China's Clean Energy Buildout: Strategic Positioning for Domestic Stock Growth Amid Deglobalization

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The strategic positioning of China’s clean energy sector represents a fundamental transformation in global industrial competition dynamics. The Seeking Alpha article published on February 10, 2026, presents a compelling thesis that domestic Chinese stocks could benefit significantly from the broader retreat of globalization, driven primarily by the country’s aggressive energy buildout and comprehensive industrial strategy [1]. This analysis integrates multiple analytical dimensions to assess the validity and implications of this thesis.

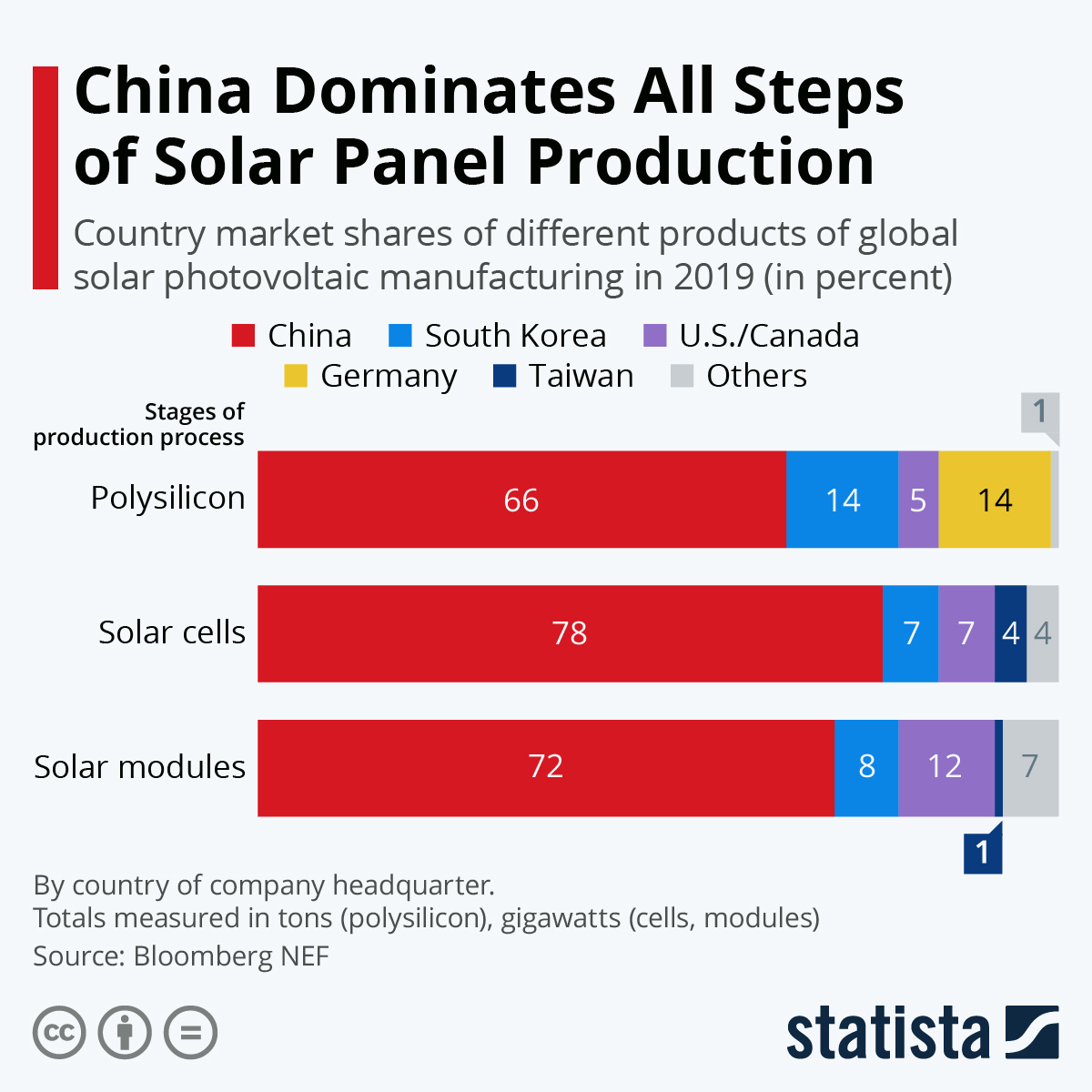

China’s manufacturing dominance in clean energy technologies has created a substantial competitive advantage that extends across multiple industry segments. From polysilicon production through module assembly in solar manufacturing, and from raw material processing through cell and pack assembly in batteries, Chinese manufacturers have systematically established positions at multiple value chain stages [0]. Companies such as TCL Zhonghuan (002129.SZ) exemplify the scale of China’s solar wafer production capacity, though market volatility remains evident in recent trading patterns showing significant price fluctuations [0]. This manufacturing capability gap presents challenges for competitors in the United States, Europe, and Asia who struggle to match Chinese scale and cost structures.

The integration of clean energy buildout with next-generation industry development creates a synergistic relationship that amplifies strategic positioning. BYD (002594.SZ), with a market capitalization of approximately $818 billion, represents the substantial market valuation assigned to China’s electric vehicle sector [0]. The company’s continued investment in battery technology and vehicle manufacturing is directly supported by domestic clean energy capacity, demonstrating how clean energy infrastructure serves as a foundation for broader industrial development [0]. Similarly, artificial intelligence computing infrastructure requires substantial electrical power capacity, and China’s domestic clean energy buildout provides the foundation for scaling computational resources without dependence on imported energy resources—a significant strategic consideration for energy security.

