Geopolitical Risk Premium Analysis: US-Iran Tensions and Oil Markets

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on comprehensive market data and geopolitical analysis, energy investors should currently price a

The oil market is experiencing heightened volatility driven by escalating US-Iran tensions. Recent developments indicate:

| Metric | Current Value | Change |

|---|---|---|

| Brent Crude | $68-70/bbl | +2% (4-month high) |

| WTI Crude | $63-65/bbl | +1.8% (4-month high) |

| OPEC Production | 28.57 mn b/d | -90,000 b/d from December |

Oil prices have yo-yoed between $65 and $70/barrel throughout February 2026, with prices briefly exceeding $70/barrel in late January for the first time since September [1][2][3]. Citigroup analysts estimate that the potential for Iran-related escalation has already added

Based on the probability-weighted analysis of potential outcomes:

| Scenario | Risk Premium | Probability | Price Impact | Catalysts |

|---|---|---|---|---|

De-escalation |

$0-2/bbl | 10% | $60-65/bbl | Nuclear deal breakthrough |

Base Case |

$2-4/bbl | 40% | $65-68/bbl | Tensions persist at current levels |

Escalation |

$5-10/bbl | 35% | $72-80/bbl | Military posturing/action |

Conflict |

$15-30/bbl | 15% | $85-100+/bbl | Strait of Hormuz disruption |

-

Iran Nuclear Negotiations(Impact: 10/10) — First-round diplomatic talks have been described as a “good start,” but outcomes remain highly uncertain [4]. A breakthrough could rapidly reduce the risk premium, while failure could trigger escalation.

-

US Carrier Deployment(Impact: 8/10) — Trump’s threat to deploy additional US carriers to the Middle East signals heightened military preparedness and increases the probability of confrontation [1].

-

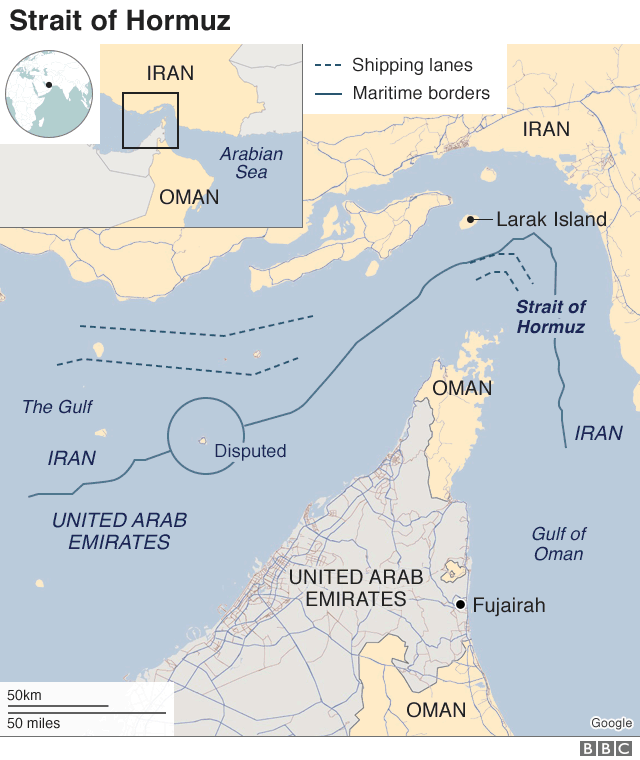

Strait of Hormuz Security(Impact: 10/10) — Approximately 20% of global oil supply transits through this chokepoint. Any disruption would immediately trigger a severe price spike [0].

-

OPEC Production Dynamics(Impact: 6/10) — OPEC output declined by 90,000 b/d in January, primarily due to declines in Iran and Venezuela, suggesting limited spare capacity buffer [1].

- Iran Oil Export Resilience: Despite sanctions and tensions, Iran has maintained oil export levels, providing some market flexibility [1].

- US Vessel Advisory: Commercial vessel advisories near Iran have increased, elevating shipping risk perception [3].

- Energy Sector Performance: The energy sector showed modest gains (+0.09%) on February 10, underperforming materials (+1.21%) but remaining stable amid broader market volatility [0].

CME Group’s announcement on February 10, 2026, regarding plans to launch Single-Stock Futures beginning summer 2026 introduces new tools for energy investors [1][5]:

- 50+ top US stocks including major energy names (XOM, CVX)

- Capital-efficient alternative to traditional equity exposure

- Financially settled contracts offering hedging flexibility

- Complements existing energy futures and options

- Provides additional hedging mechanisms for energy equity exposure

- Enables more precise tactical allocation to individual energy stocks

- Adds optionality for sophisticated investors managing geopolitical risk

| Strategy | Recommendation | Rationale |

|---|---|---|

Energy Sector Weight |

5-8% overweight (tactical) | Elevated risk premium supports tactical exposure |

Stock Selection |

Integrated majors (XOM, CVX) | Downstream exposure provides natural hedge |

Services Exposure |

Moderate (SLB, HAL) | Outperforms on escalation scenarios |

- Put Options: Purchase Brent puts at $60/bbl for downside protection

- Collar Strategy: Sell calls at $75-80/bbl to generate premium income

- Calendar Spreads: Profit from elevated volatility through term structure

| Trigger | Action |

|---|---|

| Brent breaks below $62/bbl decisively | Reduce energy exposure by 50% |

| Iran nuclear deal announced | Cut risk premium assumption to $2-3/bbl |

| Strait closure confirmed | Exit all energy positions; rotate to defensive |

| Diplomatic breakdown | Increase allocation to oil services stocks |

-

Upside Scenario ($72-80/bbl): If military tensions escalate or nuclear talks fail, the risk premium could expand to $10-15/bbl.

-

Downside Scenario ($60-65/bbl): A successful diplomatic breakthrough could compress the risk premium to $2-3/bbl, driving prices lower.

-

Base Case ($65-72/bbl): Current tensions persist without major escalation, maintaining the risk premium in the $5-8/bbl range.

[0] Ginlix AI Market Data & Internal Analysis

[1] MEES - “US-Iran Tensions Drive Oil Market Volatility” (https://www.mees.com/2026/2/6/opec/us-iran-tensions-drive-oil-market-volatility/55e49900-0367-11f1-a719-59075cea9fc9)

[2] CNBC - “Brent crude tops $70 per barrel on Iran attack concerns” (https://www.cnbc.com/2026/01/29/brent-crude-tops-70-per-barrel-on-iran-attack-concerns.html)

[3] Seeking Alpha - “Crude oil rises after US issues advisory for commercial vessels near Iran” (https://seekingalpha.com/news/4549246-crude-oil-rises-after-us-issues-advisory-for-commercial-vessels-near-iran)

[4] Bloomberg - “US-Iran Talks Make a Good Start But Oil Markets Can’t Relax Just Yet” (https://www.bloomberg.com/news/newsletters/2026-02-09/us-iran-nuclear-talks-make-good-start-but-oil-markets-can-t-relax-yet)

[5] PR Newswire - “CME Group to Launch Single Stock Futures” (https://www.prnewswire.com/news-releases/cme-group-to-launch-single-stock-futures-302684107.html)

[6] CME Group - “Five Things To Watch In Energy Markets in 2026” (https://www.cmegroup.com/openmarkets/energy/2025/Five-Things-To-Watch-In-Energy-Markets-in-2026.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.