January 2026 U.S. Employment Report: Labor Market Beats Expectations Amid Sector Divergence

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The January 2026 employment situation report, released on February 11, 2026, represents the first comprehensive labor market assessment following a period of economic uncertainty that included a partial federal government shutdown. The report’s delayed publication added particular significance to the data release, as investors and policymakers had limited visibility into labor market conditions during the shutdown period when October 2025 employment data was not collected [1]. The timing of this report carries additional weight as it precedes the Federal Reserve’s March 2026 Federal Open Market Committee meeting, where interest rate decisions will be influenced by this employment data.

The Bureau of Labor Statistics reported that non-farm payroll employment increased by 130,000 in January, marking the strongest monthly job creation since December 2024 and substantially exceeding economist expectations [1][2]. This performance is particularly notable given that consensus forecasts ranged from 55,000 to 70,000 jobs, making the actual figure nearly double the anticipated pace of hiring [2][3]. The unemployment rate remained unchanged at 4.3%, maintaining labor market conditions that economists characterize as historically tight by historical standards.

The January employment data reveals pronounced sectoral divergence that illuminates ongoing structural shifts in the American economy. Healthcare and social assistance sectors demonstrated exceptional strength, with ambulatory health care services adding 50,000 positions, hospitals contributing 18,000 jobs, and nursing and residential care facilities accounting for an additional 13,000 positions [1]. The healthcare sector’s net gain of 82,000 jobs reflects the sector’s continued role as a primary employment engine within the U.S. economy, driven by aging population demographics and ongoing healthcare service expansion.

Construction employment showed robust growth of 33,000 positions, with non-residential specialty trade contractors adding 25,000 jobs [1]. This construction sector performance may indicate early effects of infrastructure spending initiatives, though the trend will require confirmation in subsequent monthly reports. Conversely, the federal government continued its workforce reduction trajectory, eliminating 34,000 positions in January as part of the ongoing drawdown that has reduced federal employment by 327,000 positions since October 2024, representing a 10.9% decline from peak levels [1].

The financial activities sector experienced a net loss of 22,000 positions, with insurance carriers and related activities accounting for 11,000 of those job reductions [1]. This financial sector contraction raises potential concerns about broader economic implications, as employment trends in financial services historically correlate with credit market conditions and broader economic health. Several other sectors, including mining, manufacturing, wholesale trade, retail trade, transportation and warehousing, information, professional and business services, leisure and hospitality, and other services, demonstrated minimal net change during the period [1][5].

Wage data from the January report presents a nuanced picture of labor market conditions. Average hourly earnings reached $37.17, with month-over-month wage growth of 0.4% exceeding economist expectations of 0.3% [1]. However, year-over-year wage growth slowed to 3.7% from the prior month’s 3.9%, raising questions about workers’ purchasing power in an environment where inflation remains a concern [1]. The divergence between monthly acceleration and annual deceleration suggests that wage growth momentum may be moderating after reaching peak levels.

Average weekly hours increased marginally from 34.2 to 34.3 hours, indicating stable labor utilization across the economy [1]. The combination of steady wage growth, moderate hours, and solid job creation suggests a labor market that remains constructive, if not as robust as the extraordinary conditions observed in 2022 and 2023. Labor force participation held steady at 62.5%, remaining below pre-pandemic levels of approximately 63.3%, which constrains the total supply of available workers despite strong hiring activity [1].

Equity markets exhibited a counterintuitive negative response to the ostensibly positive employment data, with the S&P 500 declining 0.31% to close at 6,954.96, the NASDAQ Composite falling 0.67% to 23,123.41, the Dow Jones Industrial Average dropping 0.18% to 50,153.97, and the Russell 2000 experiencing the steepest decline at 1.29% to close at 2,665.59 [0]. This market reaction reflects investor interpretation that stronger-than-expected labor market conditions reduce the probability of near-term Federal Reserve interest rate cuts.

