Morgan Stanley下调Saia评级对美股零担货运板块影响分析

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- 评级变化:从"Equal Weight(增持)“下调至"Underweight(低配)”

- 目标价:Morgan Stanley设定为**$250.00**[1]

- 当前股价:$389.43(2026年2月10日收盘价)[0]

- 潜在下跌空间:约35.8%

- 估值担忧:Saia当前P/E高达36.74倍,远超行业平均水平[0]

- 股价与基本面背离:尽管最新财报显示收入超预期($789.95M,+2.09%),但EPS不及预期($1.77 vs 预期$1.90)[0]

- 运价压力持续:LTL行业整体面临运价下跌压力[1]

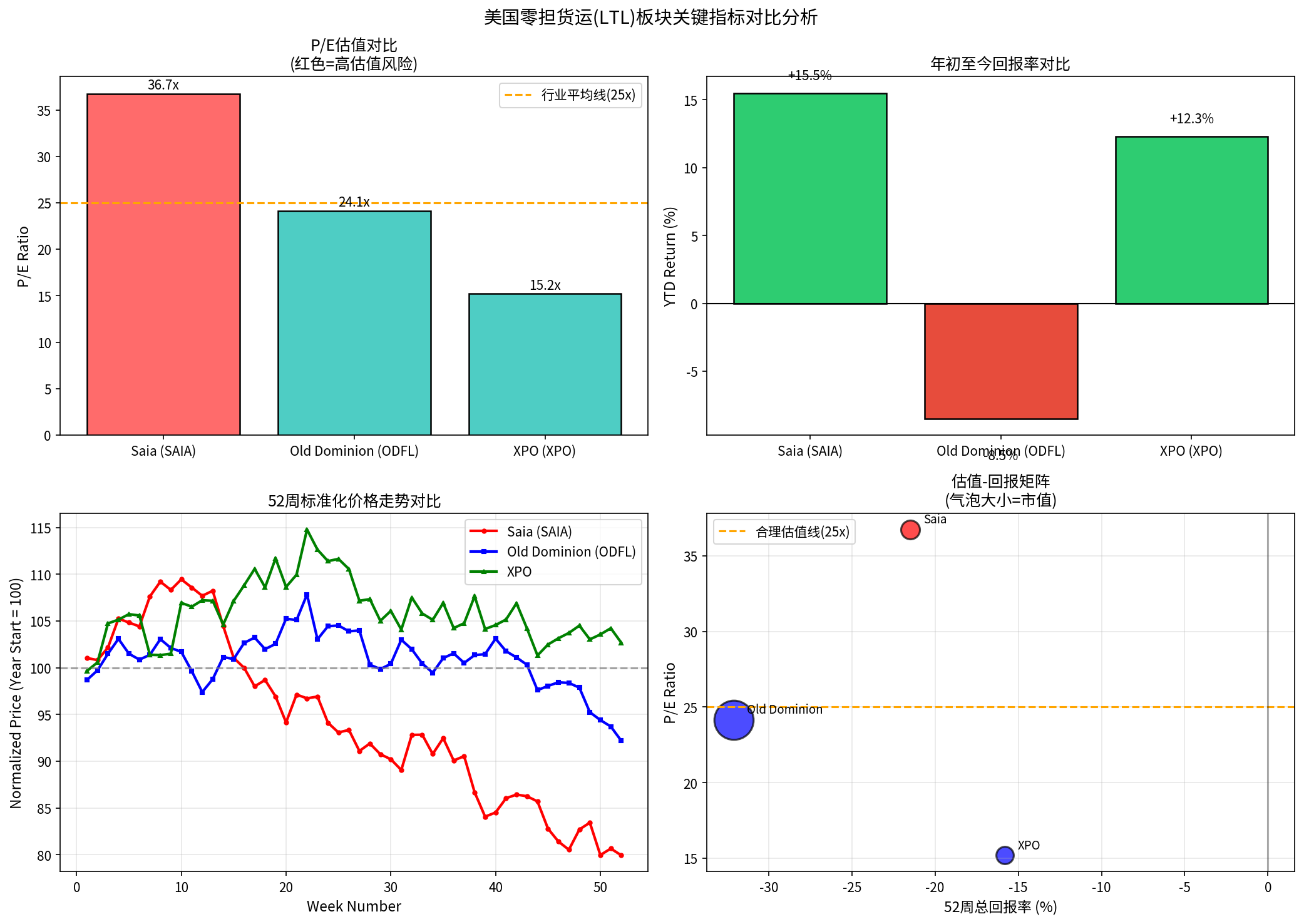

| 公司 | P/E估值 | 52周回报 | 年初至今 | 市场共识 |

|---|---|---|---|---|

Saia (SAIA) |

36.74x |

-21.5% | +15.5% | Buy |

| Old Dominion (ODFL) | 24.15x | -32.1% | -8.5% | Buy |

| XPO | 15.20x | -15.8% | +12.3% | Buy |

- Saia估值最高,但盈利能力并未显著领先于竞争对手

- Morgan Stanley目标价$250意味着仅基于15倍前瞻P/E[1]

- 分析师共识目标价为**$372.50**,较当前股价折价4.3%[0]

Morgan Stanley的此次下调传递了明确信号:

- 运价周期下行:2024-2025年运价持续承压,2026年运价环境预期仍"竞争激烈、限制涨价空间"[2]

- 货运量复苏缓慢:分析师普遍预计2026年货运量仅实现"温和改善,但仍低于历史平均水平"[2]

- 盈利能力承压:Saia最新季度EPS低于预期6.84%,显示成本传导能力减弱[0]

此次评级可能引发

| 估值情景 | Saia | 行业影响 |

|---|---|---|

乐观情景 (运价恢复) |

股价>目标价 | 板块估值修复 |

中性情景 (维持现状) |

股价≈目标价 | 估值区间震荡 |

悲观情景 (运价进一步下跌) |

股价<目标价 | 估值进一步压缩 |

- 机构投资者可能转向**Old Dominion(ODFL)**等估值更合理的标的

- XPO凭借较低的P/E(15.2x)或成为估值洼地

- Saia可能面临一段时间的资金流出压力

- 估值泡沫风险:Saia 36.74x P/E vs ODFL 24.15x,溢价理由不充分

