Market Timing Anxiety: Reddit vs. Expert Analysis on Investing at All-Time Highs

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Reddit discussion from r/stocks (905 upvotes, 966 comments) reveals a common psychological barrier for young investors facing all-time market highs[1]. The 20-year-old poster’s fear of imminent crash resonated widely, with the community offering practical wisdom:

- Time over timing: Multiple users emphasized that “time in the market beats timing the market,” with one commenter noting they’ve seen similar posts daily for two years while doubling their money[1]

- Age advantage: Commenters stressed that at 20 years old, even a 50% crash would recover by retirement age, making current concerns less critical[1]

- Historical perspective: Users cited the S&P 500’s journey from ~1,500 during 2008 to ~6,800 today as evidence that long-term holders aren’t hurt by buying at peaks[1]

- Practical strategy: The community recommended dollar-cost averaging (DCA), incremental entry, and maintaining emergency funds alongside investments[1]

Current market data validates the Reddit user’s concerns about elevated valuations:

- Record valuations: S&P 500 reached all-time highs near 6,900 in November 2024, with forward P/E ratios at 22.4-22.9x (above 10-year average of 18.6x)[2][3]

- Extreme metrics: Shiller CAPE ratio at 37.35 (second-highest ever), Buffett Indicator at 219% (all-time high), and top 10 companies representing 43% of S&P 500[3][4][5]

- Historical warnings: Similar elevated valuations preceded major downturns in 1929, 2000, and 2021[2]

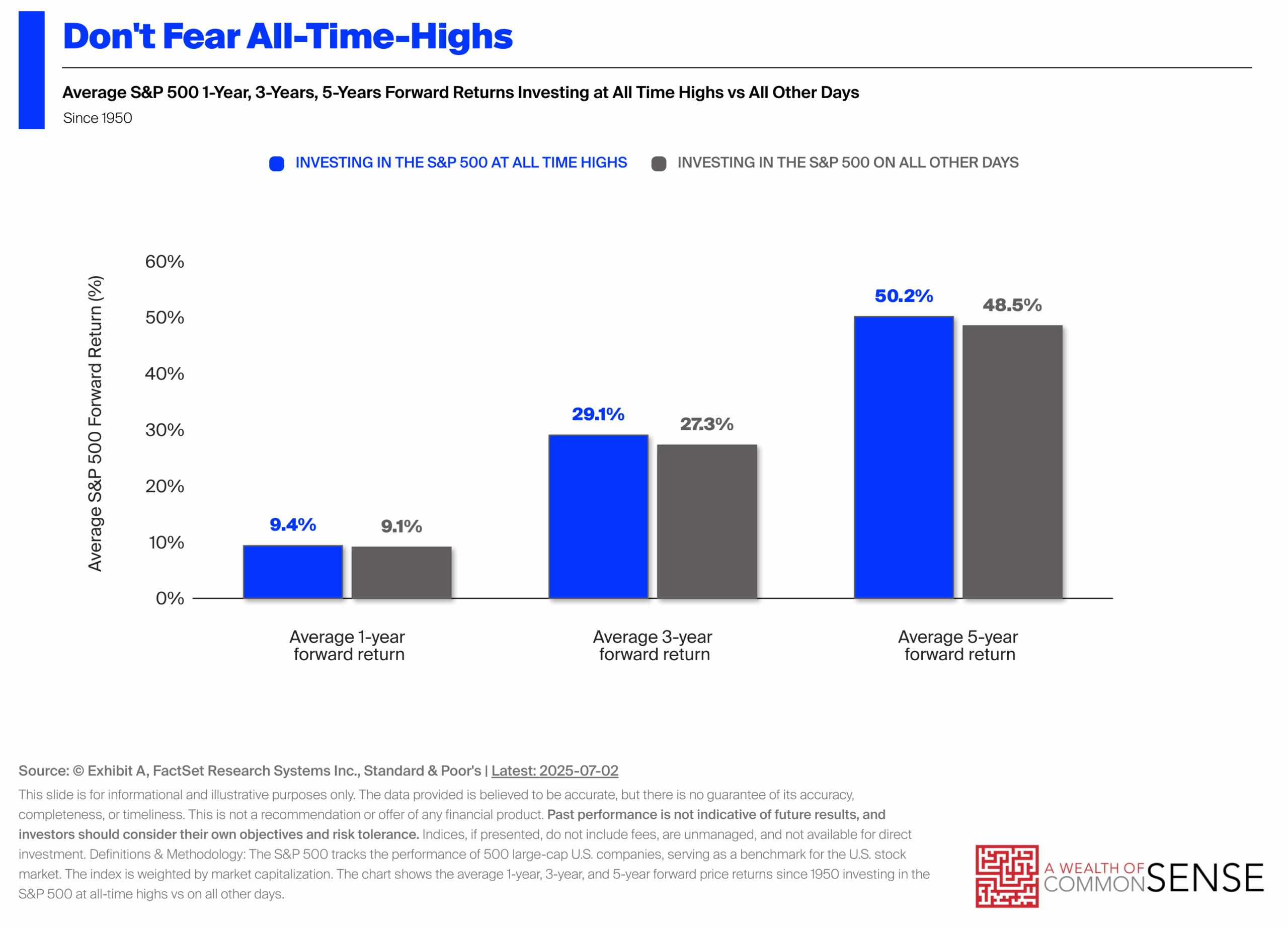

However, investment research strongly supports the Reddit community’s advice:

- Lump sum advantage: Vanguard research shows lump sum investing outperforms DCA approximately 68-70% of the time historically[6]

- Market resilience: Bear markets occur every ~6 years on average, but the S&P 500 has delivered 10.5% average annual returns since 1957 despite all downturns[6]

- Recovery certainty: Markets have recovered from every major crash and continued to reach new highs[6]

The Reddit discussion and expert research converge on a crucial insight: while current valuations are indeed elevated, attempting to time market tops has historically been counterproductive. The community’s emphasis on DCA, while statistically suboptimal to lump sum investing, provides valuable psychological benefits that help investors stay invested during volatility[6].

For young investors like the Reddit poster, the data suggests:

- Immediate action beats waiting: Historical probability favors investing now rather than waiting for better entry points

- Diversification is critical: With extreme market concentration (43% in top 10 stocks), broad exposure through total market ETFs like VT is prudent[1]

- Emergency fund priority: Maintaining cash reserves alongside investments provides flexibility during downturns[1]

- Elevated valuations suggest higher probability of near-term corrections or bear markets[2][4]

- Market concentration creates vulnerability if mega-cap stocks underperform[5]

- Economic uncertainty could trigger faster-than-expected downturns[8]

- Long-term investors can benefit from compounding regardless of entry timing

- DCA allows accumulation of more shares during any downturns

- Young investors have decades to recover from any near-term losses[1][6]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.