Quantum/AI Bubble Investigation: Pump and Dump or Sector Rotation?

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The original Reddit post serves as a cautionary tale from an investor who lost money in the recent quantum/AI/robotics hype cycle. The author describes being lured by social media hype and whale-driven pumps into what appeared to be unique stock discoveries, only to watch gains evaporate within weeks. The post resonated strongly with the community, generating significant engagement and discussion.

Key Reddit insights:

- Multiple users defended specific stocks like RKLB and NBIS as legitimate companies, with one reporting still being up 300% on RKLB

- Several commenters correctly noted that QS is a battery stock, not quantum, arguing it may be undervalued long-term

- Some users highlighted solid fundamentals: Bloom Energy’s profitability, DFLI’s strong earnings, APLD’s year-to-date gains

- Common refrain emphasized the importance of taking profits and avoiding hype-driven trades

- Expressions of resignation from some investors (e.g., “riding QBTS to zero”) contrasted with optimism that bottoms may be near

- Significant dissent about labeling the entire AI/quantum/robotics sector as pump-and-dump, with some pointing to real capex and revenue

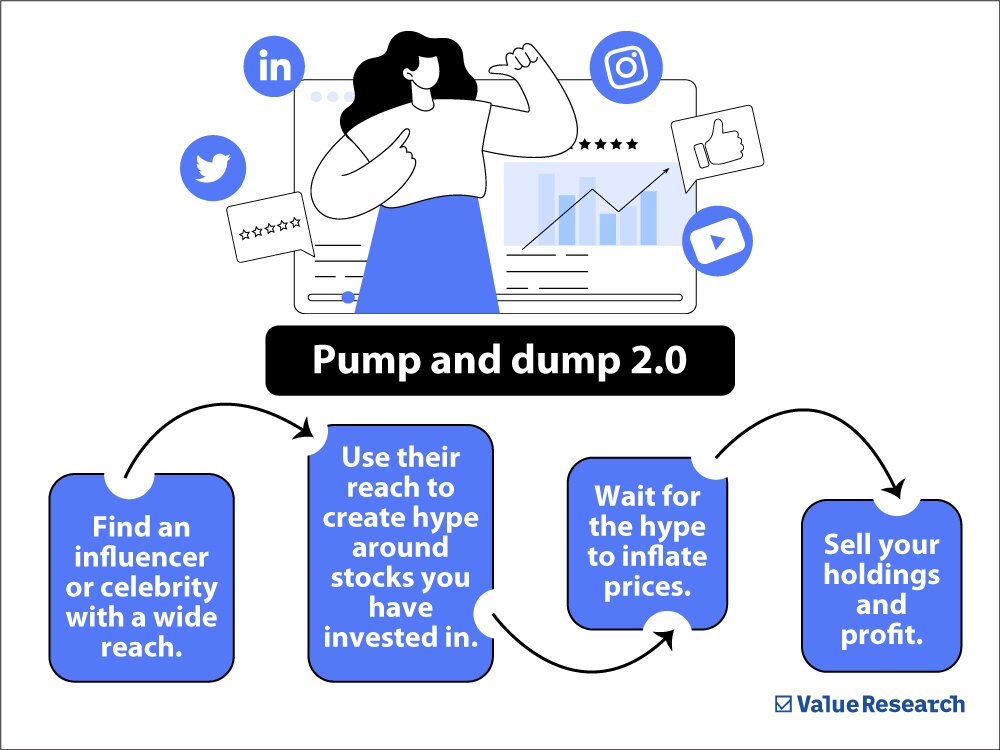

The 2025 speculative bubble around quantum computing, AI, and robotics stocks demonstrated classic pump and dump patterns with several key characteristics:

- Peak occurred around mid-October 2025, followed by a dramatic crash wiping out over $30 billion in market value from quantum stocks alone

- Quantum computing stocks experienced the most extreme movements, with some rising thousands of percent before crashing 40-55% from October highs

- Applied Digital (APLD) surged 311% in 2025, driven by AI data center speculation and massive lease contracts

- OKLO showed extreme volatility with a 52-week range of $17.14 to $193.84, demonstrating classic pump and dump patterns

- Coordinated price surges and extraordinary volume spikes across multiple stocks

- Social media platforms (Reddit, TikTok, X) became crucial market-moving engines for coordinated buying activities

- BBAI and OPEN appeared among most active stocks by share volume, indicating coordinated retail trading activity

- The bubble burst occurred when market realized commercialization timelines were “wildly optimistic” rather than due to poor fundamentals

- No SEC enforcement actions found specifically targeting the listed stocks for pump and dump schemes in 2025

- SEC continued general market manipulation enforcement activities but none involved the specified companies

- Some companies like QBTS and MSTR had routine SEC filings and insider trading reports but no enforcement actions

The evidence suggests a complex situation that blurs the line between sector enthusiasm and coordinated manipulation. While the price action and social media coordination exhibit classic pump and dump characteristics, the absence of regulatory enforcement and the presence of legitimate business fundamentals in some companies indicate this may represent broader market exuberance rather than targeted fraud.

- Both sources confirm the role of social media hype in driving the bubble

- Recognition that some companies have legitimate business models despite being caught in the hype

- Acknowledgment that the bubble burst due to unrealistic expectations rather than fundamental failures

- Reddit users identified legitimate companies that may have been unfairly labeled as pump and dumps

- The research shows no regulatory action, suggesting the phenomenon may be legal market exuberance rather than illegal manipulation

- Continued volatility in quantum/AI/robotics stocks as market recalibrates expectations

- Potential for further coordinated manipulation given the success of previous pumps

- Regulatory scrutiny could increase if manipulation patterns become more sophisticated

- Long-term value destruction for companies caught in speculative cycles without solid fundamentals

- Some fundamentally strong companies may be trading at significant discounts to intrinsic value

- The market correction may separate genuine innovation from pure speculation

- Opportunities for disciplined investors to acquire quality companies at attractive prices

- Lessons learned could lead to more sustainable investment approaches in emerging technologies

- Extreme caution warranted for stocks showing coordinated social media promotion

- Due diligence on business fundamentals remains critical even in hyped sectors

- Consideration of profit-taking strategies during momentum phases

- Monitoring of regulatory developments for potential enforcement actions

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.