- 宏观经济敏感性:经济放缓将直接冲击LTL货运需求

- 司机成本上升:人力成本压力持续挤压利润率

- 竞争加剧:大型整合商(如J.B. Hunt)持续抢占市场份额

- 货运周期回暖:若2026下半年经济复苏超预期,运价可能获得支撑

- 电商物流需求:长期来看,B2B和B2C电商物流仍将支撑LTL需求增长

- 行业整合:中小型运营商可能被迫退出,行业集中度提升

-

短期(1-3个月):承压为主。Morgan Stanley的评级下调可能引发连锁反应,其他投行可能跟进调整评级或目标价。板块估值中枢预计下移5-10%。

-

中期(3-6个月):观望等待。需观察:

- 2026年Q1/Q2财报表现

- 运价企稳信号

- 货运量复苏进度

-

长期(6-12个月):择机配置。若股价充分回调至合理区间(Saia对应P/E 20-25x),优质龙头(如Old Dominion)将具备长期配置价值。

- 回避估值过高的标的(Saia)

- 关注估值合理的行业龙头(ODFL)

- 密切跟踪运价指数和货运量数据,作为周期拐点的领先指标

[1] MarketBeat - “Saia (NASDAQ:SAIA) Cut to Underweight at Morgan Stanley” (https://www.marketbeat.com/instant-alerts/saia-nasdaqsaia-cut-to-underweight-at-morgan-stanley-2026-02-10/)

[2] Morningstar - “Old Dominion’s LTL Operating Backdrop to Remain Subdued In First-Half 2026” (https://www.morningstar.com/company-reports/1423924-old-dominions-ltl-operating-backdrop-to-remain-subdued-in-first-half-2026-but-execution-strong)

[3] Joc.com - “Top LTL carriers maintain profit while planning paths to freight recovery” (https://www.joc.com/article/top-ltl-carriers-maintain-profit-while-planning-paths-to-freight-recovery-6105968)

[0] 金灵AI金融数据库(实时市场数据、公司财务数据、分析师评级)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.