SEC Workforce Restoration: Regulatory Capacity Rebuilding After Workforce Reductions

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

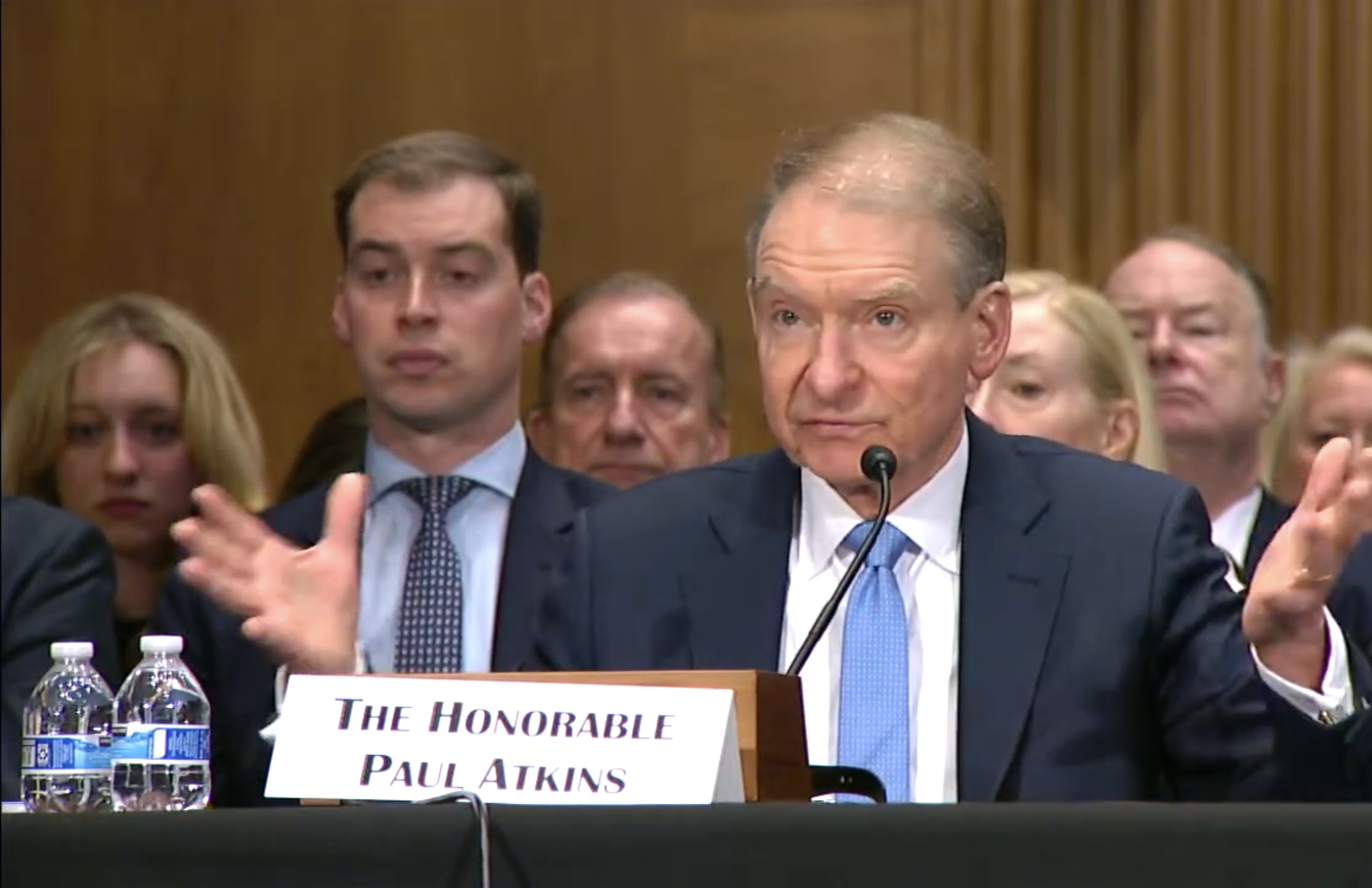

The Securities and Exchange Commission, Wall Street’s primary regulatory watchdog, announced on February 12, 2026, that it is working to restore portions of its workforce following significant staff reductions implemented over the preceding year [1]. SEC Chairman Paul Atkins disclosed this development during testimony before the U.S. Senate, acknowledging that the deep workforce cuts have created operational challenges across multiple divisions of the agency.

The workforce reductions were accomplished through a combination of voluntary buyout programs and mandated staff-cut initiatives ordered by the Trump administration. These cuts resulted in nearly a 20% reduction in the SEC’s workforce, raising concerns among market participants, legal analysts, and Congressional oversight committees about the agency’s capacity to maintain effective market oversight and enforcement activities [2].

The timing of this announcement is particularly noteworthy, as it occurs during a period of broader market volatility. On the same day as the testimony, major U.S. indices experienced significant declines: the S&P 500 fell 1.56% to 6,849.26, the NASDAQ dropped 2.12% to 22,653.01, the Russell 2000 declined 2.90% to 2,607.06, and the Dow Jones Industrial Average decreased 1.39% to 49,472.71 [0]. While these declines appear tied to broader market sentiment rather than specific reaction to the SEC announcement, the regulatory capacity concerns come at a time when market participants may be seeking stability and consistent oversight.

