The Great Market Rotation of 2026: Value Outperformance and Cyclical Leadership

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

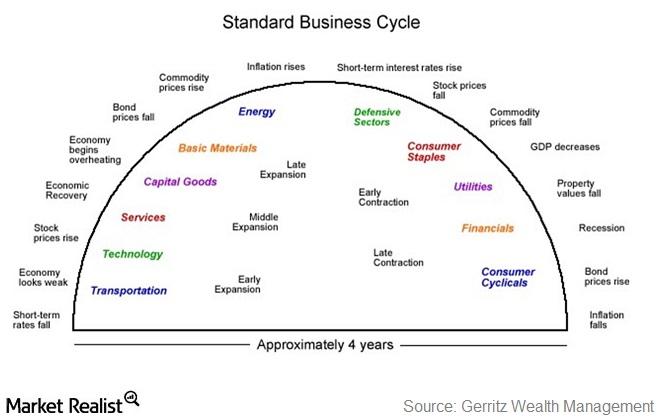

The Seeking Alpha article published on February 11, 2026, describes a significant market rotation occurring at a critical juncture in equity markets [1]. This rotation represents a fundamental shift in market leadership, with value stocks outperforming growth stocks as cyclical sectors—particularly energy, industrials, and basic materials—assume market leadership positions. Simultaneously, Big Tech faces mounting disruption concerns and valuation headwinds driven by unprecedented artificial intelligence capital expenditure commitments [1][3][4].

The convergence of quantitative evidence across multiple analytical dimensions strongly supports the rotation thesis. The Russell 2000 has achieved a 15-session winning streak against the S&P 500—the longest period of small-cap dominance since May 1996—signaling a structural regime change rather than a temporary tactical rebalancing [1]. This momentum shift is further validated by sector performance data from February 10, 2026, which shows basic materials (+1.21%) and consumer cyclical (+0.74%) leading gains, while technology (-1.09%) and consumer defensive (-2.05%) significantly underperform [0].

The fundamental driver of this rotation appears to be a strategic capital reallocation from AI hardware investments toward AI implementation beneficiaries. Money is flowing from mega-cap technology companies engaged in massive infrastructure spending toward manufacturers, logistics firms, and healthcare companies positioned to leverage artificial intelligence for operational efficiency improvements [2]. This transition reflects investor concern regarding the return-on-investment timeline for the $630-650 billion that Big Tech has committed to AI infrastructure spending in 2026—a 62% increase from the record $388 billion deployed in 2025 [3][4].

This analysis integrates quantitative market data [0] with qualitative assessments from multiple financial news sources to present a comprehensive view of the February 2026 market rotation. The original Seeking Alpha article provides the foundational thesis that value stocks are outperforming growth stocks as cyclical sectors assume market leadership while Big Tech faces disruption concerns from AI spending commitments [1]. Supporting evidence includes index-level data showing the Russell 2000’s historic winning streak against the S&P 500, sector performance data confirming cyclical leadership, and Big Tech capital expenditure commitments that have raised investor concerns about infrastructure oversupply [1][2][3][4].

The rotation represents a potential structural shift rather than a temporary tactical rebalancing, supported by the magnitude of the value-growth spread (14 percentage points), the duration of small-cap outperformance (15 sessions), and the fundamental capital reallocation from AI hardware to AI implementation beneficiaries [1][2][6]. However, sustainability depends on validating macroeconomic factors including employment growth and continued benign interest rate conditions. Upcoming catalysts—tech earnings, jobs data, and Fed commentary—will be critical in determining whether this rotation represents a new sustained market regime or a tactical adjustment that may reverse.

[0] Ginlix Analytical Database - Market Indices and Sector Performance Data

[1] Seeking Alpha - This Is A Market Where Big Money Is Made And Most Miss It (https://seekingalpha.com/article/4868258-this-is-a-market-where-big-money-is-made-and-most-miss-it)

[2] Chronicle Journal - Beyond the ‘Mag 7’: The Great Market Rotation of 2026 is Here (http://markets.chroniclejournal.com/chroniclejournal/article/marketminute-2026-2-6-beyond-the-mag-7-the-great-market-rotation-of-2026-is-here)

[3] MSN - Big Tech’s $600B AI spending spurs investor concerns in 2026 (http://www.msn.com/en-us/money/other/big-tech-s-600b-ai-spending-spurs-investor-concerns-in-2026/ar-AA1VUIlY)

[4] CTV News - Big Tech’s $600-billion spending plans exacerbate investors’ AI headache (https://www.ctvnews.ca/business/article/big-techs-us600-billion-spending-plans-exacerbate-investors-ai-headache/)

[5] Motley Fool - Jensen Huang Has a Warning for Investors Dumping Software Stocks (https://www.fool.com/investing/2026/02/10/jensen-huang-has-a-warning-for-investors-dumping-software-stocks/)

[6] Bloomberg - Wall Street’s Rotation Into Value Has a Dot-Com Warning to It (https://www.bloomberg.com/news/articles/2026-02-04/wall-street-s-rotation-into-value-has-a-dot-com-warning-to-it)

[7] Motley Fool - Taiwan Semiconductor Manufacturing CEO Delivers Fantastic News for Nvidia Investors (https://www.fool.com/investing/2026/02/11/taiwan-semiconductor-manufacturing-tsm-nvidia/)

[8] ThinkAdvisor - Stock Market Going Through ‘Vicious’ Rotation: RBC Equity Strategist (https://www.thinkadvisor.com/2026/02/09/stock-market-going-through-vicious-rotation-rbc-equity-strategist/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.