January 2026 U.S. Employment Report: Stronger-Than-Expected Job Growth Signals Labor Market Rebound

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

The January 2026 U.S. employment report, released on February 11, 2026, by the Labor Department, presents a notably positive labor market snapshot following a year of sluggish hiring in 2025 [1]. The report was delayed by one week due to the federal government shutdown, adding to market anticipation and scrutiny of the underlying data. The headline figures exceeded consensus expectations significantly, with non-farm payrolls adding 130,000 jobs against economist forecasts of roughly 75,000 positions [3].

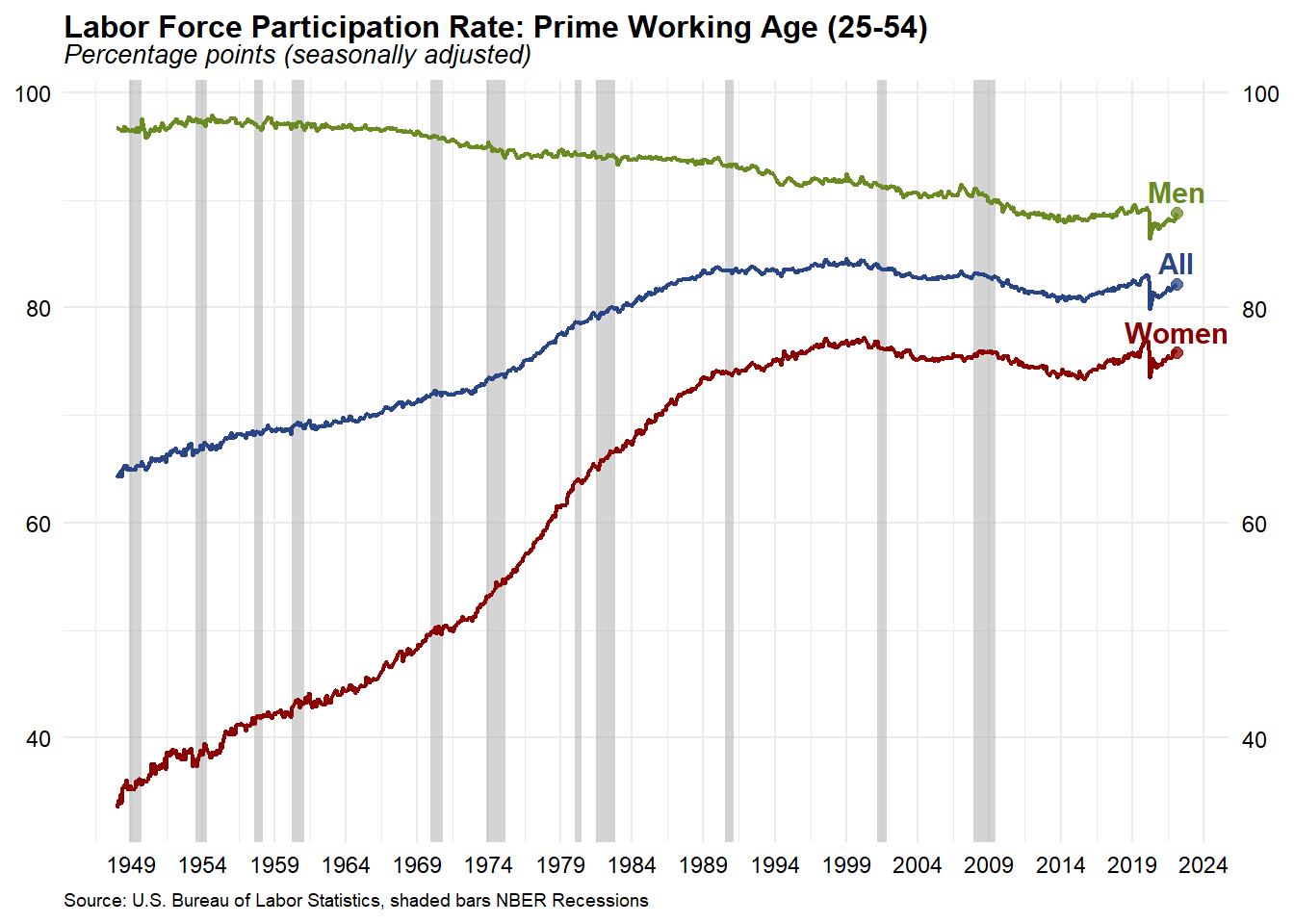

The unemployment rate’s decline to 4.3% from 4.4% represents a meaningful improvement, particularly given the context of elevated labor force participation. The 25-54 age group participation rate reached 84.1%, the highest level recorded since 2001, indicating that workers are increasingly entering or remaining in the labor force rather than disengaging [1]. This combination of robust hiring and elevated participation suggests underlying labor market strength rather than simply a shrinking labor pool.