The workforce reductions have created measurable operational gaps within the SEC’s enforcement and regulatory functions. According to legal analysis examining the SEC’s 2025 enforcement activity, there was a notable decline in enforcement actions during the period following the workforce cuts [2][4]. This decline raises important questions about the agency’s ability to investigate potential securities violations, process registration filings in a timely manner, and provide regulatory guidance to market participants.

Chairman Atkins acknowledged these challenges during his testimony, noting that “gaps in different divisions” require attention and that selective hiring is necessary to restore operational effectiveness. However, the agency faces constraints in its restoration efforts, as the Trump administration has placed limits on federal agencies’ ability to rehire staff [1]. These administrative limitations may slow the pace of workforce restoration despite the recognized operational needs.

The enforcement priorities outlined by Chairman Atkins focus on traditional fraud, cybersecurity threats, and retail investor protection [1][2]. These priorities suggest that while the agency may not immediately restore its full enforcement capacity, it is targeting critical areas where gaps pose the greatest risk to market integrity and investor safety.

The SEC workforce reductions are part of a much larger federal workforce reduction initiative. According to data from the Office of Personnel Management, the federal workforce was reduced by approximately 317,000 positions in fiscal 2025 [3]. This represents one of the most significant workforce contractions in modern federal government history and extends across multiple regulatory agencies beyond the SEC.

The cross-agency nature of these reductions raises potential concerns about interagency coordination and the broader regulatory landscape. Securities enforcement often requires cooperation with other federal agencies, including the Department of Justice, the Commodity Futures Trading Commission, and various banking regulators. When multiple agencies experience simultaneous workforce constraints, the overall regulatory framework may be affected in ways that extend beyond any single agency’s operational capacity.

Chairman Atkins rejected accusations during his Senate testimony that the workforce reductions were motivated by political considerations [1]. This denial addresses concerns raised by some lawmakers and market observers who questioned whether the workforce reductions were intended to reduce regulatory scrutiny of corporate America and financial institutions.

The SEC’s announced workforce restoration represents an acknowledgment at the highest levels of the agency that operational capacity has been compromised. However, the absence of specific numbers, timeline, or budget allocation details suggests that restoration will be gradual and potentially constrained by broader administrative policies. Market participants should anticipate that enforcement capacity may remain constrained for the foreseeable future as the agency rebuilds.

The gap between recognizing operational needs and implementing solutions may extend the period of reduced regulatory scrutiny. This has implications for both companies under existing enforcement scrutiny, who may experience extended investigation timelines, and for market behavior more broadly, as reduced enforcement presence can influence compliance incentives.

Legal analysis of SEC operations during the workforce reduction period reveals potential delays in several key functions [4]. Registration statement reviews and comment letter responses may experience extended processing times as the agency manages reduced staff levels. Companies planning securities offerings or registration activities should factor potential delays into their timeline expectations.

The enforcement function’s reduced capacity may also affect the agency’s ability to bring new actions while managing existing caseloads. Historical patterns suggest that enforcement staff reductions often result in prioritization of higher-profile or more serious violations, potentially leaving smaller matters unaddressed for extended periods or closed without action.

The SEC’s role in maintaining fair and orderly markets extends beyond enforcement to include market structure oversight, rulemaking, and investor education functions. Workforce reductions across multiple divisions may affect these functions to varying degrees. Market participants should remain attentive to any changes in SEC communication, guidance, or regulatory approach that might reflect capacity constraints.

The timing of the workforce restoration announcement, coinciding with broader market volatility, highlights the importance of regulatory continuity during periods of market stress. While market declines on February 12, 2026, appeared unrelated to the SEC announcement specifically, the broader context of regulatory capacity concerns during volatile periods merits attention from market participants and policymakers alike.

The SEC’s February 12, 2026 announcement regarding workforce restoration represents a significant policy development with implications for market oversight and regulatory capacity. The key facts established through this analysis include:

The SEC experienced nearly 20% workforce reduction through voluntary buyouts and mandated staff cuts under the Trump administration [1]. Chairman Paul Atkins acknowledged operational gaps across multiple divisions that require attention and selective hiring to address [1]. The agency faces constraints in its restoration efforts due to broader administrative hiring limits, though specific numbers, timeline, and budget details remain undisclosed [1].

Market conditions on the announcement date showed broader volatility without specific reaction to the SEC news [0]. Enforcement activity declined during 2025 according to legal analysis, and restoration of capacity will likely be gradual [2][4]. The SEC’s stated enforcement priorities include traditional fraud, cybersecurity, and retail investor protection [1][2].

Federal workforce reductions extended well beyond the SEC, with approximately 317,000 positions eliminated across the federal government in fiscal 2025 [3]. This broader context suggests that regulatory capacity constraints may be a systemic rather than isolated phenomenon.

The information presented here provides factual context for understanding the SEC’s workforce situation and its potential implications for market oversight. This summary supports informed assessment of regulatory developments without providing recommendations regarding specific investment or compliance decisions.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.