Analysis of Reddit Trading Advice: 10 Pitfalls to Avoid for Profitable Trading

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on a Reddit post from November 15, 2025, featuring advice from an 8-year experienced trader on avoiding common trading pitfalls. The post outlines 10 critical mistakes that prevent traders from achieving consistent profitability, with emphasis on systematic approaches, risk management, and psychological discipline.

The Reddit advice focuses on ten key areas: maintaining focus on one setup, respecting risk per trade, rigorous journaling, trading with a plan, backtesting for conviction, adapting to market context, controlling emotions after both losses and wins, avoiding comparison with others, and treating trading as a business rather than gambling [0].

The emphasis on risk management aligns with industry best practices. Professional trading sources indicate that risking more than 10% per trade can be catastrophic - a five-trade losing streak would wipe out 50% of capital, requiring a 100% gain just to break even [1]. Established traders typically risk only 1-2% per trade, with documented cases showing consistent 8% monthly returns using exactly 1% risk per trade with a 55% win rate and 2.2:1 reward-risk ratio [3].

The advice’s focus on emotional control reflects established trading psychology principles. Trading psychology expert Mark Douglas states that “the market doesn’t make you lose money—your psychology does” [2]. The Reddit post addresses two critical psychological traps: revenge trading after losses and overconfidence after wins, both of which can lead to account-destroying mistakes. This psychological framework is essential because most trading failures stem from psychological factors rather than strategy flaws.

The recommendation to focus on one setup, backtest thoroughly, and maintain detailed journals reflects professional trading methodologies. Trading journals are described as essential tools that “reflect the truth about your habits and your risk management” [4]. Without proper journaling and analysis, traders cannot distinguish between what actually works versus what they think works. The systematic approach eliminates emotional decision-making and creates repeatable processes.

The Reddit advice reveals interconnected relationships between trading disciplines. Risk management isn’t isolated from psychology - proper position sizing reduces emotional stress, which in turn improves decision-making quality. Similarly, journaling serves both analytical and psychological purposes by providing objective feedback while also revealing emotional patterns.

Treating trading as a business rather than gambling represents a fundamental paradigm shift. This approach requires treating trading capital as business inventory, tracking performance metrics, and making decisions based on probability rather than emotion. The business mindset naturally incorporates all other principles - risk management becomes inventory control, journaling becomes accounting, and systematic approaches become standard operating procedures.

The advice to adapt to market context addresses a critical aspect often overlooked by systematic traders. While having one setup is important, the ability to recognize when market conditions no longer support that setup is equally crucial. This balance between consistency and flexibility represents advanced trading wisdom.

The core insight that profitability comes from eliminating mistakes rather than finding perfect strategies represents a sophisticated understanding of trading success. Most traders search for better indicators or systems when they should focus on removing errors from their existing approach.

- Over-leveraging Risk: New traders particularly risk excessive position sizing, with statistics showing 90% of day traders lose 90% of their funds within 90 days [1]

- Psychological Vulnerability: Emotional decision-making after losses (revenge trading) and wins (overconfidence) represent significant account risks

- Strategy Hopping: The tendency to chase multiple setups without mastering any single approach prevents skill development

- Comparison Trap: Social media pressure to match others’ performance leads to inappropriate strategy adoption

- System Implementation: Modern trading platforms and risk management tools make systematic approaches more accessible than ever [1]

- Education Resources: Comprehensive trading psychology and risk management education is widely available [2][3][4]

- Journaling Technology: Advanced trading journal software provides detailed analytics and pattern recognition [4]

- Community Support: Trading communities like Reddit’s r/Daytrading provide peer learning and accountability

The advice remains perpetually relevant as trading psychology and risk management principles are timeless. However, the current market environment of 2025 offers enhanced technological tools for implementing these principles effectively.

- Risk management should limit exposure to 1-2% per trade maximum [1][3]

- Emotional discipline requires specific protocols for both winning and losing periods [2]

- Systematic approaches need rigorous backtesting and journal validation [4]

- Business mindset treatment of trading capital and operations

- Establish risk management rules before any trading activity

- Develop and maintain comprehensive trading journals

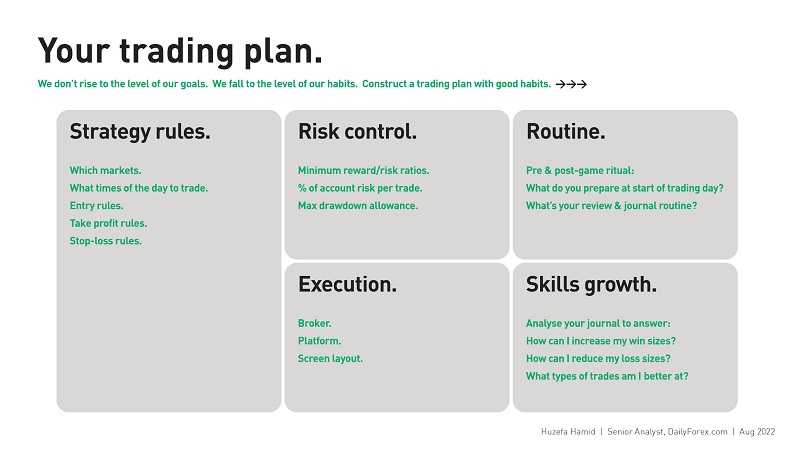

- Create detailed trading plans with entry, exit, and position sizing rules

- Implement psychological protocols for emotional control

- Focus on mastering one specific setup before expanding

Professional traders track win rates, reward-risk ratios, maximum drawdowns, and consistency metrics. Documented cases show that a 55% win rate with 2.2:1 reward-risk ratio and 1% risk per trade can generate consistent 8% monthly returns [3].

Trading psychology education [2], risk management strategies [1][3], and journaling methodologies [4] provide comprehensive support for implementing the Reddit advice principles.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.