Wage growth settled at 3.7% year-over-year, reflecting moderate but sustainable earnings expansion. However, analysis of wage distribution reveals increasing inequality across income levels, with gains concentrated predominantly among higher-income workers [2]. This concentration may limit the broader-based consumer demand benefits typically associated with tight labor markets.

The composition of job gains reveals important nuances in the labor market dynamics. Health care emerged as the largest contributor, adding 82,000 jobs—representing approximately 63% of total non-farm payroll growth [2]. This concentration raises questions about sustainability, as such heavy reliance on a single sector introduces vulnerability to sector-specific headwinds, policy changes, or reimbursement adjustments.

Federal government employment declined by 34,000 positions, reflecting ongoing workforce reduction policies under the current administration [1]. These cuts create regional economic headwinds in areas with significant federal employment concentrations, potentially offsetting gains elsewhere. The federal workforce reduction represents a structural shift rather than cyclical weakness, distinguishing it from private sector hiring patterns.

The private sector broadly added 130,000 jobs, with the government sector’s net negative contribution entirely attributable to federal workforce reductions. State and local government employment appeared relatively stable in this report, though ongoing budget pressures may create future volatility.

The robust January employment data carries significant implications for Federal Reserve monetary policy [2]. The stronger-than-expected reading reduces the urgency for accommodative policy measures, supporting the Fed’s current “pause” stance on interest rate cuts. Market participants have subsequently adjusted expectations, with the next rate cut potentially delayed until July 2026 rather than occurring earlier in the year.

The Fed faces a nuanced decision matrix: strong labor data argues for patience, yet the concentration of gains in health care and ongoing federal workforce reductions introduce uncertainty about the underlying economic trajectory. The central bank will likely await additional data points, particularly the February employment report and upcoming inflation readings, before adjusting its policy stance.

The January 2026 report must be interpreted within the context of significant downward revisions to 2025 data [2]. Annual revisions reduced 2025 job gains from an initially reported 584,000 positions to 181,000—a substantial downward adjustment that raises legitimate questions about near-term data reliability. These revisions reflect methodological improvements and benchmark adjustments, but they underscore the importance of treating monthly figures as trend indicators rather than precise measurements.

Seasonal adjustment factors also warrant consideration in interpreting January results. Post-holiday hiring normalization can inflate January figures in certain sectors, meaning the February employment report will serve as critical confirmation of the apparent labor market acceleration [3]. The persistence or dissipation of January’s strength will clarify whether the economy has genuinely transitioned to a stronger growth trajectory.

The convergence of strong hiring with record labor force participation represents a constructive labor market dynamic that supports sustainable economic expansion [0]. Historically, elevated participation often precedes reduced hiring as more workers actively seek employment, yet January’s data showed both metrics improving simultaneously. This suggests genuine labor market strengthening rather than statistical artifacts.

The 25-54 age group’s participation rate reaching its highest level in nearly 25 years indicates that prime working-age adults are re-engaging with the labor force. This trend may reflect improved job opportunities, shifting demographic patterns, or economic necessity driving additional household earners into the workforce.

The employment report reveals a mixed picture of structural and cyclical forces shaping the labor market [2]. Federal workforce reductions represent structural shifts driven by policy decisions rather than economic weakness, while health care hiring reflects ongoing demand for medical services independent of economic cycles. This structural composition suggests labor market resilience may prove durable even if broader economic growth moderates.

The concentration of job gains in health care introduces sector-specific risk, however. Any policy changes affecting health care reimbursement, insurance coverage, or hospital staffing could disproportionately impact employment figures. Diversification across sectors would indicate broader-based economic health.

Federal workforce reductions create geographic concentration risks, affecting regions with significant federal employment presence [1]. Areas surrounding federal facilities, government contractors, and communities with federal retirees may experience localized economic headwinds. These regional variations may not be apparent in national aggregates but will affect specific metropolitan economies and state fiscal situations.

The January 2026 U.S. employment report presents a stronger-than-expected labor market picture, with 130,000 jobs added against expectations of approximately 75,000 [1][3]. The unemployment rate declined to 4.3%, while labor force participation in the prime working-age group reached its highest level since 2001 at 84.1%. Health care sector hiring dominated gains with 82,000 positions added, while federal government employment fell by 34,000 positions.

The report’s implications for monetary policy support a Fed “pause” on rate cuts, with the next reduction potentially delayed until mid-2026 [2]. However, significant downward revisions to 2025 data, concentrated sector gains, and seasonal adjustment considerations warrant careful monitoring before confirming a fundamental labor market transition.

The labor market’s trajectory will become clearer with the February employment report and subsequent data releases, which will help distinguish between genuine acceleration and statistical artifacts.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.