The sector performance pattern corroborates the “risk-off” sentiment triggered by the employment data. Basic materials emerged as the best-performing sector with a 1.41% gain, followed by consumer defensive stocks rising 1.05% and healthcare advancing 0.51% [0]. Conversely, financial services declined 1.74%, industrials fell 1.25%, and technology dropped 0.79%, with these interest-rate-sensitive sectors bearing the brunt of reduced rate cut expectations [0].

Fixed income markets exhibited predictable movements in response to the employment data. The iShares 20+ Year Treasury ETF declined 0.50% to $88.09 as Treasury prices fell across maturities [0]. The CBOE Volatility Index decreased 3.43% to $17.18, indicating reduced near-term market uncertainty, though this level remains within historically moderate ranges [0]. Economists at Pantheon Macro characterized the employment report’s policy implications bluntly, stating that January’s “brisk increase in payrolls and drop in the unemployment rate means our forecast for a March [rate cut] is no longer tenable” [7].

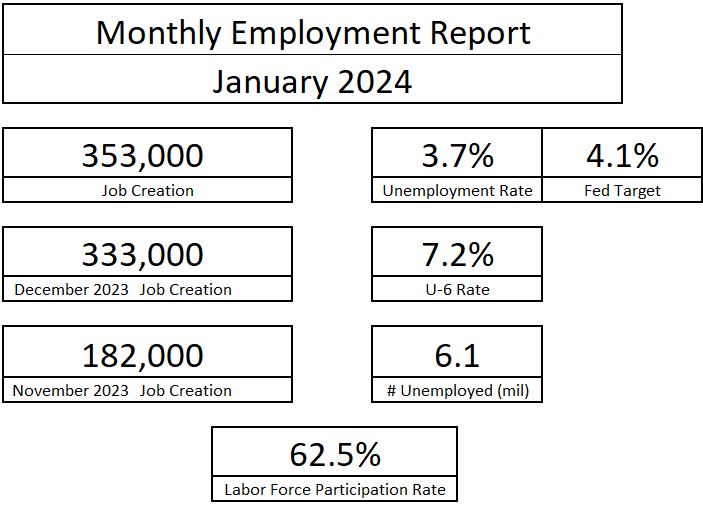

The January employment report has raised noteworthy concerns about data reliability that warrant attention from analysts and policymakers. The preliminary payroll figure underwent substantial revision from initial reports of 353,000 jobs to a revised 229,000 and ultimately to the final 130,000 positions [4]. This revision pattern reflects the BLS’s annual benchmarking process, which adjusted March 2025 employment levels downward by 898,000 jobs and has implications for the accuracy of monthly estimates [1].

Media reports have noted that every month in 2025 demonstrated negative revisions following leadership changes at the Bureau of Labor Statistics, raising questions about institutional continuity and data collection methodologies [8]. Additionally, January’s household survey response rate of 64.3% fell below historical averages, potentially affecting the accuracy of unemployment rate calculations [1]. These data quality concerns do not necessarily invalidate the employment trends identified in the report but suggest that analysts should exercise appropriate caution when interpreting preliminary estimates and remain attentive to potential revisions in future releases.

The January 2026 employment report illuminates several structural labor market trends that transcend the monthly headline figures. Healthcare sector dominance represents an enduring feature of the contemporary labor market, with the sector’s 82,000-job contribution accounting for the majority of net employment growth. This concentration of job creation in healthcare and social assistance reflects fundamental demographic pressures rather than cyclical economic conditions, suggesting that policy responses focused on general economic stimulation may be misdirected if healthcare labor shortages persist.

The continued federal government workforce reduction, now totaling 327,000 positions since October 2024, introduces a structural drag on headline employment growth that complicates labor market assessment [1]. Federal employment losses mask underlying private sector strength and may lead observers to underestimate the economy’s fundamental hiring momentum. The 10.9% decline in federal employment represents a significant reversal from the historical pattern of gradual federal workforce expansion and carries implications for regional economies dependent on government employment.

