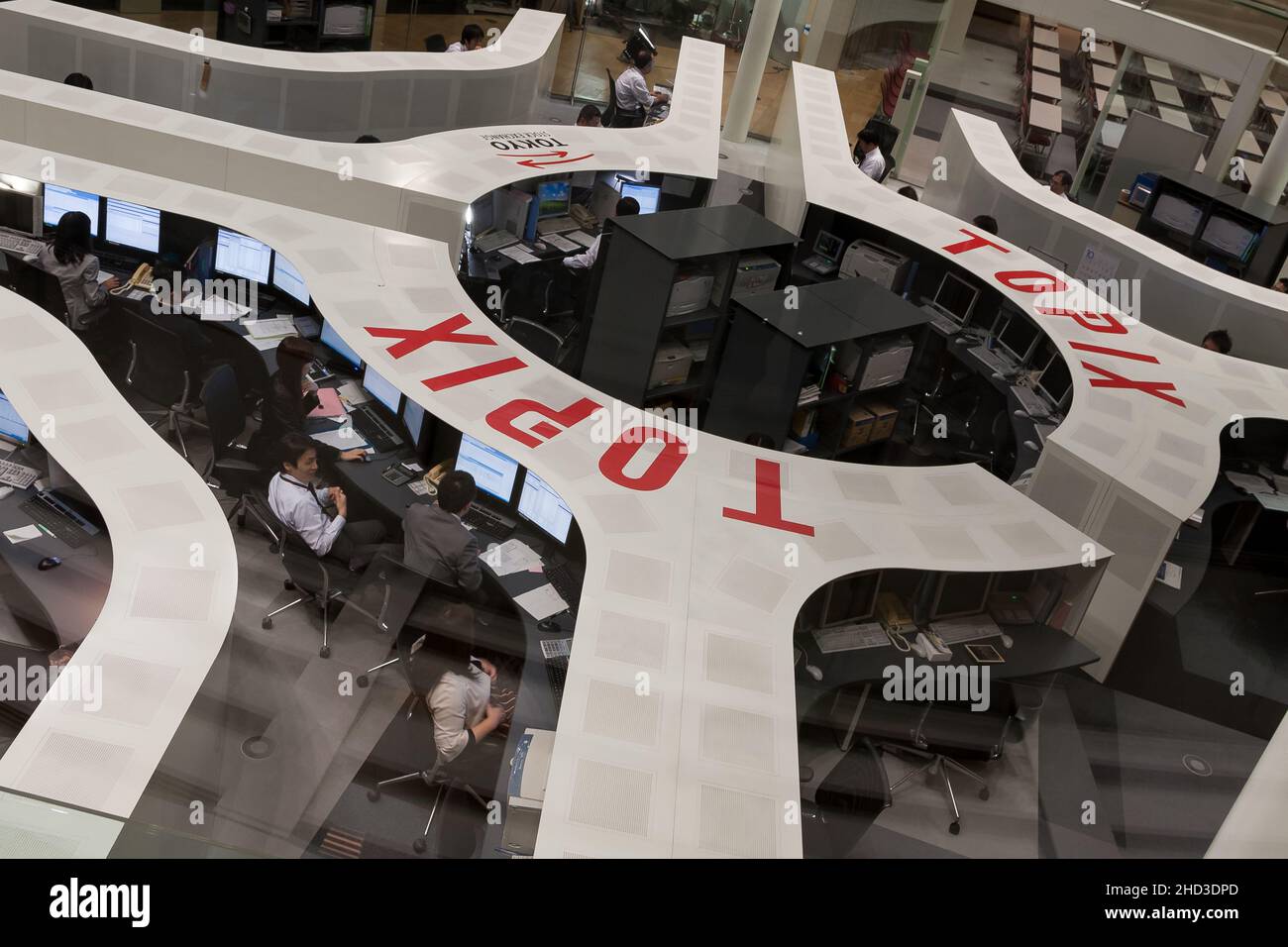

Asian markets experienced pronounced volatility during this period, driven significantly by Japanese political developments. Japan’s Nikkei 225 index surged as much as 5% to reach record levels following Prime Minister Sanae Takaichi’s governing party securing a two-thirds supermajority in parliamentary elections [2]. This electoral outcome represents a significant political mandate that signals potential policy continuity while simultaneously raising questions about fiscal expansion strategies and potential yen currency movements.