The broader context of retreating globalization creates both opportunities and challenges for domestic industrial development strategies. As nations increasingly focus on domestic production capabilities, supply chain resilience, and strategic industrial independence, China’s established clean energy manufacturing base positions it favorably within this evolving paradigm [1]. The question has shifted from whether China can compete in clean energy technologies to whether it can establish decisive leadership positions across the broader industrial landscape.

The analysis reveals several critical insights regarding China’s strategic industrial positioning. First, the clean energy sector has evolved from a nascent industry into a foundational component of national economic strategy, characterized by manufacturing dominance, massive infrastructure investment, and export-oriented production that creates an integrated industrial ecosystem benefiting from both domestic demand and international market access [0]. Government-directed capital flows into renewable energy infrastructure have created economies of scale that have driven down production costs globally while simultaneously building domestic industrial capacity.

Second, the competitive dynamics between the United States and China in clean energy have material implications for market share distribution across technology categories. In solar manufacturing, Chinese producers hold dominant global share, establishing price leadership and supply chain control. In battery production, Chinese companies lead global capacity, positioning them for electric vehicle supply chain dominance [0]. These positions create self-reinforcing industrial advantages as scale begets cost advantages, which in turn enable further capacity expansion.

Third, the strategic significance of clean energy extends beyond the energy sector itself, serving as critical infrastructure for emerging technological applications. For strategic industries including artificial intelligence and electric vehicles, domestic energy production reduces vulnerability to supply disruptions, geopolitical tensions, or trade disputes that could affect energy imports. This energy security consideration becomes increasingly important as global tensions escalate and supply chain resilience becomes a paramount concern for national policymakers.

Fourth, the horizontal effects of clean energy buildout extend to multiple related sectors including grid infrastructure, energy storage, and manufacturing automation. The deployment of renewable energy requires grid expansion, energy storage systems, and transmission infrastructure, while battery manufacturing capacity supports both electric vehicle and stationary storage applications. This creates multiple pathways for economic value creation and industrial development.

The analysis identifies several factors that could affect the realization of the strategic thesis regarding China’s domestic stock potential. On the opportunity side, the retreat of globalization favors countries with established domestic manufacturing capabilities and comprehensive industrial strategies. China’s demonstrated ability to scale clean energy technologies rapidly positions it favorably as global markets increasingly prioritize domestic production. The integration of clean energy with next-generation industries creates multiple growth vectors, as investments in clean energy infrastructure simultaneously support artificial intelligence development, electric vehicle manufacturing, and broader industrial automation.

The medium-term outlook suggests potential for sustained competitive advantage if Chinese industrial policy maintains effectiveness in establishing durable manufacturing positions. The pace of global energy transition will determine market size and opportunity, while advancement in next-generation technologies including solid-state batteries, advanced solar cells, and green hydrogen will affect competitive positioning over the three-to-five-year horizon [0].

However, significant risk factors merit attention. Trade policy developments including tariffs or trade restrictions could affect export markets for Chinese clean energy products, potentially limiting the international revenue opportunities that have supported Chinese manufacturers. Technology restrictions affecting access to advanced semiconductors and manufacturing equipment could constrain China’s ability to advance production capabilities. Domestic economic conditions, including ongoing property sector challenges and broader economic slowdown risks, could affect domestic demand for clean energy products and electric vehicles. Geopolitical tensions present perhaps the most significant risk, as escalating tensions could affect both trade flows and technology access in ways that fundamentally alter the competitive landscape.

The near-term trajectory will likely be influenced by policy announcements from both Chinese government and United States trade/administrative decisions, which will affect market sentiment toward China-related equities. Company earnings from major Chinese manufacturers including BYD will provide evidence of sector health, while any developments in US-China trade discussions could affect market expectations for export growth.

The synthesis of available analytical data supports the following key observations regarding China’s strategic positioning. China’s clean energy sector has achieved manufacturing scale that creates substantial competitive advantages in cost structure and production capacity. The integration of clean energy infrastructure with next-generation industry development—particularly artificial intelligence and electric vehicles—creates potential for sustained competitive advantage across multiple industrial domains.

Current market data shows Basic Materials (+1.67%) as the top-performing sector on February 10, 2026, while Energy sector showed modest gains (+0.05%), and Consumer Defensive underperformed at (-1.63%) [0]. These sector rotation patterns provide context for evaluating the relative attractiveness of clean energy and related industrial sectors within broader market positioning.

For stakeholders across the clean energy value chain, several factors merit ongoing monitoring. Policy consistency regarding government commitment to clean energy targets and industrial policy support levels will significantly influence sector trajectories. Production cost trajectories relative to competitors will determine competitive positioning. Technology development in next-generation areas including solid-state batteries, advanced solar cells, and green hydrogen will affect the evolution of competitive advantage. Geographic diversification trends and reshoring initiatives in key markets will influence demand patterns, while tariff and trade agreement developments will affect market access and competitive dynamics.

The fundamental conclusion emerging from this analysis is that China’s clean energy sector represents a demonstrated capability that can support broader industrial ambitions, and the retreat of globalization creates conditions potentially favorable for domestic industrial development strategies. However, the realization of this potential will depend on multiple factors including policy execution, technology development, and evolving trade relationships that remain subject to significant uncertainty.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.