Financial sector employment contraction of 22,000 positions warrants monitoring as a potential leading indicator of broader economic stress [1]. While a single month’s data does not constitute a trend, employment declines in financial activities historically precede or accompany credit market dislocations and economic slowdowns. The concentration of losses in insurance carriers and related activities may reflect structural industry pressures from technological disruption and changing risk landscapes rather than cyclical economic weakness.

The equity market’s negative reaction to positive employment data represents a regime shift in market sentiment that began in late 2025 and continued in January. Investors have transitioned from viewing strong economic data as unambiguously positive to interpreting robust labor market conditions as constraints on Federal Reserve accommodation. This dynamic creates a challenging environment for risk assets, as positive economic news may generate negative market reactions while negative data could potentially trigger rate cut expectations.

The pattern of substantial downward revisions to employment estimates introduces revision risk that affects planning and decision-making across financial markets and corporate planning functions [4]. The sequence from 353,000 to 229,000 to 130,000 jobs demonstrates that preliminary estimates may significantly overstate actual employment gains, leading to potential misallocation of resources by businesses, investors, and policymakers who rely on timely labor market data.

Federal government workforce reductions are likely to continue through 2026, representing an ongoing structural headwind for headline employment growth. The 10.9% decline from October 2024 peak levels suggests that federal workforce optimization efforts remain incomplete, with potential additional job losses in coming months that will need to be offset by private sector hiring to maintain overall employment growth [1].

Financial sector employment contraction raises concerns about potential spillover effects into credit markets and broader economic activity. While January’s 22,000-job loss represents a modest figure in absolute terms, the trend direction raises questions about the sustainability of credit conditions and potential implications for consumer and business borrowing costs.

The Russell 2000’s 1.29% decline—the steepest among major indices—highlights small-cap stock vulnerability to rising rate expectations [0]. Small-capitalization companies typically face greater sensitivity to financing costs and may experience disproportionately negative impacts from extended periods of elevated interest rates.

Construction sector employment strength presents an opportunity for investors and businesses aligned with infrastructure-sensitive industries. The 33,000 jobs added in construction may indicate early effects of infrastructure spending initiatives, and sustained construction hiring could signal broader economic multiplier effects [1].

Wage growth momentum remains constructive, with month-over-month gains of 0.4% exceeding expectations and supporting consumer purchasing power. Continued wage acceleration, even at moderate rates, could sustain consumer spending levels that support economic growth and corporate earnings.

Healthcare sector resilience provides a stable employment foundation that may moderate overall labor market volatility. The sector’s continued hiring strength offers opportunities for healthcare industry participants and suggests defensive positioning remains appropriate given ongoing labor market uncertainty.

The moderate VIX level of 17.18 following the employment data release indicates reduced near-term market uncertainty [0]. While this represents reduced volatility risk for option market participants, it also suggests that market participants may be underpricing potential future volatility events.

The January 2026 employment report presents a labor market characterized by sectoral divergence and structural transition rather than uniform strength or weakness. Healthcare and construction sectors demonstrated robust hiring, while federal government and financial activities experienced notable job losses. The unemployment rate’s steady hold at 4.3% reflects a labor market that remains tight by historical standards despite moderating from peak 2022-2023 conditions.

Market interpretation of the employment data reflects an important regime shift wherein positive economic news generates negative equity market reactions due to Federal Reserve policy constraints. This dynamic favors defensive sectors over interest-rate-sensitive industries and creates headwinds for small-capitalization stocks. Fixed income markets reacted predictably to reduced rate cut expectations, with Treasury prices declining and yields rising across maturities.

Data quality concerns surrounding the January report, including the substantial revision from preliminary estimates and below-average household survey response rates, suggest appropriate caution when interpreting monthly employment figures. The ongoing pattern of negative revisions in 2025 raises questions about BLS data reliability that merit continued monitoring by analysts and policymakers.

The February 2026 employment report will provide critical confirmation of whether January’s strength represents sustainable momentum or statistical noise. Federal Reserve policymakers will incorporate this employment data into their rate decision framework, with the March 2026 FOMC meeting representing the next major policy milestone. Continued federal workforce reductions and healthcare sector strength are likely to remain defining features of the labor market landscape in coming months.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.