However, the initial Japan-led enthusiasm stalled during European trading sessions, indicating that the positive sentiment was largely contained within the Asia-Pacific region [1]. This geographic limitation of the rally suggests several possibilities: either international investors were taking a cautious approach pending more clarity on the Takaichi administration’s policy agenda, or European market participants were focusing on different catalysts entirely. The subsequent calm in U.S. futures trading following this Asian rally further supports the interpretation that investors are in a period of consolidation and reassessment rather than sustained directional conviction.

Morgan Stanley strategists led by Michael Wilson have articulated a notably bullish view on technology stocks, providing institutional credibility to the technical rally observed in the market [3][4]. The firm’s analysis emphasizes artificial intelligence-driven revenue growth as the primary catalyst for continued sector outperformance, with robust sales outlooks underpinning the fundamental case for technology equities [3]. Wilson’s team has suggested that the current rally has meaningful room to run despite the recent gains, which contrasts with more cautious perspectives that emphasize elevated valuations [4].

This institutional bullishness adds important context to the market dynamics. When leading Wall Street strategists maintain constructive positions following a significant rally, it often reflects confidence in the fundamental underpinnings of the move rather than mere momentum trading. The Morgan Stanley perspective emphasizes that the AI capital expenditure cycle remains in early-to-mid stages, with major technology companies continuing to invest heavily in AI infrastructure that should generate revenue growth in coming quarters.

The fundamental backdrop for equity markets includes several notable economic indicators. U.S. consumer sentiment rose to a six-month high in February, despite ongoing concerns about the cost of living and potential labor market weakening [2]. This positive consumer sentiment reading provides underlying support for equity valuations, as consumer confidence often correlates with spending patterns and broader economic activity.

Federal Reserve policy expectations have undergone recalibration, with futures markets now pricing in no rate cut until June 2026 at the earliest, with expectations limited to two or fewer cuts before year-end [5]. The delayed timeline for monetary easing reflects either persistent inflation concerns or a more optimistic assessment of economic growth. Notably, the 10-year Treasury yield has risen despite these rate cut expectations, suggesting that inflation concerns remain pertinent among bond market participants [5]. The tension between equity market optimism and rising Treasury yields represents a factor that warrant close monitoring, as higher yields can eventually pressure equity valuations through multiple channels.

Fundamental developments in the artificial intelligence semiconductor supply chain provide concrete support for technology sector valuations. SK Hynix is set to ship HBM4 (sixth-generation high-bandwidth memory) this month for NVIDIA’s next-generation Vera Rubin AI accelerator [6]. This shipping milestone represents tangible progress in the AI hardware supply chain and validates the ongoing capital expenditure cycle in AI infrastructure.

Additionally, NVIDIA and SK Group are discussing potential AI data center collaboration, including HBM4 supply arrangements that would further integrate the AI semiconductor ecosystem [7]. Cisco has also entered the AI networking chip market with its Silicon One G300 processor, directly challenging established players Broadcom and NVIDIA in the data center networking space [8]. These competitive developments underscore the significant capital investment flowing into AI infrastructure and suggest continued demand visibility for leading technology companies.

The convergence of several factors creates a nuanced market environment that requires multi-dimensional analysis. The technology sector’s leadership role appears supported by both top-down macroeconomic factors (AI adoption, digital transformation) and bottom-up fundamental developments (supply chain progress, earnings growth). The Morgan Stanley bullish outlook [3][4] dovetails with the observed sector rotation patterns, suggesting that institutional investors are positioning for sustained AI-driven growth rather than short-term tactical moves.

The Japan-related market dynamics present an interesting divergence from U.S. market trends. While Japanese equities surged on political developments [2], the limited spillover to European and U.S. markets suggests that international investors are treating this as a region-specific catalyst rather than a global macro event. This geographic specificity may reflect either concerns about the sustainability of Japan’s policy agenda or simply a focus on more immediate domestic catalysts.

A notable structural feature of the current market environment is the concentration of gains in a relatively narrow set of technology names. The performance differential between leaders like NVIDIA and more modest gains elsewhere in the market raises questions about breadth and sustainability. While the Russell 2000’s +0.81% gain [0] indicates some participation beyond mega-cap technology, the overall market direction remains heavily influenced by a limited number of AI-related stocks.

The sector rotation toward defensive utilities [0] during a period of tech strength could be interpreted in multiple ways. It might indicate that investors are selectively taking profits in technology winners while maintaining exposure through more stable sectors, or it could simply reflect a broadening of the rally that would be constructive for market health. Distinguishing between these interpretations will require observation of subsequent trading sessions.

The AI supply chain developments provide concrete evidence supporting the investment thesis for AI-related technology stocks. SK Hynix’s HBM4 shipments for NVIDIA’s Vera Rubin platform [6] represent tangible progress that validates ongoing capital expenditure by hyperscalers. The competitive dynamics introduced by Cisco’s entry into AI networking [8] suggest that the market opportunity remains sufficiently attractive to draw significant new competitors, which implies sustained demand and pricing power for established players.

Several risk factors merit consideration in the current market environment. Tech concentration risk remains elevated, as market gains continue to be heavily concentrated in AI-related stocks, creating vulnerability to corrections if sentiment shifts. The high valuations of leading technology names, including NVIDIA’s P/E ratio of 47x [0], leave limited room for disappointment if growth expectations are not met.

Interest rate risk remains pertinent given the uncertainty around Federal Reserve policy and the recent rise in Treasury yields [5]. Higher yields can pressure equity valuations through multiple channels, including increased discount rates for future earnings and enhanced competition from fixed income investments. The market’s expectation of limited rate cuts through 2026 suggests bond yields may remain elevated.

Currency risk associated with Japanese political developments warrants monitoring, as the Takaichi administration’s policy agenda could impact yen volatility with potential spillover effects to global markets. Additionally, geopolitical risks including Iran-related oil market developments continue to represent background concerns that could materialize rapidly.

The constructive Morgan Stanley outlook [3][4] suggests continued opportunities in technology sector leadership, particularly in companies directly exposed to AI infrastructure spending. The current consolidation period may offer entry points for investors who missed the initial rally, assuming fundamentals remain supportive.

The broadening of market participation suggested by Russell 2000 strength [0] could indicate emerging opportunities in small-cap and value-oriented segments that have lagged the technology rally. If sector rotation continues, these areas may offer attractive risk-reward profiles.

Continued monitoring of AI capital expenditure announcements from major technology companies including Microsoft, Alphabet, Amazon, and Meta will provide signals about the sustainability of the current investment cycle. The HBM4 developments [6][7] suggest meaningful demand visibility through at least the near-term horizon.

The analysis integrates multiple data sources and analytical perspectives to provide a comprehensive view of current market conditions. Key findings indicate that U.S. equity markets are experiencing a period of consolidation following a meaningful tech rally, with the NASDAQ recovering +1.79% on February 6 and +1.25% on February 9 [0]. Morgan Stanley’s constructive outlook on technology stocks [3][4] provides institutional support for the AI-driven rally thesis, while developments in the AI supply chain including SK Hynix’s HBM4 shipments [6] offer tangible fundamental validation.

Asian markets, particularly Japan, showed pronounced volatility tied to political developments, though the enthusiasm stalled in European trading [1][2]. Consumer sentiment has reached a six-month high [2], while Federal Reserve policy expectations have shifted toward fewer rate cuts through 2026 [5]. The combination of constructive fundamentals, elevated valuations, and emerging risk factors creates a nuanced environment that warrants ongoing monitoring and position management.

Sector rotation patterns showed mixed dynamics, with utilities and basic materials outperforming alongside technology, while consumer defensive sectors lagged [0]. Individual stock performance varied within the technology sector, with NVIDIA showing strength (+2.50%) while Apple declined (-1.26%) [0]. These divergences within sectors highlight the importance of selective positioning and continued fundamental analysis.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.